An Overview of Earned & Deferred Revenue Calculations

❑Earned and Deferred Revenue Tracking is a somewhat complex accounting concept (one of many that are designed to ensure full employment for accountants and tax attorneys).

•Within the context of the accounting procedures that most of us are somewhat familiar, every Sales Invoice that is issued would normally be considered "earned" when it is created (i.e., your Company is billing someone or some company for something they've purchased and, in most cases, have already received from your Company such as a completed Work Order, or new System Installation).

•However, when billing for Recurring Revenue, those Sales Invoices are almost never "earned" when they are "billed" to the Subscriber.

✓This is because the Sales Invoices for Recurring Services (e.g., Monitoring Fees, Service Contracts, Opening & Closing Reports) are almost always printed and mailed a month (or a least a week or so) in advance of when the period of service (for which they are being billed) actually begins.

✓So technically, if the Receipts for those Recurring Revenue Invoices - are posted before the entire period of service (for which they were Invoiced) has passed:

▪The required Recurring Services that were paid with those Receipts has not yet been provided (or not provided completely).

▪Therefore, from an accounting standpoint, the Income (i.e., Revenue) which your Company received for those Recurring Services (or at least a portion of that income), could - and probably should - be considered unearned when you received it.

✓Obviously, once you have fully provided those Recurring Services, all of those Recurring Revenue associated Receipts are earned.

•In summary, Revenue billed is not fully Earned until the service - for which the Subscriber was billed - has been fully provided.

✓Therefore, the Company's "books" should reflect in some manner, that the Revenues Received for those Services are Deferred (not recognized as Earnings), until the Period of Time your Company is required to provide those Services, has expired.

❑An example of tracking those Deferred - and subsequently Earned - Revenue

•A Subscriber is billed "Quarterly" on the 15th of the month preceding the beginning of their (billed for) service period.

✓They pay on time - remember this is only an example, so stop laughing.

✓Therefore, by paying on time they have actually paid "in advance" for the full service period that was billed for those services.

✓So, the Company has billed for, and received payment for services which the Company has not yet provided.

✓This means that all or some portion of this Revenue should - for accounting purposes - be Deferred (i.e., not recognized as a Sale) until it has actually been Earned.

•Until the three months (the "Quarterly" service period for which they were billed for services) have passed, the money received for those services may already be (and in reality probably has been) spent - without fully providing those required (billed for) services.

✓Specifically, your Company is only earning one month of their prepayment at the end of each month within the service period for which they were billed.

✓So, at the end of each month, one month's worth of that prepayment Revenue is Earned, and this continues until the service period - for which the Subscriber had paid in advance - has been provided.

✓At that point, the "billed for" service period has been fully provided by your Company (and consumed completely by the Subscriber), so all of that prepayment Revenue has now been Earned..

•Are you having fun yet?

❑Why did we put you through this exercise? (Who - except Einstein - likes this kind of "thought experiment" anyway?)

•Growing companies - by the nature of that growth - enjoy increasing revenues month over month, and year over year.

•If some (and often much) of this revenue is from Recurring Services (e.g., Monitoring, Service Contracts, Opening & Closing Reports), and most - if not all of these services - are billed in advance as Recurring Revenues, then your Company may be able to "defer" some of this unearned income (for the portion of the service period that is not yet Earned) until the following tax year.

✓Generally, this is a good thing because the value of money declines over time, and in the meantime, your Company may actually be using, and/or earning interest on those Recurring Revenue payments.

✓Plus, when any Revenue is able to be Deferred into the following tax year, you don't have to pay taxes on that Revenue on the current year's tax return.

➢Important Note: This is actually legal - ask your accountant!

❑The Problem (Why doesn't every one do this?)

•Earned and Deferred Revenue Tracking can be very difficult, and extremely time-consuming to calculate and record!

✓If your Company has not automated this process, it may cost as much or more to accurately calculate those Earned and Deferred Revenues than your Company would save in Income Taxes.

❑The Solution - Let the MKMS General Ledger System calculate the Earned & Deferred Revenue in the background as part of its automated Recurring Revenue Billing - and use the associated Post Earned Revenue process to record it, because it will do so with virtually no additional effort required on your part.

