❑Account Divisions - There are several predefined types of Account Divisions (which are not related to any of your Company's Divisions, if your Company is using them)

•One Account Division will be assigned to each General Ledger Account that is defined.

✓Account Divisions are a basic, fundamental part of this, or any General Ledger System

✓Account Divisions are not an actual Maintenance Entry

✓Account Divisions are generic and cannot be changed, renamed, or added, or removed

❑Understanding Account Divisions

•The purpose and function of Account Divisions must be understood by any Employee who has been granted Accounting Administrator privileges before the remaining Maintenance Entries are defined.

•Account Divisions are used to construct the way your Company's Balance Sheet, Income Statement and Profit & Loss Comparison reports are presented (printed).

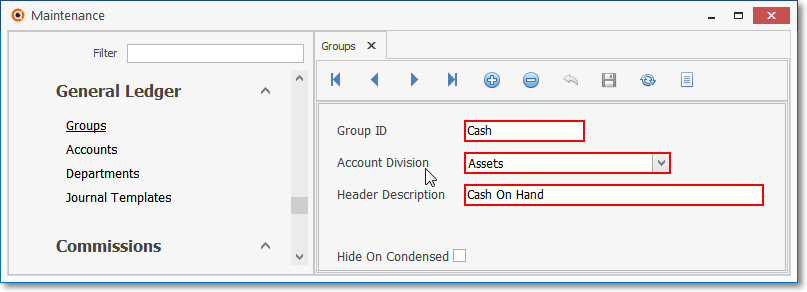

✓A General Ledger Group is assigned to an Account Division (e.g., an Account Division must be assigned to a Group).

✓Therefore, Account Divisions may be associated with one or more General Ledger Groups. (i.e., more than one General Ledger Group may be assigned to the same Account Division).

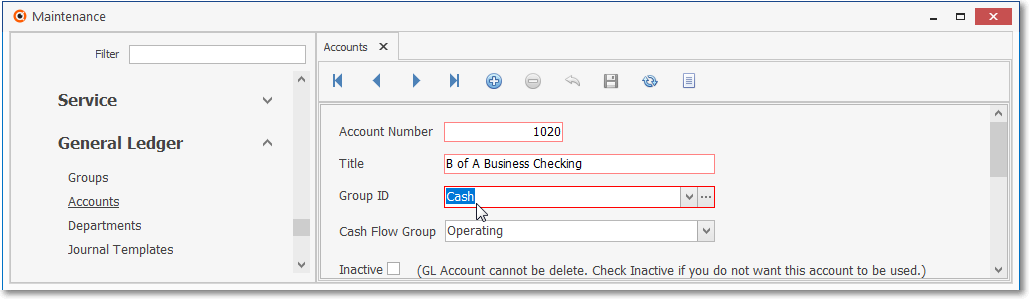

•Because each General Ledger Account is assigned to one specific General Ledger Group, by so each General Ledger Account is automatically assigned to an Account Division, as well.

❑Understanding how Account Divisions affect Financial Statements & Reporting:

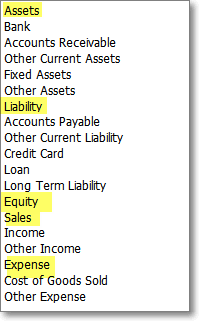

•Account Divisions are ordered as follows:

1.Assets, Secondary Assets

2.Liabilities, Secondary Liabilities

3.Equity

4.Sales, Secondary Sales

5.Expenses, Secondary Expenses

•Account Divisions represent the General Types of Financial Transactions that will be posted to the General Ledger Accounts (each of which is assigned to a Group and therefore has an associated Account Division), and so these Financial Transactions will be properly characterize, and positioned within your Company's Financial Statements, with the Values (Balances) they hold.

Account Divisions listing

Primary Account Divisions are highlighted in Yellow

•The Financial Statements (when printed) are ordered as follows:

1.The first Primary Account Division (normally included in the selected Report) is listed

2.Then, the Title of the first General Ledger Group (sorted by Group ID) assigned to that Account Division

3.Then each General Ledger Account (sorted by Account Number) that is assigned to that General Ledger Group

4.Then a sub-total for that Group

5.Then, the Title of the next General Ledger Group (sorted by Group ID) that is assigned to that Account Division

6.Then each General Ledger Accounts (sorted by Account Number) assigned to that General Ledger Group

7.Then a sub-total for that Group

8.This cycle continues until no more Groups with data are available for this (Primary or Secondary) Account Division

✓Then, the next Account Division (either Primary or Secondary, as appropriate) is listed and the cycle continues as outlined above.

❑General Ledger Groups - Primary and Secondary Account Divisions (used to identify the Types of Financial Transactions that will be posted to the General Ledger System) are somewhat general in nature, and so, along with Account Division classifications, an even more specific "Grouping" of Financial Transactions may be employed in this General Ledger System: these more specific "Groupings" are referred to as General Ledger Groups.

•General Ledger Groups are the building blocks (along with the underlying Account Divisions) which will be used to construct your Company's Balance Sheet and Income Statement reports (see the Designing Your Company's Financial Statements chapter for more information).

