❑Earned versus Deferred Revenue is a somewhat complex concept.

•Basically, every Sales Invoice that is issued would normally be considered "earned" when it is created within the context of the general accounting procedures - those which most of us are familiar.

✓However, in the case of Recurring Revenue, those Invoices are almost never "earned" when they are "billed" to the Subscriber.

✓This is because the Invoices for this Recurring Revenue are created a month (or a least a week or so) in advance of when the next period of service, for which they are being Invoiced, actually begins.

•So technically, when the money for those Recurring Revenue Sales Invoices is received before the entire period of service (for which they were Invoiced) has ended:

✓Those Receipts are Deposited (and that Income is often spent) before those services have been fully provided.

✓Therefore, at least a portion of those deposited Receipts (that portion of Income) for that period of unfulfilled service time, would (and should) be considered unearned.

❑An example of Earned and Deferred Revenues

•Your Company's Subscribers are billed Quarterly on the 15th of the month preceding the start of their service period.

✓Most of these Subscribers pay on time - remember this is only an example, so stop laughing.

✓Therefore, everyone that pays on time has paid "in advance" of when those services are actually being provided.

✓So, at that time (when they paid prior to the starting month of service), all of the Income is actually unearned.

•Until the three months for which they were Invoiced have passed, that money could be used by your Company without having fully provided the services for which they were Invoiced.

✓In fact, you are only earning a month of their prepayment for each month that was billed and paid in advance.

✓Each month, a month's worth of that prepayment is earned, until the service is fully provided for the period for which they were Invoiced, and had paid in advance.

✓So the Earned Revenue Amount is increased and the Deferred Revenue Amount is decreased each month until the prepaid Deferred Revenue Amount is all "used up".

•Are you having fun yet?

❖For General Ledger System Users, suggested additional reading:

1.The Understanding Earned & Deferred Revenue chapter for detailed information about Earned and Deferred Revenues.

2.The Post Earned Revenue chapter describing how to Post previously Deferred to the appropriate General Ledger Earnings Account.

3.The Automating the calculation of Earned and Deferred Revenue discussion in the Deferred Revenue Setup chapter for additional information.

❑Why go through this trouble? (Who - except maybe Albert Einstein - likes this type of "thought experiment" anyway?)

A.Because growing companies have - as a result of that growth - increasing Recurring Revenue Sales month over month, and year over year.

B.If some (and often all) of this Recurring Revenue is from Contracted Monitoring and Service Agreements billed in advance, for tax purposes your Company may be able to "defer" some of this Income - specifically the portion that is unearned - into the following Fiscal Year.

C.When any Recurring Revenue is deferred into the following year, assuming your Company is filing on an accrual basis, you do not have to pay taxes on unearned Recurring Revenue for the current year.

D.Generally, besides taxation, this is a good thing because the value of money declines over time, and in the meantime, you may actually be earning interest on that Recurring Revenue (enhancing the value of that unearned Income).

❑The Problem (Why doesn't every Company track this?) - Earned and Deferred Revenue is very difficult and extremely time-consuming to manually track and calculate!

•If your Company has not automated this process, it's possible that it would cost as much to accurately calculate your Company's Earned and Deferred Revenues as your Company might save in Income Taxes.

•That is not a problem with MKMS because the system calculates the Earned and Deferred Revenue as part of its Recurring Revenue Billing process with virtually no additional effort required on your part.

❑The Solution - Print a Deferred Revenue Report which computes the Deferred Revenue that existed as of a User specified Month and Year.

•Just identify the Month and Year for the month you want reported.

•To have these Deferred Revenue reported Values match your General Ledger System's Deferred Revenue Liability Account, the reporting month's Post Earned Revenue procedure must be executed before hand.

❖For General Ledger System Users - See the "Automating the calculation of Earned and Deferred Revenue" in the Deferred Revenue Setup chapter for additional information.

❑There are two ways to access the Deferred Revenue dialog:

a)From the Backstage Menu System Select Reports and Choose Receivable Reports, or

b)From the Quick Access Menu, Select Reports and Choose Receivable Reports.

✓Then, Select the Deferred Revenue option.

❑Deferred Revenue tabs - There are three tabs on the Deferred Revenue dialog.

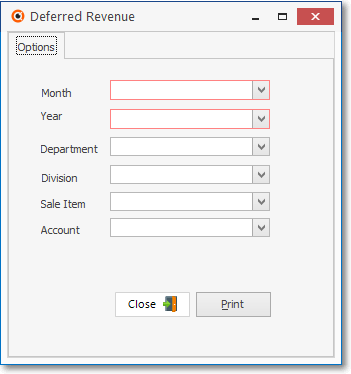

•Options - Initially only the Options tab is shown (until you make your Options selections and Select Print).

