Tracking Inventory as Assets, Liabilities, Sales and Expenses

❑Tracking the Quantity and Value of your Company's Inventory Items (as identified in the a Sale-Purchase Item Form and within the General Ledger System) as Assets, and Liabilities, and for Sales and Expenses can be a complex and tedious task - if performed manually.

•However, within MKMS, Inventory Valuation is managed as an automatic, background process.

•To take advantage of this automated process, you must first:

1.Setup the correct Mandatory General Ledger Accounts

2.Assign the appropriate General Ledger Sales and Expense Accounts to your Company's Sale Purchase Items.

3.Choose the appropriate Inventory Valuation Method for your Company.

❖For those Companies using the STARK 35 version of the General Ledger System, the required Inventory Valuation method is Average Cost of Inventory.

•There are three (3) Inventory Valuation Methods available when using the Inventory Tracking & Job Costing System.

1.Original Price (Cost) - By default, the Value of each Inventory Item is the original Price (Cost) assigned to that Inventory Item as it was entered (or subsequently manually updated) in the Sale-Purchase Category Form

2.The LIFO (Last In - First Out) - The original Price and COGS Value (Cost of Goods Sold) is automatically re-set, based on the most recent Cost paid for an Inventory Item - as charged on a Bill from a Vendor for the Re-Purchase of each Inventory Item.

a.When creating a Purchase Order and/or a Bill: be sure to enter the actual Price (Cost) being charged by the Vendor for each Inventory Item.

b.Once the actual Price being charged (including any Sales Taxes) by the Vendor is entered on a Bill, this will become the new wholesale "COGS Value" on the Sale-Purchase Category Form.

3.Average Inventory Cost - The Average Cost of Inventory is the Value that is used for the Cost when posting Inventory related Financial Transactions into the General Ledger System, and for Inventory Related Reports and General Ledger System's Financial Statements and Reports.

a.This method is turned on by first running the Start Inventory Tracking/Job Costing wizard

b.Then running the Calculate Inventory Item Average Cost procedure.

c.which set the AverageCostInventory option to True ("T") in the Company Settings dialog - which is accessible from within the Company tab of the User Options Form. (For those Companies using the STARK 35 version of the General Ledger System, the required Inventory Valuation method is Average Cost of Inventory)

•The purpose of this chapter is to let you "look under the hood" to see what the General Ledger System and the Inventory Tracking System are actually doing in the background when any of these Inventory related Financial Transactions occur.

✓It is assumed that the Inventory Valuation Method being used is the Average Cost of Inventory calculation method when using the Inventory Tracking System in conjunction with the General Ledger System).

•If your Company is using the Inventory Tracking System (and is now, or will be using the General Ledger System), the Quantity and Value calculation complexity (and tediousness) is almost completely automated.

✓The recommended Inventory Valuation Methodology is the Average Inventory Cost method.

✓Inventory Valuation calculations, and the associated Financial Transactions, are executed as an automated set of internal system entries.

✓The resulting Financial Transactions associated with Inventory Values are internally posted by the Inventory Tracking & Job Costing System to the General Ledger System when a User :

1.Makes a normal Sale and/or Purchase entry

2.Identifies Inventory Items that will be required for the completion of a Work Order

3.Invoices a Work Order that required Inventory Usage

4.Tracks any Inventory Items that will be and/or have been required for a Job (i.e., Inventory Reserved, Inventory Used).

5.Orders, and then Receives Inventory Items via the use of a Purchase Order:

a.When Inventory Items are checked-in; and

b.By the creation of a Bill - using the Bill It Icon available on the Purchase Order Form - for what was actually checked-in (received) from that Purchase Order.

❑Understanding how the Value of each Inventory Item is recorded within the older (before the STARK 35 Version) General Ledger System as they relate to Purchases of, and Sales for Inventory Items if "LIFO" is the selected Inventory Valuation Method.

•LIFO is no longer recommended for an Inventory Valuation Method. when using the newer General Ledger System

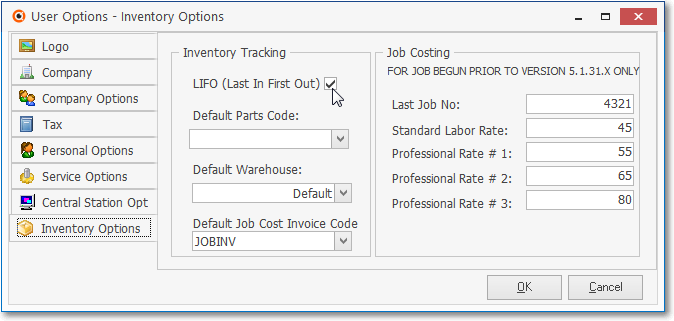

✓Check the LIFO box on the Inventory Options tab of the User Options Form to initiate this old type of Last In - First Out Inventory Valuation Method.

Check in LIFO (Last In First Out) to implement LIFO

✓Thereafter, whenever an Inventory Item is Purchased or Sold, this continuously updated (LIFO) "COGS Value" is the Value that is used for the Cost when posting an Inventory Purchase, and an Inventory Usage related General Ledger System transaction as explained below:

▪When Purchasing an Inventory Item, the default Cost will initially be the "Price" entered when the Inventory Item was first defined on the Sale-Purchase Category Form.

▪So, when creating a Purchase Order and/or a Bill:

oThe User must enter the actual Price (Cost) being charged by a Vendor for each Inventory Item.

oOnce the actual Price (including any Sales Taxes) being charged by the Vendor is entered, this will become the new "COGS Value" on the Sale-Purchase Category Form.

oSo, the Price paid for the most recently purchased Inventory Item will be inserted in the "COGS Value" field on the Sale-Purchase Category Form.

❑Understanding how the Value of each Inventory Item is recorded within the General Ledger System as they relate to Purchases of, and Sales for, Inventory Items when "Average Cost of Inventory" is the selected Inventory Valuation Method.

❖For those Companies using the STARK 35 version of the General Ledger System, the required and only Inventory Valuation method is Average Cost Inventory.

