❑In the Accounts Receivable and Accounts Payable modules (as well as the Service Tracking and Inventory Tracking/Job Costing module which internally links to those), when Financial Transactions are entered in a normal manner (using Forms like Sales and Receipts, and through automatic processes like Auto Bill or Auto Draft), those Financial Transactions are automatically posted to your Company's General Ledger Financial Statements and Reports - in the background - as they are posted through their respective modules, with virtually no additional steps required after implementing the General Ledger System, than were required before its implementation.

•Although most accounting software systems require a two step (or more) process which entails an entry, a review process, and than a posting procedure to finally get those Financial Transactions posted to their General Ledger System, this is not the case when using this MKMS General Ledger System.

•All Financial Transactions (e.g., entering Sales to Subscribers, Invoicing Work Orders, recording Bills from Vendors, entering Receipts, Paying Bills, etc.) are immediately posted in "real time" into the General Ledger's Account Register and its Transaction File - in the background - and so no additional step(s) are required on the part of the User who is making those entries.

✓In fact, No additional "posting" steps are ever required (unless special Accountant requested General Journal entries are made).

✓Once the MKMS General Ledger System is correctly setup, NO General Ledger Accounting Experience is needed by the day-to-day User of the Accounts Receivable, Job Costing & Inventory Tracking, and Accounts Payable modules.

•Some of the key advantages of this methodology are:

✓Reduced Work - Financial Transactions are posted to the General Ledger transparently, in the background, based on the predefined rules established during the General Ledger Start-up process.

✓Simpler Procedures - No additional steps are required when using the General Ledger module, then would be required when not doing so.

✓As Of Date Reporting - All of the General Ledger Financial Statements and Reports may be (re-)Viewed, and/or (re-)Printed, and/or (re-)Exported as Spreadsheet files for any Accounting Period, current or past (following the time when the General Ledger Wizard was executed).

✓Audit Trail - Automatically posts the original entries and any "adjustments" that have been made subsequent to making the initial entry, and can report who, when, and usually why all Financial Transactions were posted.

✓Account Balances Always Current - General Ledger current account balances, and all of the associated internal General Ledger System entries, are always viewable at the moment they are affected by the Accounts Receivable, Service Tracking, Job Costing & Inventory Tracking, and/or Accounts Payable modules.

•So, your Company will have Real Time Posting in the Background and Anytime Reporting capabilities by using this seamlessly integrated General Ledger System.

❑The General Ledger System Reporting Capabilities -

•These are the predefined reports available within the General Ledger System, all of which may Printed, and/or converted to a PDF or various other types of documents, and/or Exported to an Excel® Spreadsheet file:

a)Balance Sheet - provides a report of the Asset. Liability and Equity balances.

b)Balance Sheet Comparison - provides a Balance Sheet (i.e., a report listing the Assets, Liabilities and the resulting net Equity for a User specified Month and/or Year - compared to the previous Month and/or Year - for any Financial Transactions that were posted after the Set-Up Wizard for the General Ledger System was successfully executed.

c)Cash Flow Statement - provides a Statement of Cash Flows that reports the Description and net Amounts of the Operating, Financing, and Investing related Financial Transactions that increased and/or decreased the Value of your Company's Cash Position.

d)General Journal - provides a list of any manually entered Financial Transactions which have been made for the date(s) you specify.

e)Income Statement - (sometimes called the Profit & Loss Statement) compares Revenue to Expenses.

f)Profit & Loss Comparison - compares Revenue to Expenses for All or a selected set of (one or more) Departments, and/or a selected set of (one or more) Divisions, for a chosen Custom Date Range, or for one of the predefined Accounting Periods; reporting the net difference between each of those Periods (or the Month within those Years) as the Profit (or Loss - if those Expenses are greater than the Revenue) for each of the reported Years/Months.

g)Trial Balance - for preliminary analysis of a month's Financial Transactions prior to closing that month.

h)Account Register - provides a List (Grid) - which may be printed and/or exported - containing all Financial Transactions posted to a User Specified General Ledger Account - selectable by Transaction Date(s), Department, Division, Source, and General Ledger Account.

i)Transaction File - provides a List (Grid) - which may be printed and/or exported - with every Debit and Credit Financial Transaction that was posted to the General Ledger System - within a User Specified Date Range.

j)General Ledger Checkpoints - provides a List (Grid) - which may be printed and/or exported - that allows a User to review the General Ledger Checkpoints that were recorded when an Accounting Period is Closed in the General Ledger System, and any User generated Checkpoints which were created manually.

❑What's Next?

❖Help File Chapter Topic references described within this Help Files Electronic Document as "Chapters", "Chapter Topics", "sub-chapters", and/or "Topics" will all represent the same thing, a Chapter (e.g., Topic) within these Help Files which contains the required (referenced) information.

1)Read Understanding a General Ledger System chapter and its associated sub-chapters

2)Read the General Ledger Start-up Overview chapter and its associated sub-chapters

3)Perform all the Start-Up Maintenance Entries chapter and its associated sub-chapters

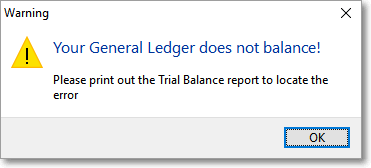

❖Once the General Ledger System is operational, if - for whatever reason - the Trial Balance becomes "Out of Balance", a Warning Message will be displayed at Login when the User who has Logged In is either an Administrator (Admin) or has been granted the Super User Authority.

✓Theoretically, this should never happen.