Deferred Revenue - Options tab

✓Month - No default Month is provided:

▪Use the Drop-Down Selection List provided to Choose the Month for which the Earned/Deferred Revenue Values will be calculated.

✓Year - No default Year is provided:

▪Use the Drop-Down Selection List provided to Choose the Year for which the Earned/Deferred Revenue Values will be calculated.

✓Department - By default, Deferred Revenue Amounts for All Departments will be included, but this report may also be limited to a selected Department.

▪To report the Deferred Revenue for only One Department, use the Drop-Down Selection List provided to Choose that Department.

✓Division - By default, the Deferred Revenue Amounts for All Divisions will be included, but this report may also be limited to a selected Division.

▪To report the Deferred Revenue for only One Division (or Alarm Dealer - if your Company is billing the Alarm Dealer's Monitoring Accounts), use the Drop-Down Selection List provided to Choose that Alarm Dealer, Division or Division Group.

✓Sale Item - By default, the Deferred Revenue Amounts for Sale Items will be included, but this report may be limited to one Recurring Revenue Sale Item

▪Use the Drop-Down Selection List provided to Choose the specific Recurring Revenue Sale Item which is to be reported.

✓Account - By default, the Deferred Revenue Amounts for General Ledger Account assigned to Recurring Revenue Sale Items will be included, but this report may also be limited to a specific General Ledger Account assigned to specific Sale Item(s).

▪The same General Ledger Account may be assigned to more than one Recurring Revenue Sale Item.

▪Use the Drop-Down Selection List provided to Choose the specific General Ledger Account assigned those Sale Item(s) which is to be reported.

•Print - Click the Print button to Preview and optionally Print (to a File or a Printer) this Deferred Revenue Report.

✓To Exit this Report dialog, Click the Close button ![]() toward the bottom of the Options tab.

toward the bottom of the Options tab.

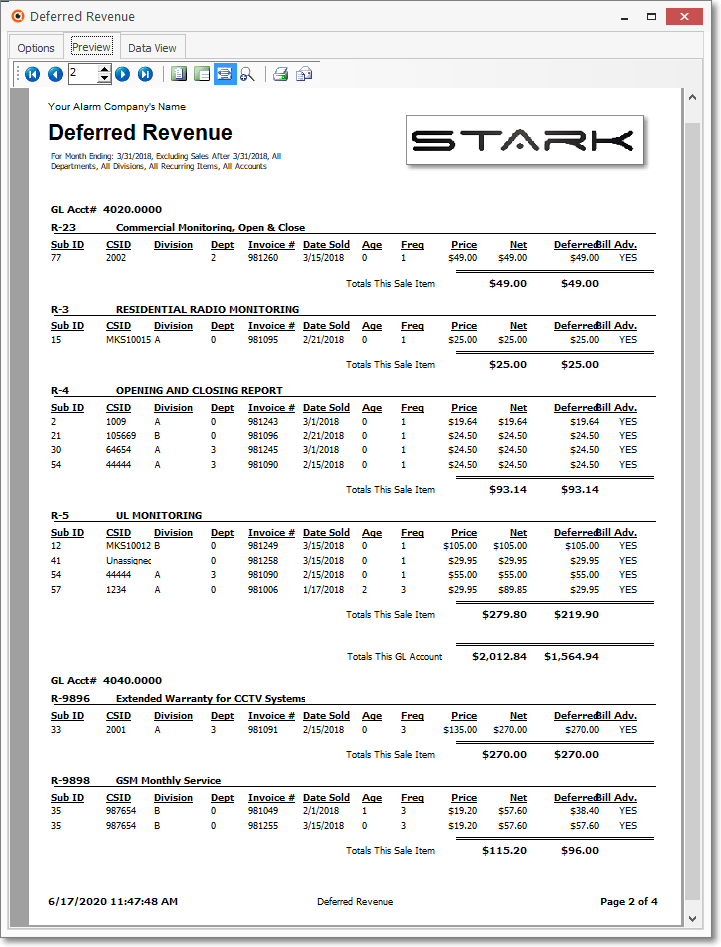

•Preview - The Preview tab presents the report which resulted from the Options you've selected.

Deferred Revenue Report - Preview tab

✓Up Arrow/Down Arrow - hi - Moves the report one line up, or one line down, respectively.

✓Page Up/Page Down - Moves the report to the previous or next page, respectively.

