❑Welcome to the Summary Page which describes the major New Features in the MKMS Version 5.1.35.XXXX Release.

•Many "bug fixes" have been completed during this series of updates.

•The major changes and enhancements are included in the Features List below.

•This New Features Table contains three columns of data relating to each of these New features:

1.Program Module(s) Affected - This column lists the specific modules that were improved.

2.Chapter Topic Links - This column lists of the link(s) to the Chapter Topic(s) where the previous instructions, illustrations and explanations have been revised to reflect the program changes and/or enhancements.

3.Description of the Enhancement - A brief explanation of the new features, functions and enhancements that have been added in this release with links to all of the affected Chapter Topics and some related Chapter Topics, also.

•Each Module also has an individualized list of those features (all of which are contained in the chart below) that were changed or enhanced specifically for that particular module.

❑Understanding the New features Chart:

•All of the Program Module(s) that are Affected are listed.

•The Chapter Topic Links are provided for finding the instructions, illustrations, and details on the operation and usage of the new feature(s).

•A brief Description of the Enhancement is shown, sometimes with additional Chapter Topic Links.

Program Module(s) Affected |

Chapter Topic Links |

Description of the Enhancement |

||||||||||

|

|

|||||||||||

Module |

Forms Affected |

8300 - 84XX New Features |

||||||||||

|

|

|

||||||||||

|

|

|||||||||||

|

|

|||||||||||

MKMS STARK |

All General Maintenance Menus and Items are now displayed in Alphabetical Order |

|||||||||||

MKMS STARK |

The Company Settings dialog has been completely redesigned. ▪Now there are five columns in the Grid: 1.Section - Starting with a No Section entry, and then listing the other settings which control various functions/features with the MKMS suite of programs and apps 2.Setting Name - The specific name for a Setting 3.Setting Value - A numeric value, logical (Y/N, T/F), or text entry associated with the selected Setting Name 4.Description - Currently left blank 5.Edit - Click the Edit box to open the Company Setting Name Edit dialog ▪There is also a Search Box field at the top of the Company Settings Form. To display the Setting Names for a specific Section (or Sections) containing a specific set of characters a.Enter the characters to be located in that Search Box b.Click the Search button c.The Section(s) and/or Setting Names containing those characters will be listed d.Re-Sort the Setting Name Column to make locating the desired Company Setting, it appropriate e.Inspect the Setting Name column to locate the desired Setting Name |

|||||||||||

MKMS STARK |

A new Email Account maintenance Form where specific SMTP Email settings may be identified. ▪The SMTP Setup tab on the Employee Form now contains a Drop-Down Selection List of the previously defined Email Account settings. (see Employees - SMTP Setup tab below) |

|||||||||||

MKMS STARK |

The SMTP Setup tab on the Employee Form has been changed. ▪This SMTP Setup tab now contains a Drop-Down Selection List of the previously defined Email Account settings. ✓An SMTP setting must be identified for each Employee who will be receiving/sending Reports, Invoices , Proposals, Work Orders, Statements, etc., via Email using a Mail Server other than Microsoft® Outlook®. ✓If no SMTP Setup data is entered for an Employee who is sending Reports, Invoices , Proposals, Work Orders, Statements, etc., via Email, the system will use the default Microsoft® Outlook® (and/or Outlook Express®) Email Account. |

|||||||||||

MKMS STARK |

▪The keyboard's Insert (to start a new entry on an Employees Form tab with a Grid format), Delete (to remove an existing entry on an Employees Form tab with a Grid format); plus the Ctrl+S combination (for Save) have been implemented. ▪The Left and Right Arrow Navigation Keys will move the focus from one Employees Form tab to another has been implemented, as has the Ctrl+Insert combination to start a new record on the Employees Form; |

|||||||||||

MKMS STARK |

Sometimes your Company may need a special report that is not available in MKMS. ▪To accommodate this need, a Reports Icon on the Shortcuts tab provides access to the Reports Module where Custom Reports may be created, Updated, Deleted, Tested, etc.

❖Important Notice - A working knowledge of SQL is required to be able to properly use this Reports Module. |

|||||||||||

|

|

|||||||||||

This new Suspended Invoicing Clean Up Maintenance dialog provides the ability to remove pending Suspended Invoices which no longer need to be Invoiced from the MKMS system. |

||||||||||||

|

|

|||||||||||

Dealer Billing Setup - Click the Billing tab on the Dealers Form to display the new Dealer Billing dialog. Each Dealer - for whom your Company's Central Station is providing Contract Monitoring Services - may be Invoiced for those services by implementing Dealer Billing. ▪Dealer Billing functions include: a)Maintains a specific Billing Address for the Invoices sent to the Dealers to pay for their Contract Monitoring Services your Company is providing to that Dealer's Subscribers b)Virtually automatic Invoice creation for billing Contract Monitoring Services provided to those Dealers c)Billing Structure provides Tiered Monitoring Rates d)Administrative Fees and Credit Card processing fees may also be Invoiced ▪Also see these Billing - Price List, Billing - Account Rate Table, Billing - Zone Rate Table, Billing - Accounts RMR, and Billing - Invoice History chapters for related information. |

||||||||||||

The new Dealer Billing Review report displays as a Grid which may be reconfigured, sorted, reconfigured, filtered. ▪The Dealer Billing Review will provide a detailed listing of each Invoice for created for Contract Monitoring Services using the Dealer Billing feature. ▪General Ledger related Transactional Posting information for a selected item may be viewed in the special Grid on the right side of this report. |

||||||||||||

The new Run Dealer Billing option on the File Menu is only available when Dealer Billing has been setup within the Dealer Billing dialog on the Dealers Form but the Dealer Billing option to set to False in Company Settings (DealerBillingWorkerEnabled = "F"), ▪By default, once Dealer Billing information has been entered, the billing process can become automatic. a)However, you must first set the Dealer Billing option to True in Company Settings (DealerBillingWorkerEnabled = "T") b)Thereafter, this automatic billing process works in a similar manner to how the Fully Automatic Recurring Revenue Billing process operates. c)If the Dealer Billing option to set to False in Company Settings (DealerBillingWorkerEnabled = "F"), the Dealer Billing must be manually implemented using this Run Dealer Billing option d)You Company's Business Module should determine whether Dealer Billing will be an automatic or manual process. |

||||||||||||

End Fixed Terms - Click on the new End Fixed Term Icon on a Fixed Term Recurring Revenue Form's Ribbon Menu to instantly remove the Payments, Balance, Amount, and Note, set the End Date to Today, and remove the system maintained Last Period/Next Period information, thus terminating this Fixed Term entry |

||||||||||||

|

|

|||||||||||

MKMS STARK & MKMSCS UL |

This column outlines the security related requirements of the Third Edition UL® 1981 Standard |

|||||||||||

UL® Password and Username Requirements: As part of properly implementing the Third Edition UL® 1981 Standard, specifically for compliance with section 6.2 Sign-on Security of the Third Edition UL® 1981 Standard, the creation of Passwords is strictly defined. |

||||||||||||

When the UL® 1981 Version is Registered (i.e., Active), the Company Settings CheckULPasswordRestrictions option is set to True ("T") to comply with Section 6.2.6 relating to Password Restrictions in the Third Edition UL® 1981 Standard.

When the CheckULPasswordRestrictions option is set to True ("T") in Company Settings, the Password Requirement legend on the Change Password Form and the Add/Delete Users Form has been updated to more clearly identify those UL® requirements for password creation. |

||||||||||||

Change Passwords: Passwords must be created using the UL® Sign-on Security requirements: ▪UL® Password and Username Requirements: As part of properly implementing the Third Edition UL® 1981 Standard, specifically for compliance with section 6.2 Sign-on Security of the Third Edition UL® 1981 Standard: 6.2.1 - The Employee's Password (i.e., Passcode) shall consist of the following: a)A Username of at least six (6) characters b)A Password which shall consist of a minimum of six alpha-numeric characters with at least one alpha and one numeric character 6.2.6 - The automation system shall prevent: a)Repeated passwords, used within the last six changes; b)Passwords that are a derivative of the user name(s); and i.[e.g., Password cannot contain 50% of a Username so a User "Stacy" cannot have a Password of "STA3841"] c)Passwords that are simply letters or numbers in order (e.g.: abcd, 1234, etc.). i.[e.g., any type of sequence is prohibited such as 'ab', '34', '89', 'xy'] |

||||||||||||

This is the new Employee Hired/Terminated report (documented to comply with the Third Edition UL® 1981 Standard) which provides a list of the Company's Employees is displayed in a functioning Grid dialog with an Employee Trace Form Title: ▪It provides a list of the Employees - retrieved based on their Hire, Termination, or original Entry Date - that is displayed in Grid format and so may then be viewed, sorted, filtered, reconfigured, printed, emailed, and/or exported. |

||||||||||||

A new Entities Drop-Down Selection List field has been added to the Review Deleted Entities Form where previously deleted Proposals were not included. ▪Entities - By default, All deleted entities (e.g., Invoices, Bills, Receipts, Proposals, etc.) will be listed based on the selected Filter type and Date Range. oUsing the Drop-Down Selection List provided, you may also Choose to list only one type of Entity. oIf Proposals are selected, you may Choose whether to list the deleted Proposals for Prospects (the default) or Subscribers.

