❑Welcome to the Summary Page which describes the major New Features added to the Accounts Receivable System within the MKMS STARK Version 5.1.35.XXXX Release.

•This New Features Table contains three columns of data relating to each of these New features:

1.Program Module(s) Affected - This column lists the specific modules that were improved.

2.Chapter Links - This column lists of the link(s) to the chapter(s) where the previous instructions, illustrations and explanations have been revised to reflect the program changes and/or enhancements.

3.Description of the Enhancement - A brief explanation of the new features, functions and enhancements that have been added in this release with links to all of the affected chapters and some related chapters, also.

❑Understanding the New features Chart:

•All of the Program Module(s) that are Affected are listed.

•The Chapter Links are provided for finding the instructions, illustrations, and details on the operation and usage of the new feature(s).

•A brief Description of the Enhancement is shown, sometimes with additional Chapter Links.

Program Module(s) Affected |

Chapter Links |

Description of the Enhancement |

|

|

|

Module |

Forms Affected |

84XX New Features |

|

|

|

MKMS STARK |

Sometimes your Company may need a special report that is not available in MKMS. ▪To accommodate this need, a Reports Icon on the Shortcuts tab provides access to the Reports Module where Custom Reports may be created, Updated, Deleted, Tested, etc.

❖Important Notice - A working knowledge of SQL is required to be able to properly use this Reports Module. |

|

|

|

|

Even after an Invoice has been Paid by Credit Card (see Pay Methods and E-Pay option) and that Payment has been Allocated, Refunds for those Credit Card Payments may now be processed automatically. |

||

|

|

|

This new Suspended Invoicing Clean Up Maintenance dialog provides the ability to remove pending Suspended Invoices which no longer need to be Invoiced from the MKMS system. |

||

Dealer Billing Setup - Click the Billing Icon on the Ribbon Menu of the Dealers Form to display the new Dealer Billing dialog. Each Dealer - for whom your Company's Central Station is providing Contract Monitoring Services - may be Invoiced for those services by implementing Dealer Billing. ▪Dealer Billing functions include: a)Maintains a specific Billing Address for the Invoices sent to the Dealers to pay for their Contract Monitoring Services your Company is providing to that Dealer's Subscribers b)Virtually automatic Invoice creation for billing Contract Monitoring Services provided to the Dealers c)Billing Structure provides Tiered Monitoring Rates d)Administrative Fees and Credit Card processing fees may also be Invoiced |

||

End Fixed Terms - Click on the new End Fixed Term Icon on a Fixed Term Recurring Revenue Form's Ribbon Menu to instantly remove the Payments, Balance, Amount, and Note, set the End Date to Today, and remove the system maintained Last Period/Next Period information, thus terminating this Fixed Term entry |

||

When the MKS Connect Service is enabled, SMS and IVR Interactive Notifications may be utilized. There are two new fields on the Subscriber tab of the Edit View of the Subscribers Form that enable the entry of: a)SMS Notify # - Enter the telephone number that should be used to send a Text Message (SMS) Interactive Notification to this Account b)Voice Number # - Enter the telephone number that should be used to send a Voice Message (IVR) Interactive Notification to this Account |

||

|

|

|

|

|

|

|

|

|

|

|

|

Module |

Forms Affected |

8255 to 8301 New Features |

|

|

|

MKMS STARK |

A Contacts tab that will list the Contact records which have been associated with the currently selected Subscriber has been added to the History Grid at the bottom of the Subscribers Form. |

|

|

|

|

This new Verify Address option will execute an Address Validation process - that will be performed by the United States Postal Service ("USPS") - for the currently selected Subscriber. |

||

There is a new Sales Tax Information box within the Invoice Header section of the Invoice Form which displays the Tax Rate ID, Tax Code, and Tax Rate assigned to the Invoice. |

||

Allow_Change_Tax_For_Invoice - A new feature enabled in Company Settings which allows a User to update the Sales Tax assessed on individual Invoices has been implemented. ▪By default, this new Allow_Change_Tax_For_Invoice option is set to False ("F"). ▪Setting the Allow_Change_Tax_For_Invoice option to True ("T"), lets the new Sales Tax Information box (see item immediately above) within the Invoice Header section of the Invoice Form to become editable (assuming that a Receipt has not been Allocated to that Invoice) |

||

The Subscriber (Prospect, and Vendor) Form's Documents options have a revised where the Add Document dialog only allows for the specific identification of the File Location to be added or a URL and has discontinued the Embedding of the actual Documents within the SQL Database |

||

There is a new Receipt Icon on the Invoice Form ▪Click the Receipt Icon on the Invoice's Ribbon Menu to open the Create Receipt and Allocate dialog in which a payment from the Subscriber may easily be posted and allocated in one step by using this Create Receipt and Allocate Form |

||

A new Transaction Type option with three choices has been added to the Cash Receipts Report i.All - Include all of the Receipts that match the User set Parameters (the default) ii.Auto Draft - Include all of the Receipts that match the User set Parameters and were posted using the Auto Draft process iii.Daily - Include all of the Receipts that match the User set Parameters and were posted using the Fully Automated Recurring Revenue Billing process |

||

In addition to the Search F2 option, the Quick Search and Multi Field Search Search Options are now part of the Subscriber Form's Ribbon Menu |

||

There is a new Auto Draft Accounts Report dialog provides a fully functioning Grid listing: a)All previously defined Payment Methods, or b)Only the previously defined Credit Cards, or c)Only the previously defined Bank Account |

||

When using Subscriber as the Search By option, the Date Received (defaulted to Today), Batch Number (defaulted to the Day number of Today), Method of Payment (defaulted to Check) and Bank Account (defaulted to the Default Bank Account) will be inserted automatically. |

||

The Enter/Edit Credit Card Form has been updated and will provide automatic insertion of certain key field (which may be modified if required) and Credit Card Number validation. |

||

A new Debit Card Check box is now available on the Enter/Edit Credit Card Form. ▪Check this box if the currently displayed Credit Card information actually represents a Debit Card rather than a Credit Card. |

||

The Enter/Edit Bank Account Form has been updated and will provide automatic insertion of certain key field (which may be modified if required) |

||

The E-Pay Form has been updated and will now provide Credit Card Number validation. |

||

The Export option in the Subscriber Statements dialog now offers a "Note to include on statement" option and the allowable length of the Statement's Note field has been increased. |

||

There is a new States Maintenance Form which is populated with all of the current US Sates and Territories, and new records may be added later, if required. ▪It will be used in conjunction with the Credit Card Surcharge feature (see below). ▪The State entries may also used in the Sales Taxes Invoiced and the Sales Tax Breakdown Reports to identify the specific State for which the Sales Taxes were Invoiced and/or Collected. |

||

A Credit Card Surcharge may now be assessed on designated Subscriber Payments that are made using their Credit Card, ▪A Credit Card Surcharge Setup process puts in place your Company's decision to assess a Credit Card Surcharge. ▪Those Surcharges are assessed as a percentage of the Amount being charged on the Credit Card ▪That Surcharge Amount charged to the Subscriber's Credit Card will be in addition to the Amount needed to pay the Balance Due on an Invoice |

||

The Sales Taxes Invoiced report has been enhanced to allow the User to request a report based on which State(s) those Sales Taxes were Invoiced for: 1)By specifying a set of one or more States which have been identified in the Tax Rates Form, or 2)By specifying those Tax Rates records which have NOT been associated with a State (i.e., Unassigned) |

||

The Sales Tax Breakdown report has been enhanced to allow the User to specify which State(s) those Sales Taxes were Invoiced or Collected for: 1)By specifying a set of one or more States which have been identified in the Tax Rates Form, or 2)By specifying those Tax Rates records which have NOT been associated with a State (i.e., Unassigned) |

||

The Accounts Receivable As Of report has a new Print Detail option: ▪When the new Show Detail box Checked a Print Detail option now becomes available as a data grid Option. ▪Click the Print Detail Icon to display the Detail for the selected Accounts Receivable As Of report item. |

||

There is a new Pay Method List (Report) that is a fully functional Data Grid which provides a list of the Payment Methods that have been entered for your Company's Subscribers. ▪This is a multi-purpose report which helps to identify anomalies in data entry, verify data entry, confirm what and from where Payment Methods were entered within a specific Date Range, |

||

|

|

▪When setting the Auto Draft field to Yes in the Receivables section of the Edit View of the Subscribers Form, the system now first confirms that there is at least one Payment Method defined as the default. ▪When setting the Auto Draft field to Yes in the Payment Method Form, the system also confirms that there is at least one Payment Method defined as the default |

|

After reporting all of the Breakdown for Sales Taxes that were Invoiced or Collected, a Summary page will now be presented - based on the User selections made - with: a)Total Invoiced or Collected Sales that were subject to Sales Tax, b)Taxes Invoiced or Collected sub-divided by Taxing Authority and each Authority's individual Sales Tax Rate c)Column with the accumulated Sales Tax totals Invoiced or Collected for each of these Sales Tax Rates d)Total of all Sales Taxes Invoiced or Collected |

||

The Recurring Revenue Breakdown report dialog has been updated to include additional selection (filtering) options. |

||

When a Bank Draft is being defined in the Payment Methods Setup option of the Subscriber Form's Edit View, there is a new "Account Holder" field available. ▪By default, the Subscriber's Name entered in the General Subscriber Information section is inserted as the Account Holder, but this should be modified as required (particularly to remove punctuation marks).

