Accounts Receivable deals with the Invoicing, Collection, Categorization and Reporting of Revenue

❑The MKMS Accounts Receivables module provides the functionality needed to maintain a detailed Subscriber database, manage Sales, Collections, the Billing of Recurring Billing, Posting of Receipts, printing Invoices and Statements, printing Receivables and Sales Analysis Reports and performing the dozens of other tasks necessary to properly manage your Company's Accounts Receivable. and also provides access to the Prospect Form

•The Receivables module is accessed from the MKMS Desktop by Choosing the Receivables Tab

•To view the Subscribers Form, Select the Subscriber Icon (or Press the F-3 function key).

![]()

MKMS Desktop - Receivables Tab - Subscribers (F3) Icon

❑To properly start the Receivables System module:

a)To get a more complete understanding of what needs to be done, read this Receivable Module Overview chapter completely.

b)Identify the Company's Bank Accounts in the Bank Maintenance Form for each of the cash accounts into which Receipts will be deposited.

c)Enter your Company's Employee Groups records (see Security & Access Management) which are created so a default set of Access Rights may be identified for each type of Employee.

d)Enter your Company's Employees, at least the Sales Personnel.

i.Later, if and/or when the Service Tracking and/or Monitoring modules are implemented, the Employees who are Technicians and/or Operators will also need be entered.

ii.Each of those module's Overview sections provide a reminder that those additional types of Employees should to be entered.

d)Complete all of the required User Options and the Receivables - General Maintenance items and any other documented entry requirements, as needed (see the "What should I do First?" discussion below for detailed information about this step).

e)Define Sales Categories describing what your Company sells.

f)Enter the Subscriber Information in the Edit View of the Subscribers Form (some of the information may have been provided if Micro Key performed a Data Conversion for your Company).

g)Complete the Accounts Receivable Section in the Edit View of the Subscribers Form,

h)Enter each Subscriber's Automatic Billing information, and assign any special Bill Payer address, when appropriate.

i)Establish each Subscriber's Starting Balance.

j)Set up the Auto Draft rules using the Payment Methods dialog to receive automatic Credit Card or Bank Draft payments, if applicable.

k)Familiarize yourself with the Contacts feature.

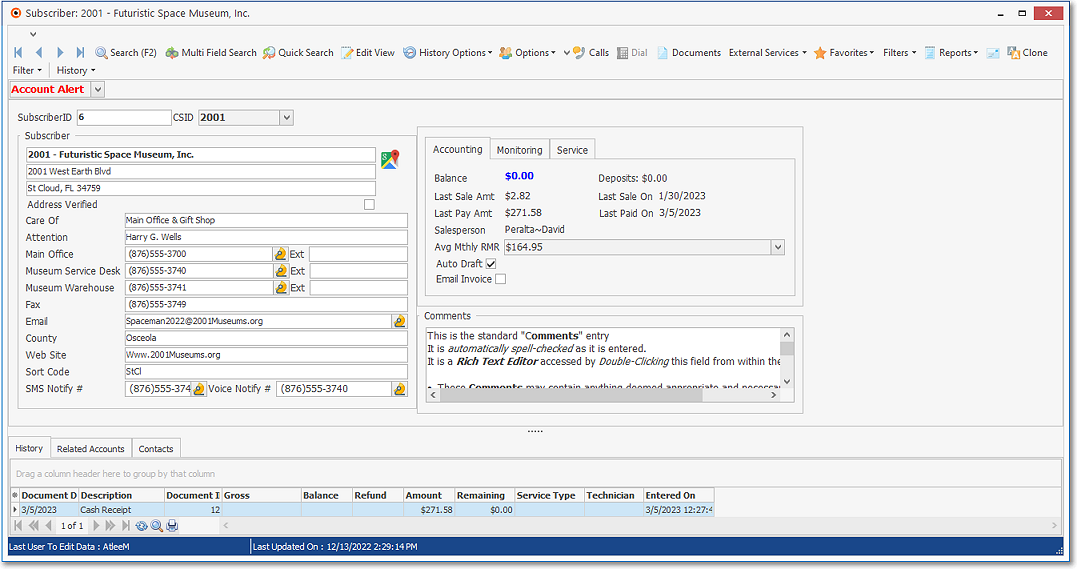

Subscribers Form

❑What should I do First?