The Inventory Options tab on the User Options Form

•When posting a General Ledger System Inventory related Transaction, the Value used for the Price of an Inventory Item when the selected Inventory Valuation Method is Average Cost of Inventory as recorded in the "COGS Value" field on the Sale-Purchase Category Form.

•The Inventory Cost Averaging Calculation of each Inventory Item that is currently "in stock" is calculated by adding the Quantity of new Inventory Purchases and subtracting the Quantity of new Inventory Sales.

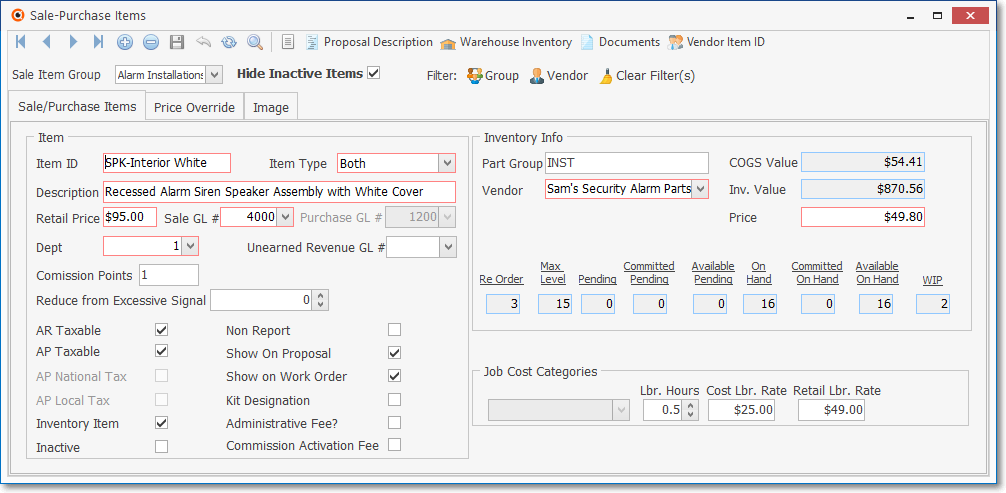

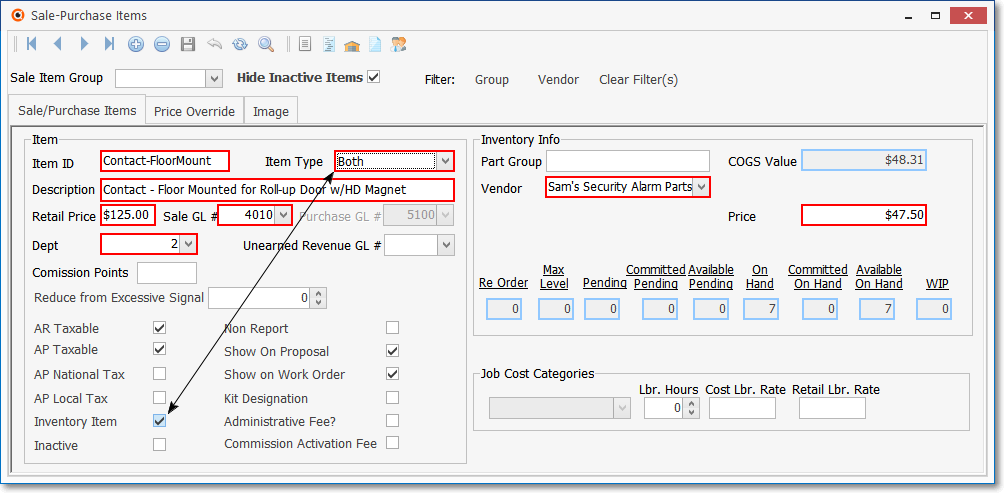

✓An Average Inventory Cost table is internally maintained by the system for each Sale-Purchase Item that has been specifically identified as an Inventory Item (i.e., there is a Check in its Inventory Item box on the Sales-Purchase Items Form).

✓This Average Inventory Cost table contains the following information:

a)Quantity of each Inventory Item that was Purchased

b)Unit Price Paid for each of those Inventory Items

c)Total Price Paid for the Purchase of those Inventory Items

d)Current Count (the Quantity On-Hand) of each Inventory Item

e)Total Cost Paid for all of the Inventory Items that are currently On-Hand

f)Average Cost of each Inventory Item that is On-Hand.

•The currently calculated Average Cost Value (including any Sales Tax paid) for each Inventory Item is displayed in the COGS Value field on the Sale-Purchase Item Form

Sale-Purchase Item Form - Inventory Item - current Price calculation

•This sample Average Inventory Cost table provides an example (in this chart no Sales Tax is charged) of how it is accessed and updated as Inventory is Purchased and Sold:

|

Quantity |

Unit Price |

Total Price |

Count |

Total Cost |

Avg. Cost |

1st Purchase |

1 |

$3.00 |

$3.00 |

1 |

$3.00 |

$3.00 |

2nd Purchase |

2 |

$3.00 |

$6.00 |

3 |

$9.00 |

$3.00 |

3rd Purchase |

3 |

$1.00 |

$3.00 |

6 |

$12.00 |

$2.00 |

1st Sale |

-1 |

|

|

5 |

$10.00 |

$2.00 |

4th Purchase |

1 |

$4.00 |

$4.00 |

6 |

$14.00 |

$2.33 |

2nd Sale |

-1 |

|

|

5 |

$11.67 |

$2.33 |

Sample Average Cost Valuation Calculations

✓When a Detail Line Item is added to a Bill for the Purchase of an Inventory Item, a corresponding entry is made in this Average Inventory Cost table with:

a.The Quantity that was Purchased

b.The Unit Price (which includes Sales tax, if charged) that was actually Paid

c.The Total Price (Unit Price x Quantity) Paid

d.A new Count value is calculated by adding the Quantity that was just Purchased to the previous Count

e.The new Total Cost Paid is calculated by adding the Total Price Paid to the previous Total Cost Paid

f.The Average Cost is re-calculated by dividing the new Total Cost be the new Count

✓When a Detail Line Item is added to an Invoice for the Sale of an Inventory Item, an entry is made in this Average Inventory Cost table with:

a.The Quantity that was Sold

b.The Count is re-calculated by subtracting the Quantity Sold from the previous Count.

c.The Total Cost Paid is re-calculated by subtracting the result of the (Quantity Sold multiplied by the previously calculated Average Cost) from the previous Total Cost Paid

d.The Average Cost is re-calculated by dividing the new Total Cost be the new Count

•Average Cost of Inventory - In review, the current Value of all In Stock Inventory Items - when using the Average Inventory Cost - is continuously recalculated by including in that Average Calculation, the Price Paid for each new Inventory Purchase - which then updates in the Price field on the Sale-Purchase Item Form.

