❑General Ledger Accounts are the fundamental building blocks of this, or any General Ledger System.

•But first, another review:

a)A Balance Sheet will have three Primary Account Division Headings (Sections) which are Assets, Liabilities, and Equity.

▪The Equity (the Value) of a Company is basically the difference between the Company's Assets and its Liabilities.

b)An Income Statement will have two Primary Account Division Headings (Sections) which are Sales and Expenses.

c)All of these report's Headings (Sections) may have additional Secondary Account Division Headings (Sections) - identified by their assigned Account Groups - which are used to more finely explain (characterize) the information being presented.

d)Although a Numbering Range on 1000 to 9999 is recommended, a much more complex numbering scheme may be utilized, if necessary.

▪See the General Ledger Start Up, and the Double Entry Bookkeeping chapters for the recommended (and optional) Numbering Range

•Account Divisions - There are five Primary Types of Accounts (i.e., Account Divisions) to which Financial Transactions may be posted and subsequently, reported.

✓Each Primary Type of Account falls within a Numbering Range that should be based on generally accepted accounting practices.

▪The five Primary Types of Accounts and their recommended Numbering Ranges are listed below:

1.Assets - recommended Account Number range of 1000 - 1999 - includes Actual Cash Assets (like real money in a desk drawer, or the money you have in a bank or money market account); and other Assets (things of value that the Company owns or is entitled to) like monies other people or businesses owe your Company, and your Company's furniture, computers, vehicles or properties.

2.Liabilities - recommended Account Number range of 2000 - 2999 - includes what your Company owes others such as Accounts Payable balances owed to Vendors, Payroll Taxes and Credit Card debt; and Long Term Liabilities for business loans and mortgages.

3.Equity - recommended Account Number range of 3000 - 3999 - includes your Company's Start Up Capital investment and the business's Retained Earnings - which are Profits you have not yet paid out to someone.

4.Revenue - recommended Account Number range of 4000 - 4999 - includes Revenue (Income) from Sales, Interest earned from savings, and any other miscellaneous Income.

5.Expenses - recommended Account Number range of 5000 - 9989 - includes General Expenses, such as rent, utilities, payroll, health insurance, shipping expenses, postage, office, supplies, interest for loans, and taxes, and Sales Related Expenses such as Cost of Goods Sold, Commissions, Advertising, etc.

✓Although a General Ledger Account Numbering scheme (see the "Choosing the Account Numbering scheme" discussion below) may contain up to 8 digits; plus 4 additional digits coming after a decimal point (e.g., 12345678.1234), the list above presents a typical - and our recommended - Account Numbering scheme (the recommended Numbering Range) for each of the five Primary Account Divisions:

✓There are many more Secondary classifications - they are listed in the order they will appear on Reports (Primary is always listed First, then Secondary in the order listed).

▪These Secondary classifications are used, as needed, to more finely classify one of the Primary Financial Transactions:

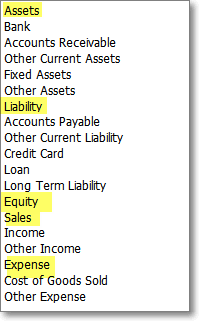

1.Assets: Secondary classifications - Bank, Accounts Receivable, Other Current Assets, Fixed Assets, Other Assets

2.Liabilities: Secondary classifications - Accounts Payable, Other Current Liability, Credit Card, Loan, Long Term Liability

3.Equity: Secondary classifications - None

4.Sales: Secondary classifications - Income, Other Income

5.Expenses: Secondary classifications - Cost of Goods Sold, Other Expense

✓Your Company's Accountant may design a different Numbering Range for the five Primary Types of Accounts (see the "Choosing the Account Numbering scheme" discussion below).

▪However, as long as each General Ledger Account is assigned to a General Ledger Group which properly represents the general type of Account Division being defined (i.e., Assets, Liability, Equity, Sales or Expense), the system will work as expected.

•General Ledger Group IDs - General Ledger Groups ("Groups") are used to identify a General Ledger Account as one of the many Types of Financial Transactions and as a member of a Primary or Secondary Account Division). Additionally, General Ledger Groups set the position in which its associated General Ledger Accounts will be listed within any Financial Statement (see the "Planning for the location of each General Ledger Group" discussion in the General Ledger Groups chapter for more information).

