❑If you are in business, your Company will make Purchases from Vendors, and later make Payments to those Vendors

•These Purchases must be categorized by type, date and amount, then stored in a systematic manner (that old shoe box document storage system will just not work anymore).

•And so you will, from time to time, owe these Vendors money (your Company's Accounts Payable), so you will have to Pay Invoices.

✓Some of what is owed may still be owed after it was due to be paid.

✓The time - within which these Purchases must be paid - should be easily reported, because knowing how much is owed, and when it is due to be paid, is important if you want to manage of your Company properly.

•So, you will need all types of Reports that detail (or summarize) all of these Financial Transactions in many, many ways.

•You will also need to Print Checks, Reconcile your Check Book(s) and issue Purchase Orders for future Purchases.

✓If applicable, all of these Financial Transactions must post automatically to your Company's General Ledger module.

•This Accounts Payable System will track all of this information - the Financial Transactions - relating to your Company's Purchases and Disbursements.

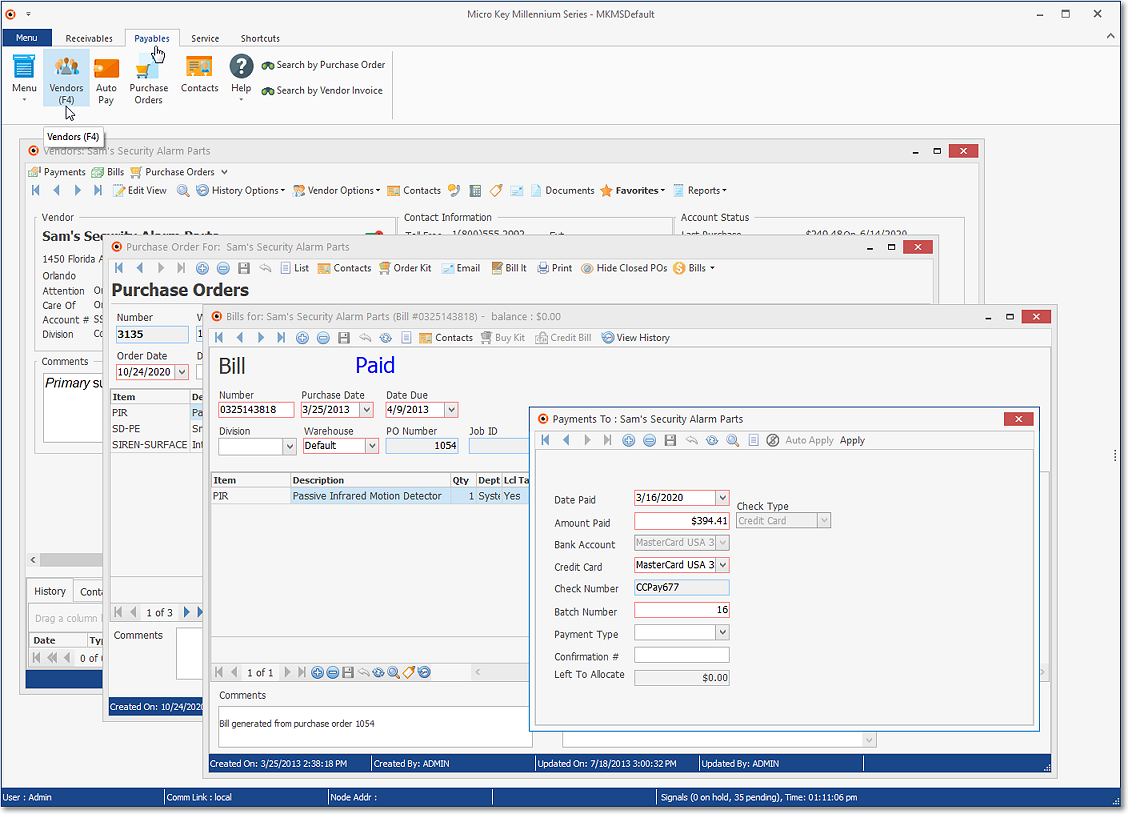

Overview of some Payables related Forms - The Vendor, Bills, and Payments Form

❑To start using the Accounts Payable module, you should first:

•Read this Overview chapter completely for a better understanding of what you will need to do.

•Complete all of the Maintenance Entries specific to the Accounts Payable System (e.g., Purchase Categories, Credit Cards used to pay Bills, Classification codes for identifying various Vendor types)

•Enter your Company's Vendors (e.g., Remittance Address, Tax Rate, Shipping Instructions, Contact Information)

•Define the Recurring Purchases your Company must pay on a regular basis, at a fixed amount (e.g., Vehicle Lease, Loan Payment, Rent) to any Vendor

•Establish the Starting Balance in this system for each Vendor

❑Then, while using the Accounts Payable module:

•Execute the Daily Procedures, as required

•On a Monthly basis (at least), perform the Periodic Procedures

•Examine/Review your Company's purchases and verify and confirm your Company's payments by Reporting the Results

❑What's Next?

•What should I do Now?

1.Read and complete the entries documented in these Payables - Maintenance Entries chapters:

a)Define Vendor Classification Codes to establish a method of grouping Vendors based on how your Company interacts with them.

b)Define your Company's preferred Shipping Methods

c)Create codes and descriptions of Purchase Categories - generic groupings for the goods and services your Company will be buying, and specific identifications of the Parts your Company will be purchasing for resale.

d)Identify the Banks that will be used (this step should have been completed as part of starting the Accounts Receivable module).

e)If your Company will use Credits Cards to Pay Bills, enter a Vendor record for each Credit Card that will be used for that purpose, enter the associated Purchase Category, then identify each of the Credit Cards that may be used to Pay a Bill (see the Credit Card Maintenance & Tracking chapter for detailed instructions).

2.Then, complete the start-up process:

a)Enter Vendor Information so the system knows from whom your Company purchases goods and services.

b)Establish the Starting Balance for each Vendor so the system knows how much, and for what, your Company currently owes each Vendor.

c)Define the Recurring Purchases your Company makes from any Vendor who sends your Company an ongoing monthly (quarterly, annual) Bill for the same Amount.