1.Purchases - The Price field on the Sale-Purchase Item Form - initially calculated using the Calculate Inventory Average Cost procedure - thereafter continuously updated on the Sale-Purchase Item Form and so that Price will always be used as the Current Value when Inventory related Financial Transactions are posted:

a.When using the Purchase Order Form to initiate the Purchase of an Inventory Item:

i.As Inventory Items are Checked In, the Inventory Asset Account is Debited (added to) for the gross cost (including sales tax, if any) of those Inventory Items, and the same gross cost (including sales tax, if any) is Credited (added to) the Inventory Purchases Liability Account.

ii.Then, when the Bill It Icon is used to create the Bill for those Inventory Items, the Inventory Purchases Liability Account is Debited (subtracted) for the gross cost Amount (including sales tax, if any), and the same Amount is Credited (added) to the Accounts Payable Liability Account.

b.When making an Inventory Purchase by entering that Inventory Purchase directly into the Bills Form (i.e., there was no Purchase Order used to order this Inventory):

i.The Inventory Asset Account (see the Mandatory Accounts chapter for additional information) will be Debited (increased) for the Amount of the actual Price being charged, times the Quantity of the Inventory Item being Purchased (plus any Sales Tax charged on that Purchase)

ii.The same Amount is Credited (added) to the Accounts Payable Liability Account.

iii.That information (i.e., Price, Quantity, Sales Tax) will also be used to update the Average Inventory Cost table,

iv.The associated Price field (not including Sales Tax) on the Sale-Purchase Item Form will reflect the Price Paid without any Sales Tax charges.

v.This Price will be inserted as the default Price when this Inventory Item is added to a Purchase Order and/or a Bill, but should (must) be changed if the Vendor now has a different Price that will be charged for this Inventory Item on that Purchase Order and/or that Bill.

2.Sales - The Price calculated using the Average Cost of Inventory process - which continuously updates the Price field on the Sale-Purchase Item Form for that Inventory Item - will be the Value used and will be posted as follows:

a.The Inventory Asset Account (one of the Mandatory Accounts) will be Credited (reduced) by the most recently calculated Price Value of the Inventory Sale-Purchase Item that was Sold.

b.The Cost of Goods Sold Account (another one of the Mandatory Accounts) will be Debited (increased) by the calculated Price Value of the Inventory Sale-Purchase Item that was Sold.

❑Understanding how the Financial Transactions associated with the Value of each Inventory Item are recorded within the General Ledger System as Inventory Item Purchases and Sales are entered:

A.Purchases for Inventory and Non-Inventory Items:

•Inventory associated Purchase Orders and Bills are posted as follows when using this new General Ledger System:

✓Reminder: There are three (3) Inventory Valuation Methods available when using the Inventory Tracking & Job Costing System.

1.Original Price (Cost).

▪By default [except for STARK 35 General Ledger System Users who should use the Average Cost of Inventory method], the Value of each Inventory Item is the original Price (Cost) assigned to that Inventory Item as it was entered (or subsequently manually updated) in the Sale-Purchase Category Form.

2.The LIFO (Last In - First Out) - The original Price stays the same, but the COGS Value (Cost) Value is automatically re-set - based on the most recent Cost paid for an Inventory Item - as costs are entered on a Bill from a Vendor for the Re-Purchase of each Inventory Item.

▪This is turned on by Checking the LIFO box on the Inventory tab of the User Options Form.

a)When creating a Purchase Order and/or a Bill: be sure to enter the actual Price (Cost) being charged by the Vendor for each Inventory Item.

b)Once the actual Price (including Sales Taxes) being charged by the Vendor is entered on a Bill, this will become the new "COGS Value" Amount shown on the Sale-Purchase Category Form and will be inserted automatically when a new Bill for this Inventory Item is created.

c)Because Sales Tax is part of the COGS Value (Amount), once this Inventory Item is Taxed when Purchased, that Sales Tax Amount is included in the "COGS Value" Amount.

3.Average Inventory Cost - The Average Cost of Inventory is the Value that is used for the Cost when posting Inventory related Financial Transactions into the General Ledger System, and for Inventory Related Reports and General Ledger System's Financial Statements and Reports.

▪For those Companies using the STARK 35 version of the General Ledger System, the required Inventory Valuation method is Average Cost Inventory.

✓See the Using the Inventory Tracking & Job Costing Setup Wizard section in the Inventory Tracking & Job Costing Setup Procedures chapter for more information.

▪After the Inventory Tracking & Job Costing Setup Wizard has finished (and the MKMS system was restarted), the ITJCIsInstalled option is automatically set to True ("T") in the Company Settings dialog - which is accessible from within the Company tab of the User Options Form.

▪Once this Average Cost of Inventory method is turned on by executing the Calculate Inventory Item Average Cost process (and the MKMS system was restarted), the AverageCostInventory option is automatically set to True ("T") in the Company Settings dialog - which is accessible from within the Company tab of the User Options Form.

•When a Purchase Order is first created with a Detail Line Item ordering any quantity of an Inventory Item, no General Ledger transactions are required.

✓The Price of the Ordered Inventory Item will by default, be the COGS Value Amount currently shown on the Sale-Purchase Category Form

✓The Price entered on the Purchase Order's Detail Line Item must be exactly what that Vendor will charge.

▪So, when necessary, the Price field in the Detail Line Item of the Purchase Order must be changed to the Price that Vendor will actually charge.