•Read the User Options for Accounts Receivable chapter and completed these Forms:

1.Company Options - General tab

2.Company Options - Invoice/Proposal tab

3.Tax (Sales Taxes) tab

➢Note: The Personal Options tab should also be completed (if you have not already done so)

•Read the Receivables - General Maintenance Menu chapter and its linked sub-chapters for detailed instructions of the following steps:

✓At a minimum, the General Maintenance Menu items listed below must be defined:

▪Pay Groups - Define the required Pay Groups that are used to properly Price your Automatic Billing entries.

▪Attrition Types - Define codes and descriptions identifying how an Account was acquired, and why an Account was lost.

▪Banks - Identify the Bank Account(s) in use in the Bank Maintenance Form.

▪Tax Rates - Define all applicable Sales Tax rules.

✓These General Maintenance Menu items may not be required initially, and are only needed if they would be required to meet your Company's current or future business model:

a.Billing Cycles - These are only required if your Company will be implementing Multiple Billing Cycles.

i.Due Day Month - Activate/deactivate and re-describe the Due Day Month Descriptions, if needed.

b.Late Fee Groups - These are only required if your Company will be implementing Multiple Billing Cycles.

c.Divisions - These are only required if your Company has multiple Divisions, or you will be automatically billing Recurring Revenue for other Alarm Dealers.

i.Warehouses - For Companies who will be using the Inventory Tracking System, the Warehouse(s) in which your Company's Inventory Items are (will be) stored may be defined, and linked to the appropriate Company Division.

d.Division Groups - These are only required if your Company has multiple Divisions.

e.Payment Gateways - These are only required if you accept Credit Cards and want to process those transactions through MKMS.

i.Gateway Kinds - The Gateway Kinds Form is used to identify those Payment Gateways that will be used (i.e., Active) , and those that will not (i.e., Inactive).

f.Pricing Markup Groups - These are only required if your Company will be implementing certain special Discount Rates.

g.Employee Sales Teams - These are only required if your Company will be implementing the Commission Tracking System.

h.Wholesale Groups - These are optionally required if your Company will be automatically billing Recurring Revenue for other Alarm Dealers.

•Read the Receivables - Other Maintenance Options chapter and its associated sub-chapters for detailed instructions for the following steps

✓Employee Groups - The Employee Group records are created so a default set of Access Rights may be identified for each Employee.

✓Employee - This Form and its many Tabs provide the required fields for entering Employee information

✓Sale-Purchase Items - Create codes and descriptions for each type of Recurring Revenue Services (e.g., Monitoring, Open & Close Services, Lease Fees) and other types of Sales (e.g., Installations, Service Calls, Inventory, Labor, Late Fees) for which your Company Invoices.

✓Subscribers - Enter the Company's Subscribers

•Electronic Funds Transfer Information - If the Company will be using Electronic Funds Transfer for receiving Subscriber payments and an arrangement with the Electronic Funds Processor (or a Company whose data/transaction import system is compatible with them) has been implemented, the required information for processing EFT transactions is defined in the Bank Maintenance Form.

✓For a general explanation of the Electronic Funds Transfer process, see How to Get Paid via Electronic Funds Transfer.

✓See the Bank Maintenance Form for additional information

❑Once the basic data entry processes are completed to properly set-up the Accounts Receivable System module:

•Set the Starting Balance of each Subscriber

•Perform the Daily Procedures, as required.

•Monthly (at least) perform the Periodic Procedures, as required.

•Track Recurring Revenue growth with the Recurring & Other Revenue Reports.

•Measure your success by Reporting the Results.