❑The Credit Card Maintenance & Tracking feature provides the ability:

a.To pay a Bill using a Credit Card - by using the Credit Card Pay option that is available on the Bills Form's Ribbon Menu.

b.To create an internal Bill for the Amount of (or any Amount toward) the Balance on a statement from the Credit Card Company to pay for some (or all) of those Credit Card charges using the Create Bill option on the Credit Card Register Form

c.To maintain a running Value of the Balance Due to each Credit Card Company that is being used by your Company to Pay those Bills with a Credit Card.

❑Set Up Instructions for using Credit Cards to Pay Bills:

•Credit Cards may be used to Pay Bills and these Credit Card Payments are tracked within a Credit Card Maintenance & Tracking System, but require the following steps to properly implement this feature:

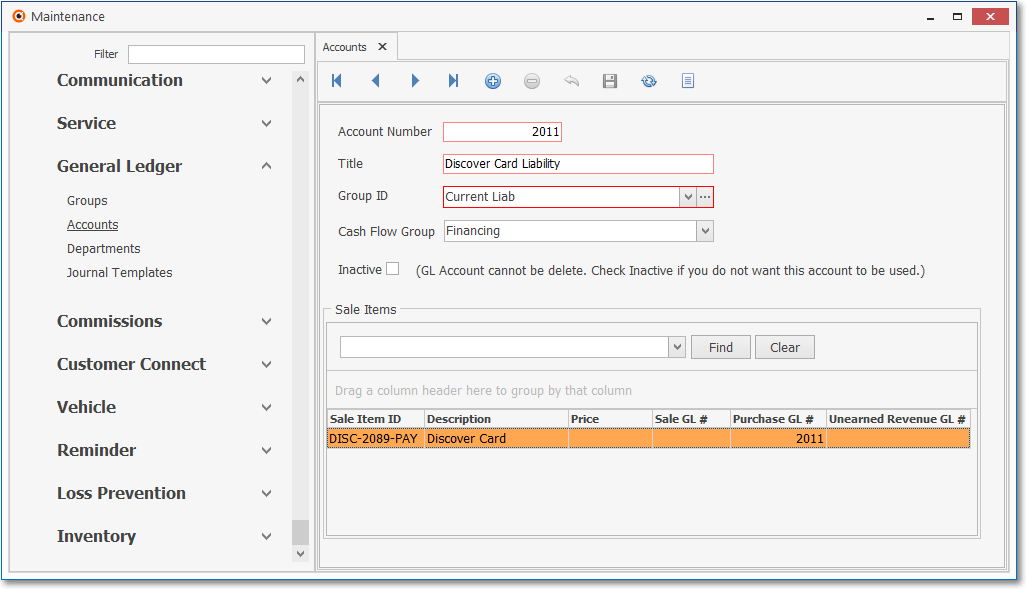

1.For General Ledger System Users Only: You must create an individual Current Liabilities Credit Card Liability Account for each Credit Card:

General Ledger sub-menu - Accounts Form - Credit Card Liability Account definition

a.Create a unique General Ledger Account (this must be a Liability Account) for each Credit Card.

i.Account Number - It will be used to track the Credit Card Debt owed by your Company to that Credit Card Company - thereby tracking, within the General Ledger System, the Credit Card Liability ("Debt") that your Company owes to each Credit Card.

ii.Title - This should be the name of the Credit Card Company

iii.Group ID - Using the Drop-Down Selection List provided, Choose Current Liab

iv.Cash Flow Group - The Credit Card related Financial Transactions from any General Ledger Account are included in the Cash Flow Statement and so must be assigned to the appropriate Cash Flow Group (i.e., Financing).

a)Specific General Ledger Accounts reported on the Balance Sheet (i.e., Asset, Liability, and Equity Accounts) may need to be assigned to a Cash Flow Group.

b)Consult the Cash Flow Group chapter for more information about assigning a Cash Flow Group.

v.Inactive - Do not Check this box.

b.This Credit Card Liability ("Debt") Account is used to record the "Purchases" i.e., the Debt that was charged to this Credit Card

vi.Therefore, there must be a unique Credit Card Liability Account defined for each Credit Card your Company will be using to make Credit Card Payments on Bills, and

vii.Each Credit Card record must be assigned its unique General Ledger Liability Account Number (if using the General Ledger System).