✓Therefore, each General Ledger Account must be assigned to a General Ledger Group, which controls how General Ledger Account will "know" where - within these Primary or Secondary Account Division Headings - each General Ledger Account should appear.

✓The General Ledger Group's Header Description will be presented on these Financial Reports as either an Account Division header, or a General Ledger Group sub-header - with each of these having their own individual sub-total - when certain General Ledger Financial Statements are printed.

✓Assigning a Group ID to each General Ledger Account ensures that:

a)The Account will be included within that General Ledger Group when its Balance is reported.

b)The Value of each assigned General Ledger Account will be included in the Value of the sub-total for that General Ledger Group

c)Those General Ledger Account Values will be included in other Totals on those report, as appropriate.

•Choosing the Account Numbering scheme - The Account Numbering scheme and the Numbering Range for each Primary Account Division that will be used for designing your Company's Chart of Accounts (i.e., General Ledger Accounts):

✓Although a Numbering Range of 1000 to 9999 is recommended, a much more complex numbering scheme may be utilized, if necessary.

▪Up to 9,999,999 main General Ledger Accounts, each with up to 9,999 subordinate Accounts may be created (e.g., 12345678.1234).

▪This power and capacity must be used wisely.

▪The longer and more complex the numbering scheme adopted for defining General Ledger Accounts is, the more complicated the management and reporting becomes for this (or any) General Ledger System.

▪Remember: With Power comes Responsibility

✓So, unless you have a compelling reason to be more complicated and complex when designing your Company's General Ledger Account Numbering Range, stick with the MKMS recommendation (i.e., a Numbering Range of 1000 to 9999).

•Mandatory Accounts - Because the use of the recommended Numbering Ranges is just that - recommended,

✓Your Company may choose to use a more complex numbering system.

✓To ensure that the Financial Statements and Reports are formatted correctly (regardless of the numbering scheme adopted), these rules must be followed:

A.Each General Ledger Account must be assigned to a General Ledger Group

B.That General Ledger Group must be associated with the appropriate Primary Account Division (i.e., Assets, Liability, Equity, Sales or Expense), or one of its Secondary Account Divisions for which that General Ledger Account is being created.

Account Divisions listing

Primary Account Divisions are highlighted in Yellow

C.A Secondary Account Division is automatically - and by definition - a member of its associated Primary Account Division

D.With this in mind, as part of the General Ledger Start Up planning process:

a.Certain specific General Ledger Accounts must exist (be defined in advance) and are identified throughout these Help Files as Mandatory Accounts.

b.Each of these Mandatory Accounts must also be assigned to the appropriate Primary (or Secondary) Account Division via its assignment to the proper General Ledger Group ID - regardless of what Account Number is used to identify the General Ledger Account.

c.In most cases, the required Primary (or Secondary) Account Division assignment is obvious - at least it will be to your Company's Accountant .

d.However, to be sure, the list presented below will clarify, and reinforce the importance of getting it right BEFORE executing the General Ledger Setup Wizard procedure.

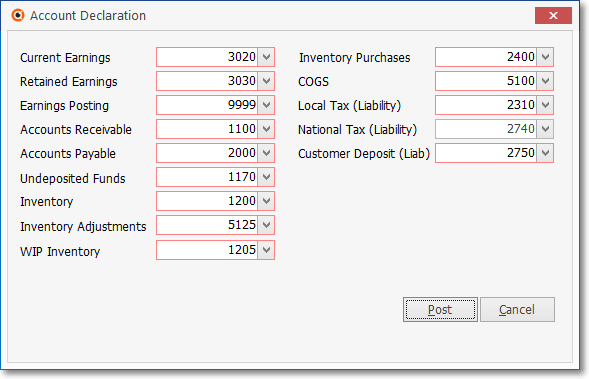

E.The fourteen (sixteen if the collection of Canada Sales Tax is implemented) Mandatory Accounts required by the General Ledger Wizard Setup - each of which must be identified in that Wizard Setup process's Account Declaration Form - are listed below:

The General Ledger Setup Wizard - Mandatory Account Declaration entries

1.Current Earnings - This must be created as the Equity Account for Current Earnings.

2.Retained Earnings - This must be created as the Equity Account for Retained Earnings.