▪The Restore option on the Review Deleted Entities Form can now restore Proposals including data entered in the Proposal Items, Recurring Items, Job Tasks, and Options tabs, when present. |

||||||||||||

There is a new E-Signature field and E-Signature Icon (shown above) on the Personal Tab of the Employees Form that provides the ability to store an Electronic Signature for an Employees. The Electronic Signature dialog - where the Electronic Signature is actually created - is accessible by Clicking the E-Signature Icon. ▪This E-Signature Icon is only active when a User has been given the appropriate Access Rights to the Electronic Signature Form. ▪These Access Rights are provided by including the Electronic Signature Form in the Employee Group to which the Employee is a member (in the Security Access Group field within the Security tab of their Employee Form), and/or by specifically adding the Electronic Signature Form to the User Access Rights Form for this User.

When entering the Employee's User Name in the Database User Name field in the Security tab of their Employee Form, if the CheckULPasswordRestrictions option is set to False ("F"), the UL® Password and Username Requirements Password Restrictions feature will be turned off. |

||||||||||||

Password Field Access: If your Company needs to restrict access to the Password field on the Central Station Data Form within the Monitoring tab, but still allow access to the other Fields on this Form, you may now simply remove the Check from the Password item in the Fields tab of the Employee Groups Form for the Central Station Form. ▪The result would be that no Employee assigned to this Employee Group would have access to that Password field. ▪In a similar manner, access to most of the other Fields on this Central Station Data Form may also be controlled.

➢Note: It is important to remember that when an Employee has specific rights assigned by using the User Access Rights Form, those rights granted or restricted by using the User Access Rights Form will override those granted or restricted on the Employee Groups Form! When restricting or granting any rights or access to a Form or a Field, be certain that those restricted or granted rights are not negated in the User Access Rights Form |

||||||||||||

The new User Login History Report (designed and documented to comply with the Third Edition UL® 1981 Standard) will list those Employees who have attempted to, or successfully Logged Into the MKMS database (mkmsdefault.db). ▪Because this is a true Grid (see the Grids & Lists - Print Preview - Exporting Data chapter for much more information), it offers the Filtering, Configuration, Sorting, Printing, Emailing and Export capabilities that are inherently part of an MKMS based data grid |

||||||||||||

The Employee Groups Form allows you to define which Access Rights will be available to the Employee (on a Form by Form basis) by assigning the appropriate Employee Group Code to that Employee. ▪Checking the Audit Access Right on all Forms assigned using the Employee Groups Form is mandatory for compliance with the Third Edition UL® 1981 Standard requirement. |

||||||||||||

|

||||||||||||

This new Verify Address option will execute an Address Validation process - that will be performed by the United States Postal Service ("USPS") - for the currently selected Subscriber. |

||||||||||||

There is a new Sales Tax Information box within the Invoice Header section of the Invoice Form which displays the Tax Rate ID, Tax Code, and Tax Rate assigned to the Invoice. |

||||||||||||

Allow_Change_Tax_For_Invoice - A new feature enabled in Company Settings which allows a User to update the Sales Tax assessed on individual Invoices has been implemented. ▪By default, this new Allow_Change_Tax_For_Invoice option is set to False ("F"). ▪Setting the Allow_Change_Tax_For_Invoice option to True ("T"), lets new Sales Tax Information box owithin the Invoice Header section of the Invoice Form to becomes editable (assuming that a Receipt has not been Allocated to that Invoice) |

||||||||||||

The Recurring Revenue Breakdown report dialog has been updated to include additional selection (filtering) options. |

||||||||||||

There is a new States Maintenance Form which is populated with all of the current US Sates and Territories, and new records may be added later, if required. ▪It will be used in conjunction with the Credit Card Surcharge feature (see below). ▪The State entries may also used in the Sales Taxes Invoiced and the Sales Tax Breakdown Reports to identify the specific State for which the Sales Taxes were Invoiced or Collected. |

||||||||||||

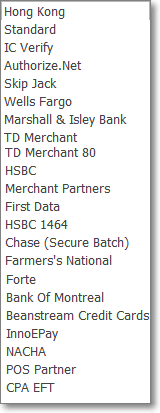

A Credit Card Surcharge may now be assessed on designated Subscriber Payments that are made using their Credit Card, ▪A Credit Card Surcharge Setup process puts in place your Company's decision to assess a Credit Card Surcharge. ▪Those Surcharges are assessed as a percentage of the Amount being charged on the Credit Card ▪That Surcharge Amount charged to the Subscriber's Credit Card will be in addition to the Amount needed to pay the Balance Due on an Invoice |

||||||||||||

The Sales Taxes Invoiced report has been enhanced to allow the User to request a report based on which State(s) those Sales Taxes were Invoiced for: 1)By specifying a set of one or more States which have been identified in the Tax Rates Form, or 2)By specifying those Tax Rates records which have NOT been associated with a State (i.e., Unassigned) |

||||||||||||

The Sales Tax Breakdown report has been enhanced to allow the User to specify which State(s) those Sales Taxes were Invoiced or Collected for: 1)By specifying a set of one or more States which have been identified in the Tax Rates Form, or 2)By specifying those Tax Rates records which have NOT been associated with a State (i.e., Unassigned) |

||||||||||||

|

||||||||||||

From time to time, it may become necessary to cancel a previously executed Bank Reconciliation and revert that Bank Account's records to the previous Bank Reconciliation ▪The new Bank un-reconcile dialog is now available for this purpose |

||||||||||||

From time to time, it may become necessary to cancel a previously executed Credit card Reconciliation and revert that Credit Card's records to the previous Credit card Reconciliation ▪The new Credit Card Un-reconcile dialog is now availa le for this purpose |

||||||||||||

The Credit Cards Form now has an Import option ▪Click the Import Icon on the Credit Cards Form to open the Import Credit Card Transactions dialog ▪This Import Credit Card Transactions option will allow your Company to import the Credit Card Transactions contained in a CSV file |

||||||||||||

|

||||||||||||

A new Select Date field has been added to these reports (see box on the left) which allows the User to select which As Of Date (e.g., Scheduled Start Date, Estimated Completion Date, etc.) will be used to construct that Aging report. |

||||||||||||

|

Central Station Monitoring Updates

|

|||||||||||

The newly revised Notifications sub-tab on the Monitoring tab now provides the ability to identify and define one or more specific Alarm Conditions which - when received by SPA - are to be processed internally by ▪sending a Predefined Message to a designated Person.by an Email or Pager, or ▪executing an Inter-active SMS or Inter-active Voice message to a defined Telephone Number (using the MKS Connect Service) |

||||||||||||

Auto Close Mins - The new Auto Close Mins (Minutes) field in the Events tab provides the ability to have a designated User (see Users below) Open the premises without triggering an Event Signal entry (Opening) as long as that User actually Closes the premises within the number of minutes set in tis Auto Close Mins field. a)This feature requires the O&C Supervised field in the Central Station Data section of the Edit View - Monitoring tab is set to "Both" and the appropriate Person/Company Employee has been assigned a User number b)This feature is implemented to facilitate Cleaning Crews, Maintenance Staff, etc., who may need to Open the premises at random times, may do so as long as they Close within the number of minutes entered in the Auto Close Mins field. |

||||||||||||

There is now a Required password to put On Test field on the Central Station Data section in the Edit View of the Subscribers Form ▪Password On Test Default in Company Setting - There is a new PasswordOnTestDefault option which by default, is set to False .When the PasswordOnTestDefault option is set to True, the Require Password to put On Test field will be Checked automatically in the Central Station Data section of all Subscribers.