Thereafter, when changing any of these Pay Method related fields a)Draft Type (CardType), b)Account Holder (BankAccountHolder), c)Routing Number (RoutingNumber), d)Account Number (BankAccountNumber), e)Account Number (CardNumber), f)Credit Card Type (CardKind), g)Account Holder's Name (CardHolderName), h)Expiration Date (CardExpiryDate), i)Account Holder's Address (CardHolderAddress), j)Zip/Postal Code (CardHolderZip)

▪The system will display a Confirmation box with three options will be displayed: 1)Yes - Click the "Yes" option to use the new information and to update any pending transactions. 2)No - Click the "No" option to save the changes and the existing payment transactions will be processed with the old (previous) information. 3)Cancel - Click the "Cancel" option to abort the changes.

When the "Yes" option is selected, the new Pay Batch Pending Transactions dialog - data grid - will be displayed. ▪This Pay Batch Pending Transactions dialog will allow the User to modify PENDING payment transactions. ▪If you do not want to modify a PENDING payment transaction, you may (as needed) Delete a selected payment transaction from the data grid and then enter a new E-Payment which would use any revised information. |

||

The Auto Draft field on the Payment Methods Form now has a Drop-Down Selection List to Choose whether ("Yes") or not ("No") this Subscriber will authorize/has authorized the use of a Credit Card or Bank Draft to process Recurring Revenue Invoice Payments via a Payment Gateway) during either the Fully Automated Recurring Billing process, or by using the Post Auto Drafts procedure. ▪This Auto Draft field setting may now be changed (No to Yes, Yes to No) when required. |

||

Checking the Auto Draft box in the Receivables section of the Edit View on the Subscribers Form indicates that this Subscriber will be using the Auto Draft feature as a method of making Payments for their on-going, automatically drafted payments for the Recurring Services being provided by your Company. ▪A new Auto Draft field within the Accounting tab on the Subscriber Form will be Checked automatically. |

||

|

|

|

A new Internal Notes Press (F9) for timestamped entry field has been added to the Proposal Form. ▪This field is used (in addition to the original Comments field) to record "Internal" notes and/or comments, has a new Time Stamp (F9) feature, and will not be printed on the actual Proposal. ▪Unlike the Comments field, it is not Rich Text Editor capable. |

||

The new Run Dealer Billing option on the File Menu is only available when Dealer Billing has been setup within the Dealer Billing dialog on the Dealers Form but the Dealer Billing On option to set to False in Company Settings (DealerBillingON = "F"), ▪By default, once Dealer Billing information has been entered, the billing process can become automatic. a)However, you must first set the Dealer Billing On option to True in Company Settings (DealerBillingON = "T") b)Thereafter, this automatic billing process works in a similar manner to how the Fully Automatic Recurring Revenue Billing process operates. c)If the Dealer Billing On option to set to False in Company Settings (DealerBillingON = "F"), the Dealer Billing must be manually implemented using this Run Dealer Billing option d)You Company's Business Module should determine whether Dealer Billing will be an automatic or manual process. |

||

|

|

|

Module |

Forms Affected |

8254 New Features |

|

|

|

MKMS STARK |

The Contacts Form has been substantially improved with ▪Search On - Additional Search On option which offers many new Search capabilities the selection of which is provided by a Drop-Down Selection List ▪By default, when the Contacts Form is opened from the Receivables tab, all Active Contacts are listed. ▪The number of Contact records displayed in the Contact List's Grid is now User definable.

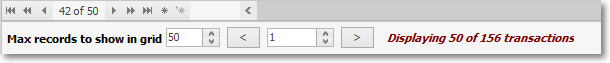

Max records to show in grid - This option - which is located at the bottom of many report Grids is set to 50 by default.

▪Provided for those Companies with a large number of Subscribers ▪This setting allows a User to restrict the number of records - that will be retrieved from the database at one time - to the Maximum number set here. ▪A pair of left and right arrow buttons provides movement from Grid page to Grid page. ▪The number of records (transactions) being displayed, and the total number of applicable records (transactions), is also shown. |

|

MKMS STARK |

The Customer Connect Service ("MKSCustomerConnectSrv.exe") is an application which runs in the background as a Windows® Service ▪This service provides a variety of automated Email responses and/or reminder Tasks to follow up with someone for a designated reason. ▪Types of automated responses which may be defined by your Company are: a)Notify New Prospects and/or Subscribers with a Welcome and/or Thank You Email b)Send a notification reminder for upcoming Service calls c)Remind Subscribers that they have a past due Invoice d)Ask Subscribers with expiring Credit Cards to update their file e)Send an Email when certain Contracts are about to expire f)Survey a Subscriber about a recently Completed Service visit g)Send an acknowledge when a Receipt record has been created |

|

|

|

|

Bill In Advance - By default, the BillInAdvance option is set to False ("F") in the Company Settings Form. ▪Those Companies using the Version 5.1.8254 or later will have the BillInAdvance option set to False ("F") and should not change it!

A new Bill in Advance Check box now permits your Company to individually identify those Billing Cycles which are to be Billed in Advance, and those that are not. ▪When this 5.1.35.8254 Upgrade is initially installed, this field will be populated based on how your Company's Bill In Advance option ("BillInAdvance") was previously set in Company Settings

Auto Billing Notification Email - By default, this new AutoBillingNotificationEmail option in Company Settings is blank. ▪This option stores the Email address of the Employee who is to be notified if (when) the Fully Automated Recurring Billing process has failed. ▪If no AutoBillingNorificationEmail Email address is entered, no Failure Notification will occur.

Email_invoice_notification - By default, the new email_invoice_notification option is set to False ("F"). ▪The emailing of the Invoice notification - using the MKS Connect Service - during the Fully Automated Recurring Billing process is activated in Company Setting by setting the "email_invoice_notification" to True ("T") and the Subscriber must have a valid Email address.

Email_receipt_notification - By default, the new email_receipt_notification option is set to False ("F"). The emailing of the Receipt notification - using the MKS Connect Service - during the Fully Automated Recurring Billing process and/or when using the Receipt Posting dialog is activated in Company Settings by setting the "email_receipt_notification" to True ("T"). ▪To take effect, the Subscriber must have a valid Email address entered prior to the next running the Fully Automated Recurring Billing process, but may manually enter a valid Email address anytime when using the Receipt Posting dialog.

Allow_ |

||

Any E-Payments created from a Work Order, Subscriber and/or an Invoice Form were always listed in the ePay Review report with a Description in the format: "Transaction Type+Subscriber+Invoice #:nnnnnn" regardless of the actual Form from which the transaction originated. ▪Now this Description's format specifically lists the "Work Order #: nnnnnn" or "Invoice #: nnnnnn" or the "Subscriber Name" as appropriate. |

||

A new Bill in Advance Check box now permits your Company to individually identify those Billing Cycles which are to be Billed in Advance, and those that are not. When this 5.1.35.8254 Upgrade is initially installed, this field will be populated based on how your Company's Bill In Advance option ("BillInAdvance") was previously set in Company Settings |

||

The E-Payments Form has been enhanced to include new options: ▪Save Current Method of Payment - If new Credit Card or Bank information was entered and this information should be saved as another Payment Method for this Subscriber, the User may now Click the "Save Current Method of Payment" bar ▪Make this Payment Method the default for Subscriber - If the currently selected (or newly defined) Payment Method should be identified as this Subscribers's Default Payment Method, the User may now Check this box. |

||

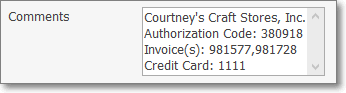

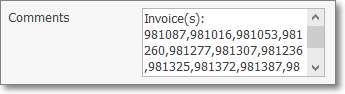

1.If a Receipt was paid by Credit Card, that information including the last four digits of that Credit Card's Account Number will now be inserted into the Comments section.

