❑This chapter will provide the next the steps required to properly start the Receivables module.

❖Before continuing, be sure the User Options for Accounts Receivable entries have been completed.

❑After reading the module's Receivables Module Overview section and completing the User Options for Accounts Receivable entries:

•Access the General Maintenance Menu:

a)From the Backstage Menu System Select Maintenance and Choose the General option, then select the General Maintenance option which displays the secondary Maintenance Menu, or

b)From the Quick Access Menu, Select Maintenance and Choose General Maintenance to display the secondary Maintenance Menu.

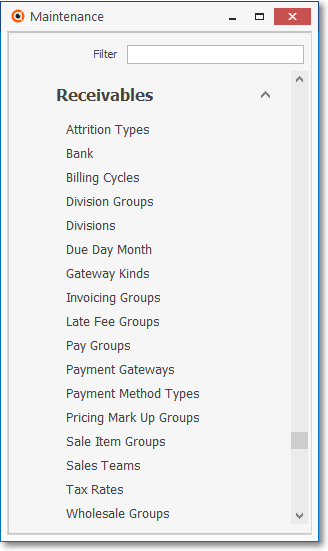

•Locate the Receivables sub-section and complete the Receivables options which are outlined below:

General Maintenance Menu - Receivables options

✓Keep in mind that other modules may also share some of the information that is entered here.

✓Applicable modules will automatically share this information, when appropriate.

•As you enter the required data listed in this Receivable Module's General Maintenance Menu, also keep in mind that some of these Data Entry Forms may/should be completed by other departments within the Company.

✓If this is the case, the information as to what module will need that data will be provided in the Help Files for that module.

✓As an example, Employee Information is used by Service Tracking, Accounts Receivable, Inventory Tracking & Job Costing and the Monitoring Module and each of those module's start-up Overview chapters will explain what information is needed to support that module.

❑What do I do Now?

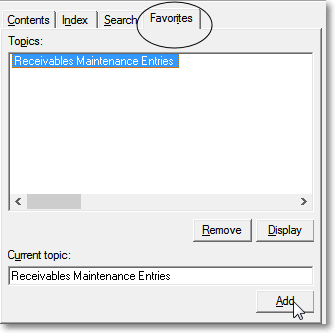

•Learn how to Bookmark and quickly Return to this, or any other Help Files Page for Quick Reference:

✓To Bookmark a (this) page:

▪Open the Help Files

▪Click on the desired page name (This page in the Help Files)

▪Select the Favorites tab

Help Files - Favorites tab

▪Click Add

✓To Return to a (this) Help Files Page:

▪Open the Help Files

▪Select the Favorites tab

▪Select the desired Help Files Page in the Topics list.

▪Then, Click Display.

✓Once you have completed the steps outlined below, you may Remove this page from your Favorites tab Topics list.

❑How Do I Start the Receivables module? - Complete each step below in the order presented:

➢Note: You should have read the User Options for Accounts Receivable chapter and completed these Forms:

1.Company Options - General tab

2.Company Options - Invoice/Proposal tab

3.Tax (Sales Taxes) tab

•Create Sales Teams and then enter the appropriate Employee information:

✓Sales Teams - If using the Commissions Tracking System, create the Sales Teams that need to be tracked, then assign one to each Employee who has been identified as a Salesperson in the Security tab of the Employee Form (the field referred to as the Employee Team).

✓Employees - Identify your Employees, particularly Salespersons, because the Salesperson must be identified in the Subscriber Information record and when creating Sales Invoices.

❖Then, enter the information in the Forms listed on the Maintenance > General Maintenance Menu > Receivables sub-menu, as appropriate:

✓Pay Groups - Define Pay Groups which are used to periodically index the Recurring Revenue stream for inflation, by upwardly adjusting their Recurring Revenue Service rates.

✓Billing Cycles - Define Recurring Billing Cycles if the cyclical billing feature has been activated (see the User Options's Company Options - Invoice/Proposal chapter)

✓Attrition Codes - Define Attrition Codes to be able to identify how new Accounts are acquired and how existing Accounts are lost.

✓Bank Maintenance - Set up your Company's Bank Accounts if you have not already done so.

✓Late Fee Groups - If you want to assess Late Fees for those Subscribers who have Past Due Recurring Revenue Invoice(s), and will be using multiple Recurring Revenue Cycles, enter Late Fee Groups

✓Tax Rates - Establish your State (or Province) Sales Tax rules, and as may be required: County and/or City Sales Tax rules in Sales Tax Rates, as needed.