3.Earnings Posting - This must be created as the Special Expense Account for Posting Earnings.

4.Accounts Receivable - This must be created as the Asset Account for Accounts Receivable.

5.Accounts Payable - This must be created as the Liability Account for Accounts Payable.

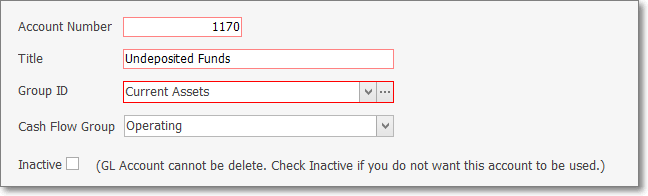

6.Undeposited Funds - This must be created as the Asset Account for Undeposited Receipts

7.Inventory - This must be created as the Asset Account for Inventory.

8.Inventory Adjustments - This must be created as the Expense Account for Inventory Adjustments

9.WIP Inventory - This must be an Asset Account for the Inventory Items that have been identified as part of a Work In Progress.

10.Inventory Purchases - This must be created as the Liability Account for Inventory Purchases

11.COGS (Cost of Goods Sold) - This must be created as the Expense Account for Cost of Goods Sold.

12.Local Tax (Liability) - This must be created - regardless of whether or not you must charge that tax - as the Liability Account for Local Sales Tax Liability.

13.National Tax (Liability) - This must be created - regardless of whether or not you must charge that tax - as the Liability Account for National Sales Tax Liability.

14.Customer Deposit (Liab) - This must be created as the Liability Account for Advance Deposits.

Canadian Sales Tax:

15.(15.) HST/GST (Asset) - Only required when the CanadaTax option is set to True ("T") in the Company Settings list, this field must be the Asset Account designated for HST/GST tax collections.

16.(16.) PST (Expenses) - Only required when the CanadaTax option is set to True ("T") in the Company Settings list, this field must be the Expense Account designated for PST tax charges.

•Also, see Mandatory Accounts chapter for some additional information.

❑Defining a General Ledger Account:

➢Note: This chapter assumes that your Company's Accountant has designed a Chart of Accounts (see the Accounting Terminology chapter for additional information) for your Company, and that you are currently using, or plan to use that set of General Ledger Accounts within this General Ledger System.

•To enter General Ledger Accounts,

e)From the Backstage Menu System Select Maintenance and Choose General and Click the General Maintenance option which displays that Maintenance Menu.

f)From the Quick Access Menu, Select Maintenance and Choose General Maintenance to display that Maintenance Menu.

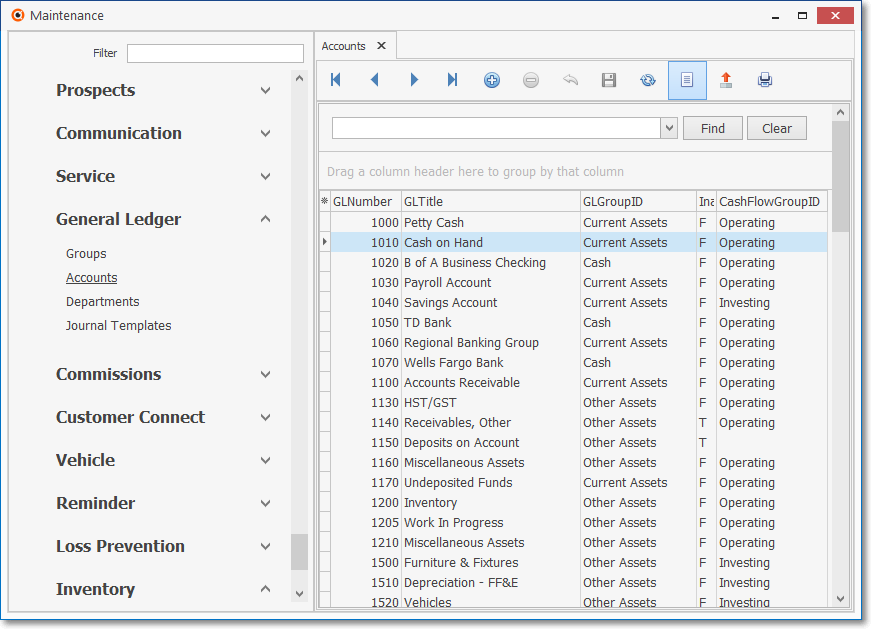

•Once the Maintenance Menu is displayed, Select General Ledger and Choose Accounts.