2.If a Receipt paid for multiple Invoices and those Invoices were selected for payment using the Receipts Form's Open Invoices Drop-Down Selections Check Box List, those Invoice Numbers will now be inserted into the Comments section.

|

||

Email Notification - When the new Email Notification box at the bottom of the Receipt Posting Form is Checked, and an Email address is inserted in the Email field, the system will now create an Email Receipt Notification. ▪For this Email Notification feature to function properly: a.The "email_receipt_notification" option in Company Settings must be set to True ("T"). b.The default Email address is the one entered in the General section within the Edit View of the Subscribers Form c.This default Email address may be changed (or added), as needed.

▪Once the Receipt is Posted, and the conditions above are in place, a This receipt has been queued to be emailed message will be presented. |

||

A new Insert Multiple Equipment Items Company Setting The Insert_Multiple_Equipment_Items option 'is a True/False entry which will determine whether a How Many? Check box will (or will not) appear in several Forms that affect when and how the Subscriber's Installed Equipment table is updated when a Work Order is Completed, a Proposal is Converted to an Invoice, and/or while using the Work Order Invoicing/Review Form. |

||

The Proposal Conversion Information dialog has been updated to include a new Installed Equipment dialog which will only be displayed if the Add Inventory To Installed Equipment? box has been Checked when Converting a Proposal to an Invoice ▪In this new Installed Equipment dialog the User can identify which Proposal Items will be added to the Subscriber's Installed Equipment table using the Qty and optional the How Many? column fields. a.Qty - By default, this Qty (Quantity) represents what was entered on the Proposal, but may be changed if needed. b.How Many? - This column will only be displayed when the Insert_Multiple_Equipment_Items option in Company Settings is set to ("T") True i.Therefore, when the Qty (Quantity) value is greater than One ("1"), Multiple Installed Equipment entries will be created in the Subscriber's Installed Equipment table - based on the How Many? Quantity entered - with each of those Subscriber's Installed Equipment table Quantity entries set to "1". ii.However, when the Insert_Multiple_Equipment_Items option in Company Settings is set to set to ("F") False, this How Many? field is not displayed and only one Installed Equipment entry will be created with the Installed Equipment dialog's Qty (Quantity) inserted into the Quantity field on that one Subscriber's Installed Equipment record. |

||

|

|

|

Module |

Forms Affected |

8253 New Features |

|

|

|

MKMS STARK |

The Advanced Sale Item Look-up dialog available within the Invoices, Proposals, Bills, and Purchase Orders Forms has been enhanced and simplified with the elimination of the Sale Item field in the header, faster operation, and a more powerful Find capability added: ▪Find - Type the characters (numbers) for the Sale-Purchase Item to be located. i.Upper and lower case entries are treated the same (the entry is compared to both). ii.The incremental search will highlight the closest match. ▪Clear - To start a new search, or just to cancel the existing search, Click the Clear option. |

|

MKMS STARK |

The Widget - Quick Search option has been deactivated because the Widgets feature is now loaded from an external application to improve MKMS performance, and as a result, this type of search would no longer work properly. |

|

MKMS STARK |

The new Quick Search dialog (to replace the deactivated Widget - Quick Search option) provides an easy method to Search designated field(s) in Subscriber, Prospect and/or Vendor records - all at the same time - and display a list of each record that matches their Search entry ▪This Quick Search dialog and is accessible two ways: 1)On the Receivables tab in the MKMS Desktop, Select the Search Icon and Choose the Quick Search option. 2)From anywhere within the MKMS Desktop, Press the Ctrl+Alt+Q key combination. |

|

MKMS STARK |

Implemented Spell Checking in most editable comments and notes fields: ▪The system will Spell Check as you type, underlining any misspelled words with a wavy red line. ▪Select (Double-Click) and then Right Click on a misspelled word to view a Drop-Down Suggestion List from which a replacement may be chosen.

Inside of the Rich Text Editor dialog (Double-Click to open in the RTE Memo field), there is now a Spell Check option to check the entire memo. ▪F7 is a hot key for checking inside the Rich Text Editor dialog. |

|

MKMS STARK |

The selected sorting order for a List (which, when changed, becomes the new default sorting order for that List), will also determine how, and which records are displayed (when the User is not in the List mode) as those Record Movement options (e.g., Begin, Next, Previous, Last) are used on the Main Form's Ribbon Menu. |

|

MKMS STARK |

In the Subscriber Search dialog, the system will now show the Limit Record and Search Delay menu options in the Drop-Down Selection Menu for all Users, not just for the Admin User. |

|

MKMS STARK |

A special MKGM.dup file is included in this upgrade to enable the use of Google Maps® without incurring the map views limitation. Google Map® may now initially display either in the "roadmap" (default) view, or in the "satellite" view, as your Company's Central Station and/or Operations Manager prefers. ▪For those who want to use this feature, this feature requires the installation of a new Company Setting which may be accomplished by using the dbisql utility to run this script: INSERT INTO "DBA"."CompanySettings"("Section","SettingName","SettingValue") VALUES('Feature','DefaultMapType','roadmap') ▪To change the default map display to "satellite": update dba.companysettings set settingvalue = 'satellite' where settingname = 'DefaultMapType' |

|

MKMS STARK |

An MKS Validate stand-alone Utility has been created with similar functionality to the Validate Database function within MKMS. |

|

MKMS STARK |

▪The keyboard's Insert (to start a new entry on an Employees Form tab with a Grid format), Delete (to remove an existing entry on an Employees Form tab with a Grid format); plus the Ctrl+S combination (for Save) have been implemented. ▪The Left and Right Arrow Navigation Keys will move the focus from one Employees Form tab to another has been implemented, as has the Ctrl+Insert combination to start a new record on the Employees Form; |

|

MKMS STARK |

A universal Contacts capability has been added to the system. ▪The Ribbon Menu on the MKMS Desktop's Receivables tab contains a new Contacts Icon which opens the Contacts Form ▪The Subscribers Form, Invoice Form, Prospects Form, Proposals Form, Vendor Form, Purchase Orders Form, Bills Form, and Work Order Form all provide a Contacts (Form access) option as well. |

|

MKMS STARK |

Various as Listed |

The keyboard's Insert (to start a new entry), Delete (to remove an existing entry), and the Left-Right-Up-Down-Arrow Keys for Navigating within the Grid or Form; plus the Ctrl+S combination (for Save) are implemented on these Forms: ▪On the Job Costing Form's i.Labor tab ii.Sub-Contract tab iii.Materials tab iv.Expenses tab v.Commissions tab vi.Job Tasks tab vii.Inventory tab's Item List sub-tab ▪General Journal Entry Form ▪Work Order Invoicing/Review dialog |

MKMS STARK |

There is a new Customer Connect History (Grid) which displays the history of the Customer Connect Service's Communication transmissions. ▪It is a Grid with full search, column selection and rearrangement,sorting, filtering, etc., features and also provides Print, Export, and Email capabilities. |

|

MKMS STARK |

A new Salesperson Search field has been added to the Multi-Field Search Form. |

|

|

|

|

To improve the stability of the Accounting Processes as they relate to the use of Sale-Purchase Items, several changes have been made to better enforce internal accounting system rules: Users may no longer change the Item Type of a Sale-Purchase Item which has already been used after the General Ledger System has been activated (see the GL Setup Wizard chapter for more information).

a)If a Sale-Purchase Item is found in any Invoice, Proposal or Work Order and the Sale-Purchase Item is changed to an Item Type of "Purchase", the system will raise the error "You cannot change the "Item Type" to "Purchase" for an item used on Invoices, Proposals or Work Orders." b)If a Sale-Purchase Item is found in any Bill or Purchase Order and the item changed to a type "Sale", the system will raise the error "You cannot change the "Item Type" to "Sale" for an item used on Bills or Purchase Orders."

▪The User would need to create a new Sale-Purchase Item if they wanted to make that change, then make the initial item "Inactive". Why? After a Sale-Purchase Item is in use, should the Item Type is changed, the wrong General Ledger Accounts would be updated when that Sale-Purchase Item is used in a Financial Transaction, thereby forcing the General Ledger System Out of Balance! |

||

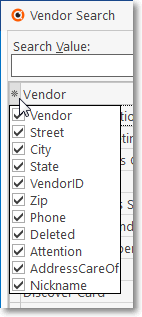

Two new features have been added to the Subscriber F2 Search, Prospect F2 Search and Vendor F2 Search dialogs: ▪Columns - A User may now Select which specific columns are to be listed in these Search dialogs:

Sample - Vendor Search dialog Sample - Field selection options

i.Click the asterisk (¬) at the left of the list's Header row (see the mouse pointer in the illustration above) to display a list of all of the column names - and associated data - which may be displayed. ii.By default, all Column Names will be Checked. iii.Remove the Check mark (Click on the Check to remove it) to hide that column of data from the list.