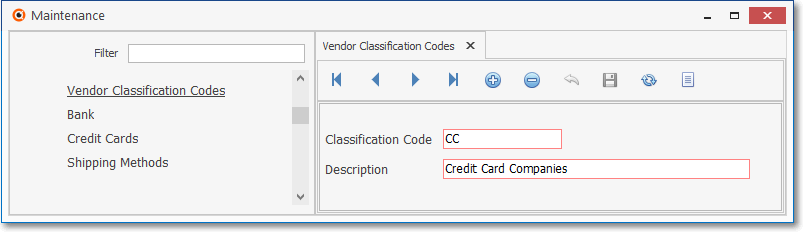

2.Create a Vendor Classification Code (such as "CC") to be assigned to all Vendor records that represents a Credit Card company.

General (maintenance) Menu - Payables sub-menu - Vendor Classification Codes Form - Credit Card Companies code

a.This Vendor Classification Code should then be assigned to each (all) of those Vendors representing a Credit Card Company your Company will be using to make Credit Card Payments on Bills.

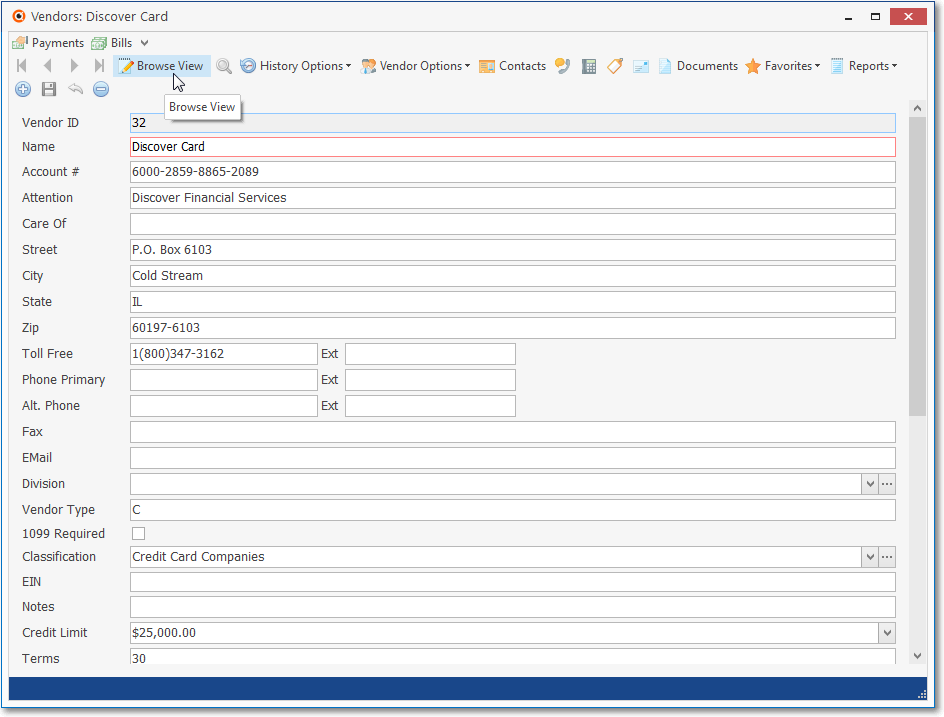

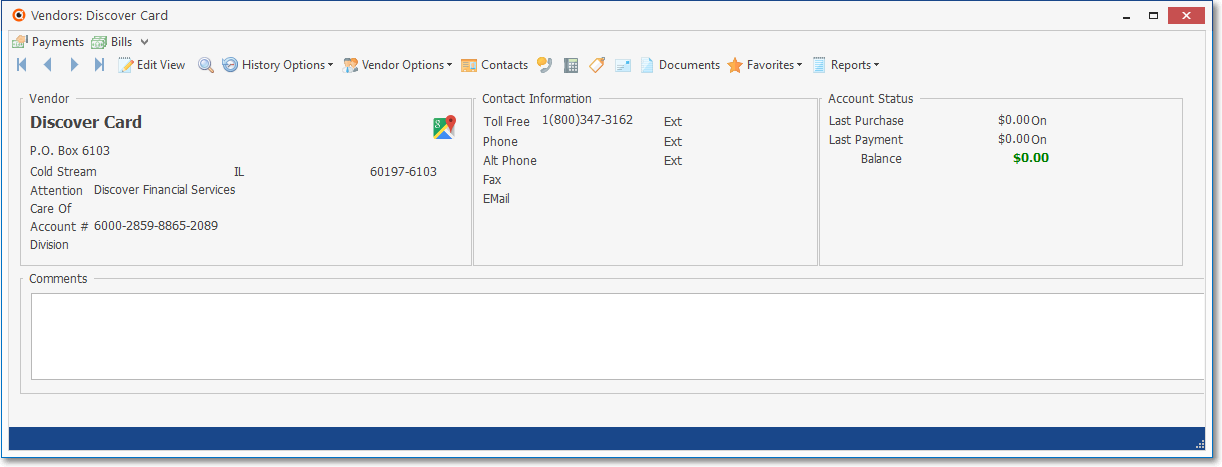

3.Create a Vendor record for each Credit Card that your Company will be using to make Credit Card Payments on Bills

Vendors Form - Edit View - Credit Card Company entry

a.Assign the Vendor Classification Code created above to each of these Vendor Credit Card records.

b.Thereafter, a Bill may be created for that Vendor representing the outstanding balance on a Credit Card, which will at a later date be Paid by Check or Electronic Transfer.

i.In the Bills Form of a Credit Card Vendor, there is NO Insert, Delete, or Cancel option on its Ribbon Menu.

ii.Any Bills that were paid using a Credit Card are created using the Credit Card Pay option on that Bills Form for the Vendor who is charging the Balance Due on that Bill to this Credit Card company.

