❑Materials - While Job Costing, you will probably have anticipated charges for various Materials for the Job (such as wire, batteries, other electrical supplies, conduit, clamps, etc., which are not actually Inventory Items), which are not itemized on the Proposal but are almost always required on every Job your Company installs.

❖The functionality described below assumes that the Insert_JobMaterial_When_Bill_is_Created option is set to True ("T") in Company Settings.

✓Insert_JobMaterial_When_Bill_is_Created - By default, the Insert_JobMaterial_When_Bill_is_Created option is set to True ("T") so that from within the Materials tab when a Purchase Order is created materials used on a Job, and a Bill is subsequently created for that Purchase Order, a record is automatically inserted in the Materials tab of that Job specifying that tho Materials Expense was accounted for in that Bill.

▪If the Insert_JobMaterial_When_Bill_is_Created option is set to False ("F") no entry will be made in the Materials tab.

▪Instead, the Materials expense must be accounted for by creating a Job Task, and the associated Work Order, then record the Materials used in that Work Order's Inventory/Materials Drop-Down Information box.

▪Please set the Insert_JobMaterial_When_Bill_is_Created option to True ("T")

•To record these miscellaneous costs, locate the Job to which you need to record these Materials costs:

![]()

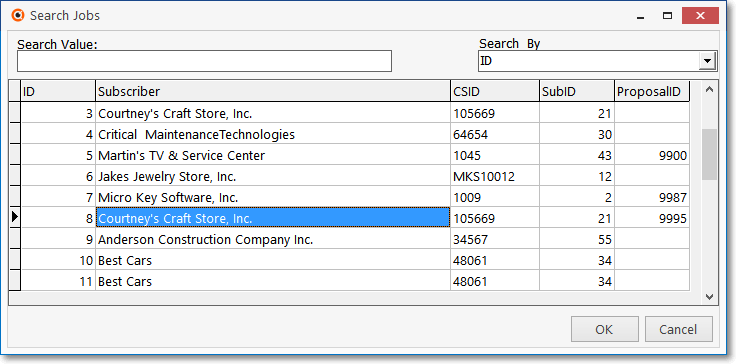

✓Click the Search Icon at the top of the Job Costing Form to open the Search Jobs dialog.

Search Jobs dialog

✓Search By - Use the Drop-Down Selection List to Choose your desired search method.

✓Search Value - Enter the characters that will best locate the desired Job. As you enter information, the record pointer4will be continually relocated based on your entry.

✓OK - Click OK when you have the correct Job ID located.

1.Select the Materials tab on the Job Costing Form first, then

2.Click the New Bill option on the Job Form's Navigation Menu at the top of the Job Costing Form

![]()

Job Costing Form - New Bill Icon - Materials tab

3.Choose the Vendor who will provide the Materials.

4.Enter the Bill for these miscellaneous Material costs (in the Accounts Payable module)

5.Hand Write, or Print a Check.

❑Documenting and Billing Step-by-Step instructions for Material expenses using the Material tab on the Job Costing Form:

•Locate the appropriate Job following the instructions at the beginning of this chapter.

•Click the New Bill option at the top of the Job Costing Form.

✓Using the Select Vendor dialog, locate the appropriate Vendor (the individual or organization to which your Company owes the cost of these Materials)

Select Vendor dialog

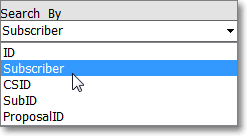

▪Search By - Using the Drop-Down Selection List to Choose the preferred Search method.

oYou may search by the Vendor Name (the default), or the Vendor ID.

▪Search Value - Enter the appropriate Search phrase.

oAs you enter characters, the pointer „ relocates to the most appropriate Vendor record.

▪Once the pointer is at the correct record, to Select that Vendor record, Click OK.

•The Accounts Payable module's Bill Form will be displayed.

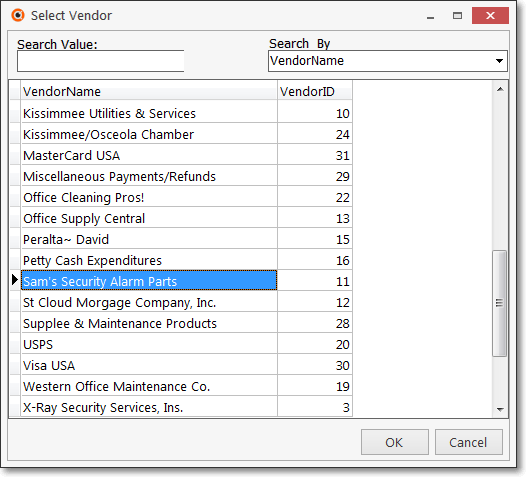

![]() Click the Insert Icon to start a new Bill record in the Bill Form and the appropriate Job Number will be inserted.

Click the Insert Icon to start a new Bill record in the Bill Form and the appropriate Job Number will be inserted.

✓You must enter a Number (i.e., Invoice Number).

▪Hint: If you don't have an actual invoice number from the Vendor as in the case above, follow a regular pattern for creating these Invoice Numbers for Commissions.

▪Example: MAT-23A - This pattern uses an abbreviation for Materials - "MAT-", and then the Job number "23", and a letter - this is the first Materials charge, so we used "A" - so multiple charges can be paid as the Job progresses and additional materials costs are incurred

▪You may also change the Purchase Date and Due Date, if desired.

✓Enter a Detail Line Item for the Materials costs that is to be (or has been) paid.

▪Item - You must use the Drop-Down Selection List to Choose the Sale-Purchase Item you assigned for the Job Cost Category of Materials (using the Item ID of "JOBMAT" as recommended in the Inventory Tracking & Job Costing Set Up chapter).

