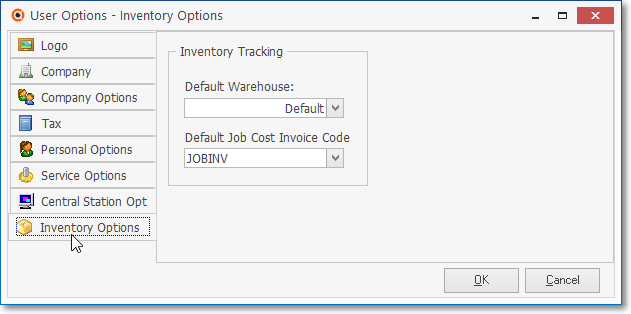

❑The Inventory Options tab on the User Options Form provides the ability to (re-)set the default behavior of the Inventory Tracking and Job Costing System.

•Information previously entered using the setup wizard of the Inventory Tracking and Job Costing System may also be reset within this Inventory Options tab.

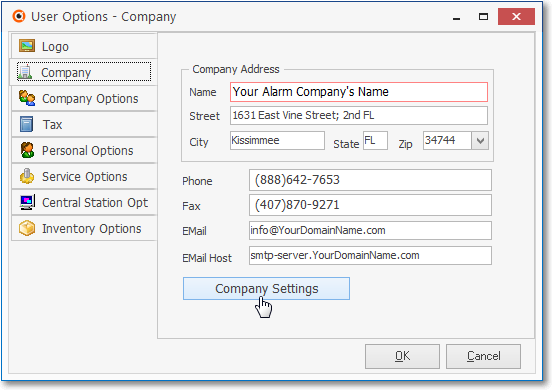

•To access the User Options Form

a)From the Backstage Menu System Select Maintenance and Choose General and Click User Options or,

b)From the Quick Access Menu, Select Maintenance and Choose User Options.

✓This will open the User Options Form

❑These are the Inventory Tracking & Job Costing Module related tabs and/or sub-tabs on the User Options Form which should be updated, when appropriate, as explained below:

I.Company tab - Click the Company Settings button on the Company tab of the User Options Form to (re-)set availability to any of the features outlined below.

User Options - Company tab - Company Settings bar

a.ADI Import - For Inventory Tracking, Accounts Payable and Accounts Receivable System users, setting this option to True ("T") will activate the menu options for the ADI Inventory Import procedures.

b.Insert_Comments_From_WOMD_To_Invoices - Inventory/Materials:Comments will not be added to the Invoice's detail line item when the Company Setting "Insert_Comments_From_WOMD_To_Invoices" is set to False ("F").

▪If the "Insert_Comments_From_WOMD_To_Invoices" option is set to True ("T"), those Inventory/Materials Comments will be included in the Invoice's detail line item

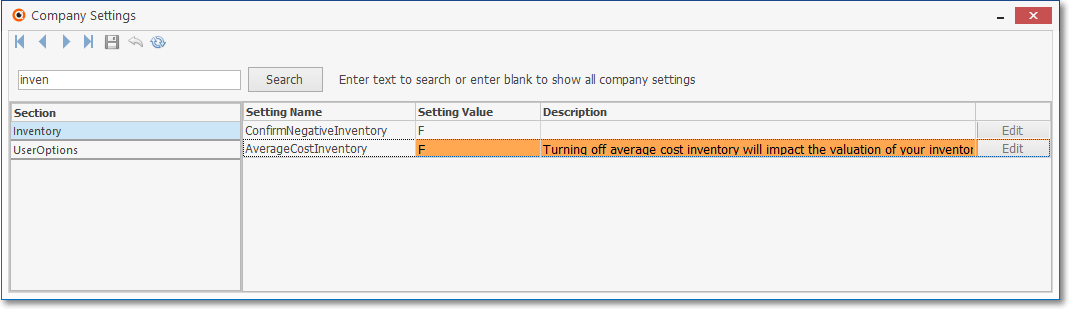

c.Confirm Negative Inventory - By default, the ConfirmNegativeInventory option is set to False ("F")

i.When the ConfirmNegativeInventory option is set to True ("T"), if an Inventory item is used in the Job Costing Form's Inventory tab, entered in the Inventory\Materials tab of a Work Order, added to an Invoice, or included as a Proposal Item on a Proposal - and the addition of that Inventory item would result in a negative Quantity on Hand value for that Inventory item, a Pop-Up Warning Message will be displayed.