•Earned & Deferred Revenues are calculated on a Monthly basis using the data in these automated billing processes and Billing Cycles fields:

1.Fully Automated Recurring Billing feature completely automates the creation of your Company's Recurring Revenue Invoices.

❖This Fully Automated Recurring Billing process makes the Invoicing of your Company's Recurring Revenue a truly "set it and forget it" process.

2.The manually selected Auto Billing process allows you to select which and when selected Billing Cycles will be automatically Invoiced.

3.The Billing Cycle Form is used to define when and how your Company's Recurring Revenues are to be Invoiced.

a.Sale Day - The Sale Day field on the Billing Cycle Form is used to construct the Sale Date on the Invoice when billing the Recurring Revenue for each Billing Cycle:

i.Use the Drop-Down Selection List to Choose the Day on which the Bill (Invoice for these Services) will actually be Dated (and created).

ii.The system will not allow a Sale Day Number greater than 28 to be used (because an Recurring Revenue related Invoice with a Sale Day Number greater that 28 would not be generated in February - even if it should have been)

iii.However, it does offer a Last Day of Month option in that Drop-Down Selection List.

b.Period Covered Day - The Period Covered Day field on the Billing Cycle Form is used to identify when the Period of Service actually will begin for this Billing Cycle.

c.Bill In Advance - The Bill In Advance Day Check box field on the Billing Cycle Form is used to identify which (if any) Billing Cycles should be billed a Month in Advance.

•These "Sale Day, "Period Covered Day" and "Bill In Advance" fields in the Billing Cycle Form are used to determine when the First month of a Recurring Revenue Invoice is to be Earned or Deferred.

✓These are the two situations your Company should consider before filling in the "Sale Day, "Period Covered Day" and "Bill In Advance" fields

1.Your Company will be implementing the Fully Automated Recurring Billing feature which allows your Company to specify on what Day (the Sale Day) throughout the month a Subscriber's Recurring Revenue entries (each of which is assigned to a specific Billing Cycle) will be automatically Invoiced.

a.The Sale Day entry in the Billing Cycle Form is used to construct the Sale Date of each Invoice.

b.The Period Covered Day entry in the Billing Cycle Form represents the Day of the Month when the Recurring Service(s) being Invoiced will start being provided.

i.This Period Covered Day may be the same as, or different than, the Sale Day:

ii.The Period Covered description on the Invoice will show a starting day that matches the Period Covered Day (not the Sale Day) and will determine when and how the Earned Revenue is posted

iii.When the Period Covered Day is "1", the First month of service will be fully Earned (fulfilled) within that Month, therefore the first month's Revenue will be posted as Earned on the last day of the first month.

iv.When the Period Covered Day is greater than "1", the First month of service cannot be fully Earned (fulfilled) until the following Month, therefore the first month's Revenue will not be Earned until the last day of the next month.

c.However, when the Bill In Advance field in the Billing Cycle Form is Checked, the Period Covered Day's starting day is reset to the Month following the Invoice's Sale Date

i.When Bill In Advance is in effect and the Period Covered Day is "1", the First month of service will be fully Earned (fulfilled) in the next Month, therefore the first month's Revenue will not be posted as Earned until the last day of the next month.

ii.When Bill In Advance is in effect and the Period Covered Day is greater than "1", the First month of service cannot be fully Earned (fulfilled) until the Month following the next Month, therefore the first month's Revenue will not be posted as Earned until last day of the month after the next month

2.Your Company will not be implementing the Fully Automated Recurring Billing feature, but instead will use the manually selected Auto Billing process in which a specific set of Subscribers who have Recurring Revenue entries assigned to a specific Billing Cycle will be Invoiced for those Recurring Revenues.

a.In this case, using the manually selected Auto Billing process: YOU choose when to create the Invoices for a specifically selected Billing Cycle and YOU manually enter the Sale Date on the Auto Billing Form at the time that process is run.

i.That Sale Date becomes the Sale Date entered on each Invoice.

