❑Before using this feature, please review the Understanding Earned and Referred Revenues chapter.

❖For General Ledger System Users - When Earned and Deferred Revenues are being tracked (established by running the Deferred Revenue Setup Wizard)

✓Thereafter, when any Automatic Billing procedure is executed:

a.The Gross Amount (including Sales Tax, if charged) of each Recurring Revenue Sale is Debited (added) to the Accounts Receivable Asset Account (a Mandatory Account)

b.The Net Amount (not including any Sales Tax) is Credited (added) to the associated Deferred Revenue Liability Account

c.When Sales Tax is charged, the Amount of that Sales Tax is Credited (added) to the appropriate Sales Tax Payable Liability Account (i.e., Local, National, or both, as required).

❑The Post Earned Revenue dialog is used to periodically calculate, distribute, and post Earned Revenues to the appropriate General Ledger Account balances, and record them in the Transaction File and Account Register.

•During this Post Earned Revenue procedure:

1.The proportioned Earned Revenue Amount for each Detail Line Item is Posted (added) to the Detail Line Item's EarnedAmount field (an internal system field that is not visible to the User)

2.The Invoice Header of any Invoice with a Recurring Revenue Sale (containing one or more Detail Line Item(s) that were assigned a Recurring Revenue Sale-Purchase Item) will also have the currently calculated Earned Revenue Amount Posted (added) to its EarnedAmount field (an internal system field that is not visible to the User)

✓Therefore, the Invoice Header will contain the most recently updated Total of all of the Earned Revenue for that Invoice.

❖For General Ledger System Users, to better understand Deferred Revenue management, here are some additional reading suggestions:

1.The Understanding Earned & Deferred Revenue chapter for detailed information about Earned and Deferred Revenues.

2.The Automating the calculation of Earned and Deferred Revenue discussion in the Deferred Revenue Setup chapter for additional information.

❖For General Ledger System Users - When Earned and Deferred Revenues are being tracked:

✓Once each month, this Post Earned Revenue dialog is used to calculate the Earned Recurring Revenue for a designated Accounting Period

a.The Deferred Revenue Liability Account is Debited (reduced) by the Value of the Recurring Revenue that was Earned during this Accounting Period

b.The Sales Account assigned to the associated Recurring Revenue Item is Credited (increased) by the Value of the Recurring Revenue that was Earned during this Accounting Period

c.The Current Earnings Equity Account (a Mandatory Account) is Credited (increased) by the Value of the Recurring Revenue that was Earned during this Accounting Period

d.The Earnings Posting Expense Account (a Mandatory Account) is Debited (increased) by the Value of the Recurring Revenue that was Earned during this Accounting Period

❑To Post Earned Revenue,

•Access the Post Earned Revenue Form using either of these two methods:

a)From the Backstage Menu System Select File and Choose the Receivable Menu, then Click the Post Earned Revenue option, or

b)From the Quick Access Menu, Select File and Choose the Receivable Menu, then Click the Post Earned Revenue option.

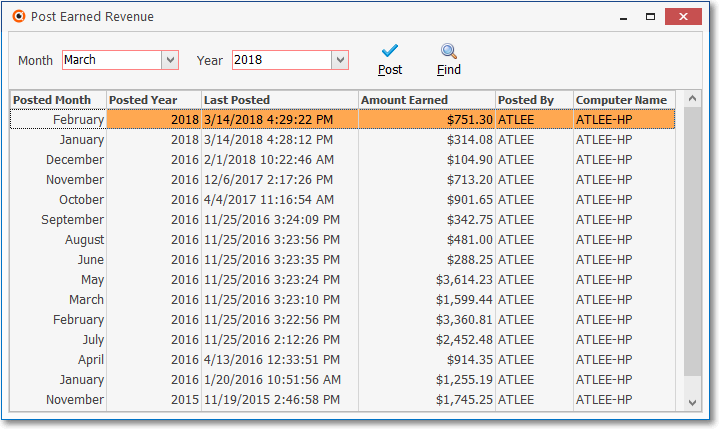

•Any previously Posted Earned Revenue Summary records are listed on the Post Earned Revenue Form.