When the Password On Test Default in Company Setting is set to True, the Account Pwd button on the Place an Account On Test dialog MUST be selected and a valid Password must be selected from the pop-up Password Selection dialog before that Account may be placed on test. ▪Also, there is a new Require Password to put On Test field on the Alarm Conditions Form to identify specific Alarm Condition Codes that will require a Password to be placed On Test.

❖Understanding the Require password to put On Test feature . oWhen the the Require Password On Test option is set to True in Company Settings, the Require Password to put On Test field in the Central Station Data section (of the Monitoring tab in the Edit View of the Subscribers Form) will default to Checked automatically, thus enforcing that a Password will be required before an Account may be Placed On Test. oThis Require password to put On Test field may also be Checked (or un-checked) individually, based on a specific Subscriber's requirement. oSee the Alarm Conditions chapters, the Password On Test Default option and the Require Password On Test option in Company Settings for more information about this requirement. |

||||||||||||

The new Get Agencies option can automatically assign Police, Medical, and Fire Agencies based on the Subscriber's Address by creating (when needed) a Town Code record which is then added to the Central Station Data section of the Subscriber record ▪Your Company must Subscribe to this service ▪Go to https://developer.precisely.com/pricing ▪Available plans and pricing will be provided at that site, and this is also where your Company may also subscribe to the service. |

||||||||||||

The new LLP Schedule Form allows for the selection of a New, or existing Schedule which is then associated with a specific Alarm Condition. ▪Thereafter, when an Alarm Signal for that Alarm Condition is received for the Account that was assigned this LLP Schedule, that Signal will be processed as an LLP (Interactive Low Level Signal Processing) if it was received within the time and day parameters of that Schedule.

There is a new LLP Schedule Icon on the Monitoring tab of the Edit View of the Subscribers Form ▪LLP (Interactive Low Level Signal Processing) will automatically send interactive SMS or Voice messages to a Dealer, to the Subscriber's Premise, and/or to any Contact so they can interact with the system and handle certain designated Alarm Signals without the need for Operator intervention. ▪LLP Schedules may also be associated with a Contact List where an Alarm Condition, and optionally a Signal ID or Zone code will determine when (if) that LLP Schedule response will be executed. ▪Also see Understanding the Schedules feature referenced by this LLP Schedule option for more information about defining and using Schedules

The revised Notifications sub-tab on the Monitoring tab now provides the ability to identify and define one or more specific Alarm Conditions which - when received by SPA - are to be processed internally by sending a Predefined Message to a designated Person.by an Email or Pager, or an Inter-active SMS or Inter-active Voice message to a defined Telephone Number (using the MKS Connect Service) |

||||||||||||

There is a new Action Plans Icon located on the Monitoring tab's Ribbon Menu which provides the ability to identify one or more Action Plans, each of which may or may not have an associated Alarm Condition Code that, when received at the Central Station, will not be processed by the Operator using the standard Operator Guided Response, but instead will follow the designated Action Plan, using the Action Steps defined in that Action Plan ▪There is also a new Action Plans Icon located on the CSID Zones tab, the CSID Overrides tab, the Panel Zones tab, the Panel Zone Override tab, the Alarm Conditions Form and the Dealers Form

If more than one Action Plan is available when an Alarm Signal is being Processed, the Order of Priority for implementing those Action Plans is: |

||||||||||||

MKS recommends using the MKS Customer Connect Service for Low Level Processing and Twilio (www.twilio.com) to provide cloud based interactive SMS and IVR (Text & Voice) communication services. ▪See MKS Connect Service (and its subordinate chapters) and IVR Management (and its subordinate chapters) for important information! |

||||||||||||

|

|

The new Schedules feature was created because certain situations require very customized responses based on the day(s) or the week, month(s) of the year, various time cycles and/or other special circumstances The new Schedules Form will display all of the existing (previously created) Schedules and provide for the creation of new ones ▪The Schedules Form has three sections: 1)Schedule List section with previously defined Schedules 2)Availability section listing the Days of the Week when a selected Schedule will be in effect 3)Assignments section where the individuals or Subscribers using the selected Schedule are listed

▪Once a Schedule is created, it may be assigned to a Contact List a)A Contact List is used for a specific purpose (it defines who should respond to a certain Alarm Condition and/or CSID Zone and/or Zone) within the specified date and time parameters of the Schedule to which the Contact List is assigned b)Members of a Contact List are individually chosen from all existing Contacts (selected from that Account's Contacts (People To Call) , Alternate Call List, and/or Dealer Call List) c)Call Numbers on the Contacts (People To Call) Form d)LLP Schedules may be assigned to specific Subscribers |

|||||||||||

The new Contact Lists tab in the Subscriber Panels section of the Edit View of the Subscribers Form and its three sections provides a new interface: 1.To list all Available Contacts associated Contacts (People To Call), Alternate Contact List, and/or Dealer Contact List for each Subscriber Panel's CSID 2.To design a Contact List for Responses to specific Alarm Conditions, and 3.To assign a Schedule for specific Days and Times, and Alarm Events to a Contact List, and 4.To assign a Schedule to a designated Contact List, and/or to an individual Contact (e.g.,Contacts (People To Call), Alternate Contact List, and/or Dealer Contact List member) and/or to its List Members

❖See Contacts (People To Call) and Call Order below for related information ❖See the Before Dispatch and/or After Dispatch below for that special new feature |

||||||||||||

The revised Contacts (People To Call) tab still contains the names, telephone numbers, and other important information for the People To Call ▪Plus, it now includes a Call Order tab which replaces the previous stand--alone Call Order tab and it allows for the Re-Setting of the Call Order sequence of the existing Contacts (People To Call) ▪Any Call Number for a Contact entered in any Contacts (People To Call) Form may be assigned to any Schedule |

||||||||||||

There are new instructions for processing an Alarm Event that has the new Before Dispatch and/or After Dispatch Contact List ▪Before & After Dispatch Contact Lists are created in the Contact List Form: a.When Processing Alarm Signal - as the software is preparing to enter the Dispatch phase, the system now checks if there is a “Before Dispatch” Contact List created for this Account (CSID). b.Assuming there is a Contact List entry which is active and not expired: 1)If the Contact List entry's Alarm Condition, CSID Zone Signal Identifier and Physical Zone fields are all empty, then the “Before Dispatch” Call List is always presented before proceeding to the actual Dispatch phase, 2)If there are specified conditions (Alarm Condition, and/or Signal Identifier, and/or Physical Zone) assigned to the Contact List entry, then the Alarm Signal must have those same conditions before the list is presented 3)If the specified conditions do not match the "Before Dispatch" Contact List entry, the software proceeds directly to the normal Dispatch sequence described below. c.Any “After Dispatch” Contact List entries adhere to the same rule but are presented after the Alarm Signal has been Dispatched. d.There is no default "fall back to" for Before Dispatch and After Dispatch Contact List entries 1)When there is no matching Before Dispatch and After Dispatch Contact List entry, the software moves on the next logical step in the Operator Guided Response, or Action Plan. 2)Call Lists will be displayed in the same format and same locations as they always have and will be as expected when presented to the Operator. 3)The only exception is for the Before Dispatch and After Dispatch Contact Lists. |

||||||||||||

|

Must Contact List Type |

New Must Contact - List Type: For those situations where, regardless of who was contacted prior to, or during the Notifications process, a specific person (or persons) must also be contacted (notified) prior to displaying the Signal Options tab on the Signal Processing screen. ▪When this new Contact List's Must Contact List Type is assigned to a Contact List entry, the List Members for this Contact List entry must be notified as described below: i.The List Member(s) must be contacted prior to Completion of the Signal Processing procedure ii.To ensure this action is taken, the List Member(s) will be shown in a Must Call List sub-tab within the Signal Options tab iii.These Contact(s) must be reached before a Resolution Code is selected |

|||||||||||

▪The Notification List on the CSID Zones Form now supports the SMS, Voice, and RS-232 message Types (in addition to Pager and Email). ▪The Notify Subscriber on Alarm Dispatch and the Notify Dealer on Alarm Dispatch fields on the CSID Zones Form now supports SMS, and Voice message types (in addition to Pager and Email). |

||||||||||||

The Smooth Operator Form is used to define (identify and configure) certain procedures that will provide an Automatic Action (predefined alarm signal processing functionality) while Processing Signals within MKMSCS. |