▪Columns - A User may now Rearrange the left to right sequence in which the Columns are to be displayed: iv.To move a Column left or right of its original location, Drag and Drop that Column to the desired location. v.This relocation may be executed on the Vendor Search dialog itself, or within the Column List described above. |

||

|

|

|

See the New Auto Billing Features chapter for how to implement these new & revised features: 1.InnoEPay Payment Batch / File Generation |

|

3.InnoEPay 7.Payment Batch / File Generation 8.Automatic Billings Setup Wizard 9.Fully Automated Recurring Billing

|

MKMS now provides a Fully Automated Recurring Billing process for each Subscriber who has any Recurring Revenue records defined to be billed and will: ▪Identify who needs to be Invoiced daily ▪Creates the required Invoices ▪Posts any applicable Auto Draft transactions ▪Creates the associated Receipt record(s) oComments - If the Receipt was a Credit Card payment, the last four digits of that Credit Card's Number will be inserted into the Comments section of that Receipt record. ▪Deposits that revenue into the correct Bank Account

An Automatic Billings Setup Wizard is also provided. |

||

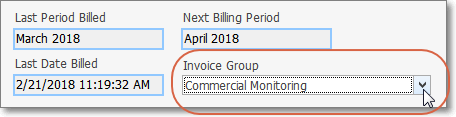

Features Overview of the Fully Automated Recurring Billing process: a)It will run automatically, Generating Recurring Revenue Invoices each morning at 4:00am [this requires that the Automatic Billing Setup Wizard be run to set the “AutoBillingOn” option in Company Setting to True (‘T’)] b)Selects only those Accounts (Subscribers) who have Recurring Revenue billing records with a Billing Cycle Starting Day matching the day number of the current Date ("Today" at 4:00am). c)Recurring Revenue Invoices may be created in advance of the Invoice's Sale Date [this requires the “DayPriorToCylceStart”option in Company Setting be set to the appropriate Value (= the Number of Days to be billed In Advance)] - This requires that the Automatic Billing Setup Wizard be run to set the “DayPriorToCylceStart”option in Company Setting to the appropriate Number of Days. d)The generation of Recurring Revenue Invoices respects the Separate RMR Invoice option to specifically generate a separate Invoice for designated Service Accounts e)Includes any unbilled Suspended Invoicing charges on the Recurring Revenue Invoices f)Generates Late Fees during the Automated Recurring Billing process [this feature requires the “GenerateLateFees” option in Company Setting be set to True (‘T’)] g)Supports the grouping of Detail Line Items on the Recurring Revenue Invoices (this feature requires the definition of Invoicing Groups and the assignment of an Invoice Group to the appropriate Recurring Revenue records) h)Automatically generates and submits these Payment Transactions to the InnoEPay recommended Payment Gateway [which requires that 1) the Company's InnoEPay account - and/or Authorize.net and/or Forte.net) has been setup, 2) the “ePayAPI" option in Company Setting is set to True (‘T’), and 3) the MKSePayService is running]. i)Generates Receipt records for each of the Approved Batch Payment Transactions when acknowledged by InnoEPay. j)Allocates those Receipts to the appropriate Recurring Revenue Invoices k)Generates e-mail notifications for Invoices to customers l)Generates e-mail notification for Receipts to customers |

||

Micro Key is now recommending a new way to Assign Batch Numbers on the Receipts, E-Payments, Receipt Posting, and Post Auto Drafts Forms that will better identify When (what day and month) the Receipt was entered, and will also identify what Type of Receipt was posted (e.g,, Check or Cash, Electronic Funds Transfer [E-Pay], the specific Credit or Debit Card, Other) which will make Bank Deposits and Bank Reconciliation processes much easier. ▪When a Batch Number needs to be entered, follow this process: a)Enter the (one digit) number for the Payment Type of the Receipt being posted (1 - 9 based on your Company's adopted Batch Number Assignment method) b)Append the two-digit Month Number and two-digit Day Number ▪If your Company is using InnoEPay as your Payment Gateway, this Batch Number configuration will be inserted in the E-Payments Form and while Posting Auto Drafts automatically. |

||

There is a new Search Open Invoice Read Only - By default, the SearchOpenInvoiceReadOnly option is set to False ("F") which means, when the Subscriber Search by Invoice Number feature is used, the Invoice - if located - will NOT be opened in Read Only Mode, even if the Invoice is for a Service Only Address record and it has a separate Bill Payer identified. ▪Setting this SearchOpenInvoiceReadOnly option to True ("T") Will open the Invoice in Read Only Mode, but only when that Invoice is for a Service Only Address record with a separate Bill Payer identified. ▪When an Invoice is opened in Read Only Mode, the Navigation Icons are not available. |

||

Special new Sales Tax related Company Settings: a.3 Digits Tax - By default, the 3DigitsTax option is set to False ("F"). ▪When Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this Company Settings that must be re-set to True ("T") to support Charging and Collecting this type of Sales Tax. ▪Therefore, setting this 3DigitsTax option to True ("T") will also activate this Three Decimal Places Sales Tax feature in the Tax Rates Form.

b.Show Tax And Total Per Line Item Report - By default, the ShowTaxAndTotalPerLineItemReport option is set to True ("T"). ▪By always setting this ShowTaxAndTotalPerLineItemReport option to True ("T"), which is recommended, it will automatically support - when required - the Three Decimal Places Sales Tax feature's three (3) Decimal Places Sales Tax format on reports; and will also show the exact Sales Tax being charged on each Detail Line Item on related reports regardless of how many decimal places, are needed. ▪Whether or not Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this Company Settings may be set to add support on Reports for Charging and Collecting this type of Sales Tax (also see "Show Tax And Total Per Line Item Screen" immediately below) . ▪Setting the ShowTaxAndTotalPerLineItemReport option to False ("F") will eliminate Detail Line Item Sales Tax totals from reports.

c.Show Tax And Total Per Line Item Screen - By default, the ShowTaxAndTotalPerLineItemScreen option is set to True ("T") which - regardless of the 3DigitsTax option setting, includes Detail Line Item calculations for Sales Tax Amounts (the Tax Rate and Sales Tax per line item is shown); and also provides a Totals information box with Net, Tax, and Gross Amounts at the bottom of the Invoice. ▪When Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this is one of the three Company Settings that may be set (see "Show Tax And Total Per Line Item Report" immediately above) to add support for Charging and Collecting this type of Sales Tax on Invoices. ▪Setting this ShowTaxAndTotalPerLineItemScreen option to True ("T") which is the default, will also support this Three Decimal Places Sales Tax feature on Invoices thus showing three (3) Decimal Places on all Detail Line Item entries plus net, tax and total columns. ▪However, you may still consider changing the ShowTaxAndTotalPerLineItemScreen option setting to its default of False ("F") when the 3DigitsTax option to True ("T"). oThis False setting will show the Tax Rate on an Invoice's Detail Line Item in two (2) or three (3) Decimal Places, as appropriate, but will not show the extension pricing in two (2) or three (3) Decimal Places to avoid confusion. oIn this case the net, tax and total columns are removed, but a Totals information box with Net, Tax, and Gross Amounts is included at the bottom of the Invoice. ▪See the Sample Results of these Sales Tax related Company Settings Options discussion in the Company Settings for Accounts Receivable chapter for Invoice Detail Line Item illustrations. |

||

The Deferred Revenue Setup procedure has been enhanced with three new options: 1)Select GL Account # - Using the Drop-Down Selection List provided, Choose the Deferred Revenue Liability created for that purpose in the General Ledger Accounts Form. 2)Date To Start Deferred Revenue - Use the Drop-Down Calendar/Date Entry field provided to Choose the desired Date when you want to start tracking your Company's Deferred Revenue 3)Set All - Click this option to assign the selected Deferred Revenue Liability General Ledger Account Number to all Recurring Revenue Sale-Purchase Items ▪Optionally, a GL Number may still be assigned or modified for any listed GL Number - one at a time. |

||

The Batch Number of a Receipt may now be changed, even after it was Deposited, when necessary. ▪Note: See the "Batch Number Assignment" discussion in the Receipts chapter for more information about Batch Numbering. |

||

Added a new Email Notification Icon on the Receipts Form to be used to create an Email to inform the Subscriber that a Receipt record has been entered for their most recent Payment. ▪Requires that the Customer Connect Service is active. |

||

|

|

Previously, once a Check (Receipt) had been Reconciled, it could no long be Bounced (the Bounce option was Grayed Out). In real life, this limitation was not workable. ▪The system will now allow the User to Bounce a Receipt that is Reconciled. |

|

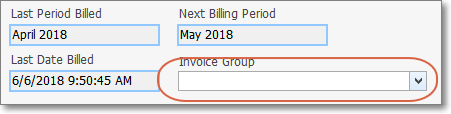

▪A new "Log_Recurring Revenue" table has been created and will be used to record Recurring Revenue record Inserts, Edits and Deletes. ▪There is a new Recurring Revenue (Audit Report) which is displayed in a fully functioning Grid format and contains the data recorded in the new "Log_Recurring Revenue" table described above. The data to be included may or may not be filtered by a Date Range, and reported for All Recurring Revenue records, or only those entries made for a User selected Subscriber. ▪This report has been enhanced with additional system maintained fields for the Last Period Billed , Next Billing Period, and Last Date Billed information. |

||

The new Subscriber Listing (Grid) is a fully function Grid so it allows for sorting, rearrangement of columns, filtering, data export, etc., and provides options to help you discover: a)Potential lost Recurring Revenues b)Members of a specific Division c)Are owned by a specific Dealer d)Create customized lists based on your own specifications. |

||

▪The Recurring Revenue Form has been enhanced with system maintained fields for the Last Period Billed , Next Billing Period, and Last Date Billed information.

