Bounced Checks Do Happen!

❑Reversing Allocations because of a Bounced Check (or because a Credit Card was subsequently Declined after an initial approval):

•If a Receipt record must be canceled (because a Check bounced, an entry was made in error, or a previously posted Credit Card payment was declined):

✓Press F-2 Search on the Navigation section of the Subscribers Form to locate the appropriate Subscriber record,

✓Open the Subscriber Options Menu on the Navigation section of the Subscribers Form, Select the Receivables sub-menu, then Choose the Receipts option.

✓Use the List option (see the List Data View information in the Receipts chapter) to Locate and Select the required Receipt record

✓Click the List option again to return to the Record Editing View on the Receipts Form.

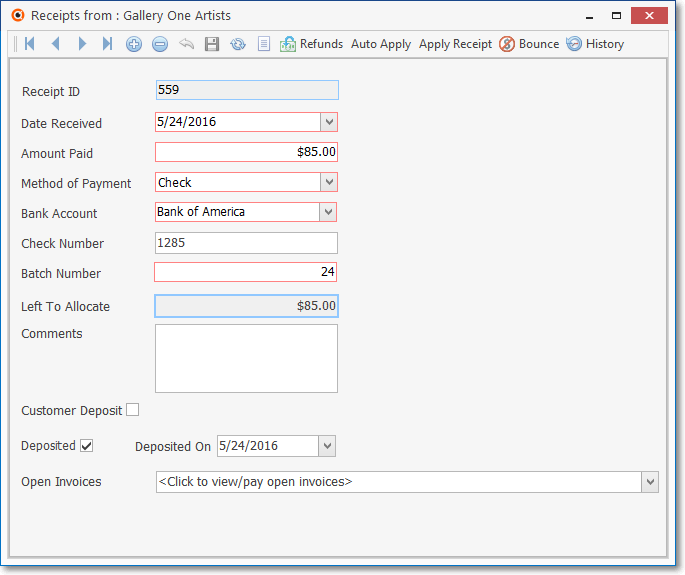

➢Note: A Receipt must be Deposited before it can be Bounced.

Receipts Form - Check in Deposited - Deposited On Date entered

✓Click the Bounce Receipt option located in Actions Menu on the Receipts Form.

![]()

Receipts Form - Ribbon Menu - Bounce Receipt Icon

▪Regardless of whether or not a Receipt has been Allocated, a Receipt cannot be Bounced - the Bounce option will not be available - until that Receipt has been recorded as Deposited in the Bank!

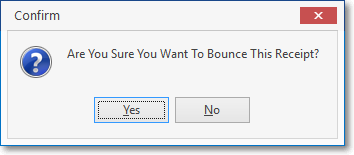

Are You Sure You Want To Bounce This Receipt?

✓Confirm that this is what you wanted to do.

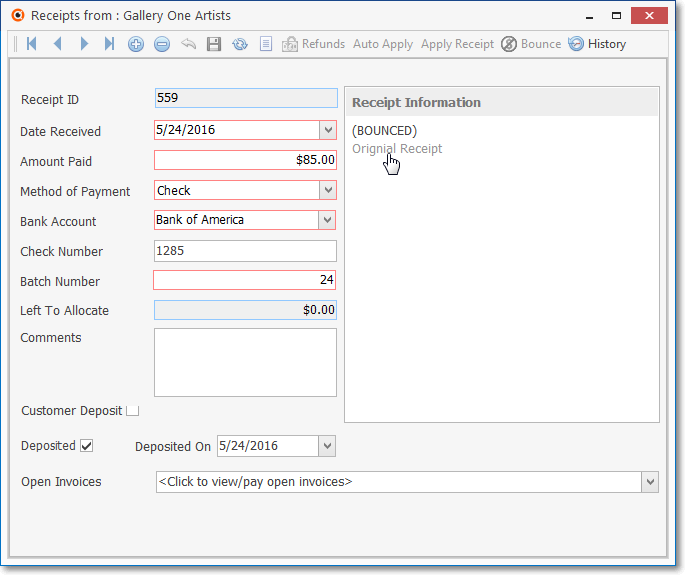

▪Any Invoice(s) that were Paid (or partially Paid) when this Receipt was Allocated to them, will automatically be Unallocated.

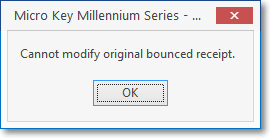

Receipts Form - Receipt Information - (BOUNCED) - Add/Edit Refund, Bounce, Apply, and Auto Apply options are deactivated

▪The original Receipt record will be identified with the Bounce Receipt button deactivated and shown in light gray.

oThe Left To Allocate field's value set to 0.00.

oThe original Receipt record's Receipt Information column will have a (BOUNCED)Original Receipt message inserted.

oThis original Receipt record may not be modified except the Date Received and Deposited On Date can be changed as long as both are on or after the original Bounced Check Date when is was Deposited.

