❑After entering an Invoice, or anytime a printed copy of a Subscriber's Invoice is needed, locate that Invoice and Click the Print Icon on the Actions Section of the Invoice Form's Ribbon Menu.

❖For instructions on printing a (selectable) group of Invoices see the Invoice Printing Options chapter for that information.

•Once completed and saved, an Invoice may be viewed and printed immediately.

✓To print the Invoice immediately, Click the Print Icon Click the Print Icon on the Actions Section of the Invoice Form's Ribbon Menu.

•To return later to print a specific Invoice,

✓Open the Subscribers Form and use the F2 Subscriber Search function to Locate the appropriate Account.

✓Click the Invoices option on the Subscriber Options Menu on the Subscribers Forms.

✓Then, Select the Invoices option on that Invoices option's sub-menu.

✓Locate the desired Invoice on the Invoice record in the Invoice Form's Previous Invoices Tab

✓Then Click the Print Icon on the Actions Section of the Invoice Form's Ribbon Menu.

❖When Sales Taxing Authorities have implemented Sales Tax Percentage Rates with up to three (3) Decimal Places, three Company Settings may need to be re-set to support Charging and Collecting this type of Sales Tax.

1.3 Digits Tax - By default, the 3DigitsTax option is set to False ("F").

a)When Sales Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this is one of the three Company Settings that, in this case, must be re-set to True to support Charging and Collecting this type of Sales Tax.

b)Setting this 3DigitsTax option to True ("T") will activate this Three Decimal Places Sales Tax feature in the Tax Rates Form.

2.Show Tax And Total Per Line Item Report - By default, the ShowTaxAndTotalPerLineItemReport option is set to False ("F"). <<<<

a)When Sales Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this is one of the three Company Settings that should be re-set to add support on Reports for Charging and Collecting this type of Sales Tax (also see "Show Tax And Total Per Line Item Screen" immediately below).

b)Setting this ShowTaxAndTotalPerLineItemReport option to True ("T") will include this Three Decimal Places Sales Tax feature's three (3) Decimal Places Sales Tax formatting on reports.

3.Show Tax And Total Per Line Item Screen - By default, the ShowTaxAndTotalPerLineItemScreen option is set to False ("F") which - regardless of the 3DigitsTax setting, excludes Detail Line Item calculations for Sales Tax Amounts (the Tax Rate is still shown); but instead provides a Totals information box with Net, Tax, and Gross Amounts at the bottom of the Invoice and/or Proposal).

a)When Sales Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this is one of the three Company Settings that may be re-set to add support for Charging and Collecting this type of Sales Tax on Invoices. (see "Show Tax And Total Per Line Item Report" immediately above)

b)Setting this ShowTaxAndTotalPerLineItemScreen option to True ("T") will activate this Three Decimal Places Sales Tax feature on Invoices thus showing three (3) Decimal Places on all Detail Line Item entries plus column totals.

c)However, consider leaving the ShowTaxAndTotalPerLineItemScreen option setting to its default of False ("F") when the this 3DigitsTax option to True ("T").

i.This False setting will show the Tax Rate on an Invoice's Detail Line Item in three (3) Decimal Places but will not show the extended pricing in three (3) Decimal Places to avoid confusion.

ii.In this case a Totals information box with Net, Tax, and Gross Amounts is included at the bottom of the Invoice and/or Proposal.

➢Note: See the Sample Results of these Sales Tax related Company Settings Options discussion in the Company Settings for Accounts Receivable chapter for Invoice Detail Line Item illustrations.

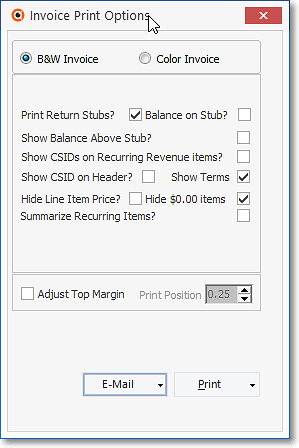

•Understanding the Invoice Print Options

Invoice Print Options

✓Click B&W Invoice or Color Invoice, as desired.

✓Choose the appropriate Format and Content options:

▪Print Return Stubs? - Check this box to include a Return Stub on the printed Invoice (the default).