b.The Period Covered Day entry in the Billing Cycle Form represents the Day of the Month when the Recurring Service(s) being Invoiced will start being provided.

i.The Period Covered description on the Invoice will show a starting day that matches the Period Covered Day (not the Sale Date) and will determine when and how the Earned Revenue is posted

ii.This Period Covered Day may be the same as, or different than the Sale Date:

iii.When the Period Covered Day is "1", the First month of service will be fully Earned (fulfilled) within the Month, therefore the first month's Revenue will be posted as Earned on last day of the first month.

iv.When the Period Covered Day is greater than "1", the First month of service cannot be fully Earned (fulfilled) until the following Month, therefore the first month's Revenue will not be posted as Earned until the last day of the next month.

c.However, when the Bill In Advance field in the Billing Cycle Form is Checked, the Period Covered Day's starting day is reset to the following Month.

i.When Bill In Advance is in effect and the Period Covered Day is "1", the First month of service will be fully Earned (fulfilled) in the next Month, therefore the first month's Revenue will not be posted as Earned until the last day of the next month.

ii.When Bill In Advance is in effect and the Period Covered Day is greater than "1", the First month of service cannot be fully Earned (fulfilled) until the Month following the next Month, therefore the first month's Revenue will not be posted as Earned until the Month after the next Month.

3.Your Company may use a combination of both the Fully Automated Recurring Billing and the manually selected Auto Billing processes, if your Company's business model requires it.

A.For General Ledger System Users - When Earned and Deferred Revenues are being tracked, the Sale Day and Period Covered Day (as described above) in combination with the Bill In Advance setting of the Billing Cycle are used to determine when that Recurring Revenue is to be Earned.

1.This Earned (or Deferred) Revenue is calculated automatically when using either the Fully Automated Recurring Billing feature and/or the manually selected Auto Billing process, and will be posted appropriately (following the situations discussed above) by using the Post Earned Revenue procedure.

2.Earned Revenue should be posted to the General Ledger System - using the Post Earned Revenue process - on or after the Last Day of the selected Month being posted.

B.For General Ledger System Users - When Earned and Deferred Revenues are being tracked:

1.The Gross Amount (including Sales Tax, if charged) of each Recurring Revenue Sale is Debited (added) to the Accounts Receivable Asset Account (a Mandatory Account).

2.The Net Amount (not including any Sales Tax) is Credited (added) to the associated Deferred Revenue Liability Account

3.If Sales Tax was charged, the Amount of that sales tax is Credited (added) to the appropriate Sales Tax Payable Liability Account (i.e., Local Tax, National Tax, or both, as needed).

4.Then, once each month, the Post Earned Revenue dialog is used to calculate the Earned Recurring Revenue for a selected Accounting Period. during which:

a.The Deferred Revenue Liability Account is Debited (reduced) by the Value of the Recurring Revenue that was Earned during the Accounting Period

b.The Sales Account assigned to the Recurring Revenue Item is Credited (increased) by the Value of the Recurring Revenue that was Earned during the Accounting Period

c.The Current Earnings Equity Account (a Mandatory Account) is Credited (increased) by the Value of the Recurring Revenue that was Earned during the Accounting Period

d.The Earnings Posting Expense Account (a Mandatory Account) is Debited (increased) by the Value of the Recurring Revenue that was Earned during the Accounting Period

C.For General Ledger System Users - When Earned and Deferred Revenues are not being tracked:

1.The Net Amount (not including any Sales Tax) is Credited (added) to the associated Sales Account (assigned to that Recurring Revenue Item).

2.The Gross Amount (including Sales Tax, if charged) of each Recurring Revenue Sale is Debited (added) to the Accounts Receivable Asset Account (a Mandatory Account).

3.If Sales Tax was charged, the Amount of that sales tax is Credited (added) to the appropriate Sales Tax Payable Liability Account (i.e., Local Tax, National Tax, or both, as needed).

4.The Net Amount (not including any Sales Tax) is Credited (added) to the Current Earnings Equity Account (a Mandatory Account).

5.The Net Amount (not including any Sales Tax) is Debited (added) to the Earnings Posting Account (a Mandatory Account).