Post Earned Revenue Form

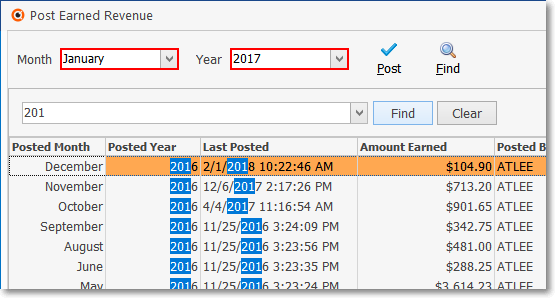

•Find - Click on this ![]() Icon to display the Search text field, and the Find and Clear buttons to view previous Earned Revenue Posting data.

Icon to display the Search text field, and the Find and Clear buttons to view previous Earned Revenue Posting data.

✓Find - Enter text to search for a specific record.

▪Up to 10 previously entered search text is saved for future reference.

✓Clear - To remove the text to search for entry, Click the Clear option.

✓Click on this ![]() Icon again to remove the Search text field, and the Find and Clear buttons.

Icon again to remove the Search text field, and the Find and Clear buttons.

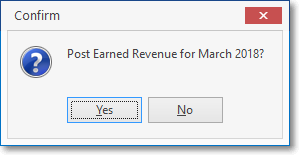

•Post - Click the Post button.

➢Important Note: This Post Earned Revenue procedure must be executed each month after all of the month's Recurring Revenue Sales have been Invoiced (using with the Fully Automated Recurring Billing and/or the Auto Billing procedure).

✓Confirm that this Post Earned Revenue process is to be executed.

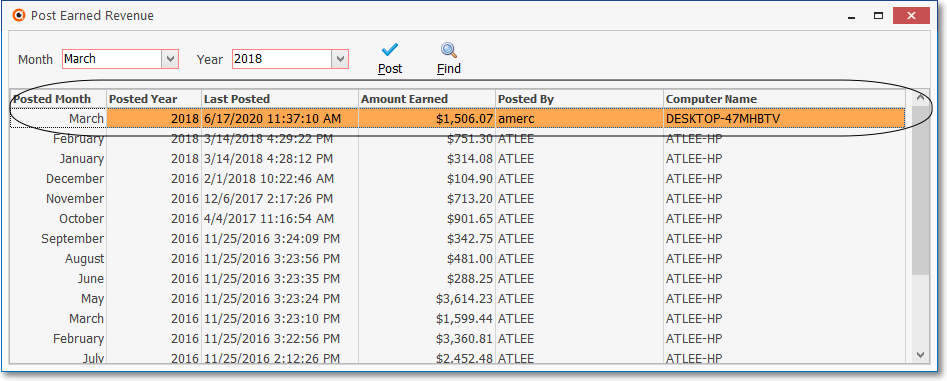

▪The process runs to completion

▪A new Earned Revenue record is inserted in the Post Earned Revenue Form.

•A Posted Earned Revenue table is maintained internally with a summary of the Earned and Deferred Revenues posted during the execution of each Post Earned Revenue procedure.

✓All of the previously Posted Earned Revenue records are listed on the Post Earned Revenue dialog.

•To Exit, Click the Close ![]() box to Close this Post Earned Revenue dialog.

box to Close this Post Earned Revenue dialog.

❑Review - In the General Ledger System:

•When Earned and Deferred Revenues are being tracked in the General Ledger System:

1.The Gross Amount (including Sales Tax, if charged) of each Recurring Revenue Sale is Debited (added) to the Accounts Receivable Asset Account (a Mandatory Account).

2.The Net Amount (not including any Sales Tax) is Credited (added) to the associated Deferred Revenue Liability Account

3.If Sales Tax was charged, the Amount of that sales tax is Credited (added) to the appropriate Sales Tax Payable Liability Account (i.e., Local, National, or both, as needed).