c.This process will reimburse (make a payment to) that Credit Card Company (the associated Vendor) for the Amount(s) your Company had previously charged as Payments on various Bills.

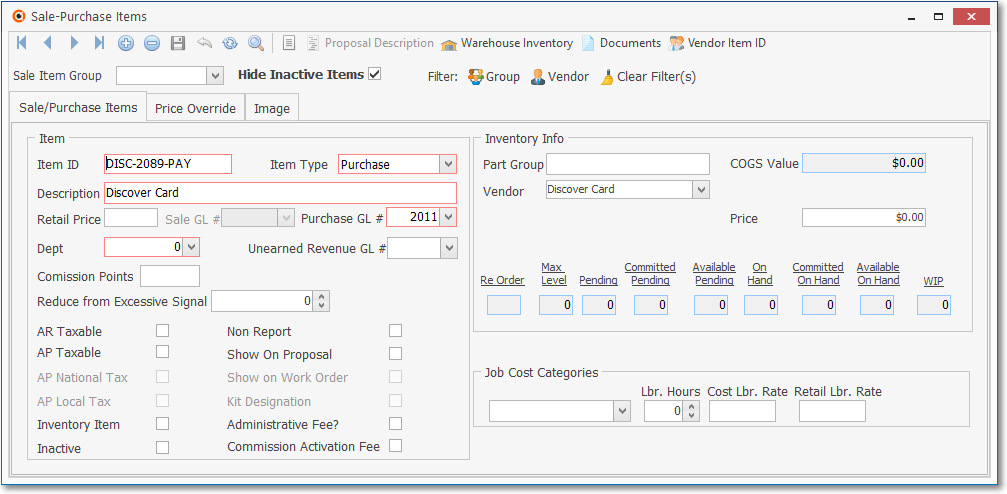

4.Create a Purchase Category record for each Credit Card

Sale-Purchase Item Form - Purchase Category for Credit Card Company

a.Item ID - It must be assigned an Item ID representing that Credit Card followed by a dash, a Number to identify that specific Credit Card followed by a dash, and then the letters "PAY" (e.g., DISC-2089-PAY)

b.Item Type - Using the Drop-Down Selection List provided, Choose the "Purchase" option.

c.Description - Enter the Name of this Credit Card (e.g., "Discover Card").

d.For General Ledger System Users:

i.Purchase GL # - Using the Drop-Down Selection List provided, Choose the Liability Account Number (created in step 1. above) created for the "Purchase GL# field on the corresponding Credit Card Purchase Category record.

ii.No Checks are entered in any Check Boxes and any default Check Marks should be removed.

iii.Thereafter, this Purchase Category will be used to track and report - and track within the General Ledger System - that Credit Card's Purchases (i.e., the Debt charged to that Credit Card as Payments on various Bills).