•When Inventory Items on that Purchase Order are Checked In:

✓The Price entered when the Inventory Items were ordered (see above) must be confirmed, and if necessary, if the Price that will actually be charged is different, obviously it must be updated to reflect the real cost.

✓Enter the Quantity that was checked-In.

a)The Gross Value [(Price x Quantity) + Sales Taxes] of the Inventory Items that were Checked-In is Debited (added to) the Inventory Asset Account

b)That same Gross Value is Credited (added to) the Inventory Purchases Liability Account.

•When the Bill It option is used to create a Bill for those Inventory Items on that Purchase Order:

✓The Gross Value (Price x Quantity + all Sales Taxes) of the Inventory Items that were Billed is Debited (subtracted from) the Inventory Purchases Liability Account (thus "zeroing out" that "temporary Inventory Purchases holding" Liability Account)

✓That same Gross Value (Price x Quantity + all Sales Taxes) is Credited (added to) the Accounts Payable Liability Account

✓If Canada Sales Taxes are being charged, the Sales Taxes are handled differently:

a)In addition to being included in the Gross Value Credited (added to) the Accounts Payable Liability Account, the National Sales Tax Amount is Debited (added) to GST/HST Asset Account.

b)If a local PST Tax was charged:

i.That PST Tax Amount will be Debited (added) to the PST Sales Tax Expense Account,

ii.Debited (subtracted) from the Current Earnings Equity Account

iii.Credited (subtracted) from the special Earnings Posting (the Special Debit Account for Posting Earnings)

•When a Purchase Order is created with a Detail Line Item ordering one or more of a specific Purchase Items that are not Inventory Items, no General Ledger transactions are required.

✓When Purchase Items - which are not Inventory - are Checked In: no General Ledger transactions are required.

✓When the Bill It option is used to create a Bill for those non Inventory Purchase Items:

a)The Gross Value [(Price x Quantity) + all Sales Tax] of the entire Purchase is Credited (added to) the Accounts Payable Liability Account;

b)That same Gross Value is Debited (subtracted) from the Current Earnings Equity Account;

c)That same Gross Value is Credited (subtracted) from the special Earnings Posting (the Special Debit Account for Posting Earnings)

d)The Value Gross Value (Price x Quantity + all Sales Taxes) of each Detail Line Item is Debited (added to) the appropriate Purchases Expense Account (as defined for each Purchase Item)

✓If Canada Sales Taxes are being charged instead:

a)In addition to being included in the Amount Credited (added to) the Accounts Payable Liability Account, the National Sales Tax Amount is Debited (added) to GST/HST Asset Account.

b)In addition to being included in the Amount Credited (added to) the Accounts Payable Liability Account, if a local PST Tax was charged

i.That portion of the local PST Tax will be Debited (added) to the PST Sales Tax Expense Account

ii.Debited (subtracted) from the Current Earnings Equity Account

iii.Credited (subtracted) from the special Earnings Posting (the Special Debit Account for Posting Earnings)

•When a Bill is created (directly - without using a Purchase Order) with a Detail Line Item for an Inventory Item:

✓The Gross Value [(Price x Quantity)+ all Sales Taxes] is Credited (added to) the Accounts Payable Liability Account.

✓The Gross Value [(Price x Quantity)+ all Sales Taxes] of the Inventory Items on the Detail Line Item is Debited (added) to the Inventory Asset Account.

✓If Canada Sales Taxes are being charged instead:

a)GST/HST - In addition to being included in the Amount Credited (added to) the Accounts Payable Liability Account, the National Sales Tax Amount is Debited (added) to GST/HST Asset Account.

b)PST - In addition to being included in the Amount Credited (added to) the Accounts Payable Liability Account, if a local PST Tax was charged,

i.That local PST Tax Amount will be Debited (added) to the PST Sales Tax Expense Account

ii.Debited (subtracted) from the Current Earnings Equity Account

iii.Credited (subtracted) from Earnings Posting (the Special Debit Account for Posting Earnings).

•When a Bill is created (directly - without using a Purchase Order) with a Detail Line Item having a Quantity of one or more Non-Inventory Item(s)

✓The Gross Value [(Price x Quantity) + Sales Tax] of the Detail Line Item is Credited (added to) the Accounts Payable Liability Account;

✓That same Gross Value is Debited (subtracted) from the Current Earnings Equity Account

✓That same Gross Value is Credited (subtracted) from Earnings Posting (the Special Debit Account for Posting Earnings)

✓That same Gross Value is Debited (added to) the appropriate Purchases Expense Account (as defined for the Purchase Item)

✓If Canada Sales Taxes are being charged instead:

a)GST/HST - In addition to being included in the Amount Credited (added) to the Accounts Payable Liability Account, the actual National Sales Tax Amount is Debited (added) to GST/HST Asset Account.

b)PST - In addition to being included in the Amount Credited (added) to the Accounts Payable Liability Account, if a local PST Sales Tax was charged, that actual local PST Sales Tax Amount will be Debited (added) to the PST Sales Tax Expense Account

B.Sales of Inventory and Non-Inventory Items:

•Non Inventory Sales - Sales of any Non-Inventoried Item are posted automatically as follows within the General Ledger System

✓When any Detail Line Item is created for a Sale, these transactions are posted as outlined below:

1.The Gross Value of that Detail Line Item [(Price x Quantity) + Sales Tax] is Debited (added) to the Accounts Receivable Asset Account

2.The Net Value of that Detail Line Item (Price x Quantity) is Credited (added) to the Current Earnings Equity Account

3.That Net Value is Debited (added) to the Earnings Posting (the Special Debit Account for Posting Earnings)

4.That Net Value is Credited (added) to the Sale Item's (Sales GL #) Sales Account

5.If a local Sales Tax is charged, that Local Sales Tax Amount is Credited (added) to the Sales Tax Liability Account

6.If Canada Sales Taxes are being charged instead:

a.GST/HST - In addition to being included in the Amount Credited (added to) the Accounts Receivable Asset Account, the National Sales Tax Amount is Credited (added) to the National Tax Liability Account.