Automating the Earned & Deferred Revenue Tracking Process

❑Preparing for Earned and Deferred Revenue Tracking when using the General Ledger System: (once this preparation has been completed, you must Run the Deferred Revenue Setup Wizard which will validate the start up process):

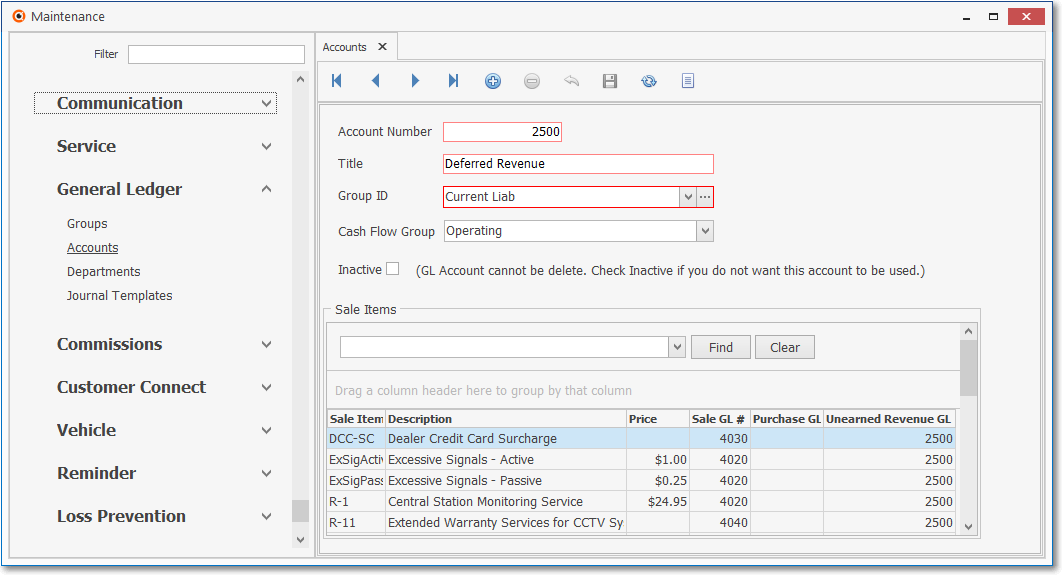

•Define a Deferred Revenue General Ledger Account as a Liability Account - usually placed within a Current Liability General Ledger Group.

Maintenance - General Ledger - Account Form - Deferred Revenue Account

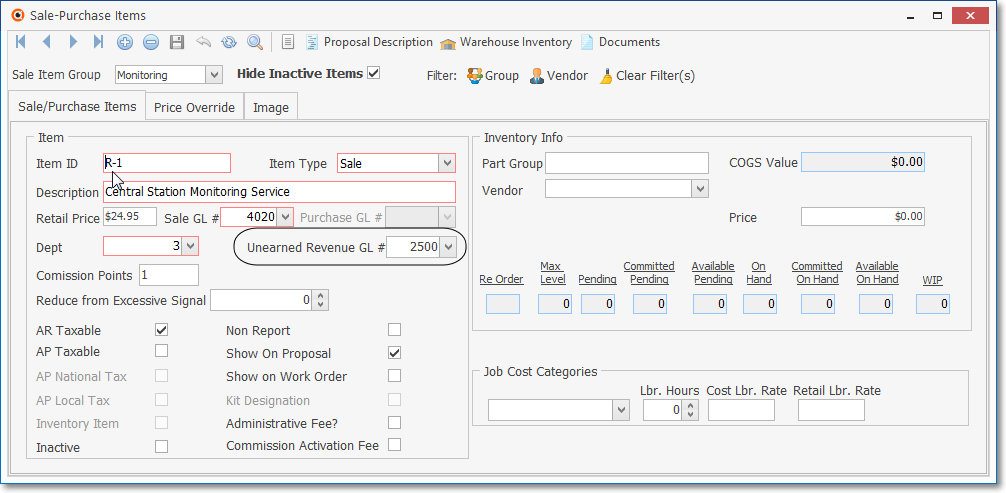

•Assign that Deferred Revenue General Ledger Account (in the Unearned Revenue GL# field) to each Sale-Purchase Item that represents a Recurring Revenue type of Sale which should/might be Deferred.