4.Then, once each month, the Post Earned Revenue dialog is used to calculate the Earned Recurring Revenue for a selected Accounting Period. Where for each detail line item

a.The Deferred Revenue Liability Account is Debited (reduced) by the Value of the Recurring Revenue that was Earned during the Accounting Period

b.The (Revenue) Sales Account assigned to the Recurring Revenue Item is Credited (increased) by the Value of the Recurring Revenue that was Earned during the Accounting Period

c.The Current Earnings Equity Account (a Mandatory Account) is Credited (increased) by the Value of the Recurring Revenue that was Earned during the Accounting Period

d.The Earnings Posting Expense Account (a Mandatory Account) is Debited (increased) by the Value of the Recurring Revenue that was Earned during the Accounting Period

•When you Post Earned Revenue for a negative Recurring Revenue detail line item it will do exactly the opposite.

a.The Deferred Revenue Liability Account is Credited (increased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period

b.The (Revenue) Sales Account assigned to the Recurring Revenue Item is Debited (decreased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period

c.The Current Earnings Equity Account (a Mandatory Account) is Debited (decreased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period

d.The Earnings Posting Expense Account (a Mandatory Account) is Credited (decreased) by the Value of the Recurring Revenue that was Un-Earned during the Accounting Period

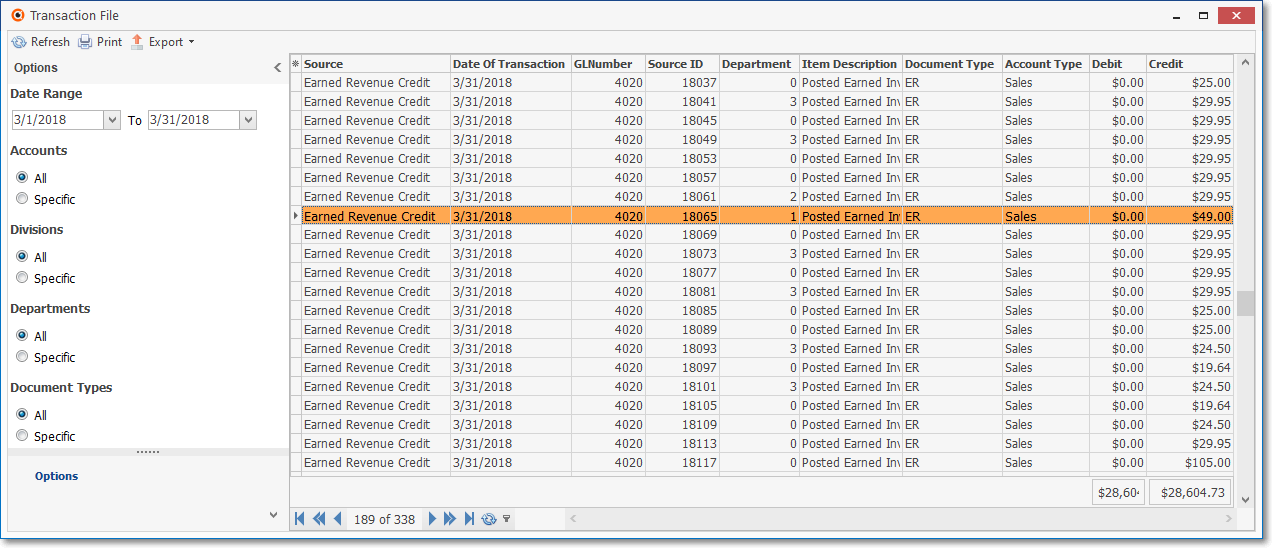

•Viewing the Deferred and Earned Revenue Financial Transactions posted to the Transaction File Form:

Transaction File Form - Post Deferred & earned Revenue Transactions

✓Deferred Revenue is identified as "DR" (Deferred Revenue for the associated Liability Account) in the Document Type column for each of the (Deferred Revenue) Debit entries shown above.

✓Earned Revenue is identified as "ER" (Earned Revenue for the associated Sales Account) in the Document Type column for each of the (Earned Revenue) Credit entries shown above