b.PST - In addition to being included in the Amount Credited (added to) the Accounts Receivable Asset Account, if a local PST Tax was charged that local PST Tax Amount will be Debited (added) to the Local Tax Liability Account

•Inventory Sales - Sales of Inventory Item(s) are posted automatically exactly as outlined above, plus:

✓When the Detail Line Item on an Invoice is for the Sale of an Inventory item, a different set of entries are required to track the Cost of the Goods (Inventory) that are being Sold ("COGS"), because the Value of the COGS must also be calculated and recorded in the General Ledger System:

1.The Gross Value of that Detail Line Item [(Price x Quantity) + Sales Tax] is Debited (added) to the Accounts Receivable Asset Account

2.The Net Value of that Detail Line Item (Price x Quantity) is Credited (added) to the Sale Item's (Sales GL #) Sales Account

3.The COGS is Calculated and Posted:

a.Calculate the COGS Amount - To calculate the COGS Amount the current COGS Value of the Inventory Item is multiplied by the Quantity of the Inventory Item that is being sold on the Detail Line Item.

b.That COGS Amount is Credited (subtracted) from the Inventory Asset Account (because it has been sold and so is no longer in stock)

c.That COGS Amount is Debited (added) to the COGS Expense Account

d.The Net Amount of the Detail Line Item - excluding the COGS Amount and any Sales Tax [Net Amount = Total Charges on the Detail Line Item - Sales Tax - COGS Amount] - becomes the Profit for that Sale which is Credited (added) to the Current Earnings Equity Account.

e.The same Net Amount of the Detail Line Item is Debited (added) to the Earnings Posting (the Special Debit Account for Posting Earnings).

4.If a local Sales Tax is charged, that Local Sales Tax Amount is Credited (added) to the Sales Tax Liability Account

5.If Canada Sales Taxes are being charged instead:

c.GST/HST - In addition to being included in the Amount Credited (added to) the Accounts Receivable Asset Account, the National Sales Tax Amount is Credited (added) to the National Tax Liability Account.

d.PST - In addition to being included in the Amount Credited (added to) the Accounts Receivable Asset Account, if a local PST Tax was charged that local PST Tax Amount will be Debited (added) to the Local Tax Liability Account

❑Understanding How to Adjust for, and properly Post any Inventory Valuation Drift

•Normally, within most Companies a Re-Count of all Inventory Items is periodically undertaken (typically annually, but more often when a Company's business model dictates it).

✓No Inventory Valuation Method will completely eliminate value anomalies when comparing General Ledger System Inventory Asset Account Values with the Inventory Valuations reported in certain Inventory Related Reports.

✓This valuation drift occurs over time as Costs are re-set, and/or Purchases are made for same Inventory Item at a different Price (Cost), and the history and timing of those Cost re-sets will be unclear.

•Whenever a full Inventory Re-Count is completed, the process outlined below will allow you to properly adjust the General Ledger System Inventory Asset Account Values (whether your Company is using the MKMS General Ledger or a separate stand-alone system).

1.The existing Available On Hand Quantities must be adjusted (based on the results of the Re-Count) to make the sum of the Committed On Hand plus the Available On Hand equal the Total On Hand Quantity found during the physical Inventory Re-Count.

➢Note: Read the "Special Purpose Adjust, Transfer, and Transfer Buttons on the Warehouse Inventory Form" discussion in the Warehouse Inventory chapter for instructions on how to make these adjustments).

2.The result: The internally tracked Value in the Inventory Tracking System will now align with what is actually In Stock and ready to be used (i.e., Available On Hand plus Committed On Hand) in your Company's Warehouse(s).

➢Note: If your Company is using the MKMS General Ledger System, the appropriate General Journal entries will be made automatically when these Inventory Adjustments are posted, so the only other Financial Transaction entries (i.e., General Journal Adjustments) that will be required will be as a result of "shrink" and "breakage".

3.An Inventory Listing or an Inventory Listing (Grid) - which has "As Of" capabilities - is then printed which will contain the Gross Value - derived from your Company's selected Inventory Valuation Method - of the Total On Hand Quantities, the Value of which is based on what is actually Available On Hand plus Committed On Hand in your Company's Warehouse(s).

4.Using that report (the Inventory Listing or an Inventory Listing (Grid)), simple General Journal entries are created to re-balance the Actual Inventory Value with the Inventory Asset Value reported in your Company's General Ledger Balance Sheet which is accomplished as follows:

a.If the Gross Value reported on the Inventory Listing is less than the current Value of the General Ledger's Inventory Asset Account's Balance, create a General Journal entry to:

i.Credit (reduce) the General Ledger's Inventory Asset Account's Balance by the difference between that current Inventory Asset Account's Value and the Value reported on the Inventory Listing,

ii.Debit (increase) the Inventory Expense Account by that same Value

b.Conversely, if the Gross Value reported on the Inventory Listing is greater than the current Value of the General Ledger's Inventory Asset Account's Balance, create a General Journal entry to:

i.Debit (increase) the General Ledger's Inventory Asset Account's Balance by the difference between that current Inventory Asset Account's Value and the Value reported on the Inventory Listing,

ii.Credit (reduce) the Inventory Expense Account by that same Value

5.At this point, Inventory Counts, the associated Values, and the General Ledger's Inventory Asset Account should all be in "sync".

An Overview of the various Inventory Tracking System Processes

❖Everything you ever wanted to know about Inventory related Financial Transactions: Understanding the calculation and posting of Inventory Counts in the Inventory Tracking System, and the Inventory related Financial Transactions that are posted in the General Ledger System:

Sale-Purchase items Form - Inventory Item record

❑For General Ledger and Inventory Tracking & Job Costing module Users: The Inventory Counts and an abbreviated discussion of the related General Ledger Financial Transactions will be posted (see the "Understanding how the Financial Transactions associated with the Value of each Inventory Item are recorded within the General Ledger System as Inventory Item Purchases and Sales are entered" discussion above for the General Ledger Financial Transaction details) as outlined below when Inventory Items are:

1.Ordered using a Purchase Order

2.Recorded as Checked In on a Purchase Order

3.Recorded as Purchased on a Bill

4.Recorded as Sold in an Invoice

•Inventory is Ordered - Using the Purchase Orders and Job Costing Forms to track Orders for Inventory Items:

1.When Inventory Items are ordered using the Purchase Order Form:

▪In the Inventory Tracking System

oThe Inventory Item's " Pending " Count on the Sale-Purchase Item Form will be increased by the Quantity that was Ordered.

oThe Inventory Item's " Available Pending " Count on the Sale-Purchase Item Form will be increased by the Quantity that was Ordered.