Sale-Purchase Item Form - Unearned Revenue GL# field

❑Run the Deferred Revenue Setup Wizard

➢Note: Before running the Deferred Revenue Setup Wizard, go into Company Settings and set the Bill in Advance option ("BillInAdvance") to False ("F").

Thereafter, you will use the Billing Cycles Form to individually set each Billing Cycle entry to Bill In Advance, or not to Bill In Advance, as needed, based on your Company's business model.

See the Automating the calculation of Earned and Deferred Revenue discussion in the Deferred Revenue Setup chapter for more information.

•The Deferred Revenue Setup Wizard is used to properly initialize the Deferred Recurring Revenue feature within MKMS Accounts Receivable module and - if the General Ledger module is Registered - in the General Ledger System.

•Once the Deferred Revenue Setup process has been completed:

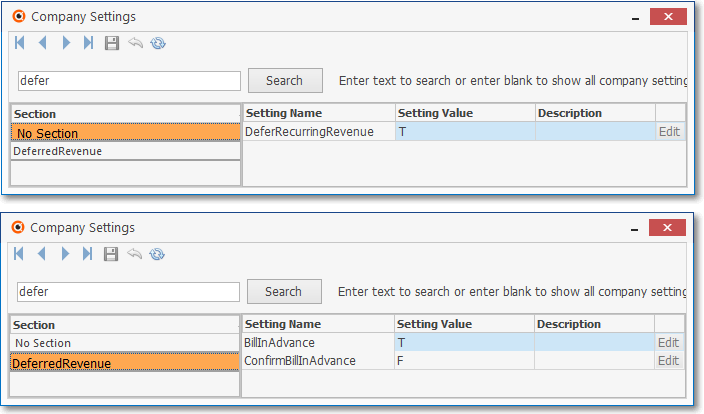

1.Certain Company Settings options will be changed.

2.To view those changes, search for "Defer" in the Company Settings list to see the Setting Names associated with tracking Earned & Deferred Revenue.

Company Settings - Search "Defer" - Results

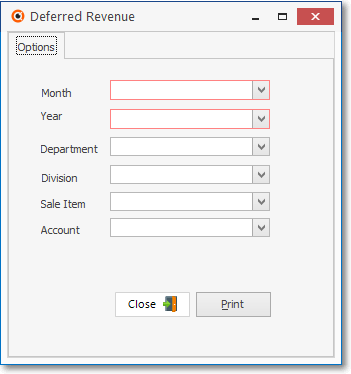

•If you are manually posting Earned and Deferred Revenue to an "outside" General Ledger, the Earned/Deferred Revenue Report (see illustration below) provides you with those Earned and Deferred Revenue Tracking Values.

Deferred Revenue Report - Options tab

•Otherwise, your Company will use the Post Earned Revenue procedure to post those Earned Recurring Revenues automatically.

❑Understanding the General Ledger System internal posting process when a Recurring Revenue Sale is created:

•If the General Ledger System is activate (the DeferRecurringRevenue option is set to True), when a Recurring Revenue Invoice is created (i.e., it has one of the Recurring Revenue Sale-Purchase Items assigned to one or more Detail Line Items):

✓The Gross Total Value (Total Value = [the (Detail Line Item's Sales Value which is Quantity * Price) + (Sales Tax Rate * that Detail Line Item's Sales Value)] of each Detail Line Item is posted (added) to the General Ledger System's Accounts Receivable Account.

✓The Sales Value (Quantity * Price) of each of those Detail Line Items will be posted (added) to the Deferred Revenue General Ledger Account instead of the General Ledger Sales Account - that Deferred Revenue Account Balance will be increased (a Credit will be posted to the designated Deferred Revenue Liability Account) for the Value of each of those Detail Line Items.

✓The Sales Tax Value (Sales Tax Rate * that Detail Line Item's Sales Value) is added to the Sales Tax Payable Liability Account.