▪Description - Click to Modify the default Description entered for this Sale-Purchase Item to include the Job Number (shown in the Job ID field above) and any other relevant information.

▪Qty - By default, this should be the number 1.

▪Dept - If using the General Ledger module, use the Drop-Down Selection List to Choose the appropriate Department to be charged for this Expense.

▪Note - You may want to Click the Notes field to enter an explanatory Note or Comment relating to this Expense.

▪Price - Enter the amount of the Expense to be paid.

▪Net - The Quantity times the Price.

▪Sales Tax - This is calculated automatically based on this Vendor's Taxing Information but may be edited when needed.

▪Gross - The Sum of the Quantity times the Price, plus the Sales Tax (if any).

✓Click the ![]() Icon to record this Materials Invoice (Bill).

Icon to record this Materials Invoice (Bill).

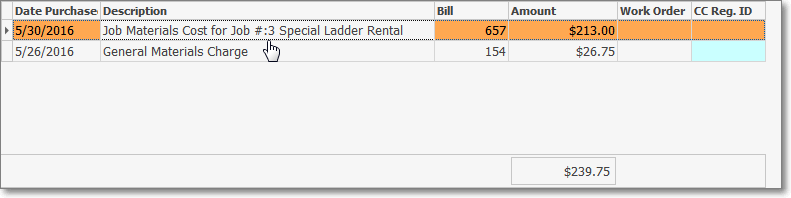

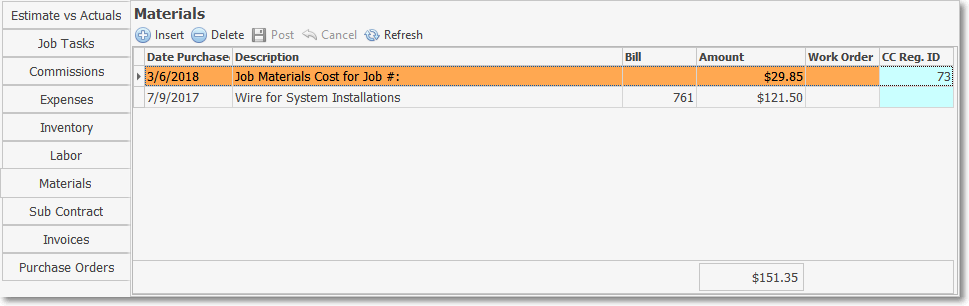

Material cost entry within the Materials Tab of the Job Costing Form

✓The Accounts Payable department will be responsible to Hand Write, or Print the Check(s).

•You will be returned to the Materials tab on the Job Costing Form when you close this Bill Form.

✓The Materials expense entry will be added into the Bill Form

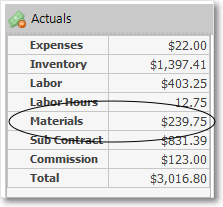

✓The Materials expense Amount will be added to the existing Materials expense Total on the Estimate vs Actual tab.

✓Double-Click any Material line item to view the associated Bill Form.

❑Documenting and Billing Materials expenses through a Work Order:

•A Job Task may be identified, and the completion of that Task may be requested via a Work Order.

✓If there are miscellaneous Materials expenses associated with the completion of that Work Order, those expenses may be identified on that Work Order Form.

✓Materials expenses associated with a Work Order that was generated from a Job Task will be posted to the Materials tab

➢Note: A Material entry may also be added directly in the Materials list, but no Bill or Work Order information (i.e., record Number) can be entered.

•You may view the Estimate vs Actual Tab on the Job Costing Form to view the most current Estimate vs Actual information, regardless of its source (i.e., Bill, Work Order).

Actual expenses - Materials charge

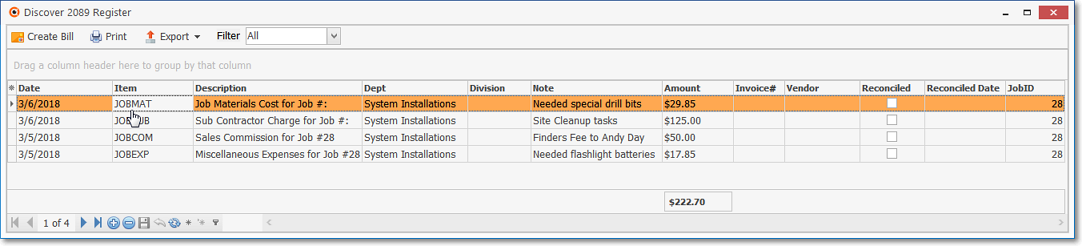

•When a Technician has Emergency and/or unscheduled "in-the-field" Job Material Expenses that are charged to a Company Credit Card, those charges are subsequently recorded in the Credit Card Register Form

✓In the process of doing so, a Job ID Number and a Job Material Expense Item's Purchase Category Code are identified.

✓This Credit Card Register entry automatically inserts a Job Materials Expense record in this Materials tab.

✓This Job Expense record includes:

a)Date - The Date that these Materials was charged.

b)Description - The explanation of the Materials charge.

c)Bill ID - There will be no Bill ID because this is a direct entry, bypassing the New Bill process described above.

d)Amount - The Amount of the Credit Card charge for the Materials.

e)CC Reg. ID - The Credit Card Register record Number for a Job related Credit Card charge is inserted by the system for cross-reference purposes.

✓This Materials Expense entry is also included in (i.e., added to) the Actuals Materials Amount reported in the Estimate vs Actual tab.

➢Note: Also read the Recording an (emergency and/or unscheduled) "in-the-field" Credit Card charge discussion in the Credit Card Register chapter for additional information.

▪Also see the "Creating a Job Costing System entry directly from the General Journal" discussion in the General Journal Entries chapter.