✓Pricing Mark Up Groups - If you offer Discounts, enter those Discounts as Pricing Mark Up Groups.

✓Divisions - If your Company is divided into Divisions, and/or are Billing an Alarm Dealer's Accounts other Alarm Companies, identify those as Divisions.

▪If and when your Company starts using the Inventory Tracking System, the Divisions Form also allows you to identify a default Warehouse so that any Inventory related Sales, Work Orders, Bills and/or Purchase Orders will be associated with that Warehouse..

•Read the Managing Recurring Revenues chapter

✓Then, enter the Recurring Revenue Sales Items in the Maintenance > Sale - Purchased Items Form

✓If you will be using the Fully Automated Recurring Billing feature, set up that function.

•These additional Forms listed on the Maintenance > General Maintenance Menu > Receivables sub-menu may also need data entered based on the operational needs of your Company:

❖Wholesale Groups - These are used to identify the Contract Monitoring Providers supplying monitoring services for some or all of your Company's Subscribers.

✓Sales Teams - These are used to identify the "Sales Teams" that may exist within your Company

❖Sale Item Groups - These are used in conjunction with the Advanced Sale Item Lookup function, for locating a specific Sale-Purchase Item when creating a new Sale - or recording a Purchase - will be much easier and faster for those who have many hundreds of Sale-Purchase Items defined.

✓Invoicing Groups - These may be used by those Companies who have a large number of Accounts (Subscribers), many of whom are Invoiced for on-going monitoring and recurring maintenance services, and often these services are provided at multiple locations for multiple, for varying sets of those recurring services. Under these circumstances, the associated Recurring Revenue Invoices can become extremely long and complicated to read (and difficult to comprehend).

✓Division Groups - These Division Group may have any number of Divisions as members within that Group. and several Accounts Receivable System Reports allow for filtering or record selection based on what Division Code is assigned to the Subscriber and/or the Division Group to which that Division Code belongs.

❖How to Get Paid via Electronic Funds Transfer explains Gateway Kinds, Payment Method Types, and the use of Payment Gateways

✓Gateway Kinds - This Form is used to identify those that will be used (i.e., are Active) , and those that will not (i.e., are Inactive) by your Company from a list of predefined Kinds of Payment Gateways

✓Payment Gateways - Identify the appropriate Log In Names, Passwords, and Special Instructions which are required to be defined for each Payment Gateway (that will be used) before accessing the E-Payments Form to charge E-Checks and Credits Cards for a selected Subscriber (also read about the Recommended InnoEPay system Payment Gateway.

✓Payment Method Types - Form is used to identify the various types of Payments which may be paid by and received from Subscribers

▪But, most importantly, identifies the associated default Batch Number preface (see Batch Number Assignment) discussion in the Receipts chapter for more information) that should be used to construct the Batch Number assigned to a Receipt record, particularly when executing the Post Auto Draft and E-Payments processes.

▪Most (perhaps all) of the required Payment Method Types have been pre-defined.

❑What Else should be done Next?

1.Define the non-recurring revenue Sales Categories that may be billed (Parts, Labor, Trip Charges, Services, etc.).

2.Enter the Subscriber Information which controls the module (these are the key records for this Accounts Receivable module).

3.Enter the Recurring Revenue requirements for each Subscriber.

4.As available, enter the Payment Methods (Bank Draft and/or Credit Card information) each Subscriber may want to use.

5.Enter the Starting Balances for each Subscriber.

6.Review the Daily and/or Periodic procedures that enable you to get the greatest benefit from the Accounts Receivable module.

a.It is very important to establish a specific schedule for how and when you will do them.

b.There may be multiple ways to accomplish basically the same process (e.g., how you will manage past due Collections, when you will bill Recurring Revenues, how detailed you want the Subscriber's Invoices, etc.).

c.So experiment a little as you become more familiar with the processes.

d.Decide what method you will use based on your understanding of your Company's business requirements.

7.Familiarize yourself with the available Reports by viewing the Receivable Reports sub-menu:

a)From the Backstage Menu System, Select Reports and Choose the Receivable Reports sub-menu, or

b)From the Quick Access Menu, Select Reports and Choose the Receivable Reports sub-menu

❖Read the Credit Card Surcharge Setup chapter if your Company is located (or has Subscribers) within a State that authorize Credit Card Surcharges

•Once the Receivable Reports sub-menu is displayed, Select the desired Report option, as required.