▪A new Billing History Grid has been added - accessed with the new Billing History Icon - which displays a Grid List of all Recurring Revenue Billing records that were Invoiced to (and/or subsequently Deleted form) this Subscriber for the selected Recurring Revenue record. |

||

The Subscriber's Ledger Card report has a new Running Balance Format which Lists all Invoices for (Purchases by) the current Subscriber in chronological order based on a User selected Date Range. |

||

When using Subscriber as the Search By option, the Date Received (defaulted to Today), Batch Number (defaulted to the Day number of Today), Method of Payment (defaulted to Check) and Bank Account (defaulted to the Default Bank Account) will be inserted automatically. |

||

|

|

When the MultinationalTax option is set to False ("F") - the default in Company Settings - and the CanadaTax option is set to True ("T") - and a National Sales Tax (or a National and Local Sales Tax) is identified in the Tax tab of the User Options Form: a)The appropriate Provincial Sales Tax Rate Code must be assigned to each Canadian Subscriber, b)On a Detail Line Item of an Invoice the National Tax Code (Ntl) may only be N, E, 1, 2, or 3; and the Local Tax Code (Lcl) may only be Y, N, or E. |

|

|

|

|

For those Companies who use multiple fully automated Payment Gateways (i.e., InnoEPay, Authorize.net, and/or Forte.net) and also use multiple Banks into which Receipts are deposited during the Fully Automated Recurring Revenue Billing process, this Division Level Payment Gateway Default capability allows your Company to Designate the following for all Subscribers assigned to that specified Division: a)The Bank ("Default Bank") into which b)The specified Payment Gateway that will process and deposit ACH ("Bank Payment Gateway") payments c)The specified Payment Gateway that will process and deposit Credit Card ("Card Payment Gateway") payments |

|

|

|

Display Warranty Info - By default, the new DisplayWarrantyInfo option is set to False ("F") which means when a Subscriber record is displayed, their Warranty Status is not included on the Information Bar on that Subscriber Form. ▪When the ShowWarrantyInfo option is set to True ["T"] the Subscriber's Warranty Status is displayed in the Information Bar on that Subscriber Form. |

||

Each Subscriber and/or Vendor may be assigned to a Division. The Divisions Form now allow a Company to identify a Default Warehouse for a Division ▪Thereafter, when Invoices and/or Work Order documents are created for a Subscriber; or Purchase Orders and/or Bills for a Vendor who is assigned to a Division (a Division assignment to a Subscriber or Vendor is optional), any Inventory related Transaction posted to one of those documents will automatically be assigned to that (Subscriber's or Vendor's) default Warehouse but the Warehouse may be changed, when appropriate. |

||

The Ctrl+Insert and Ctrl+S key combinations have been implemented to Insert (Add) a new record and Save a record respectively in the Subscriber Form - Edit View and the Prospect Form - Edit View Forms. |

||

|

|

There is a new UpdatePackagePrices option in Company Settings. To Automatically Update the Sale-Purchase Item's Price in a Proposal Package when an associated Sale-Purchase Item's Retail Price field is modified in the Sale-Purchase Items Form: ▪Set the UpdatePackagePrices option in Company Settings to True ("T") - which is the initial default setting. ▪Setting the UpdatePackagePrices option in Company Settings to False ("F") will turn off that Automatic Price Update feature. |

|

When Taxing Authorities have implemented Sales Tax Percentage Rates with up to three (3) Decimal Places, three Company Settings may (one must) be re-set to support Charging and Collecting this type of Sales Tax. 1)3 Digits Tax - By default, the 3DigitsTax option is set to False ("F"). ▪When Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this Company Settings must be re-set to support Charging and Collecting this three (3) Decimal Places Sales Tax. ▪Setting this 3DigitsTax option to True ("T") will activate this Three Decimal Places Sales Tax feature in the Tax Rates Form.

2)Show Tax And Total Per Line Item Report - By default, the ShowTaxAndTotalPerLineItemReport option is set to False ("F"). ▪When Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this is one of the three Company Settings that may be re-set to add support on Reports for Charging and Collecting this type of Sales Tax. ▪Setting this ShowTaxAndTotalPerLineItemReport option to True ("T") will include a three Decimal Places Sales Tax format on reports. a)Setting this ShowTaxAndTotalPerLineItemReport option to True ("T") will activate this Three Decimal Places Sales Tax feature on certain Reports (listed below) thus showing the Tax Collected/Invoiced in three (3) Decimal Places on all Detail Line Item entries. b)Alternately, consider leaving the ShowTaxAndTotalPerLineItemReport option setting to its default of False ("F") when the 3DigitsTax option has been set to True ("T"). i.To avoid confusion, this False setting will show the Tax Rate in three (3) Decimal Places for each Invoice, but will not show the extended price in three (3) Decimal Places and column Totals are shown rounded to two Decimal Places. ii.In this case a Totals information with rounded Net, Tax, and Gross Amounts are typically included in a Totals section at the bottom of the Report.

3)Show Tax And Total Per Line Item Screen ▪By default, the ShowTaxAndTotalPerLineItemScreen option is set to False ("F") which - regardless of the 3DigitsTax setting, excludes Detail Line Item calculations for Sales Tax Amounts (the Tax % Rate is still shown); but instead provides a Totals information box with Net, Tax, and Gross Amounts at the bottom of the Invoice. ▪When Taxing Authorities have implemented Sales Tax Percentage Rates to three (3) Decimal Places (e.g., nn.nnn%), this is one of the three Company Settings that may be re-set (see "Show Tax And Total Per Line Item Report" immediately above) to add support for Charging and Collecting this three (3) Decimal Places Sales Tax on Invoices. c)Setting this ShowTaxAndTotalPerLineItemScreen option to True ("T") will activate this Three Decimal Places Sales Tax feature on Invoices thus showing three (3) Decimal Places on all Detail Line Item entries plus in each column's Total field. d)Alternately, consider leaving the ShowTaxAndTotalPerLineItemScreen option setting to its default of False ("F") when the 3DigitsTax option has been set to True ("T"). iii.To avoid confusion, this False setting will show the Tax Rate on an Invoice's Detail Line Item in three (3) Decimal Places but will not show the extended price in three (3) Decimal Places and no column Totals are shown. iv.In this case a Totals information box with Net, Tax, and Gross Amounts are included in a Totals information box at the bottom of the Invoice.

Once these two Sales Tax related Company Settings are re-set to True ("T"): e)The Tax Rates Form will allow for a Sales Tax entry with three (3) Decimal Places when identifying a Tax Rate. f)The Receivable section within the Edit View of the Subscribers Form will allow for a Sales Tax entry with three (3) Decimal Places when identifying a Tax Rate. g)The Detail Line Items section on the Invoice Form will allow for a Sales Tax entry with three (3) Decimal Places h)The Printed Invoices will support the resulting Sales Tax charges. i)The Sales Taxes Invoiced report will include this three (3) Decimal Places Sales Tax information j)The Sales Taxes Collected report will include this three (3) Decimal Places Sales Tax information k)The Sales Taxes Breakdown report will include this three (3) Decimal Places Sales Tax information l)The Recurring Revenue Form will display the three (3) Decimal Places when identifying a Tax Rate. m)The Sales Analysis Report (detail) will report the resulting Sales Tax charges. n)The Ledger Card for a Subscriber will will report the resulting Sales Tax charges. o)The Tax Information section within the Edit View of the Prospects Form will allow for a Sales Tax entry with three (3) Decimal Places when identifying a Tax Rate. p)The Detail Line Items section on the Proposal Form will allow for a Sales Tax entry with three (3) Decimal Places q)The Recurring Revenue Items for a Proposal will display three (3) Decimal Places r)The Printed Proposals will report the resulting Sales Tax charges. s)The Vendor Tax Information section in Edit View of the Vendors Form allows for a Sales Tax entry with three (3) Decimal Places t)The Detail Line Items section on the Bills Form supports a three (3) Decimal Places Sales Tax entry.