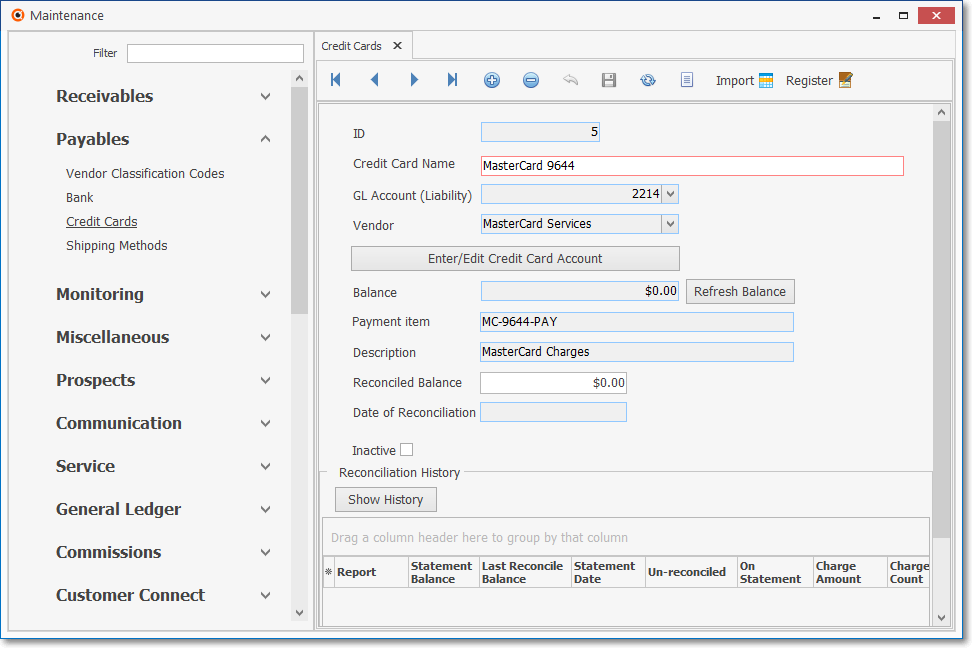

5.Create a Credit Card maintenance record (corresponding to the Purchase Item entered in step 4. above) with a unique Credit Card Name.

General (maintenance) Menu - Payables sub-menu - Credit Cards definition

a.ID - System inserted a record number when this entry is initially saved.

b.Credit Card Name - Enter a unique Credit Card Name (perhaps the standard name or abbreviation for that type of Credit Card plus the last four digits of its Account Number)

c.GL Account (Liability) For General Ledger System Users Only:- Using the Drop-Down Selection List provided, Choose the General Ledger Liability Account (created in step 1. above) associated with this Credit Card.

d.Vendor - In the Vendor field, using the Drop-Down Selection List provided, Choose the corresponding Vendor record created for this purpose (see step 3. above)

e.Enter/Edit Credit Card Account - Optionally, you may also enter the actual full Account Number of that Credit Card

f.Balance - This is a system maintained field

g.Refresh Balance - Click this button to refresh (upload) the Current Balance owed on this Credit Card

h.Payment Item - Use the Drop-Down Selection Box provided to Choose the appropriate Purchase Category (see step 4. above) defined for creating Bills which will then be Paid to this Credit Card.Company.

i.Description - This is the Description of the Payment Item (i.e., Purchase Category) identified above.

j.Reconciled Balance - This Amount is provided by the system once a Credit Card Statement has been Reconciled, but may be manually entered when first defined.

k.Date of Reconciliation - This Date is provided by the system once that Credit Card Statement has been Reconciled

l.Inactive - Checked if this Credit Card is no longer used.