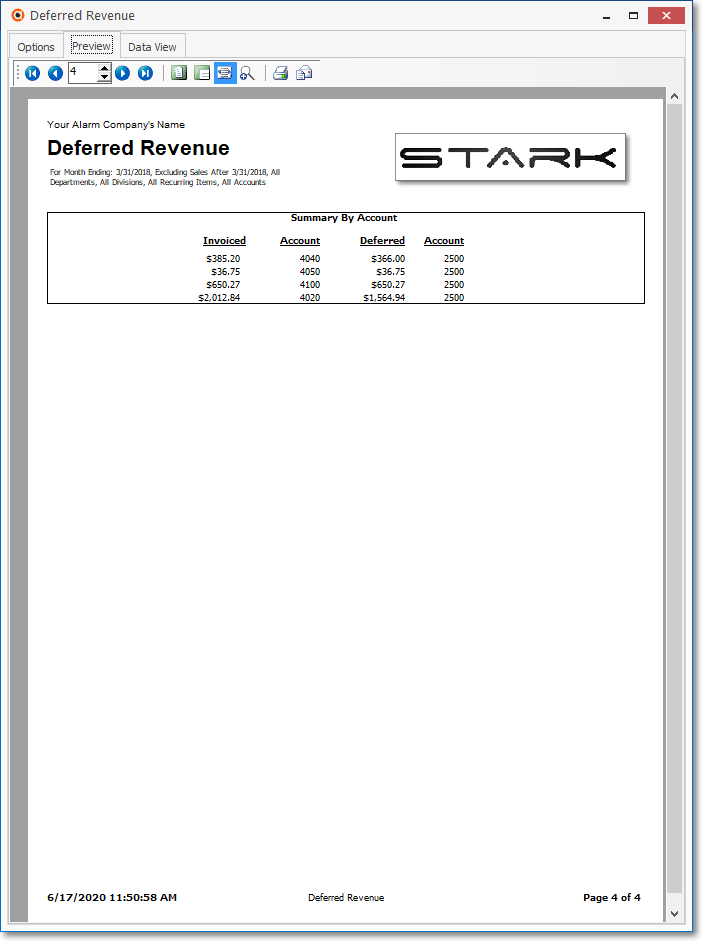

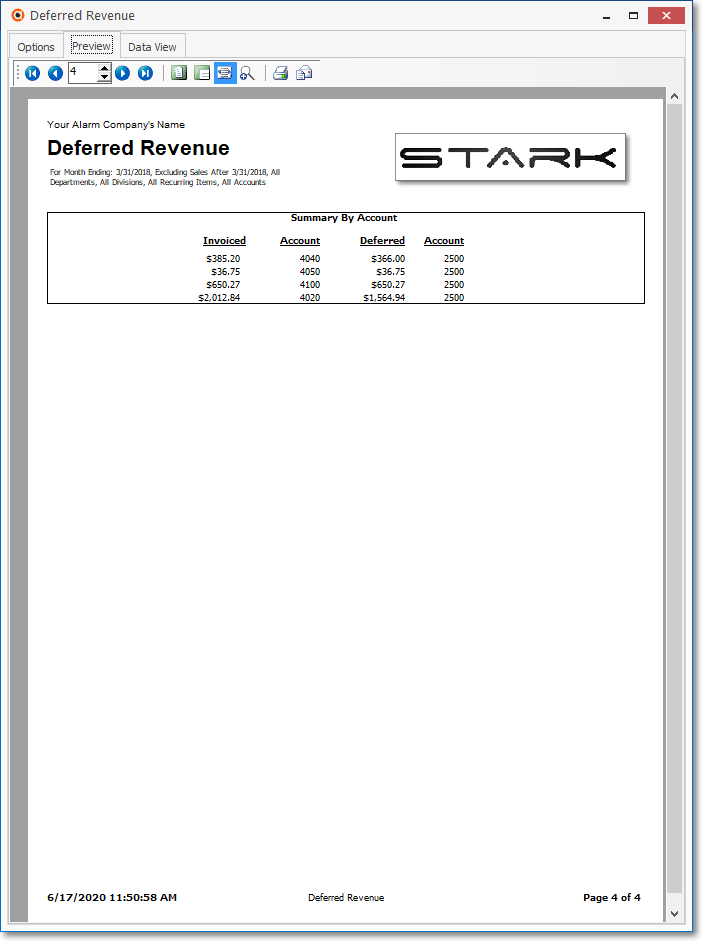

Deferred Revenue Report - Preview tab - with Summary Recap and GL data

✓Home - ![]() - Using either the screen Icon or your Keyboard's Home key, moves the report to the top of the first page.

- Using either the screen Icon or your Keyboard's Home key, moves the report to the top of the first page.