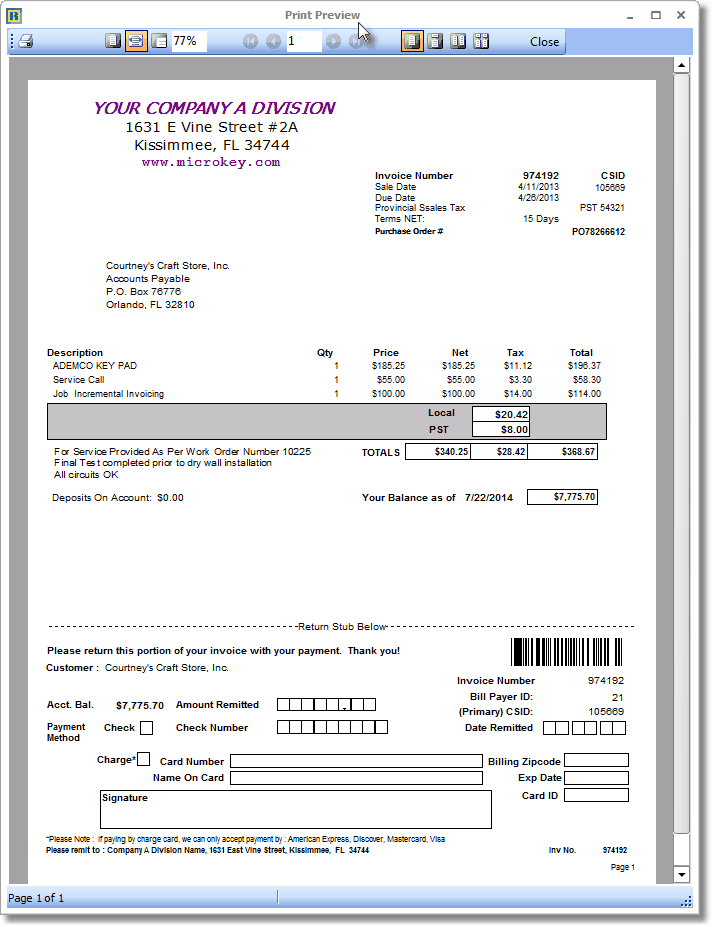

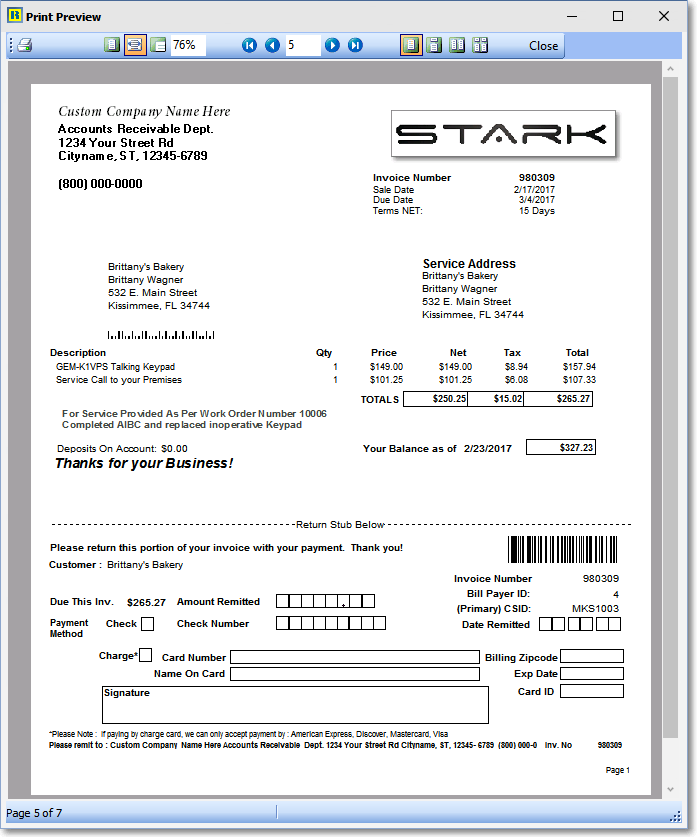

i.Invoices may be printed with a Return Stub which the Subscriber may tear off and return with their payment

ii.Invoices may include the Invoice itself without a return portion included.

iii.An example of a complete Invoice with a Return Stub is shown below.

▪Balance on Stub? - Only if Print Return is Checked, you may Check Balance on Stub so that, if the Subscriber has a Previous Balance, the total amount due - including that previous balance - will be printed on the Invoice Stub

▪Show Balance Above Stub? - Check Show Balance Above Stub so when the Subscriber has a Previous Balance, the total amount due - including that previous balance - will be printed on the Invoice just below the total amount of the current Invoice, this grand total will include the previous balance and the amount due on this Invoice.