6.After entering a Credit Card maintenance record, you may also create an entry in its Credit Card Register to identify the current balance previously accrued and currently owed to this Credit Card prior to its entry here.

a.You may add a record in its Grid (use the Insert Icon on the Ribbon Menu at the bottom of the Credit Card Register Grid) that represents the current balance on this Credit Card

b.Alternately, you do nothing in the Credit Card Register which will set the current balance owed on this Credit Card to $0.00.

c.Either way, a Credit Card Register is automatically maintained thereafter for each Credit Card

7.The Bills Form (for the Vendors who are not classified as a Credit Card Company) will have a Credit Card Pay option with a Drop-Down Selection List containing all of the established Credit Cards.

![]()

a.Use its Drop-Down Selection List of all identified Credit Cards to Choose the Credit Card Company that should be used to Pay for the currently selected Bill.

b.The Amount Due on the Bill will be the default Payment for the Credit Card Pay Icon transaction and will be Credited (added to) the General Ledger Liability Account (e.g., "Credit Card-1234-PAY"); and that Amount will be Debited (subtracted from) the General Ledger Accounts Payable Liability Account.

c.This Payment on the Bill - owed to that Vendor - will be recorded in the Credit Card Register Form.

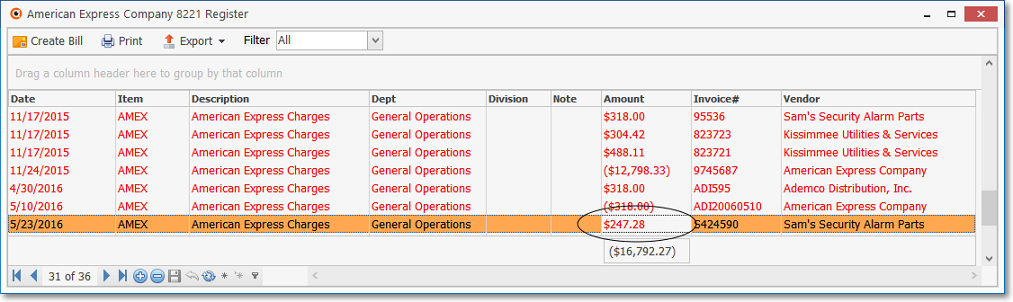

8.Thereafter, each Credit Card maintenance record (see step 5. above), and each associated Vendor record created for each Credit Card your Company uses (see step 3. above), will have a Credit Card Register Form that displays a Grid with:

Credit Card Register

a.A list of all the previously posted Payments made on Bills using to the currently selected Credit Card (or Credit Card Company);

b.A list of all Statements (entered as Bills to that Credit Card Company Vendor) for the currently selected Credit Card Company.

c.A Create Bill option which may be used to create a Bill for a specified Amount (or all) of the outstanding charges listed on a Statement received from that Credit Card Company.

d.This Bill created for that Credit Card Company may then be Paid in the normal manner to the Vendor (which was identified for that Credit Card).

e.A Check may then be printed (or an EPay payment executed) for those Credit Card Statement balances.

