❑A Consistent and Organized approach to the Collection of Past Due Accounts will virtually ensure a much lower rate of Past Due Accounts.

•The best Collections scheme - when performed erratically - is worse than having no Collection scheme.

✓One person, or if a large Company, one Supervisor must be "in charge" of the Collection process and must also be both accountable and rewarded for its success.

•This Four Step Collection method represents a set of practical and effective collection procedures that have a proven record of success, but should also be customized to your Company's needs.

•Most importantly, you must have a Written Plan that can be executed even when the primary Collections person (or Supervisor) is away on leave - and which at a minimum - should include these four Tasks:

I.Contact Past Due Subscribers Regularly

•Three days a week, print an Accounts Receivable Collection Report for Past Due Accounts.

1.On Day 1 print the 1 to 30 days Past Due Report: Contact these Subscribers using a "gentle reminder" approach (e.g., "I noticed that we haven't received your Payment for Invoice #### and we would really appreciate you taking care of that as soon as you can, Thanks!"

2.On Day 2 print for 31 - 60 days Past Due Report: Contact these Subscribers using a "less gentle" approach (e.g., "We haven't received your Payment for Invoice #### and we need you make that Payment. Please tell me when we can expect to received it."

3.On Day 3 print for 61 - 90 days Past Due Report: Contact these Subscribers using a "less gentle" approach (e.g., "We haven not received your Payment as promised - or when expected - for Invoice #### and it must be Paid as soon as possible. Please tell me when we will received it."

✓Then, once each week, review all 90 days + Past Due Accounts to consider whether another call would be appropriate , consider them for submission to an outside collections service.

•Making Collection Calls may not be everyone's favorite past time, but a regular, staged follow up with those Subscribers who have Past Due Invoices is absolutely the most effective method of getting their payments.

✓To make this easier, use the Reminders function coupled with the Calls option to help manage who should be called (and called back) and when that should occur.

✓Confirm any payment promise made by a Subscriber with a follow up letter using the Word Merge feature, and/or if their Email address is available, an e-mailed message.

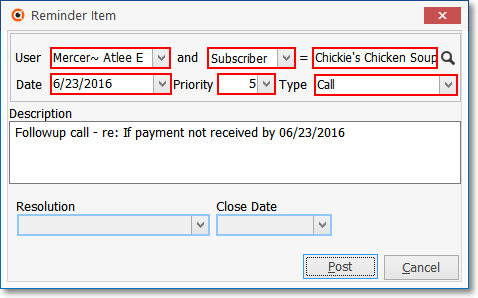

✓Create a new Reminder Item to check and/or follow up the conversation and/or payment promise at the appropriate time (just after the "Promise to Pay-By Date").

✓Always enter clear, concise Collection related notes in the Subscribers Form's Comments field, in the Calls Form's Call Info field, and/or if creating a Word Merge document, in that letter.

II.Design and Execute Specific Collection Procedures

•Service Requests - When a Subscriber calls for service, be sure that they are referred to the Accounts Receivable Department if they have a Past Due Balance (the Service Department will be reminded automatically when they attempt to enter the Work Order).

•Telephone Contacts - There is no more effective Collections process than a personal telephone call from your Accounts Receivable Department to the Past Due Subscriber.

✓Record the Calls.

✓Ask them for their name and if they have received the Invoice - if not - E-mail them a copy immediately.

✓Ask if they have a question about this Invoice or if someone else is required to OK its payment.

✓Ask when you can expect their payment, or a response from the responsible person.

✓Based on the results of this Collection Call, set a Reminder to check if they have made the payment as promised, if you received the expected call back, or to schedule a re-call.

Reminder Item documenting a Collections call follow up

•Collection Letters - The second most effective Collections process is sending a personalized Collection Letter - using the special Word Merge function on the Subscribers Form - to ask that a specific Payment be made on a specific Invoice.

•E-mail Reminders - The third most effective Collections process is E-mailing the Subscriber to ask for a specific Payment on a specific Invoice by attaching a copy of that Invoice to the E-mail using that Email option in the Invoice Printing dialog to create an Email that, when sent, will have the currently selected Invoice attached to it. Alternately,

✓An Invoice may quickly be scanned into a PDF file using almost any all-in-one printer.

✓You may also have a Print to a PDF function enabled within your network printers.

✓In either case, save that PDF file by its Invoice Number.

✓E-mail the Subscriber asking the same series of personal telephone call questions (see "Telephone Contacts" above) and attach the scanned Invoice.

•Late Fee Invoice Generation - Establish a set time each month to Assess Late Charges

✓This process may be done multiple times each month for different Late Fee Groups of Subscribers.

✓Also, see the "Assess Late Charges on Past Due Invoices" information below.

•Mail Account Statements - Establish a set time each month to send Statements to all of the Subscribers who have open (unpaid) Invoices.

III. Assess Late Charges on Past Due Invoices

•For Late Fees to be effective, they must be enforced.

•Generating Late Fee Invoices that are subsequently written off because the Subscriber sends in their payment - eventually - completely undermines the very purpose of assessing Late Fee.

•Subscribers who pay late affect your cash flow, require more staff time, and so erode the net value of your Sales to them.

IV.The Salesperson must contact the Subscriber who has not paid for their Installation (or any other commission related Sale).

•Print an Accounts Receivable Collection Report - by Salesperson - to identify each Past Due Invoice for which they may receive a Commission.

•Then, the Salesperson must call those who have Invoices that have earned, or will earn that Salesperson a Commission.

•Using the Cash Receipts Report, excluding Non-Report Sale-Purchase Items, will provide a list of what has been paid, allowing the Salesperson to request their Commission payment after the Past Due Invoice(s) have been paid.