❑Most of the time, Purchases for Resale are taxed at the retail level, not the wholesale level, so by default, that type of Vendor generally considers Purchases made by your Company to be Non-Taxable (i.e., they will not charge your Company for Sales Taxes on any of your Company's Bills).

•If Sales Tax is never charged by this Vendor, do not Check the Charge Tax? box (the Vendor Tax Information box will not be displayed - see below)

❑If the Vendor is required to charge your Company (local and/or national) Sales Tax (at any time) on any of your Company's Purchases:

•Check the Charge Tax? box on the Edit Tab on the Vendors Form to display the Vendor Tax Information box.

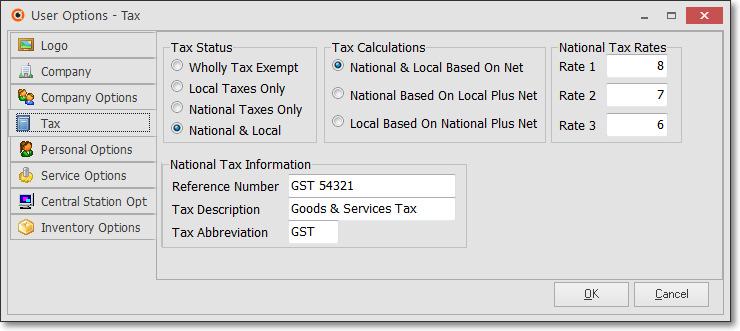

▪Review the Tax Rates and the Tax Tab on the User Options Form chapters.

▪Examine the actual data entered in the Tax Rates Form and the Tax Tab on the User Options Form

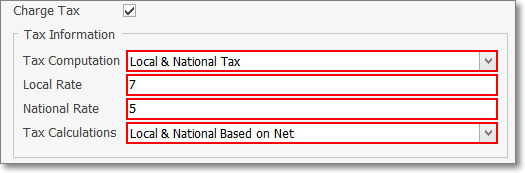

➢Note: One of the most complex Sales Taxing Requirements is shown in the illustrated below

❑The Tax Information box - Identifying how a Vendor should charge Sales Tax on a Bill:

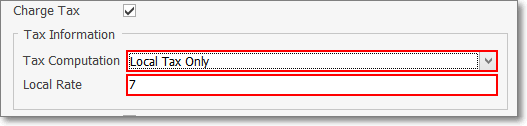

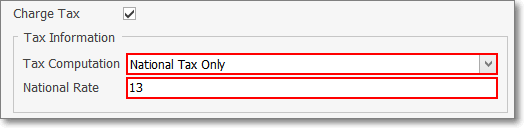

•Tax Computation - There are three cases which may be encountered when identifying how a Vendor should charge Sales Tax on a Bill:

1.Only a Local Sales Tax may be assessed

2.Only a National Sales Tax may be assessed

3.A National and a Locate Sales Tax may be assessed

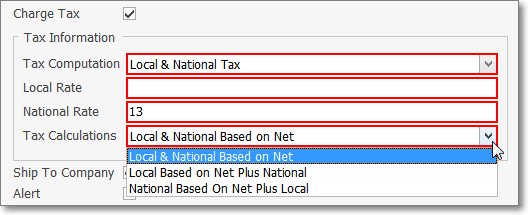

•Tax Calculations - This field will only be presented when there is a National and a Local Sales Tax Rate to be assessed

✓Use the Drop-Down Selection List to identify which Tax Calculation method to be used by this Vendor.

✓Because those two Governmental Agencies may assess Sales Taxes in different ways, three choices are offered:

a.Local & National Based on Net - Select when each category of Sales Tax (i.e., National, Local) is calculated on the Net Amount of all Taxable Items on a Bill.

b.Local Based on Net Plus National - Select when a National Sales Tax is charged on the Gross Amount of a Bill and then a Local Sales Tax is calculated based on the sum of the Net Amount of all Taxable Items within the Bill PLUS the Amount of the National Sales Tax being charged.

c.National Based on Net Plus Local - Select when there is a National and a Local Sales Tax and the National Sales Tax is charged on the Gross Amount of all Items within the Bill PLUS the Amount of the Local Sales Tax which has been calculated on the Net Amount of the Invoice's Taxable Items.

❑How is this Tax Information used?

•Thereafter, based on the Sales Taxing rules in effect for your Company (setup in the Tax Tab on the User Options Form and identified here in the Tax Information box), if this Vendor was identified as having to assess Sales Tax

✓As a Bill from this Vendor is entered:

▪Each Detail Line Item on that Bill may be defined as being Taxable or Non-Taxable,

▪Taxable will be the default.

▪The Sales Tax Rate(s) identified here will be inserted automatically on that Detail Line Item

▪It a specific Detail Line Item should not be charged Sales Tax, the Non-Taxable status may be chosen for that Detail Line Item.

•Trust but Verify - It is important to get this right, because these Governmental Agencies often check your Company's Sales Tax Returns - in person.

✓To validate that your Company did pay the required Sales Tax Amounts on those Purchases, the Taxes Billed Report lists each Detail Line Item on each Bill that was assessed Sales Tax,

✓This Taxes Billed Report is sorted by, and sub-totaled for each Vendor Classification Code.