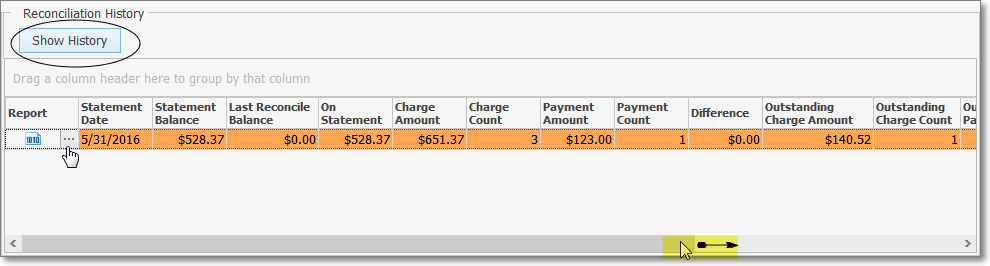

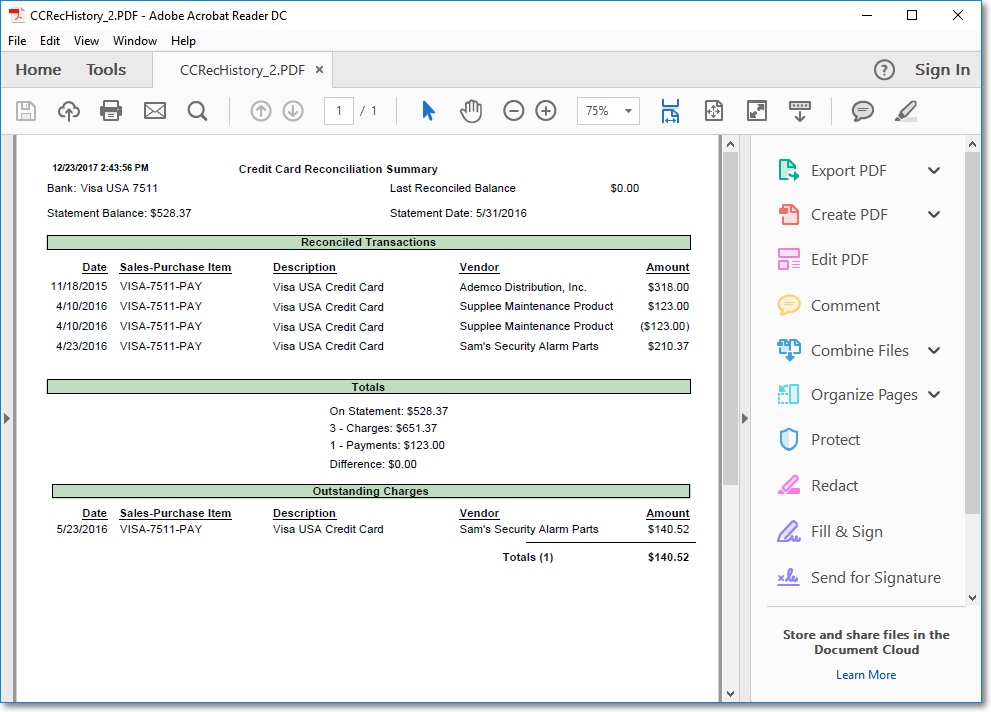

9.Credit Card Reconciliation Grid - This section on the Credit Card maintenance list of each previously completed Credit Card Reconciliations:

a.Click the Show History button to display a summary of each previously completed Credit Card Reconciliations for the currently selected Credit Card.

b.There is a Horizontal Slide Bar - displayed when needed - located at the bottom of the Reconciliation History Grid to allow the User to view all of the data included in all of the columns.

c.Report - Click the Ellipse on one of the line items in the Report column to display the associated Credit Card Reconciliation report

Credit Card Reconciliation Summary - Reconciled Charges and Payments Transactions

•For General Ledger System Users:

A.When an Item is added to the Credit Card Register (using either the Credit Card Pay option on the Bill Form; or the Insert option on the Ribbon Menu at the bottom of the Credit Card Register Grid itself), the Amount of the charge is posted as follows:

1.The Credit Card Pay Amount is posted as a Debit (subtracted) from the Accounts Payable Liability Account

2.The same Credit Card Pay Amount is posted as a Credit (added) to the General Ledger Credit Card Liability Account defined for that purpose in the Credit Cards (maintenance) Form (see step 5. above).

B.When you create a Bill using the Create Bill option within the Credit Card Register Form, the Amount of that Bill - which is being created to pay a balance owed (some or all of the Debt owed) to that Credit Card Company - is posted:

![]()

1.As a Credit (added) to the General Ledger Accounts Payable Liability Account.

2.As a Debit (subtracted) from the General Ledger Credit Card Liability Account

Because:

a)This General Ledger Credit Card Liability Account was first defined to track that Credit Card's Debt

b)That Credit Card's General Ledger Liability Account was assigned to the Sale-Purchase Item (created for that purpose as explained in Step 4., a. above)

c)Finally, it was assigned to the specified Credit Card record as its Payment Item

C.When the Bill - created (in step B. above) to pay a balance owed to the Credit Card Company - is subsequently Paid (by Check, Hand Check, or EFT), that Payment Amount is posted as follows:

1.Debited (subtracted) from the Accounts Payable Liability Account,

2.Credited (subtracted) from the General Ledger Asset Account assigned to the associated Bank.

❖See the Credit Cards and the Credit Card Register chapters for other important information.