❑Mandatory Accounts - Your Company's General Ledger Accounts are required for the proper implementation of the General Ledger System, and the successful completion of the General Ledger Setup Wizard process:

•When you run the General Ledger Setup Wizard there are specific General Ledger Accounts that must be identified because the MKMS General Ledger System uses these to complete the various internally managed Financial Transactions.

✓Keeping in mind that every Financial Transaction must have both a Debit and Credit Account entry (often more than just two of them) accommodating the Double Entry Bookkeeping methodology (also covered in the Understanding the General Ledger System chapter).

✓The General Ledger Setup Wizard will ensure that you have identified (as needed) one or more of these General Ledger Accounts for all records in the Sale-Purchases Items Form and the Bank Maintenance Form.

✓Thereafter, when you enter a Sale or Purchase, the appropriate General Ledger Account Number for the Sale and/or Purchase of that item having been identified in that Sale-Purchases Items Form, will be used appropriately while posting the Sale and/or Purchase Financial Transaction.

✓Also, when you enter a Receipt from a Subscriber, or a Payment to a Vendor, the General Ledger Account Number having been identified for that Bank will therefore use the appropriate Account Number while posting those Financial Transactions.

•However, the other side of these Financial Transactions (the other Debit or Credit entry required with Double Entry Bookkeeping) is not specifically identified on a Sale-Purchases Items or Bank Maintenance Form.

✓Predefining these "other side of the Financial Transaction" Accounts allows the General Ledger System to complete the double entry accounting process automatically - without asking the User to identify any General Ledger Account information at the time those Financial Transactions are posted.

✓These "other side of the Financial Transaction" Accounts are identified in the Account Declarations Form when the General Ledger Setup Wizard is executed.

➢Note: Although a Numbering Range on 1000 to 9999 is recommended (see the General Ledger Start Up, and the Double Entry Bookkeeping chapters for the recommended Numbering Range ), a numbering scheme using up to 9,999,999 main General Ledger Accounts, each with up to 9,999 subordinate Accounts, may be created.

•Upgrades generally require Revisions and/or Additions to the Mandatory Accounts.

✓From time to time, as Upgrades are provided, changes to module requirements may also include additions to, or removal of certain no longer required Mandatory Accounts.

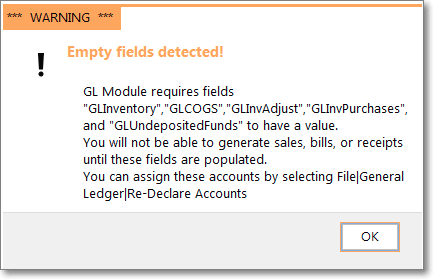

▪These requirements will usually be "announced" with a *** WARNING *** Message specifically describing the changes and providing the solution.

Warning - Empty Fields Detected!

Additional Mandatory Accounts required

❑List of the current Mandatory Accounts

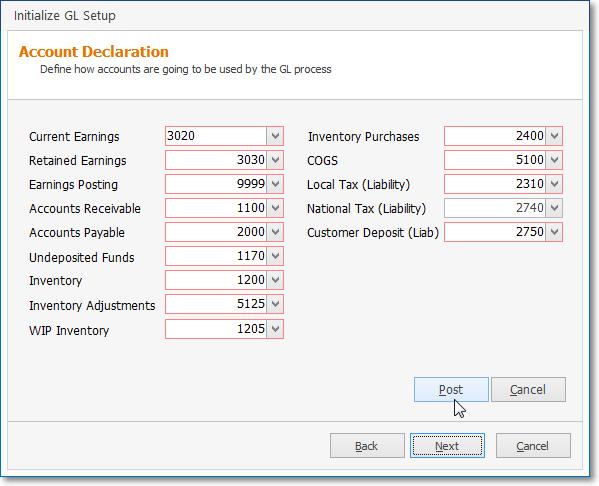

•The General Ledger Setup Wizard includes an Account Declarations Form which is used to identify the mandatory General Ledger Account Numbers (and Titles).

✓You must enter (or ensure that) a specific General Ledger Account Number is defined for each of these Mandatory transaction types.

General Ledger Setup Wizard - Account Declaration

•Mandatory Accounts required for the General Ledger Wizard Setup - specifically in the Account Declaration Form are:

1.Current Earnings - This must be created as the Equity Account for Current Earnings.

2.Retained Earnings - This must be created as the Equity Account for Retained Earnings.

3.Earnings Posting - This must be created as the Special Expense Account for Posting Earnings.

4.Accounts Receivable - This must be created as the Asset Account for Accounts Receivable.

5.Accounts Payable - This must be created as the Liability Account for Accounts Payable.

6.Undeposited Funds - This must be created as the Asset Account for Undeposited Receipts

7.Inventory - This must be created as the Asset Account for Inventory.

8.Inventory Adjustments - This must be created as the Expense Account for Inventory Adjustments

9.WIP Inventory - This must be an Asset Account for the Inventory Items that have been identified as part of a Work In Progress.

10.Inventory Purchases - This must be created as the Liability Account for Inventory Purchases

11.COGS (Cost of Goods Sold) - This must be created as the Expense Account for Cost of Goods Sold.

12.Local Tax (Liability) - This must be created - regardless of whether or not you must charge that tax - as the Liability Account for Local Sales Tax Liability.

13.National Tax (Liability) - This must be created - regardless of whether or not you must charge that tax - as the Liability Account for National Sales Tax Liability.

14.Customer Deposit (Liab) - This must be created as the Liability Account for Advance Deposits.

Canadian Sales Tax:

15.(15.) HST/GST (Asset) - Only required when the CanadaTax option is set to True ("T") in the Company Settings list, this field must be the Asset Account designated for HST/GST tax collections.

16.(16.) PST (Expenses) - Only required when the CanadaTax option is set to True ("T") in the Company Settings list, this field must be the Expense Account designated for PST tax charges.

❖See the Use of, and Purpose for Mandatory Accounts chapter for more detailed information.