•General Ledger Groups are used to further sub-divide the five Primary classifications and many more Secondary sub-classifications of Account Divisions that are being used to classify Financial Transactions

✓The advantage of adding this additional Financial Transaction classification "Grouping" method, is that it provides an even more focused clarification of the Purpose and Functionality of each General Ledger Account entry on those Financial Statements.

•Each Account Division within your Company's General Ledger will automatically contain its associated set of General Ledger Accounts because:

General Ledger - Groups Form - Account Division field

1.Each General Ledger Group is assigned (as shown above) to an Account Division (either Primary or Secondary)

General Ledger - Accounts Form - Group ID field

2.Each General Ledger Account is assigned (as shown above) to a General Ledger Group, and therefore

3.Every General Ledger Account is automatically identified as a member of an Account Division because every Account has been assigned to a General Ledger Group that has been assigned to an Account Division.

❑Numbering your Company's General Ledger Accounts:

•Although General Ledger Account Numbering scheme (see the "Choosing the Account Numbering scheme" discussion below) may contain up to 8 digits; plus 4 additional digits coming after a decimal point (e.g., 12345678.1234), the list below presents a typical - and our recommended - Account Numbering scheme (the recommended Numbering Range) for each of the five Primary Account Divisions.

•These are the five Primary Account Divisions (i.e., account classifications - see the list below) for the Financial Transactions that will be posted to the General Ledger Accounts:

✓The first three (1-3) Primary Account Divisions represent the three components of a Balance Sheet report; the last two (4-5) represent the two components of an Income Statement report.

1.Asset Accounts 1000 - 1999 - Debit - An Asset Account identifies items that have an actual cash value or can reasonably be converted to cash.

2.Liability Accounts 2000 - 2999 - Credit - A Liability Account identifies a portion of what the Company owes, or in some other manner is obligated to pay to others.

3.Equity Accounts 3000 - 3999 - Credit - The Equity Accounts identify the net value of the business (Company).

4.Sales Accounts 4000 - 4999 - Credit - These Revenue Accounts identify the Revenue (Income) from Sales, Interest earned from savings, and any other miscellaneous Income.

5.Expense Accounts 5000 - 9989 - Debit - These Expense Accounts identify the cost of acquiring those Sales, and all other business expenses.

✓There are many more Secondary classifications - listed below with their associated Primary classification

▪Each of these Secondary classifications are used to more finely classify one of the Primary Financial Transaction Types:

a.Assets: Secondary classifications - Bank, Accounts Receivable, Other Current Assets, Fixed Assets, Other Assets

b.Liabilities: Secondary classifications - Accounts Payable, Other Current Liability, Credit Card, Loan, Long Term Liability

c.Equity: Secondary classifications - None - but General Ledger Groups may be created for sub-dividing, and sub-totaling the Equity values reported on your Company's Balance Sheet.

d.Sales: Secondary classifications - Income, Other Income

e.Expenses: Secondary classifications - Cost of Goods Sold, Other Expense

✓These Primary and Secondary Account Division classifications and sub-classifications will determine whether the General Ledger Account is a Debit or a Credit type of Account (see the Understanding Debits & Credits chapter for more information on these Terms).

▪They will also determine where and if their associated General Ledger Accounts will appear within the Balance Sheet or the Income Statement reports (see the "Debits must equal Credits " discussion immediately below).

▪Therefore, as you are Designing Your Company's Financial Statements - remember that General Ledger Groups may (and often should) be created to further sub-divide, and sub-total the Primary and/or Secondary Types of Financial Transactions reported on those Financial Statements.

•Debits must equal Credits - Because the sum of all Debits must equal the sum of all Credits on both of these standard Financial Statement types:

1.Balance Sheet - For the Balance Sheet report, it is easy to see that the net sum of each of the Asset (Debit ) Accounts (#1 in the list above) must equal the net total of the sum of all of the (#2 & #3 in the list above) Liability and Equity (Credit ) Accounts with two User Defined General Ledger Accounts for Current Earnings and Retained Earnings (see the General Ledger Setup Wizard chapter for more information on these Mandatory Account Declarations) providing the Accounts to which those types of Earnings information will be posted in order to balance this Balance Sheet report.

2.Income Statement - With the Income Statement report, the net sum of all of the Sales (Credit ) Accounts must equal the net total of all of the Expenses (Debit ) Accounts with a User Defined General Ledger Account for Earnings Posting (see the General Ledger Setup Wizard chapter for more information on this Mandatory Account Declarations) providing the Account to which the Profit (or Loss) will be posted to balance this report.

•Choosing the Account Numbering scheme - Determine what Account Numbering scheme and the Numbering Range for each Primary Account Division will be used for designing your Company's Chart of Accounts (i.e., General Ledger Accounts):

✓Although a Numbering Range of 1000 to 9999 is recommended, a much more complex numbering scheme may be utilized, if necessary.

▪Up to 9,999,999 main General Ledger Accounts - each with up to 9,999 subordinate Accounts - may be created (e.g., 12345678.1234).

▪This power and capacity must be used wisely, as the longer and more complex the number scheme used for defining General Ledger Accounts, the more complicated the management and reporting becomes for this (or any) General Ledger System.

▪Remember: With Power comes Responsibility

✓So, unless you have a compelling reason to be more complicated and complex when designing your Numbering Range, stick with our recommendation (i.e., a Numbering Range of 1000 to 9999).