||||||||||||

Sub Dealers now also has a Schedule Reports option which is accessed by: ▪Clicking on the Sub Dealers Icon to display the list of Sub Dealers section ▪Selecting the Sub Dealer record that needs a Schedule Report defined ▪Clicking the new Schedule Reports option |

||||||||||||

Two areas on the Main tab of the Dealers Form have new features added 1)Notifications section - The Notify On Dispatch field now supports SMS via the SMS Notification #, or by Voice using the Voice Notification # as (in addition to Pager, or E-Mail) 2)Alarm Notifications may now be specified for a specific Alarm Condition using SMS via the SMS Notification #, or by Voice using the Voice Notification # (in addition to Pager, or E-Mail), each using a selected Predefined Message |

||||||||||||

When the Copy Operator Notes ("CopyOperatorNotes") option is set to True in Company Settings, a Copy Operator Notes From History button will now be available at the bottom of the Notes tab during the Verification process. ▪When selected, a Signal History dialog for that Account will be displayed ▪The Operator may locate the appropriate Signal and Select the appropriate Signal Detail item, then: i.Copy Selected Notes and/or ii.Copy All Operator Notes and/or iii.Use Ctrl+Click or Shift+Click to multi-select operator notes ▪Once the desired Note(s) are chosen, those note(s) will immediately be inserted into the Notes tab |

||||||||||||

When the MKS Connect Service is enabled, SMS and IVR Interactive Notifications may be utilized. There are two new fields on the Subscriber tab of the Edit View of the Subscribers Form that enable the entry of: a)SMS Notify # - Enter the telephone number that should be used to send a Text Message (SMS) Notification to this Account b)Voice Number # - Enter the telephone number that should be used to send a Voice Message (IVR) Notification to this Account

For those Companies using the MKS Connect Service, the Notify Subscriber on Dispatch field on the Central Station data section in the Monitoring tab of the Edit View of the Subscribers Form now supports the option to have the system automatically notify the Subscriber whenever a Dispatch is executed for an Alarm Signal received from their premises by SMS via the SMS Notify #, or by Voice using the Voice Notify # as described above (in addition to Pager, or E-Mail) |

||||||||||||

|

|

|

||||||||||

Module |

Forms Affected |

8255 - 8258 New Features |

||||||||||

|

|

|

||||||||||

MKMS STARK |

The Customer Connect Service ("MKSCustomerConnectSrv.exe") is an application which runs in the background as a Windows® Service ▪This service provides a variety of automated Email responses and/or reminder Tasks to follow up with someone for a designated reason. ▪Types of automated responses which may be defined by your Company are: a)Notify New Prospects and/or Subscribers with a Welcome and/or Thank You Email b)Send a notification reminder for upcoming Service calls c)Remind Subscribers that they have a past due Invoice d)Ask Subscribers with expiring Credit Cards to update their file e)Send an Email when certain Contracts are about to expire f)Survey a Subscriber about a recently Completed Service visit g)Send an acknowledge when a Receipt record has been created |

|||||||||||

MKMS STARK |

A Contacts tab which will list the Contact records that have been associated with the currently selected Subscriber has been added to the History Grid and Related Accounts tabs at the bottom of the Subscribers Form. |

|||||||||||

MKMS STARK |

New |

|||||||||||

|

|

|||||||||||

The Subscriber (Prospect, and Vendor) Form's Documents options have a revised where the Add Document dialog only allows for the specific identification of the File Location to be added or a URL and has discontinued the Embedding of the actual Documents within the SQL Database |

||||||||||||

There is a new Receipt Icon on the Invoice Form ▪Click the Receipt Icon on the Invoice's Ribbon Menu to open the Create Receipt and Allocate dialog in which a payment from the Subscriber may easily be posted and allocated in one step by using this Create Receipt and Allocate Form |

||||||||||||

A new Transaction Type option with three choices has been added to the Cash Receipts Report i.All - Include all of the Receipts that match the User set Parameters (the default) ii.Auto Draft - Include all of the Receipts that match the User set Parameters and were posted using the Auto Draft process iii.Daily - Include all of the Receipts that match the User set Parameters and were posted using the Fully Automated Recurring Revenue Billing process |

||||||||||||

|

|

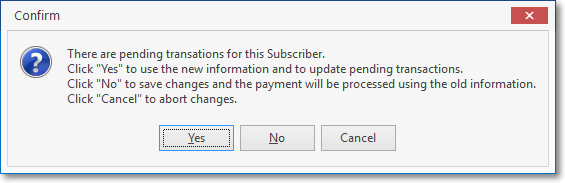

▪When setting the Auto Draft field to Yes in the Receivables section of the Edit View of the Subscribers Form, the system now first confirms that there is at least one Payment Method defined as the default. ▪When setting the Auto Draft field to Yes in the Payment Method Form, the system also confirms that there is at least one Payment Method defined as the default |

|||||||||||

The Enter/Edit Credit Card Form has been updated and will provide automatic insertion of certain key field (which may be modified if required) and credit card number validation. |

||||||||||||

The Enter/Edit Bank Account Form has been updated and will provide automatic insertion of certain key field (which may be modified if required) |

||||||||||||

The Enter/Edit Credit Card Form has again been updated as follows: ▪Card Holder's Name MUST be what is embossed/printed on the Credit Card itself, ▪Only alphabetic characters are permitted (and so in many cases the existing entry will need to be modified) ▪Therefore, No numbers and/or punctuation marks are permitted (e.g., "2", "5", ",", ".", "-")

The Enter/Edit Bank Account Form has again been updated as follows: ▪Account Holder's Name MUST be what is shown on the Bank Statement itself, but only alphabetic characters are permitted (and so in many cases the existing entry will need to be modified) ▪Therefore, No numbers and/or punctuation marks are permitted (e.g., "2", "5", ",", ".", "-")

|

||||||||||||

A new Debit Card Check box is now available on the Enter/Edit Credit Card Form. ▪Check this box if the currently displayed Credit Card information actually represents a Debit Card rather than a Credit Card. |

||||||||||||

There is a new Pay Method List (Report) that is a fully functional Data Grid which provides a list of the Payment Methods that have been entered for your Company's Subscribers. ▪This is a multi-purpose report which helps to identify anomalies in data entry, verify data entry, confirm what and from where Payment Methods were entered within a specific Date Range, |

||||||||||||

The E-Pay Form has been updated and will now automatically provide credit card number validation. |

||||||||||||

When using Subscriber as the Search By option, the Date Received (defaulted to Today), Batch Number (defaulted to the Day number of Today), Method of Payment (defaulted to Check) and Bank Account (defaulted to the Default Bank Account) will be inserted automatically. |

||||||||||||

The Export option in the Subscriber Statements dialog now offers a "Note to include on statement" option and the allowable length of the Statement's Note field has been increased. |

||||||||||||

After reporting all of the Breakdown for Sales Taxes that were Invoiced or Collected, a Summary page will now be presented - based on the User selections made - with: a)Total Invoiced or Collected Sales that were subject to Sales Tax, b)Taxes Invoiced or Collected sub-divided by Taxing Authority and each Authority's individual Sales Tax Rate c)Column with the accumulated Sales Tax totals Invoiced or Collected for each of these Sales Tax Rates d)Total of all Sales Taxes Invoiced or Collected |

||||||||||||

|

Installed Equipment dialog

|

When Converting a Proposal to an Invoice, there is a new Add Inventory To Installed Equipment?option ▪When that Add Inventory To Installed Equipment? box is Checked, a new Installed Equipment dialog will be displayed. |

|||||||||||

There is a new States Maintenance Form which is populated with all current States and Territories of the US, with the ability to add new records as may be added. ▪It is be used in conjunction with the Credit Card Surcharge feature |

||||||||||||

In addition to the Search F2 option, the Quick Search and Multi Field Search Search Options are now part of the Subscriber Form's Ribbon Menu |

||||||||||||

The Accounts Receivable As Of report has a new Print Detail option: ▪When the new Show Detail box Checked a Print Detail option now becomes available as a data grid Option. ▪Click the Print Detail Icon to display the Detail for the selected Accounts Receivable As Of report item. |

||||||||||||

The Auto Draft field on the Payment Methods Form now has a Drop-Down Selection List to Choose whether ("Yes") or not ("No") this Subscriber will authorize/has authorized the use of a Credit Card or Bank Draft to process Recurring Revenue Invoice Payments via a Payment Gateway) during either the Fully Automated Recurring Billing process, or by using the Post Auto Drafts procedure. ▪This Auto Draft field setting may now be changed (No to Yes, Yes to No) when required. |