•The Value of the Detail Line Item's internal Earned Revenue field is initially set to $0.00.

✓No General Ledger System transaction is generated for Earned Revenue.

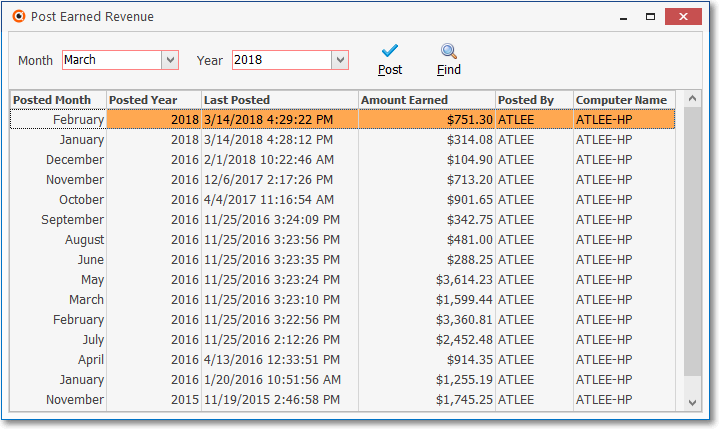

•The Post Earned Revenue procedure (see the illustration below) updates the Values in the Deferred Revenue General Ledger Account and associated Recurring Revenue Sale Accounts.

Post Earned Revenue Form

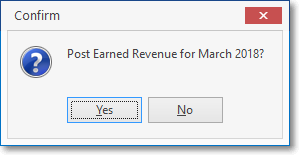

•Periodically, a Post Earned Revenue procedure will be executed.

✓During this Post Earned Revenue procedure:

▪The proportioned Earned Revenue Amount for each Detail Line Item is Posted (added) to the Detail Line Item's internal Earned Revenue field's balance.

▪The Invoice Header of any Invoice with a Recurring Revenue Sale (i.e., containing one or more Detail Line Item(s) assigned one of these Recurring Revenue Sale-Purchase Items) will also have the currently calculated Earned Revenue Amount Posted (added) to its internal Earned Amount field.

▪So, the Invoice Header will contain (internally) the updated Total of all of the Revenue that was Earned on that Invoice.

•When Earned and Deferred Revenues are being tracked in the General Ledger System:

1.The Gross Amount (including Sales Tax, if charged) of each Recurring Revenue Sale is Debited (added) to the Accounts Receivable Asset Account (a Mandatory Account).

2.The Net Amount (not including any Sales Tax) is Credited (added) to the associated Deferred Revenue Liability Account

3.If Sales Tax was charged, the Amount of that sales tax is Credited (added) to the appropriate Sales Tax Payable Liability Account (i.e., Local, National, or both, as needed).

4.Then, once each month, the Post Earned Revenue dialog is used to calculate the Earned Recurring Revenue for a selected Accounting Period. Where for each detail line item

a.The Deferred Revenue Liability Account is Debited (reduced) by the Value of the Recurring Revenue that was Earned during the Accounting Period

b.The (Revenue) Sales Account assigned to the Recurring Revenue Item is Credited (increased) by the Value of the Recurring Revenue that was Earned during the Accounting Period

c.The Current Earnings Equity Account (a Mandatory Account) is Credited (increased) by the Value of the Recurring Revenue that was Earned during the Accounting Period

d.The Earnings Posting Expense Account (a Mandatory Account) is Debited (increased) by the Value of the Recurring Revenue that was Earned during the Accounting Period

✓When you Post Earned Revenue for a negative Recurring Revenue detail line item, it will do exactly the opposite:

a.The Deferred Revenue Liability Account is Credited (increased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period

b.The (Revenue) Sales Account assigned to the Recurring Revenue Item is Debited (decreased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period

c.The Current Earnings Equity Account (a Mandatory Account) is Debited (decreased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period

d.The Earnings Posting Expense Account (a Mandatory Account) is Credited (decreased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period