ii.To turn off this Pop-Up Warning Message feature again, set the ConfirmNegativeInventory option to False ("F").

c.ITJC Is Installed - By default ITJCIsInstalled is set to False ("F").

i.Running the Start Inventory Tracking/Job Costing setup wizard will set the ITJCIsInstalled option in Company Settings to True ("T").

d.Average Cost Inventory - By default AverageCostInventory is set to False ("F").

ii.For those Companies using the STARK 35 version of the General Ledger System, the required Inventory Valuation method is Average Cost Inventory

iii.Running the Calculate Inventory Item Average Cost process will set the AverageCostInventory option in Company Settings to True ("T").

❖See the Implementing Average Inventory Cost instructions for making it your Company's Inventory Valuation Method

II.Inventory Options tab - Click the Inventory Options tab and identify the Inventory Valuation Method and other information as requested below:

❖Review the Inventory Valuation Methods chapter first.

User Options Form - Inventory Options tab

✓Default Warehouse - The default entry is the system's predefined Default Warehouse.

▪When entering a Detail Line Item on a Sales Invoice for the sale of an Inventory Item, or on a Bill for the Purchase of an Inventory Item, the Warehouse from which this Inventory Item was (or will be) taken (or stocked) is identified - by default - as the Default Warehouse selection provided here.

▪Use the Drop-Down Selection List to Choose a different Warehouse Name, if desired.

▪The Divisions Form allows your Company to identify a Default Warehouse for that (each) Division

oThereafter, when Invoices, Purchase Orders, Bills and/or Work Orders are created for a Subscriber who was assigned to a Division (a Division assignment to a Subscriber is optional), by default, any Inventory related Transaction posted to one of those Invoice, Purchase Order, Bill and/or Work Order documents will automatically be assigned to that default Division Warehouse but may be changed when needed.

✓Default Job Cost Invoice Code - Enter the default Sale-Purchase Item that is to be used when creating a Job Costing Invoice.

•Inventory Valuation Methods - a brief review:

a)Original Price (Cost) - By default, the Value of each Inventory Item is the original Price Value assigned to that Inventory Item in the Sale-Purchase Category Form.

b)LIFO - Used to initiate the Last In - First Out Inventory Valuation Method.

▪When an Inventory Item is Purchased, this feature immediately updates the COGS Value (LIFO) Amount in the Sale-Purchase Items Form and in the General Ledger System transactions that follow.

c)Average Cost Inventory (Required) - Another approach to Inventory Valuation (required when using the STARK 35 General Ledger System) is to use the Average Inventory Cost for to determine the Value that is used in the associated General Ledger System transactions.

▪This Inventory Valuation Method will establish and maintain the Value of the Inventory by Averaging the Cost of that Inventory so that all Price (cost) changes of an Inventory Item are taken into consideration whenever the Value of that Inventory Item is reported.

User Options - Company tab - Company Settings grid - Average Cost Inventory option

▪The ITJCIsInstalled is set to True ("T") when the Start Inventory Tracking/Job Costing setup wizard was/is executed.

i.If LIFO (Last In/First Out) was the previously selected Inventory Valuation Method, it will be turned off automatically.

▪When the Calculate Average Inventory Item Cost process is executed, the AverageCostInventory option will be set to True ("T") in the Company Settings dialog (in the Company tab of the Users Options Form).

ii.It will convert the Inventory Valuation to the Average Cost paid for an Inventory Item,

iii.For those Companies using the STARK 35 version of the General Ledger System, the required Inventory Valuation method is Average Cost Inventory

1)Review the Implementing Average Inventory Cost instructions in the Inventory Valuation Methods for making that your Company's Inventory Valuation Method

2)Review the Understanding how Inventory Values & Counts are Calculated chapter in the General Ledger section of these Help Files for more information if you are (or will be) using the STARK 35 General Ledger System.

❑What's Next?

•Remember, for those Companies using the STARK 35 version of the General Ledger System, the required Inventory Valuation method is Average Cost Inventory

•Go to Job Types chapter.