||||||||||||

Checking the Auto Draft box in the Receivables section of the Edit View on the Subscribers Form indicates that this Subscriber will be using the Auto Draft feature (see Payment Methods immediately above) as a method of making Payments for their on-going, automatically drafted payments for the Recurring Services being provided by your Company. ▪A new Auto Draft field within the Accounting tab on the Subscriber Form will be Checked automatically. |

||||||||||||

The Subscriber (Prospect, and Vendor) Documents option has a revised Add Document dialog which allows for the specific identification of the File Type to be added |

||||||||||||

|

|

|||||||||||

In addition to the Search F2 option, the Quick Search and Multi Field Search Search Options are now part of the Prospect Form's Ribbon Menu |

||||||||||||

|

|

|||||||||||

If a Sale-Purchase Item has been designated the Default Sales Code on the Service Options tab of the User Options Form, it can no longer be designated as Inactive. |

||||||||||||

There is a new Order Inventory dialog accessible from the Parts List tab of a Work Order Form ▪See the "Understanding the Order Inventory option on the Work Order's Parts tab" discussion in the Parts List tab chapter for more information |

||||||||||||

|

|

|||||||||||

A.There is a new Restrict Vendor PO in the Company Settings Form- By default, this RestrictVendorPO option is set to False ("F") in the Company Settings Form and the previous "normal" behavior will be in effect ▪A Sales-Purchase Item (e.g., Purchase Category) may be associated with (e.g., belong to) a Sales-Purchase Item when any of these actions occur: 1)A Vendor is selected in the Sales-Purchase Item Form's Vendor field a)When chosen for the Vendor field, it populates the internal APID field in the SaleItem table 2)A Vendor is added to the Sales-Purchase Item Form's Vendor Item ID Grid a)When inserted into the Vendor Item ID Grid, it also creates a record in table Vendor Codes.

B.If the RestrictVendorPO option is set to True ("T") the above actions are still in effect, plus: 1)When creating a Purchase Order for a Vendor, the User will only be able to pick from a list of the Sales-Purchase Items which have been associated with (e.g., belong to) that Vendor 2)From the Work Order Form, when creating a Purchase Order by Clicking the Order Icon,

Work Order Ribbon Menu Order Icon

a)The User is required to select a Vendor, then b)The Purchase Order Form will be limited to selecting Sales-Purchase Items that "belong" to that selected Vendor. 3)When the Order Inventory option is selected within the Part List tab on a Work Order Form, in the Order Inventory dialog, the User must Choose a Vendor and a Warehouse, after which the User will only be able to Order from a list of the Sales-Purchase Items which have been associated with (e.g., belong to) that Vendor 4)From the Item List sub-tab within the Inventory tab on the Job Costing Form, when the Order Inventory option is chosen an Order Inventory dialog is displayed in which the User must Choose a Vendor and a Warehouse, after which the User will only be able to Order from a list of the Sales-Purchase Items which have been associated with (e.g., belong to) that Vendor 5)From Work Order Invoicing/Review - When viewing the Parts List tab of a specific Work Order Form, if the Order Inventory option is selected within the Part List tab on that Work Order, in the Order Inventory dialog, the User must Choose a Vendor and a Warehouse, after which the User will only be able to Order from a list of the Sales-Purchase Items which have been associated with (e.g., belong to) that Vendor |

||||||||||||

|

|

|||||||||||

Pay a Bill directly via E-Pay from within the Bills Form itself by using the Pay Bill By Bank option on its Action Menu |

||||||||||||

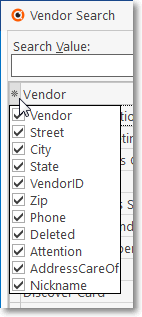

There is a new Nickname field in the Edit View of the Vendors Form where a brief "nickname" for each Vendor may be created. This Nickname will be included in the F2 Vendor Search columns and on the main Vendor Form |

||||||||||||

|

|

Purchase Orders may now be created for delivery to: i.Your Company Billing Address (the default Address entered in the Company Tab of the User Options Form) ii.A predefined "Ship To" address (explained in the Edit View on the Vendor Form chapter) iii.The address of an end-user ("Direct Sale" explained in the Creating a Purchase Order chapter) ▪All purchases will still be billed to your Company's Address. |

|||||||||||

The (Subscriber Prospect, and) Vendor Documents option has a revised Add Document dialog which allows for the specific identification of the File Type to be added |

||||||||||||

|

|

|||||||||||

This new Job Status Form is used to define the Progress of Job Costing records (e.g., Status of the Job as it progresses from creation to completion) ▪The Job Status of a Job Costing entry is initially assigned when it is created, and then periodically updated as that Job progresses toward completion. |

||||||||||||

The revised Item List sub-tab on the Inventory Tab of the Job Costing Form provides many capabilities (e.g., maintain a parts list and print it as needed, Order news parts, reserve parts for this Job, identify the parts that were "used"). |

||||||||||||

|

|

|||||||||||

Module |

Forms Affected |

8254 New Features |

||||||||||

|

|

|

||||||||||

MKMS STARK |

The Contacts Form has been substantially improved with ▪Search On - Additional Search On option which offers many new Search capabilities the selection of which is provided by a Drop-Down Selection List ▪By default, when the Contacts Form is opened from the Receivables tab, all Active Contacts are listed. ▪The number of Contact records displayed in the Contact List's Grid is now User definable. ▪Max records to show in grid - This new option - which is located at the bottom of the Contacts List (Grid) is set to 50 by default. oProvided for those Companies with a large number of Contacts oThis setting allows a User to restrict the number of Contact records that will be retrieved from the database at one time to the Maximum set here. oA pair of left and right arrow buttons provides movement from Grid page to Grid page. |

|||||||||||

|

|

|||||||||||

Bill In Advance - By default, the BillInAdvance option is set to False ("F") in the Company Settings Form. ▪Those Companies using the Version 5.1.8254 or later will have the BillInAdvance option set to False ("F") and should not change it!

Auto Billing Notification Email - By default, this new AutoBillingNotificationEmail option in Company Settings is blank. ▪This option stores the Email address of the Employee who is to be notified if (when) the Fully Automated Recurring Billing process has failed. ▪If no AutoBillingNorificationEmail Email address is entered, no Failure Notification will occur.

Email_invoice_notification - By default, the new email_invoice_notification option is set to False ("F"). ▪The emailing of the Invoice notification - using the MKS Connect Service - during the Fully Automated Recurring Billing process is activated in Company Setting by setting the "email_invoice_notification" to True ("T") and the Subscriber must have a valid Email address.

Email_receipt_notification - By default, the new email_receipt_notification option is set to False ("F"). The emailing of the Receipt notification - using the MKS Connect Service - during the Fully Automated Recurring Billing process and/or when using the Receipt Posting dialog is activated in Company Settings by setting the "email_receipt_notification" to True ("T"). ▪To take effect, the Subscriber must have a valid Email address entered prior to the next running the Fully Automated Recurring Billing process, but may manually enter a valid Email address anytime when using the Receipt Posting dialog. |

||||||||||||

Any E-Payments created from a Work Order, Subscriber and/or an Invoice Form was always listed in the ePay Review report with a Description in the format: "Transaction Type+Subscriber+Invoice #:nnnnnn" regardless of the actual Form from which the transaction originated. ▪Now this Description's format specifically lists the "Work Order #: nnnnnn" or "Invoice #: nnnnnn" or the "Subscriber Name" as appropriate. |

||||||||||||

The E-Payments Form has been enhanced to include new options: ▪Save Current Method of Payment - If new Credit Card or Bank information was entered and this information should be saved as another Payment Method for this Subscriber, the User may now Click the "Save Current Method of Payment" bar ▪Make this Payment Method the default for Subscriber - If the currently selected (or newly defined) Payment Method should be identified as this Subscribers's Default Payment Method, the User may now Check this box. |

||||||||||||

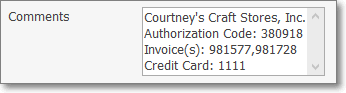

If a Receipt was paid by Credit Card, that information including the last four digits of that Credit Card's Account Number will now be inserted into the Comments section.