▪Show CSIDs on Recurring Revenue items? - Check this box if you want the Subscribers Primary CSID printed on Recurring Revenue Invoices as part of the line item detail.

▪Show CSID on Header? - Check this box to include the CSID in the Invoice Header (next to the Invoice Number).

▪Show Terms - The Header of the printed Invoice includes a Sale Date and a Due Date. If you want to include a brief explanation of your Company's Terms, Check Show Terms.

▪Hide Line Item Price? - Check this box to have the line item pricing eliminated from the Invoice, resulting with only the Total, Tax and Grand Total being shown.

➢Note: As long as Hide Line Item Price? is not selected: if the ShowTaxAndTotalPerLineItemsReport option is set to True ("T") in Company Settings,

The Tax Amount field on each Detail Line Item displays three (3) Decimal Places,

Otherwise only two (2) Decimal Places will be displayed.

▪Exclude $0.00 items - Check this box to have any zero value ("$0.00") line items excluded from that Invoice.

▪Adjust Top Margin - Depending on your printer, the size of your Company Logo, and the Invoice Form you are using, you may need to adjust the Top Margin of your Printed Invoice by re-setting its Print Position to have the Subscribers Name and Address show correctly in the window of the envelope.

▪Print Position - Click Adjust Top Margin and use the up or down arrow in the number selection box to adjust Print Position of the top margin.

✓Click E-Mail or Print to send this Invoice via Email, or actually print a copy of this Invoice.

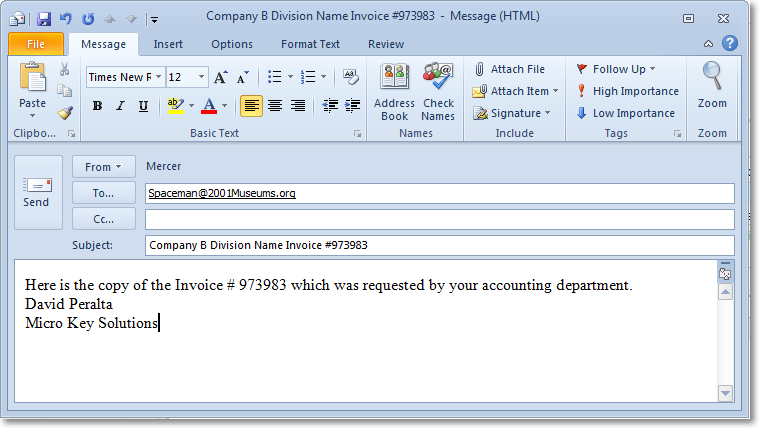

▪Email - The Email will be sent via Outlook® therefore Windows® Outlook must be available on your computer.

oTo - If there are one or more Email addresses entered on the Subscribers Form, those addresses will be inserted automatically, otherwise you will be able to enter an Email address as part of this process.

oSubject Line - If there is a Division Code entered for this Subscriber the name of that Division and the Invoice Number will be inserted into the Subject line of the Email, otherwise the Subscriber's Name and Invoice Number will be inserted.

oAttachment - The Invoice will be attached as a PDF file.

oMessage - Enter a message that clarifies the purpose of sending this Invoice via Email.

oSend - Click the Send button to transmit the Email.

▪Print - You must have a Printer installed - either as a Local or available as a Network device - to actually Print a copy of an Invoice.

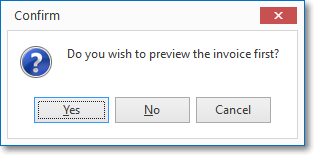

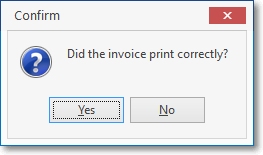

Print Invoice?

oEven if you do not have access to a Printer, you can View what the Invoice would look like, if printed, by choosing Yes to Do you wish to preview the invoice first?

oOnce you have Viewed the Invoice, you may Click the Print Icon to Print the Invoice, or Choose Close to exit preview.

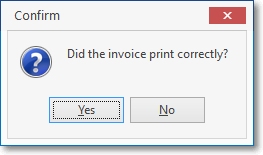

oIf you Closed the Preview and had not actually printed the Invoice, answer No to the Did the invoice print correctly? question.

oEven if you answer Yes to Do you wish to preview the invoice first? in error, you will still be able to reprint the Invoice even though the Printed box will say Printed: Yes.

Color Print Preview with Return Stub, and the full Balance Due