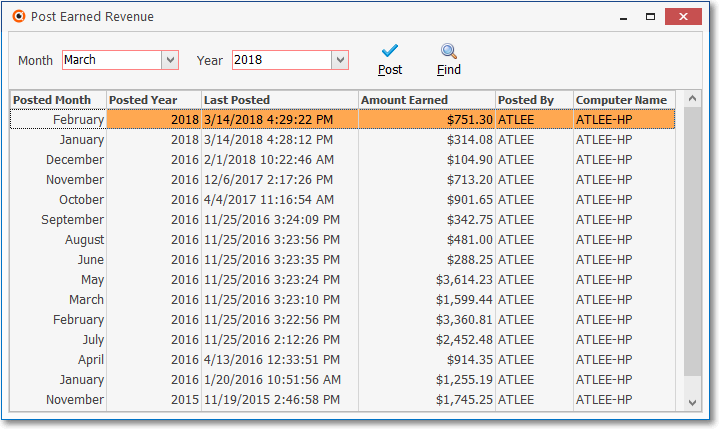

•The Post Earned Revenue table is maintained internally with a summary of the Earned Revenues posted during the execution of each Post Earned Revenue procedure

✓Those previous Posted Earned Revenue records are listed on the Post Earned Revenue dialog

Post Earned Revenue Form

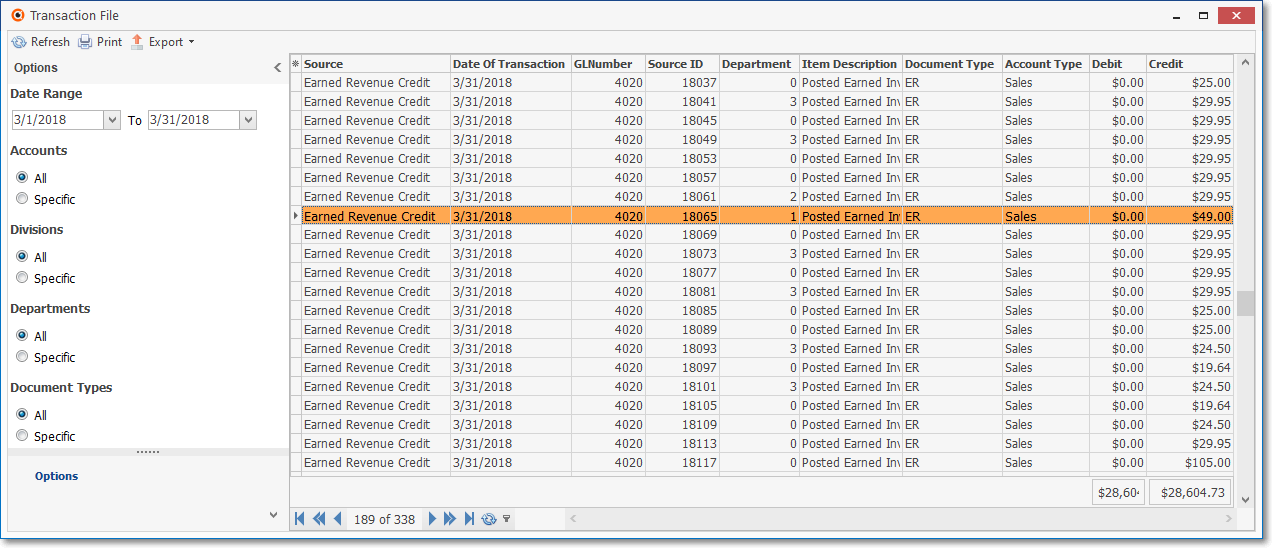

✓These Earned and Deferred Revenue transactions may be viewed in the Transaction File (see below).

•Viewing the Earned Revenue Financial Transactions posted to the Transaction File Form:

Transaction File Form - Posted Earned Revenue Transactions

a)Deferred Revenue is identified as "DR" (Deferred Revenue for the associated Liability Account) in the Document Type column for each of the (Deferred Revenue) Debit entries shown above.

b)Earned Revenue is identified as "ER" (Earned Revenue for the associated Sales Account) in the Document Type column for each of the (Earned Revenue) Credit entries shown above

❖See the Post Earned Revenue chapter for additional information.