If a Receipt paid for multiple Invoices and those Invoices were selected for payment using the Receipts Form's Open Invoices Drop-Down Selections Check Box List, those Invoice Numbers will now be inserted into the Comments section.

|

||||||||||||

Email Notification - When the new Email Notification box at the bottom of the Receipt Posting Form is Checked, and an Email address is inserted in the Email field, the system will now create an Email Receipt Notification. ▪For this Email Notification feature to function properly: a.The "email_receipt_notification" option in Company Settings must be set to True ("T"). b.The default Email address is the one entered in the General section within the Edit View of the Subscribers Form c.This default Email address may be changed (or added), as needed.

▪Once the Receipt is Posted, and the conditions above are in place, a This receipt has been queued to be emailed message will be presented. |

||||||||||||

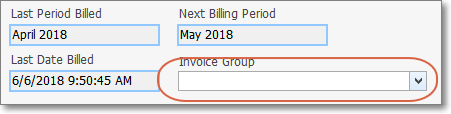

A new Bill in Advance Check box now permits your Company to individually identify those Billing Cycles which are to be Billed in Advance, and those that are not. When this 5.1.35.8254 Upgrade is initially installed, this field will be populated based on how your Company's Bill In Advance option ("BillInAdvance") was previously set in Company Settings |

||||||||||||

A new Internal Notes Press (F9) for timestamped entry field has been added to the Proposal Form. ▪This field is used (in addition to the original Comments field) to record "Internal" notes and/or comments, has a new Time Stamp (F9) feature, and will not be printed on the actual Proposal. ▪Unlike the Comments field, it is not Rich Text Editor capable. |

||||||||||||

|

|

|||||||||||

The Proposal Conversion Information dialog has been updated to include a new Installed Equipment dialog which will only be displayed if the Add Inventory To Installed Equipment? box has been Checked when Converting a Proposal to an Invoice ▪In this new Installed Equipment dialog the User can identify which Proposal Items will be added to the Subscriber's Installed Equipment table using the Qty and optional the How Many? column fields. a.Qty - By default, this Qty (Quantity) represents what was entered on the Proposal, but may be changed if needed. b.How Many? - This column will only be displayed when the Insert_Multiple_Equipment_Items option in Company Settings is set to ("T") True i.Therefore, when the Qty (Quantity) value is greater than One ("1"), Multiple Installed Equipment entries will be created in the Subscriber's Installed Equipment table - based on the How Many? Quantity entered - with each of those Subscriber's Installed Equipment table Quantity entries set to "1". ii.However, when the Insert_Multiple_Equipment_Items option in Company Settings is set to set to ("F") False, this How Many? field is not displayed and only one Installed Equipment entry will be created with the Installed Equipment dialog's Qty (Quantity) inserted into the Quantity field on that one Subscriber's Installed Equipment record. |

||||||||||||

|

|

|||||||||||

An E-Payment option has been added to the Quick Work Order Form which may be used to "collect" the balance for a Past Due Work Order (or Invoice) prior to accepting a new service request. |

||||||||||||

Default Sales Code - The Drop-Down Selection List on the Service Options tab on the User Options Form which is used to Choose the default Sales Category Code for the invoicing of a Service Request will no longer include Inactive Sales Category Codes, any Sales Category Code beginning with "R-", and Sales Category Codes identified as Inventory Items. |

||||||||||||

The load time for the Technician Schedule Form has is now substantially faster. |

||||||||||||

The process of using the Complete button when the Non Billable? field was Checked on a Work Order has changed. Now, if one or more Inventory Items were identified as being Used, and the Non Billable? field was Checked, the Installed Equipment dialog will now be displayed. ▪Install - Check all of the items that where installed from Inventory and should be added to the Installed Equipment table for this Subscriber), then Save the entries. |

||||||||||||

There is a new Quantity field on the Subscriber's Installed Equipment Form ▪During the update to MKMS Version 5.1.8235, this field will be set to one ("1") but may be modified as needed. |

||||||||||||

A Subscriber's Installed Equipment Form's List may now be Grouped by a User selected column name to be able to easily see how many of a particular type of Equipment has been installed at this premises. |

||||||||||||

|

|

A.While Completing a Work Order, and using the Generate Invoice option in the Itemized Invoice Form (see the Automatic Invoice Generation discussion in the Completing a Work Order chapter), when selecting the Inventory Items which are to be added to the Subscriber's Installed Equipment table (the Install box was Checked), the How Many? field must be filled in: ▪When this How Many? Quantity entered is greater than One ("1") - based on the new Insert_Multiple_Equipment_Items option's True/False entry in Company Settings - there are now two possibilities: 1.False - One Installed Equipment entry will be created with the Itemized Invoicing dialog's How Many? Quantity inserted into the Quantity field on that Subscriber's Installed Equipment record. 2.True - Multiple Installed Equipment entries will be created in the Subscriber's Installed Equipment table - based on the How Many? Quantity entered - with each of those Quantity entries set to "1".

B.When using the Work Order Invoicing/Review Form, while Recording Work Order Charges, the Installed Equipment (Shift+F9) tab's How Many? Quantity should be filled in. ▪How Many? - By default, the Quantity in this Installed Equipment (Shift+F9) tab will match the number in the Quantity field in the Inventoryt/Materials tab, but this Quantity may be modified (reduced but not increased), as may be appropriate. oWhen this How Many? Quantity is greater than One ("1") - based on the new Insert_Multiple_Equipment_Items option's True/False entry in Company Settings - there are two possibilities: 1.False - One Installed Equipment entry will be created with the Installed Equipment (Shift+F9) tab's How Many? Quantity inserted into the Quantity field on that new Subscriber's Installed Equipment record. 2.True - Multiple Installed Equipment entries will be created in the Subscriber's Installed Equipment Form - based on the Installed Equipment (Shift+F9) tab's How Many? Quantity - with each of those Quantity entries set to "1". |

|||||||||||

|

|

There's a new capability added to the Job Invoice Multi Usage dialog: ▪Install - Check the box in the Install column for each Inventory Item that is to be recorded in the Subscriber's Installed Equipment Form (if all listed Inventory Items were installed, Check the Green Install box). 1)If the new Insert_Multiple_Equipment_Items option in Company Settings is set to ("F") False - and the Install box is Checked on the Job Invoice Multi Usage Form, one Installed Equipment record will be inserted in the Subscriber's Installed Equipment Form with the Quantity entered equaling the Quantity field entry on that Job Invoice Multi Usage Form.

▪How Many? - This new field is only displayed on the Job Invoice Multi Usage Form when the new Insert_Multiple_Equipment_Items option in Company Settings is set to ("T") True 1)By default, this number will be the same number as the Job Invoice Multi Usage Form's Quantity column but may be changed as needed. 2)When the Insert_Multiple_Equipment_Items option in Company Settings is set to ("T") True - and the Install box is Checked on the Job Invoice Multi Usage Form, then Multiple Installed Equipment entries will be created in the Subscriber's Installed Equipment table - based on the How Many? Quantity that was entered - with each of the Installed Equipment Form's Quantity entries set to "1". |

|||||||||||

There is a new Insert Multiple Equipment Items option in Company Setting Depending on the Insert_Multiple_Equipment_Items option's True/False entry, there are two possibilities: 1.False - One Installed Equipment entry will be created with the Itemized Invoicing Form's How Many? Quantity inserted into the Quantity field on that Subscriber's Installed Equipment record. 2.True - Multiple Installed Equipment entries will be created in the Installed Equipment Form, based on the How Many? Quantity , with each Installed Equipment record's Quantity entry set to "1". |

||||||||||||

There are two new fields and a new Icon located below the Ribbon Menu at the top of the Pending Work Orders section of the Technician Scheduling Form: ▪Start Date - Used to enter the first Date Requested Date to identify the Date Range for the Work Orders that should be included in the Pending Work Orders Grid. ▪End Date - Used to enter the last Date Requested Date to identify the Date Range for the Work Orders that should be included in the Pending Work Orders Grid. ▪Retrieve WOs - Click this Icon to retrieve the appropriate Work Orders. |

||||||||||||

|

|

|||||||||||

The Comments field on the Bills Form be now be included in the List's Grid when it is displayed. |

||||||||||||

|

|

|||||||||||

Module |

Forms Affected |

8253 New Features |

||||||||||

|

|

|||||||||||

MKMS STARK |

Completely new user interface offering a simpler, cleaner design. |

|||||||||||

MKMS STARK |

Implemented Spell Checking in most editable comments and notes fields: ▪The system will Spell Check as you type, underlining any misspelled words with a wavy red line. ▪Select (Double-Click) and then Right Click on a misspelled word to view a Drop-Down Suggestion List from which a replacement may be chosen.