✓End - ![]() - Using either the screen Icon or your Keyboard's End key, moves the report to the bottom of the last page.

- Using either the screen Icon or your Keyboard's End key, moves the report to the bottom of the last page.

✓Arrows - The arrows allow you to move back and forth, from page to page.

✓Number - Indicates the page number you are viewing.

▪You may also type in a specific page number, Press 8 Enter and that page will be displayed immediately.

▪If you enter an invalid page number, it will be ignored.

✓Fit To Page - Click the first button after the arrows to size a full page of the report to fit the screen.

✓Zoom To 100% - Click the second button after the arrows to display the page at 100% (of the printed view).

✓Fit To Page Width - Click the third button after the arrows to size the page of the report to fit the full width of the screen.

✓Zoom To Percentage - Click the fourth button after the arrows to re-size the page of the report by percentage.

![]()

▪When you Click the Zoom To Percentage button, the Percentage selector will be displayed.

▪You may then Click the Up or Down ‚ arrow to set the exact amount of Zoom you want.

✓Print - Click the Print button to Print (to a File or a Printer) ![]() the displayed Deferred Revenue Report.

the displayed Deferred Revenue Report.

▪See Printing to a File for additional information ion how to save this report in several different file formats.

✓Email - Click the Email button ![]() to send the Report to an Email Address of your choosing.

to send the Report to an Email Address of your choosing.

•Exit the Form by Clicking the Close button ( X ) on the right at the top of the Form.

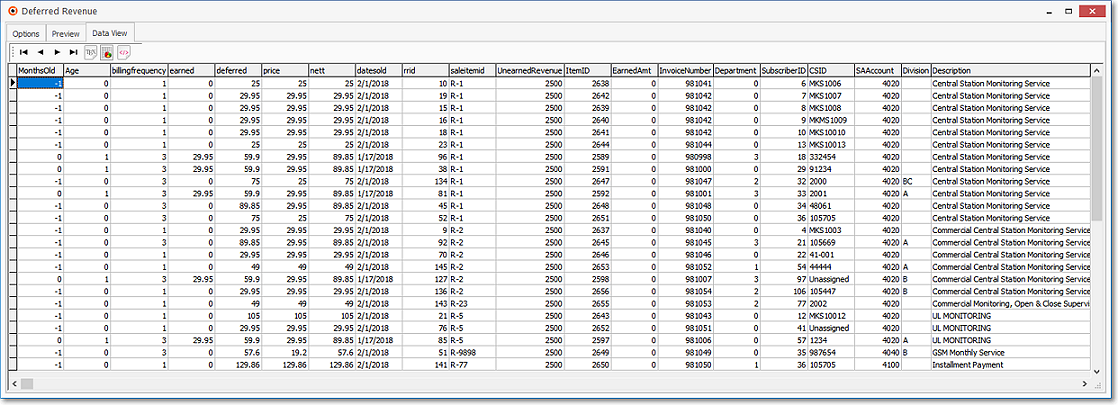

•Data View - This view provides a tabular (spreadsheet style) presentation of the selected data.

Deferred Revenue Report - Data View tab

✓Arrows - Click the arrows to move through the record.

✓Export - Exporting the data from this Data View tab (note the "fly-over" help available on these buttons):

▪Export to CSV - Click the first button after the arrows to export the data to a Comma Separated Values (CSV) file format.

▪Export To Excel - Click the second button after the arrows to export the data to an Excel (.xls) file format.

▪Export To Html - Click the third button after the arrows to export the data to an HTML formatted file.

✓To Exit the Data View tab and Close this Report dialog, Click the Close button on the right at the top of the Data View tab.

❑For General Ledger System Users: We suggest you use the automated Post Earned Revenue procedure, but this process may be done manually, if desired (but why would you want do that to yourself?).

•This Deferred Revenue Report may be used as their General Journal Entry manual posting guide to distribute the Earned and Deferred revenues on a Monthly Basis.

✓That portion of the revenue that was able to be deferred into the next taxable year is defined in your Balance Sheet as a "Deferred Revenue" Liability Account.

•The General Journal Entry required to post the Deferred Revenues at the end of the year is to Debit each of the General Ledger Sales Account(s) containing the Deferred Revenue Amounts, and Credit the Deferred Revenue Liability Account for the total of that Deferred Revenue.

•Then, each month in the following year you must recognize that portion of the Deferred Revenue that was subsequently Earned in each of those months.

✓This is done by Debiting the Liability account for the earned revenue and Crediting each of the Sales account(s) for that portion that was earned within that sales category.

Deferred Revenue Report - Summary Recap and GL data