▪See the Sample Results of these Sales Tax related Company Settings Options discussion in the Company Settings for Accounts Receivable chapter for illustrations. |

||

The CSID field on the main Subscribers Form's Browse View page now has a Drop-Down Selection List to allow a User to view all of the CSIDs that have been defined for that Subscriber. |

||

When Printing Invoices, in some cases, the Comments entered when an Invoice was created where so long, or had rows of extra spaces, that they were generating extra blank pages on the Invoice. ▪These extra long Comments and/or blank lines are now being trimmed, when required. |

||

There is a new Run Auto Draft Days Prior setting: As part of the Fully Automatic Recurring Billing functionality, the associated Auto Draft process is now executed separately, as needed, on or prior to the Due Date of each Invoice which is eligible for that service. ▪The RunAutoDraftDaysPrior option in Company Settings determines when the Bank Draft or Credit Card charge will occur in relation to that Due Date. ▪By default the RunAutoDraftDaysPrior option is set to '1' but may be changed based on your Company's business operating model (see the Billing Cycles chapter for more information). |

||

To avoid a Bank Reconciliation problem, the system will not allow the User to modify the "Deposited On" date of a Receipt which has already been Reconciled. |

||

If either the Date Paid of a Receipt which has been Allocated, or a Date Sold of an Invoice which has been Allocated has subsequently been modified, the system will now update the Allocation Date to be equal to either the Date Paid on the Receipt or the Sale Date of the Invoice, by inserting whichever of those Dates is newer. |

||

This new Deferred Revenue Setup procedure is used to properly initialize the Deferred Recurring Revenue feature in the MKMS Accounts Receivable module and supported by the General Ledger module.

When the Deferred Revenue Setup process is completed, the User must Click the OK button to acknowledge the successful completion of the Deferred Revenue Setup procedure. ▪The Defer Recurring Revenue ("DeferRecurringRevenue") option in Company Settings will be set to True ("T"). ▪As indicated in a new "Complete! - Deferred Revenue tracking is now active." message, the User is now reminded that they must Logout and then Log In again to fully activate the Deferred Revenue process.

Earned & Deferred Revenues are calculated on a Monthly basis. ▪Bill in Advance - This means that the Date Sold recorded on the Invoice is within the month before the Billing Day of the Period Covered for the related Billing Cycle. ▪Starting Day - The Billing Day - which is identified in the Billing Cycle record - is now used to determine when the Recurring Revenue related Services will start being provided (i.e. Earned). ▪Start Date - The Start Date (Month + Billing Day + Year) of the Period Covered being Billed is not always the "First of the Month"

Therefore: a)Whenever the Billing Day is not the "First of the Month" and the Date Sold recorded on the Invoice is in the month before or simply in the same month but Prior to the Billing Day of the Period Covered for the related Billing Cycle: the associated Recurring Revenue will not be "Earned" until the following month, or b)Whenever the Date Sold recorded on the Invoice is in a month Prior to the first month of the Date Range of the Period Covered being billed: the associated Recurring Revenue will not be "Earned" for that month until service for the Period Covered month has been provided. c)Whenever the Date Sold recorded on the Invoice is within (on or after) the Period Covered identified on the Invoice, your Company is not Billing in Advance, nor deferring the first months Revenue, so the first month of the Period Covered is "Earned" in that month. |

||

A new "Panel Description" Search By option has been added to the F2 - Subscriber Search function [and the Search button on the Sub Info (F2) Form within MKMSCS). ▪This new "Panel Description" Search By option is associated with the Description that is defined in the Subscriber Panels section of the Monitoring Information tab within the Edit View of the Subscribers Form. |

||

|

|

|

|

|

The internal General Ledger calculations for Earned & Deferred Revenue have been updated: ▪Earned & Deferred Revenue is now calculated on a Monthly basis rather than on a Daily basis. ▪The Billing Day - which is identified in the Billing Cycle record - is used to determine when the Recurring Revenue will start being Earned. ▪Billing in Advance means that the Date Sold recorded on the Invoice is before the Billing Day of the Period Covered for the related Billing Cycle. ▪Keep in mind that sometimes the Starting Date (Billing Day) of many Periods Covered being Billed may not by the "First of the Month"

Therefore, when the Billing Day is not the "First of the Month" and the Date Sold recorded on the Invoice is before the Billing Day of the Period Covered for the related Billing Cycle, then the associated Recurring Revenue will not be "Earned" until the following month. ▪If the Date Sold recorded on the Invoice is within the Period Covered on the Invoice, your Company is not Billing in Advance. ▪To assure the Earned Revenue is posted for the final Months within all Service Periods that were Billed, it's best to Post Earned Revenue after the normal Date of the last Automatic Billing process (e.g., we suggest the last day of the month). |

|

When you Post Earned Revenue for a negative Recurring Revenue detail line item it will now post these Transaction File entries: a)The Deferred Revenue Liability Account is Credited (increased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period b)The (Revenue) Sales Account assigned to the Recurring Revenue Item is Debited (decreased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period c)The Current Earnings Equity Account (a Mandatory Account) is Debited (decreased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period d)The Earnings Posting Expense Account (a Mandatory Account) is Credited (decreased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period |

||

When the MultinationalTax option is set to False ("F") - the default in Company Settings - and a National Sales Tax (or a National and Local Sales Tax) is identified in the Tax tab of the User Options Form: ▪If a Proposal is being entered with a Recurring Revenue Item, the Natl Tax field is now set to 1 by default, but may be reset to N, E, 1, 2, or 3 as needed. |

||

When inserting a taxable Detail Line Item into a Prospects/Subscriber's Proposal, the Local Tax ("Lcl") column was being populated with "Y". ▪The Local Tax column is now pre-populated with the Tax Code entered for the selected Tax Rate ID for this Subscriber in the Receivables section of the Edit View of the Subscriber Form (or the corresponding Tax Information section is the Prospects Form).

The Activate/Deactivate Edit Mode Icon which was used to toggle the Detail Line Item's Edit Mode interface has been removed from the Proposals Form so In Line Editing is now the only data entry method supported. ▪In doing so, the issue with not being able to modify data while the Edit Text Editor was activated has been resolved. |

||

Several enhancements have been added to the Proposal Form's Header section: ▪Inside Sale - The purpose of this field is to determine if a Proposal was created for an existing, but unassigned Subscriber (the Sales Person would enter their name in the Salesman field and Check this Inside Sale box when creating the Proposal); or a new or existing Prospect (the field will be left unchecked). The Converted Proposals and Proposals (Grid) reports will include the "Inside Sale" field and allow the User to filter that Inside Sale field in those reports' Grids by "True" or "False" ▪Demoed - Check this box when the Proposal has been presented and/or demonstrated to the Prospect. ▪Demoed By - Use the Drop-Down Selection List to Choose the appropriate Salesperson. ▪Active? - This box, by default, will be Checked to indicate that this is an Active Proposal. You may Un-check this box if the Proposal becomes Inactive. •Salesperson - Renamed from Salesman |

||

The Activate/Deactivate Edit Mode Icon which was used to toggle the Detail Line Item's Edit Mode interface has been removed from the Invoice and Proposals Forms so In Line Editing is now the only data entry method supported. ▪In doing so, the issue with not being able to modify data while the Edit Text Editor was activated has also been resolved. |

||

When importing the Detail Line Items for a new Proposal by using an existing Proposal as a Template, if a Detail Line Item in the selected Template is Taxable (e.g., Tax Code is Y, 1, 2, 3) then: a)If the Proposal is for a Subscriber the Tax Code and Tax Rate will be pulled from the Receivables section of the Edit View of the current Subscriber, b)If the Proposal is for a Prospect the Tax Code and Tax Rate will be pulled from the Tax Information section of the current Prospect (as appropriate).