Inside of the Rich Text Editor dialog (Double-Click to open in the RTE Memo field), there is now a Spell Check option to check the entire memo. ▪F7 is a hot key for checking inside the Rich Text Editor dialog. |

|||||||||||

MKMS STARK |

Re-implemented Context Sensitive Help Files (The most recent Help File document (MKS.chm) must be located within the folder in which the MKMS.exe resides). 1.Pressing Ctrl+F1 will open the Help File's Introduction page and the Contents Menu. 2.When the User is within a Form for which Context Sensitive Help has been implemented, by Pressing F1 the specific Help Files Chapter Topic - associated with the current Form - will be displayed. 3.There is also a Help Menu Icon on two MKMS Desktop tabs (i.e., Receivables, Payables). |

|||||||||||

MKMS STARK |

A new Themes capability has been added which allows the User to set their preferred coloration, screen accents (and special occasion) Theme in MKMS and MKMSCS. |

|||||||||||

MKMS STARK |

Backstage Menu System Menu tab on the MKMS Desktop provides a single point of access to almost all File, Maintenance, Reports, Windows, Security and Help options. |

|||||||||||

MKMS STARK |

Quick Access Menu opened with a Right-Click executed on any blank space on the MKMS Desktop, or be Clicking the Menu Icon at the top left of the MKMS Desktop, and provides access to almost all of the File, Maintenance, Reports, Windows, Security and Help options, and this Menu may be accessed while any number of Forms are currently displayed. |

|||||||||||

MKMS STARK |

The Widgets Dashboard normally used within MKMS is now available as a stand-alone MKS Dashboard application and provides access to any/all of those same Widgets. ▪Because it is a stand-alone application, it can be run from any workstation on your Company's network that has access to the SQL Anywhere Network Server. ▪Owners and Managers may use the MKS Dashboard application without having to run MKMS - thereby using less local and network resources. |

|||||||||||

MKMS STARK |

The Widget - Quick Search option has been deactivated because the Widgets feature is now loaded from an external application to improve MKMS performance, and as a result, this type of search would no longer work properly. |

|||||||||||

MKMS STARK |

The new Quick Search dialog (to replace the deactivated Widget - Quick Search option) provides an easy method to Search designated field(s) in Subscriber, Prospect and/or Vendor records - all at the same time - and display a list of each record that matches their Search entry ▪This Quick Search dialog and is accessible two ways: 1)On the Receivables tab in the MKMS Desktop, Select the Search Icon and Choose the Quick Search option. 2)From anywhere within the MKMS Desktop, Press the Ctrl+Alt+Q key combination. |

|||||||||||

MKMS STARK |

MKS Auto Billing |

The Auto Billing capability normally used within MKMS is now available as a stand-alone MKS Auto Billing application and provides far greater flexibility for determining when and which Billing Cycles will be Invoiced. ▪Because it is a stand-alone application, it can be run from any workstation on your Company's network that has access to the SQL Anywhere Network Server. ▪Accounting Administrators and authorized Accounts Receivable System Users may run the MKS Auto Billing application without having to run MKMS - thereby using less local and network resources. |

||||||||||

MKMS STARK |

The new MKMS Data Archive Utility application provides an alternative to the current set of MKMS Purging capabilities.. ▪It can Purge Alarm History and Purge Audit Data based on a selected Purge Date, |

|||||||||||

MKMS STARK |

The Advanced Sale Item Look-up dialog available within the Invoices, Proposals, Bills, and Purchase Orders Forms has been enhanced and simplified with the elimination of the Sale Item field in the header, faster operation, and a more powerful Find capability added: ▪Find - Type the characters (numbers) for the Sale-Purchase Item to be located. i.Upper and lower case entries are treated the same (the entry is compared to both). ii.The incremental search will highlight the closest match. ▪Clear - To start a new search, or just to cancel the existing search, Click the Clear option. |

|||||||||||

MKMS STARK |

Various Reports presented in a data grid |

For some time: A data grid may be separated into Groups based on a selected column's Header Name by Dragging & Dropping a Header Name to the Drag a column here to group a column area above the data grid's Header. ▪Then, to cancel the Grouping, the User would Drag & Drop the selected Header Name back to the Header itself. ▪Now if this data grid is closed when Grouping is still in effect, once reopened, in most cases the previously established Grouping will still be in effect. |

||||||||||

MKMS STARK |

Print Preview (from Grid style Reports) |

Any user defined Print Preview enhancements (e.g., Headers, Footers, Page Numbering, Date & Time location, User Name, Machine Name) are stored and retrieved automatically for each User and for each Report that is derived from a Grid. |

||||||||||

MKMS STARK |

New Icons on Reports using a data grid |

An Email (the data in the Grid) capability, and in some cases a Print Detail and/or Go To Subscriber function has been added to many more reports that present their information in a data grid. When available, these options will appear on the Ribbon Menu at the top of that Report Form as an Icon. Those reports include: |

||||||||||

MKMS STARK |

The Logo tab on the User Options Form will now accept .bmp, .jpg, and .png file formats when Choosing the Company's Logo Image. The Image File Size requirement remains the same. |

|||||||||||

MKMS STARK |

A special MKGM.dup file is included in this upgrade to enable the use of Google Maps® without incurring the map views limitation. Google Map® may now initially display either in the "roadmap" (default) view, or in the "satellite" view, as your Company's Central Station and/or Operations Manager prefers. ▪For those who want to use this feature, this feature requires the installation of a new Company Setting which may be accomplished by using the dbisql utility to run this script: INSERT INTO "DBA"."CompanySettings"("Section","SettingName","SettingValue") VALUES('Feature','DefaultMapType','roadmap') ▪To change the default map display to "satellite": update dba.companysettings set settingvalue = 'satellite' where settingname = 'DefaultMapType' |

|||||||||||

MKMS STARK |

All of the basic Maintenance Forms that must be accessed as each module is implemented (see the How to Setup a Module Chapter Topic for additional information) are now located (with a few exceptions) within their own General Maintenance Menu system and may be accessed with the General Maintenance option on the Backstage Menu System Menu tab and/or the Quick Access Menu |

|||||||||||

MKMS STARK |

The Review Audit Form provides a dialog where records - identified as Audit Form Activity eligible records - are available for viewing. |

|||||||||||

MKMS STARK |

There is a new Review Deleted Entities Form (Only available to the System Administrator i.e., ADMIN) which offers a dialog that allows for the selection by Date Range - based on either the Deletion Date or the Document's Creation Date - of a List of those Entities (e.g., Invoices, Receipts, Bills, Payments) which have been manually deleted by an authorized User from MKMS. |

|||||||||||

MKMS STARK |

Documents are now identified exclusively as a Link to a Drive, Folder, and File name (but previously Embedded Documents will still be available). |

|||||||||||

MKMS STARK |

The selected sorting order for a List (which, when changed, becomes the new default sorting order for that List), will also determine how, and which records are displayed (when the User is not in the List mode) as those Record Movement options (e.g., Begin, Next, Previous, Last) are used on the Main Form's Ribbon Menu. |

|||||||||||

MKMS STARK |

In the Subscriber Search dialog, the system will now show the Limit Record and Search Delay menu options in the Drop-Down Selection Menu for all Users, not just for the Admin User. |

|||||||||||

MKMS STARK |

An MKS Validate stand-alone Utility has been created with similar functionality to the Validate Database function within MKMS. |

|||||||||||

MKMS STARK |

▪The keyboard's Insert (to start a new entry on an Employees Form tab with a Grid format), Delete (to remove an existing entry on an Employees Form tab with a Grid format); plus the Ctrl+S combination (for Save) have been implemented. ▪The Left and Right Arrow Navigation Keys will move the focus from one Employees Form tab to another has been implemented, as has the Ctrl+Insert combination to start a new record on the Employees Form; |

|||||||||||

MKMS STARK |

Various as Listed |

The keyboard's Insert (to start a new entry), Delete (to remove an existing entry), and the Left-Right-Up-Down-Arrow Keys for Navigating within the Grid or Form; plus the Ctrl+S combination (for Save) are implemented on these Forms: ▪On the Job Costing Form's i.Labor tab ii.Sub-Contract tab iii.Materials tab iv.Expenses tab v.Commissions tab vi.Job Tasks tab vii.Inventory tab's Item List sub-tab ▪General Journal Entry Form ▪Work Order Invoicing/Review dialog |