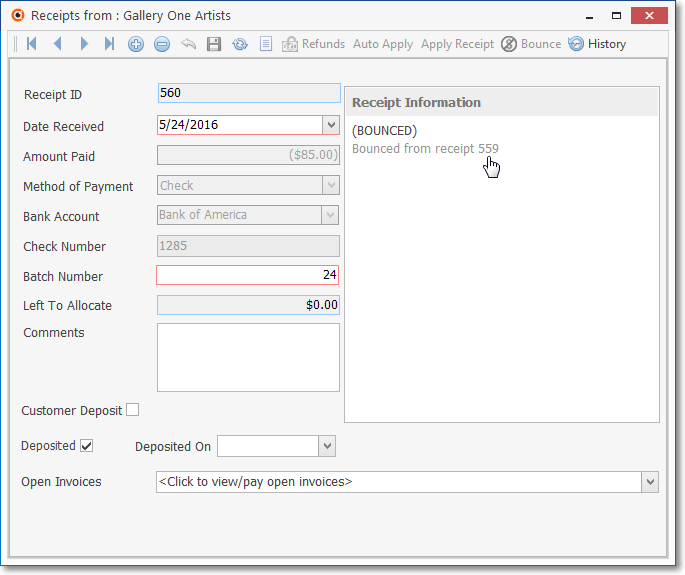

▪A new Receipt record will also be created for the Bounced item with a negative value (negative values are shown within a parenthesis) equal to the Bounced Amount Paid,

▪This Receipt record will also be identified with the Bounce Receipt option deactivated and shown in light gray.

oThis new Receipt record's Receipt Information column will have a:

(BOUNCED)

Bounced from receipt ####

omessage inserted.

Receipts Form - New Bounced Check record with negative balance

Receipt Information - (BOUNCED) Bounced from receipt ####

oFor General Ledger System Users - Keep in mind that a Receipt cannot be Bounced unless it was previously Deposited in your Bank:

a)When the Amount of the Receipt - which was for the payment of one (or more) Invoices - has been recorded as Bounced (i.e., the Customer Deposit box was not Checked), that Bounced Amount will be Debited (added back into) the Accounts Receivable Asset Account and the same Bounced Amount is Credited (subtracted from) the Bank's Asset Account.

oIf that Bounced Amount had been Allocated - and so that Allocation had to be reversed, Unallocating that Receipt will have no effect on the General Ledger.

b)However, when the Amount of the Receipt from a Subscriber - which was identified as a Customer Deposit - has Bounced, it does not affect your Company's Accounts Receivable Account balance, but instead affected the Advanced Deposits Liability Account balance (as well as the Bank's balance).

c)Therefore, when the Customer Deposit box is Checked, that Receipt Amount which has Bounced will be:

i.Debited (subtracted from) the Customer Deposit (Liab) Account, and

ii.Credited (subtracted from) the Bank's Asset Account.

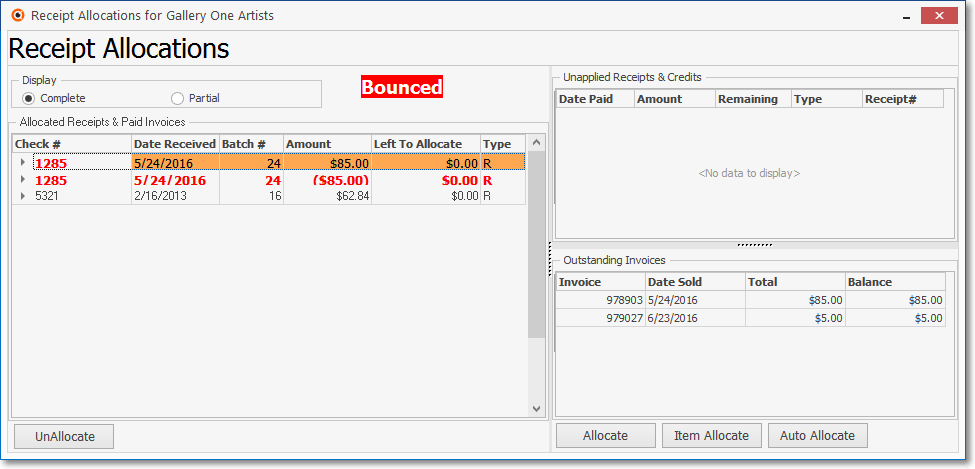

✓When this Receipt is later viewed in the Allocated Receipts & Paid Invoices Display box on the Receipt Allocations Form:

Allocated Receipts & Paid Invoices list with Bounced message displayed when record is selected

▪The original Receipt entry and the Bounced entry will be identified with the word Bounced when either of these records are specifically selected.

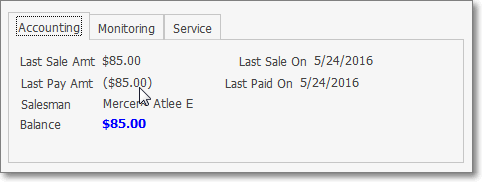

✓The Subscribers Form's Accounting sub-tab will be updated as follows:

▪Balance - The Amount of the Bounced Check will be added to the existing Balance to reflect the loss of those Funds.

▪Last Paid On - This Date will be the Date the Bounced Check was recorded.

▪Last Pay Amount - This Amount will be the negative value of the Bounced Check.