However, If any Detail Line Item in the selected Template is Non Taxable (Tax Code is N or E), the system will use that same Tax Code from the selected Template's Detail Line Item (therefore the Tax Code will be N or E), regardless of the current Subscriber's or Prospect's tax status. |

||

New Icons on Reports using a data grid |

An Email (the data in the Grid) capability, and in some cases a Print Detail and/or Go To Subscriber function has been added to many more reports that present their information in a data grid. When available, these options will appear on the Ribbon Menu at the top of that Report Form as an Icon. Those reports include: |

|

There is a new Proposal Status Form (located in General Maintenance) which is used to create Descriptions representing the current Status (as it relates to a Proposal's Sales Cycle) of any Proposal created for a Prospect or Subscriber. a)One of these Proposal Status Descriptions must be assigned to each Proposal. (initially the system provided Default Proposal Status will be assigned automatically). b)Thereafter: 1)The associated Pipeline Analysis Report will provide a list (among many other things) of the Status of each listed Proposal 2)The associated Proposals (Grid) report will also report the Status of each listed Proposal. 3)The new Proposal Lost Report (see below) which includes the Status that existed immediately prior to when the Proposal was rejected. 4)The Status and Rating Modification report (see Status/Rating Modification Report below) which displays a list (of selected) Proposals which have had a Proposal Status and/or Confidence % Rate change occur (See the "Understanding and Using the Confidence % field" discussion in the Proposals chapter for more information) within a specified Range of Days. c)These reports may be grouped, sorted, and/or filter by one or more the assigned Proposal Status. |

||

There is a new Proposal Lost Reason Form (located in General Maintenance) which is used to identify the various Reasons for why a Proposal would be/has been rejected by a Prospect or Subscriber. a)One of these Proposal Lost Reasons must be assigned to any Proposal which was ultimately rejected. b)Thereafter: 1)The associated Proposal Loss Report will provide a list of those Proposals which were determined to have been lost (i.e., ultimately rejected by a Prospect or Subscriber) and includes - among other information - the Date of, and Reason for each rejection. 2)The associated Proposals (Grid) report will also report the Reason why a Proposal was rejected. 3)The Proposal Lost Report c)These reports may be grouped, sorted, and/or filter by one or more Reasons. |

||

There are 5 new fields which have been added to the Proposal Header on the Proposals Form ▪These fields allow your Company to more effectively track current Status (within the Sales Cycle), its Confidence Percentage Rating, and why a Proposal was Lost, the Lost Date, the Lost Reason. 1."Status" – a Drop-Down Selection List field - the appropriate Proposal Status must be selected.. 2.Confidence % - a numeric field - requires 0 - 100 (%) entered as appropriate â. 3.Proposal Lost - a Check box field - Defaults to False (not checked). 4.Date - a Drop-Down Calendar/Date field - If "Proposal Lost" box is Checked, the Date Lost will be required and will be defaulted to Today. 5.Reason – a Drop-Down Selection List field - If "Proposal Lost" box is Checked, the Proposal Lost Reason will be required. â See the "Understanding and Using the Confidence % field" discussion in the Proposals chapter for more information.

The following reports use some or many of these new entries: |

||

There is a new Proposal Lost Report which displays a fully functional data grid (list) of those Proposals that were determined to have been lost (i.e., ultimately rejected by a Prospect or Subscriber) which includes - among other information - the Date of, and Reason for each rejection, and the Status that existed immediately prior to when the Proposal was rejected. ▪This Proposal Lost Report data may be viewed, sorted, filtered, reconfigured, printed, emailed, and/or exported, as may be required. ▪See the "Understanding and Using the Confidence % field" discussion in the Proposals chapter for more information. |

||

There is a new Proposal Expiration Aging Report - presented as a data grid - which displays an "Aging Grid" showing how many days have passed since the Expiration Date that was assigned to each listed Proposal. ▪This information lets the Sale Team and/or Sales Manager see how "stale" these Proposals have become. |

||

A new Themes capability has been added which allows the User to set their preferred coloration, screen accents (and special occasions) Theme in MKMS and MKMSCS. |

||

|

|

A new Email option is now available on the Subscriber, Prospect, Employee and Vendor Forms; and as part of the Printing an Invoice, and/or Printing a Proposal process. a)Click the Email option to open a pre-populated Email Dialog (e.g., using Outlook©, or another Email protocol) to send an Email to the Email Address associated with that Form b)When an Email of an Invoice, or Proposal is sent, the appropriate document is attached to that Email as a PDF file. |

|

▪The new Add or Remove Buttons option - accessed by selecting the Down-Arrow at the top of the Subscribers, Prospect, and Vendor Forms - will now allow the User to Customize the content of the new Quick Access Tool Bar on these Forms. |

||

|

|

There is a new Proposal Package Commission in the Company Settings dialog By default the ProposalPackageCommission option is set to False ("F") because most Companies - when converting a Proposal into Installation Order - want to bring Price entered on the Proposal (the default setting) converted to that Work Order, but some Companies will not. ▪When the ProposalPackageCommission option is set to False ("F"), the program will use the Price of each item as it was entered on the Proposal. ▪When the ProposalPackageCommission option is set to True ("T"), the program will use the preset Price of the Proposal Package regardless of the Price entered on the Proposal. |

|

There are situations where a User who has Access Rights to Create, Read, Update, and Audit. but not to Delete a Proposal - but that User may still need to Delete a specific Detail Line Item. This capability has been added using the new option in Company Settings which is the Proposal Override Line Item Delete ("ProposalOverrideLineItemDelete") option in Company Settings. a)When set to False ("F") - which is the default - the normal case exists (i.e., When a User does not have Delete Access Rights for a Proposal, he/she may not delete a Proposal nor any Detail Line Item in that Proposal. b)When set to True ("T") if a User does not have Delete Access Rights for a Proposal, he/she may now delete any Detail Line Item in that Proposal. |

||

▪The system will no longer allow a Proposal containing a line item with a Zero ("0") Quantity to be Converted to an Invoice. ▪When Converting a Proposal to a Job, the system was not populating the Job's Title field. When a Proposal with a Title entered, is converted to a Job, the Title is now properly converted and displayed on that Job Costing Form. |

||

▪Status - A new Status field has been added to the Lead Information section of the Edit View of the Subscribers Form (which, during a conversion of a Prospect to a Subscriber, will also be populated with any corresponding Status field in the Edit View of the Prospects Form). If empty, use the Drop-Down Selection List provided to select appropriate Status of this Subscriber (or any their pending Proposals). ▪This Status field is also used in the new Pipeline Analysis Report |

||

1)The Proposals Form has a new Demoed field which should by Checked when a presentation and/or demonstration was provided to the Prospect and/or Subscriber. 2)The Proposals (Grid) report also lists that new Demoed field when a presentation and/or demonstration was identified on a Proposal to the Prospect and/or Subscriber. 3)The Pipeline Analysis report also lists that new Demoed field when a presentation and/or demonstration was identified on a Proposal to the Prospect and/or Subscriber. |

||

|

Layouts for the Subscribers Form |

This completely redesigned Subscribers Form has a whole new "look" including new Ribbon Style Menu with special Edit View and Search Icons, History Options and Subscriber Options Menus, plus options on the Navigation and Actions sections of its Ribbon Menu; new Accounting, Monitoring and Service information sub-tabs, plus a Layout option (See Layouts below) which allows a User to customize what and where the Subscribers Form data is displayed. ▪Layouts - Among others, Deposits and Average Monthly Recurring Monitoring Revenue option ("Avg Mthly RMR") is now available for the Accounting tab on the Subscribers Form and a new Sort Code field in the Subscriber section. ▪Setting the new SaveSubscriberHistorySetting option to True ("T") in the Company Settings dialog will cause the system to save ("remember") each User's History Options History setting as they prefer it. |

|

All additions, modifications and deletions of Subscriber data is now performed within the Edit tab on the Subscribers Form which has two sub-tabs: 1.Subscriber - This is where General information about the Subscriber is entered, and where specialized data entry sections for the Receivables, Payment Methods, Service, Acquisition and any Custom Defined field data are provided. 2.Monitoring - This is where basic Central Station Data is entered, and specialized sections for Subscriber Panels, Medical and the myriad number of other Monitoring related information fields are provided |

||

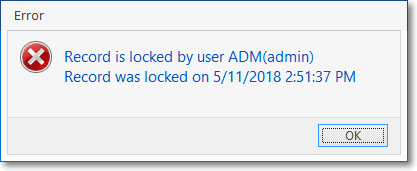

While in the Subscribers Form: Edit View, two Users could modify the same Subscriber record at the same time. Once this issue was identified, it was corrected by implementing record locks when a User has started Editing a record. ▪If a User attempts to modify an existing Subscriber's record while another User has already started doing the same, an error message will now be displayed:

Record is locked by user XYZ (abc)