||||||||||

MKMS STARK |

A universal Contacts capability has been added to the system. ▪The Ribbon Menu on the MKMS Desktop's Receivables tab contains a new Contacts Icon which opens the Contacts Form ▪The Subscribers Form, Invoice Form, Prospects Form, Proposals Form, Vendor Form, Purchase Orders Form, Bills Form, and Work Order Form all provide a Contacts (Form access) option as well. |

|||||||||||

MKMS STARK |

Customer Connect Service |

There is a new Customer Connect History (Grid) which displays the history of the Customer Connect Service's Communication transmissions. ▪It is a Grid with full search, column selection and rearrangement,sorting, filtering, etc., features and also provides Print, Export, and Email capabilities. |

||||||||||

MKMS STARK |

A new Salesperson Search field has been added to the Multi-Field Search Form. |

|||||||||||

|

|

|||||||||||

|

|

|

||||||||||

When the UL® 1981 Version is Registered (i.e., Active), the Company Settings CheckULPasswordRestrictions option is set to True ("T") to comply with Section 6.2.6 relating to Password Restrictions in the Third Edition UL® 1981 Standard.

When the CheckULPasswordRestrictions option is set to True ("T") in Company Settings, the Password Requirement legend on the Change Password Form and the Add/Delete Users Form has been updated to more clearly identify those UL® requirements for password creation. |

||||||||||||

A new Entities Drop-Down Selection List field has been added to the Review Deleted Entities Form where previously deleted Proposals were not included. ▪Entities - By default, All deleted entities (e.g., Invoices, Bills, Receipts, Proposals, etc.) will be listed based on the selected Filter type and Date Range. oUsing the Drop-Down Selection List provided, you may also Choose to list only one type of Entity. oIf Proposals are selected, you may Choose whether to list the deleted Proposals for Prospects (the default) or Subscribers.

▪The Restore option on the Review Deleted Entities Form can now restore Proposals including data entered in the Proposal Items, Recurring Items, Job Tasks, and Options tabs, when present. |

||||||||||||

There is a new E-Signature field and E-Signature Icon (shown Above) on the Personal Tab of the Employees Form that provides the ability to store an Electronic Signature for an Employees. The Electronic Signature dialog - where the Electronic Signature is actually created - is accessible by Clicking the E-Signature Icon. ▪This E-Signature Icon is only active when a User has been given the appropriate Access Rights to the Electronic Signature Form. ▪These Access Rights are provided by including the Electronic Signature Form in the Employee Group to which the Employee is a member (in the Security Access Group field within the Security tab of their Employee Form), and/or by specifically adding the Electronic Signature Form to the User Access Rights Form for this User.

When entering the Employee's User Name in the Database User Name field in the Security tab of their Employee Form, if the CheckULPasswordRestrictions option is set to False ("F"), the UL® Password and Username Requirements Password Restrictions feature will be turned off. |

||||||||||||

|

|

|

||||||||||

|

|

|

||||||||||

|

|

A new Email option is now available on the Subscriber, Prospect, Employee and Vendor Forms; and as part of the Printing an Invoice, and/or Printing a Proposal process. a)Click the Email option to open a pre-populated Email Dialog (e.g., using Outlook©, or another Email protocol) to send an Email to the Email Address associated with that Form b)When an Email of an Invoice, or Proposal is sent, the appropriate document is attached to that Email as a PDF file. |

|||||||||||

▪The new Add or Remove Buttons option - accessed by selecting the Down-Arrow at the top of the Subscribers, Prospect, and Vendor Forms - will now allow the User to Customize the content of the new Quick Access Tool Bar on these Forms. |

||||||||||||

▪Status - A new Status field has been added to the Lead Information section of the Edit View of the Subscribers Form (which, during a conversion of a Prospect to a Subscriber, will also be populated with any corresponding Status field in the Edit View of the Prospects Form). If empty, use the Drop-Down Selection List provided to select appropriate Status of this Subscriber (or any of their pending Proposals). ▪This Status field is also used in the new Pipeline Analysis Report |

||||||||||||

|

|

When the new "UseSubscriberTerms" option in Company Settings is set to True ("T"), it now also requires that the Convert a Prospect to Subscriber Process gets the payment Terms your Company will offer to that newly created Subscriber. |

|||||||||||

The documentation for the Understanding Earned & Deferred Revenue and Post Earned Revenue chapters, plus the related Billing Cycles, Company Settings, Run Automatic Billing and Deferred Revenue Setup chapters have all been rewritten; and the Deferred Revenue, and Earned Revenue by Month report chapters have also been updated - all based on the revised (Monthly Basis) methodology used to calculate Earned & Deferred Revenues . |

||||||||||||

|

|

This completely redesigned Subscribers Form has a whole new "look" including new Ribbon Style Menu with special Edit View and Search Icons, History Options and Options Menus, plus options on the Navigation and Actions sections of its Ribbon Menu; new Accounting, Monitoring and Service information sub-tabs ▪Setting the new SaveSubscriberHistorySetting option to True ("T") in the Company Settings dialog will cause the system to save ("remember") each User's History Options History setting as they prefer it. |

|||||||||||

All additions, modifications and deletions of Subscriber data is now performed within the Edit tab on the Subscribers Form which has two sub-tabs: 1.Subscriber - This is where General information about the Subscriber is entered, and where specialized data entry sections for the Receivables, Auto Draft, Service, Acquisition and any Custom Defined field data are provided. 2.Monitoring - This is where basic Central Station Data is entered, and specialized sections for Subscriber Panels, Medical and the myriad number of other Monitoring related information fields are provided |

||||||||||||

Micro Key is now recommending a new way to Assign Batch Numbers on the Receipts, E-Payments, Receipt Posting, and Post Auto Drafts Forms that will better identify When (what day and month) the Receipt was entered, and will also identify what Type of Receipt was posted (e.g,, Check or Cash, Electronic Funds Transfer [E-Pay], the specific Credit or Debit Card, Other) which will make Bank Deposits and Bank Reconciliation processes much easier. ▪When a Batch Number needs to be entered, follow this process: a)Enter the (one digit) number for the Payment Type of the Receipt being posted (1 - 9 based on your Company's adopted Batch Number Assignment method) b)Append the two-digit Month Number and two-digit Day Number ▪If your Company is using an Automatic Payment Gateway (i.e., InnoEPay, Authorize.net, or Forte.net) as your Payment Processor, this Batch Number configuration will be inserted in the E-Payments Form and while Posting Auto Drafts automatically. |

||||||||||||

There is a new Search Open Invoice Read Only - By default, the SearchOpenInvoiceReadOnly option is set to False ("F") which means, when the Subscriber Search by Invoice Number feature is used, the Invoice - if located - will NOT be opened in Read Only Mode, even if the Invoice is for a Service Only Address record and it has a separate Bill Payer identified. ▪Setting this SearchOpenInvoiceReadOnly option to True ("T") Will open the Invoice in Read Only Mode, but only when that Invoice is for a Service Only Address record with a separate Bill Payer identified. ▪When an Invoice is opened in Read Only Mode, the Navigation Icons are not available. |

||||||||||||

Special new Sales Tax related Company Settings: a.3 Digits Tax - By default, the 3DigitsTax option is set to False ("F"). ▪When Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this Company Settings that must be re-set to True ("T") to support Charging and Collecting this type of Sales Tax. ▪Therefore, setting this 3DigitsTax option to True ("T") will also activate this Three Decimal Places Sales Tax feature in the Tax Rates Form.

b.Show Tax And Total Per Line Item Report - By default, the ShowTaxAndTotalPerLineItemReport option is set to True ("T"). ▪By always setting this ShowTaxAndTotalPerLineItemReport option to True ("T"), which is recommended, it will automatically support - when required - the Three Decimal Places Sales Tax feature's three (3) Decimal Places Sales Tax format on reports; and will also show the exact Sales Tax being charged on each Detail Line Item on related reports regardless of how many decimal places, are needed. ▪Whether or not Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this Company Settings may be set to add support on Reports for Charging and Collecting this type of Sales Tax (also see "Show Tax And Total Per Line Item Screen" immediately below) . ▪Setting the ShowTaxAndTotalPerLineItemReport option to False ("F") will eliminate Detail Line Item Sales Tax totals from reports.