▪No General Ledger System transaction is executed (nor required) during the creation of a Purchase Order for Inventory Items.

2.When Inventory Items are ordered through the Job Costing Form: A Purchase Order is created and assigned that Job Number.

▪In the Inventory Tracking System

oThe Inventory Item's " Committed Pending " Count on the Sale-Purchase Item Form will be increased by the Quantity that was Ordered.

▪No General Ledger System transaction is executed (nor required) during the creation of a Purchase Order for Inventory Items.

•Inventory is Received - When Inventory Items that were ordered using a Purchase Order, are actually Received, they are Checked In.

✓In the Inventory Tracking System

▪The Inventory Item's " Pending " and " Available Pending " Count on the Sale-Purchase Item Form will be reduced by the Quantity that was Checked In

▪The Inventory Item's " On Hand " and " Available On Hand " Count on the Sale-Purchase Item Form will be increased by the Quantity that was Checked In

✓In the General Ledger System:

▪The Inventory Asset Account will be Debited (increased) for the Gross Value of what was Checked In (Quantity multiplied by the Price),

▪The Inventory Purchases Liability Account will be Credited (increased) by the same Value.

•Inventory Purchases are Billed - Using the Bill It Icon on the Purchase Order Form:

✓The Received column on the Purchase Order will be updated by the system to reflect the Quantity that had been previously Checked In and has now been Billed.

✓The Inventory Cost recorded on the Sale-Purchase Item Form will be updated to reflect this Inventory Item's new Average Price

✓In the Inventory Tracking System

▪No Inventory Counts are changed on the Sale-Purchase Item Form.

✓In the General Ledger System, when the Bill It Icon is used to create a Bill for those Inventory Items that were previously Checked In:

a)The Gross Value (Price x Quantity + all Sales Taxes) is Debited (subtracted) from the Inventory Purchases Liability Account.

b)The Gross Value (Price x Quantity + all Sales Taxes) is Credited (added) to the Accounts Payable Liability Account.

•Inventory is directly Purchased - If a Bill from a Vendor is entered that includes Inventory Items (that did not originate using the Purchase Order process outlined above):

✓In the Inventory Tracking System

a)The Inventory Item's " On Hand " Count on the Sale-Purchase Item Form will be increased by the Quantity that was entered as a Detail Line Item on the Bill.

b)The Inventory Item's " Available On Hand " Count on the Sale-Purchase Item Form will be increased by the Quantity that was entered as a Detail Line Item on the Bill.

✓In the General Ledger System: when a Bill from a Vendor is entered that includes a Detail Line Item representing an Inventory Item

a)The Gross Value (Price x Quantity + all Sales Taxes) of those Inventory Items is Debited (added) to the Inventory Asset Account

b)The Gross Value (Price x Quantity + all Sales Taxes) of those Inventory Items is Credited (added) to the Accounts Payable Liability Account.

✓When a Bill from a Vendor is entered which includes any Detail Line Item which is not for an Inventory Item

a)The Value (Quantity multiplied by the Price, plus any Sales Tax that was charged) of that Detail Line Item is Debited (added) to the Expense Account assigned in the Sale-Purchase Item Form

b)That same Value is Credited (added) to the Accounts Payable Liability Account.

c)That same Value is Debited (subtracted) from the Current Earnings Equity Account.

d)That same Value is Credited (subtracted) from the Earnings Posting (the Special Debit Account for Posting Earnings).

•Reserving Inventory - When an Inventory Item is Reserved on the Job Costing Form:

✓In the Inventory Tracking System

a)The Committed on Hand Count will be increased by the Quantity that was recorded Reserved.

b)The Available on Hand be decreased by the Quantity that was recorded Reserved.

✓No General Ledger System transaction is required because no Inventory Item Values have changed.

•Using Reserved Inventory - When an Inventory Item is Used on the Job Costing Form which was previously Reserved on that Job Costing Form:

✓In the Inventory Tracking System

a)The Committed on Hand Count will be decreased by the Quantity that was recorded as Used.

b)The WIP (Work in Progress) will be increased by the Quantity that was recorded as Used.

✓In the General Ledger System

a)The current Value (COGS Value multiplied by the Quantity used) of what was Used is Credited (subtracted) from the Inventory Asset Account

b)That same Value is Debited (added) to the Inventory WIP Asset Account.

•Using Inventory that was not Reserved - When an Inventory Item is Used on the Job Costing Form which was not previously Reserved on that Job Costing Form:

✓In the Inventory Tracking System

a)The Available on Hand Count will be decreased by the Quantity that was recorded as Used.

b)The WIP (Work in Progress) will be increased by the Quantity that was recorded as Used.

✓In the General Ledger System

a)The Value (COGS Value multiplied by the Quantity used) of what was Used is Credited (subtracted) from the Inventory Asset Account

b)That same Value is Debited (added) to the Inventory WIP Asset Account.

•When Inventory Usage is recorded on a Service Request Form: and (1.) that Service Request record was created through the Job Costing Form, and (2.) the required Inventory Item(s) were previously identified on that Job Costing Form as Reserved:

✓In the Inventory Tracking System

a)The On Hand Count will be decreased by the Quantity that was recorded as Inventory Items Used on the Inventory\Material tab of the Service Request Form.

b)The Available On Hand will be decreased by the Quantity that was recorded as Inventory Items Used on the Inventory\Material tab of the Service Request Form.

c)The WIP (Work in Progress) will be increased by the Quantity that was recorded as Inventory Items Used on the Inventory\Material tab of the Service Request Form.