▪OK - Click OK to continue, and the modification made by the second User will be canceled. ▪Once the first User has completed and Saved their entry, the second User may then proceed with making their changes. |

||

|

|

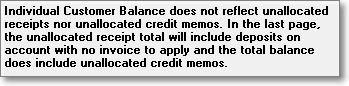

The Receipts Form has been updated, and the process of Posting Receipts has changed. Now, once a Receipt is recorded, it must then be Deposited by entering that Deposited information on this Receipts Form, or by using the Bank Deposits Form. 1.All Receipts must now be classified as either: a)A Customer Deposit (a payment Amount accepted in advance of an anticipated future - as yet unentered - Sale (recorded in the General Ledger as an Advance Deposit Liability Account b)An Amount that will be allocated to reduce (or eliminate) the balance due on an existing Invoice 2.All Receipts are initially recorded as not deposited, and are posted to the Undeposited Funds Asset Account in the General Ledger System (if in use). 3.A Receipt, regardless of whether it is an Advanced Deposit, or will be used to reduce a currently owed Accounts Receivable balance, must be specifically Deposited (See Recording a Deposit below). c)A Receipt may not be Bounced, or Refunded until it has been Deposited. d)A Receipt may not be Applied to an Invoice if it had been identified as a Customer Deposit - that designation must be changed (i.e., the Check removed on the Receipts Form) to be able to Allocate it. e)The new Open Invoices Drop-Down Selection List on the Receipts Form provides a quick and easy will to selectively allocate the current Receipt. to one or more Invoices. ▪The Batch Number of a Receipt may now be changed, even after it was Deposited, when required. ➢Note: See the "Batch Number Assignment" discussion in the Receipts chapter for more information about Batch Numbering. ▪The Posting Receipts Form and that process is essentially unchanged. |

|

There is a new possible (RECONCILED) entry in the Receipt Information section on the right of the Receipts Form which may now include: 1)(BOUNCED) - The Receipt has Bounced. 2)(RECONCILED) - Includes the Bank Statement Date for when the Receipt was Reconciled. 3)(CONVERTED) - The Receipt was Converted from a Customer Deposit to a regular Receipt. 4)Refund Issued - A Refund was Issued for this Receipt. The detail information for that Refund is available by Clicking the Refunds Icon on the Receipts Form. |

||

|

|

Bounced Check records, and the original Receipt record are now reported on the Accounts Receivable Report.as follows: ▪The original Receipt record, and the negative Bounced Check record, will be included in the Accounts Receivable Report only until the report's selected As Of Date is equal to, or after the Date the of (negative) Bounced Check record. ▪If the Receipt record and the negative Bounced Receipt record were dated the same day, neither will be included on the Accounts Receivable Report.

Disabled the Bounce Icon on the Receipt created for a Customer Deposit, if that Customer Deposit has been Reconciled. |

|

Recording a Deposit using the revised Receipts Form ▪Deposited On - If the Receipt being posted was (or will be) Deposited individually: use the Drop-Down Calendar/Date Entry field provided in the Deposited On field to record that Date (the Receipt will be deposited in the Bank identified on the Receipts Form). ▪Deposited - Once recorded as Deposited by entering a Date in the Deposited On field (or by using the Bank Deposits Form), the system will insert a Check in the Deposited box for this Receipt. However, in most cases multiple Receipts will be deposited at the same time and that type of Deposit Transaction will be recorded using the Bank Deposits Form (see below) so in that case the Check in the Deposited field and the Date in the Deposited On field will be inserted by the system automatically.

The new Bank Deposits Form lists all Receipts which have not yet been recorded as Deposited. These un-deposited Receipts are listed by Batch Number, Date recorded, Subscriber, Amount, and the Bank to which the Receipt has been assigned. ▪A Bank Deposit may then be identified based on the User selected (one, several or all) Batch Number(s). |

||

There is a new Deposited Only choice on the Cash Receipts report Options tab. which allows you to see those Receipts that were actually deposited in a Bank within a specific Date Range. |

||

The Cash Receipts Report dialog has been updated with the addition of a Data View tab and an enhanced version of the Windows® Print dialog's Print to File option (available using the Print option on the Preview tab). ▪The User may now create a Spreadsheet ("XLS Data File") by Choosing Print to File, then selecting the Type: of XLS Data File, and indicating Where: that file is to be "written." |

||

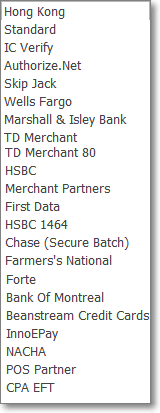

▪The Payment Gateways which are MKMS supported Automatic Payment Processors are: 3.InnoEPay

▪Manual Payment Gateways may be defined as needed

➢Note: Each Payment Gateway may be set up to be : i.the Default Payment Processor for Credit Cards transactions, or ii.the Default Payment Processor for ACH/Check transactions, or iii.the Default Payment Processor for both Credit Card and ACH/Check transactions, or iv.Not the Default Payment Processor for any Credit Card or ACH/Check transactions |

||

|

|

As installed, MKMS will have dozens of Payment Gateways defined, but no Company will use all or even more than a few of those pre-defined Payment Gateways. ▪The new Gateway Kinds Form is used to identify those that will actually be used (i.e., are Active) by your Company, and those that will not (i.e., are Inactive). ▪This new Form is provided to allow you to "hide" those Inactive Payment Gateways from Drop-Down Selection Lists to restrict a Users choices and thereby prevent the accidental selection of an Inactive Payment Gateway. |

|

|

|

There is a new Payment Gateway available named InnoEPay - and because of its advanced functionality, InnoEPay is now the Micro Key Solutions™ recommended Payment Gateway ▪InnoEPay is one of the oldest Payment Gateway providers in the eCommerce industry. ▪InnoEPay integrates seamlessly with MKMS, is secure, simple to use, and has plenty of extra features in addition to its basic Credit Card and Check processing functions. 1.InnoEPay is an automatic, real-time Payment Gateway that is installed on your system (computer) as a Service and so is available whenever it's needed. There are no files to upload or download because all of the payment processing requirements are handled internally by MKMS. 2.The E-Payments dialog - available from the Subscriber and Invoice Forms - now supports the InnoEPay Payment Gateway. 3.The File Type field offers the InnoEPay Payment Gateway on the Post Auto Drafts Form ▪When InnoEPay is adopted as your Company's Payment Gateway, this will be the only Payment Gateway that you'll need. See the "The InnoEPay Setup Process" discussion in the InnoEPay chapter, plus the Auto Draft Setup, Subscriber Payment Methods, ePay Review, E-Payments, and the Post Auto Drafts chapters for additional information. ➢Note: InnoEPay will match any Rates charged by your Company's current Payment Gateway ▪MKMS also supports Authorize.net, and/or Forte.net |

|

Advanced Payment Gateway Authentication Information (when and as required): To accommodate Payment Gateway Payment Transactions originating from both the local system and from the Internet (via Pay Point and/or Tech Pro), there may be two sets of Login Name and Password required. ▪This is why the Payment Gateways maintenance screen now accepts both a Merchant and an Internet Login and Password set.

When a Payment Transaction is created from Pay Point or Tech Pro, the Payment Transaction will now be flagged as it has originated from the "Internet". ▪When a Payment Transaction originated from the Internet, the e-Pay Review report's Internet column will be Checked.

When the e-Pay Service is processing a Payment Transaction from the Internet, it will attempt to use the Internet Login Name and Password. ▪If there is no Internet Login Name and Password defined or it's not accepted, the e-Pay Service will attempt to use Merchant Login Name and Password. |

||

|

|

There is a new ePay Review report - presented as a data grid - which provides a listing with (a selectable set of any or) All of the Reportable Data Elements of the new/revised InnoEPay, Authorize.net, and Forte.net service's transactional responses (see the "InnoEPay Status and Error Codes" chapter for that information) . ▪This ePay Review report's data grid includes Credit Card and Check Payments (Receipts), Transaction Flow, and related Funding Status updates, plus other related information. ▪This data may be Printed as a report, and/or Exported (or Emailed) as an Excel style Spreadsheet (or as a comma delimited file, or a text file).

The ePay Review report (data grid) also: ▪Allows a User to specify which Date Field Type (i.e., Date Created, Due Date, Status Time, Last Status Update, or Last Retry) will be used when retrieving the ePay Review report's data; and to retrieve that data set based on a User specified Date Range. ▪Allows a User to open an Invoice associated with the currently select ePay transaction using the Radial Right-Click Menu

Show Totals - This new option provides a summary of the data retrieved (based on the User selected options) in the form of a Pop-Up dialog.

Max records to show in grid - This option - which is located at the bottom of the ePay Review Grid is set to 50 by default.