✓In the General Ledger System:

a)The Value (COGS Value multiplied by the Quantity used) of what was Used is Credited (subtracted) from the Inventory Asset Account

b)That same Value is Debited (added) to the Inventory WIP Asset Account.

•When Inventory Usage is recorded directly into the Inventory\Material tab on a Service Request Form (not created from a Job Costing record):

✓In the Inventory Tracking System

a)The On Hand Count will be decreased by the Quantity that was recorded as Inventory Items Used on the Inventory\Material tab of the Service Request Form.

b)The Available On Hand will be decreased by the Quantity that was recorded as Inventory Items Used on the Inventory\Material tab of the Service Request Form.

c)The WIP (Work in Progress) will be increased by the Quantity that was recorded as Inventory Items Used on the Inventory\Material tab of the Service Request Form.

✓In the General Ledger System:

a)The Value (Quantity recorded multiplied by the COGS Value of those Inventory Items) is Credited (subtracted) from the Inventory Asset Account

b)That same Value is Debited (added) to the WIP Inventory Asset Account.

•When a Service Request - which had Inventory Usage recorded on the Inventory\Material tab of a Service Request Form (see above) - is then Invoiced to the Subscriber

✓In the Inventory Tracking System:

a)As part of the Completing the Service Request, when an Invoice is created for the services performed and there were Inventory and Materials recorded as required for the completion of that Service Request,

b)The WIP (Work in Progress) Count will be decreased by the Quantity that was recorded on the Inventory\Material tab of the Service Request Form

✓In the General Ledger System:

a)The Value (Quantity multiplied by the Retail Price) of each Detail Line Item is Credited (added) to the Sales Credit Account (using the Sale GL # assigned in the Sale Purchase Items Form)

b)That same Value is Debited (added) to the Accounts Receivable Asset Account

c)For the Sales Tax, if any Sales Tax(es) were charged,

i.The Amount(s) of Sales Tax(es) are Credited (added) to the appropriate Sales Tax Liability Account(s).

ii.The Gross Amount(s) of all Sales Tax(es) are Debited (added) to the Accounts Receivable Asset Account

❑General Ledger System Inventory Sales Considerations - An Overview:

•When any Detail Line Item on an Invoice represents the Sale of Inventory Item(s), these additional Financial Transactions (performed automatically) are required for tracking the Change of the Cost of Goods Sold Expense and Inventory Asset Values, and recording any resulting Profit/Loss:

1.Calculate the COGS Amount - The current COGS Value of the Inventory Item (as currently recorded on the Sale-Purchases Items Form) is multiplied by the Quantity of the Inventory Item that is being Invoiced becomes the calculated COGS Amount.

2.That COGS Amount is Credited (subtracted) from the Inventory Asset Account

3.That COGS Amount is Debited (added) to the COGS Expense Account

4.The Net Amount of the Detail Line Item - excluding the COGS Amount (i.e., The Quantity x Price of that Detail Line Item - but not including any Sales Tax charges - minus the calculated COGS Amount = Net Amount) - becomes the Profit for that Sale (Amount of Profit)

5.Posting the Profit

a)That Amount of Profit is Credited (added) to the Current Earnings Equity Account.

b)That same Amount of Profit is Debited (added) to the Earnings Posting (Special Debit Account for Posting Earnings).

•When a Service Request is Closed - which had Inventory Usage recorded on the Inventory\Material tab of a Service Request Form - is Closed, but will Not be Invoiced (e.g., Warranty Repair, Free-bee, for Office use):

✓In the Inventory Tracking System:

a)As part of the Completing the Service Request, when no Invoice is created for the services performed but there were Inventory and Materials recorded as required for the completion of that Service Request, then

b)The WIP (Work in Progress) Count will be decreased by the Quantity that was recorded on the Inventory\Material tab of the Service Request Form

✓In the General Ledger System:

a)COGS Amount - The Value of each Inventory Item (as currently recorded in the COGS Value field on the Sale-Purchases Items Form) is multiplied by the Quantity of that Inventory Item that was recorded on the Inventory\Material tab of the Service Request Form is used to calculate the COGS Amount.

b)That COGS Amount is Credited (subtracted) from the Inventory Asset Account

c)That COGS Amount is Debited (added) to the COGS Expense Account

d)The COGS Amount is Debited (subtracted) from the Current Earnings Equity Account.

e)The COGS Amount is Credited (subtracted) from the Earnings Posting (Special Debit Account for Posting Earnings).

•When any Inventory Item is directly Sold - When a Subscriber is Invoiced directly for an Inventory Item as part of a "stand-alone" Sale (and any Inventory Items included in the Sale were not Invoiced, or were not in some other way accounted for as Inventory Used elsewhere in a Service Request and/or as part of a Job Costing entry):

✓In the Inventory Tracking System:

a)The Inventory Item's " On Hand " Count on the Sale-Purchase Item Form will be decreased by the Quantity that was Invoiced.

b)The Inventory Item's " Available On Hand " Count on the Sale-Purchase Item Form will be decreased by the Quantity that was Invoiced.

c)No WIP (Work in Progress) Count is changed

✓In the General Ledger System:

1.There will be a Credit posted for the Amount of the Retail Price of all Inventory Items (added) to the Sales Credit Account (using the GL Account Number assigned in the Sale Purchase Items Form) and a Debit (added) to the Accounts Receivable Asset Account for the same Amount.

2.If any of the Inventory Items that were sold had to be Taxed, the Sales Tax Amount that was charged to that Sale will also be Debited (added to) the Accounts Receivable Asset Account (as part of the General Ledger System Sales transaction), and a Credit posted (added) to the appropriate Sales Tax Liability Account(s).

3.Then, the Value of the COGS Financial Transactions must be calculated and recorded as follows:

a.COGS Amount - The "COGS Value" currently stored on the Sale-Purchases Items Form for this Inventory Item is multiplied by the Quantity of the Inventory Item that is being sold, to calculate the COGS Amount.

b.That COGS Amount is Credited (subtracted) from the Inventory Asset Account

c.That COGS Amount is Debited (added) to the COGS Expense Account

d.The Net Profit Amount of the Detail Line Item is calculated by:

i.Excluding any Sales Tax charges and

ii.Excluding the COGS Amount that was posted in b. and c. above)

iii.The remaining Amount of this Detail Line Item is the Net Profit Amount

e.This Net Profit Amount is Credited (added) to the Current Earnings Equity Account.

f.That same Net Profit Amount is Debited (added) to the Earnings Posting (Special Debit Account for Posting Earnings).

❑How Inventory Adjustments are managed: When a Credit Memo is Issued by a Vendor

•From time to time your Company will need to return unused or inoperative Inventory Items that will generally result in a Credit being issued by that Vendor for the Cost of those Inventory Items

•When a Credit Memo from a Vendor is entered in the Accounts Payable System which includes a Detail Line Item representing the return of one or more Inventory Items

✓In the Inventory Tracking System:

a)The Inventory Item's " On Hand " Count on the Sale-Purchase Item Form will be decreased by the Quantity that was Credited.

b)The Inventory Item's " Available On Hand " Count on the Sale-Purchase Item Form will be decreased by the Quantity that was Credited.

✓In the General Ledger System

a)The Gross Value [(Price x Quantity) + Sales Taxes] of those Inventory Items is Credited (subtracted) from the Inventory Asset Account

b)The same Gross Value is Debited (subtracted) from the Accounts Payable Liability Account.

•When a Credit Memo is issued to a Subscriber - From time to time your Company may accept the return of unused or inoperative Inventory Item(s) from a Subscriber and will therefore issue them a Credit Note:

✓In the Inventory Tracking System:

a)The Inventory Item's " On Hand " Count on the Sale-Purchase Item Form will be increased by the Quantity that was returned.

b)The Inventory Item's " Available On Hand " Count on the Sale-Purchase Item Form will be increased by the Quantity that was returned.

c)The Inventory Item's " Available Pending " Count (as shown on the Sale Purchase Item Form) will not be changed.

d)The Inventory Item's " Total Pending " Count (as shown on the Sale Purchase Item Form) will not be changed.

✓In the General Ledger System: When a Detail Line Item on the Credit Note represents a previously sold Inventory Item, the Accounts Receivable, Sale and COGS Values of this Financial Transaction must be calculated and recorded:

a)The Gross Value (Quantity multiplied by the Retail Price plus any Sales Tax that was credited - then converted to a positive Value) is Credited (subtracted) from the Accounts Receivable Asset Account.

b)The Net Value (Quantity multiplied by the Retail Price that was credited - then converted to a positive Value) is Debited (subtracted) from the Sales Credit Account (using the Sale GL # assigned to that Inventory Item in the Sale Purchase Items Form)

c)The Sales Tax Amount(s) if charged is Debited (subtracted) from the appropriate Sales Tax Liability Account(s).

d)Then, the Value of the COGS Financial Transactions must be calculated and recorded as follows.

i.COGS Amount - This will be the "COGS Value" of the Inventory Item (as currently recorded on the Sale-Purchases Items Form) - not including Sales Tax - is multiplied by the Quantity credited on the Detail Line Item (that will result in a negative Value) and is then converted to a normal (positive) Amount (Value * -1).

ii.This COGS Amount is then subtracted from the Gross Detail Line Item Amount - thus eliminating any Sales Tax charges - and is converted to a positive value (COGS Value x -1) to derive the Net Credit Value.

iii.The (now positive) Net Credit Value Amount is Debited (added) to the Inventory Asset Account

iv.The Net Credit Value Amount is Credited (subtracted) from the COGS Expense Account

v.The Net Credit Value of the Detail Line Item is Debited (subtracted) from the Current Earnings Equity Account.

vi.The Net Credit Value of the Detail Line Item is Credited (subtracted) from the Earnings Posting (Special Debit Account for Posting Earnings).

e)Sales Tax Amount - If any of these Inventory Items were charged Sales Tax, the Sales Tax Amount on the Credit Memo will also be:

i.Credited (subtracted) from the Accounts Receivable Asset Account and

ii.Debited (subtracted) from the Sales Taxes Payable Liability Account.

•Inventory Transfers - From time to time you may relocate (i.e., Transfer) Inventory Item(s) from one Warehouse location to another.

✓In the Inventory Tracking System:

▪These Transfers do no affect the overall Quantity of any Count shown on the Sale Purchase Item Form.

✓In the General Ledger System:

▪No General Ledger System transactions are executed (none are required).

•Inventory Adjustments - From time to time you may perform a physical Inventory Count.

✓As a result of this Inventory Counting Procedure ("taking Inventory"), and the subsequent Inventory Count Adjustments (using the Adjust option on the Warehouse Inventory Form), the "Available On Hand" Count of certain Inventory Items will usually need to be changed.

▪These Inventory Adjustments are accomplished by simply making a change to the Quantity of certain " Available On Hand " Counts (this field is also shown on the Sale Purchase Item Form).

✓Within the General Ledger System: Depending on whether a Count was increased or reduced, an Inventory Difference Value of that change is determined by multiplying the Quantity Difference (i.e., either a positive or negative number) by the current COGS Value as shown on the Sale Purchase Item Form.

1.Inventory Adjustments - The Inventory Adjustments Expense Account is Credited (added to) if the Quantity of Available on Hand was increased; or Debited (reduced) if decreased.

2.Inventory - The Inventory Asset Account is Debited (added to) if the Quantity of Available on Hand was increased; or Credited (reduced) if decreased.

3.Current Earnings - The Current Earnings Equity Account is Credited (added to) if the Quantity of Available on Hand was increased; or Debited (reduced) if decreased.

4.Earnings Posting - The Earnings Posting (Special Debit Account for Posting Earnings) is Debited (added to) if the Quantity of Available on Hand was increased; or Credited (reduced) if decreased.

❖See the "Special Purpose Buttons on the Warehouse Inventory Form" section in the Warehouse Inventory and the Editing Warehouse Inventory Levels chapters for information about entering these Inventory Adjustments.

❖See the Use of, and Purpose for Mandatory Accounts chapter for more information.