✓The General Ledger Accounts Form will be displayed.

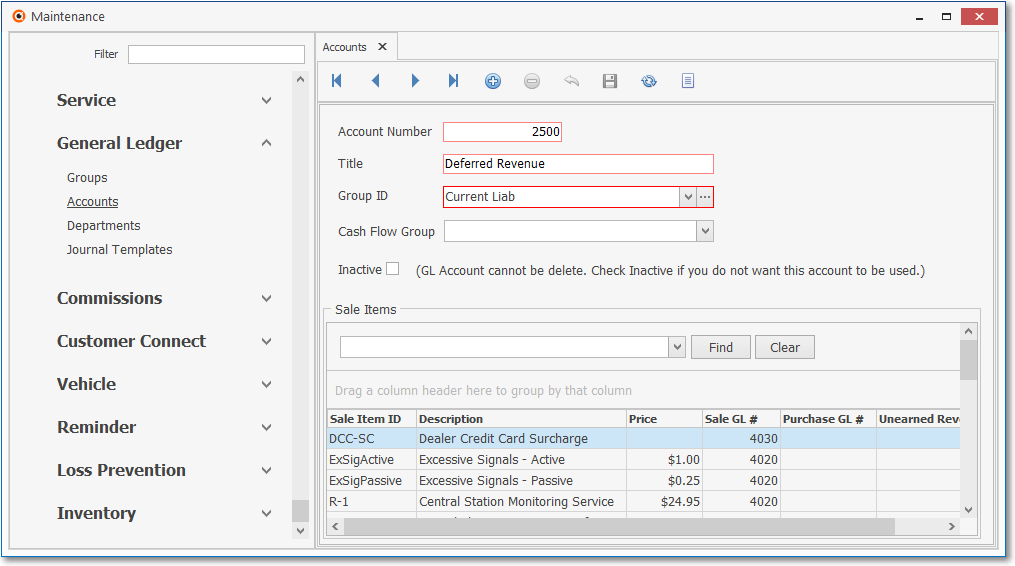

Maintenance - General Ledger - Account Form

✓This General Ledger Accounts Form may be Re-sized by Dragging the Top and/or Bottom up or down, and/or the Right side in or out.

•Navigation Menu - The Navigation Menu is located at the top of the General Ledger Group Form.

✓This Navigation Menu provides the normal Record Movement, plus Add, Delete, Cancel, Save, Search, and Grid options.

•Record Editing section - The details of the currently selected record are displayed below the Navigation Menu at the center (Main Body) of the General Ledger Accounts Form.

General Ledger Account Form - Record Editing section

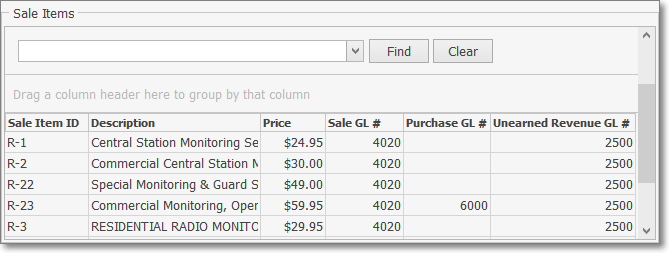

•Sale Items section - Lists each Sale-Purchase Item which has been assigned to the currently selected General Ledger Account

General Ledger Account Form - Sale Items section

•To define a General Ledger Account, Click the ![]() Icon to start the General Ledger Account entry in the Record Editing section.

Icon to start the General Ledger Account entry in the Record Editing section.

➢Note: Although an Account Numbering Range of 1000 to 9999 is recommended (see the General Ledger Start Up, and the Double Entry Bookkeeping chapters for the recommended Numbering Range ), up to 9,999,999 main General Ledger Accounts, each with up to 9,999 subordinate Accounts may be created.

✓Account Number - Enter the Account Number (from 1000 to 9999) for this General Ledger Account.

▪This General Ledger System does not assume that the Numbering Scheme actually being implemented is the same as the one recommended above.

▪See "The five Account Types and their Numbering Ranges" section above for the recommended Numbering Scheme.

▪All internal calculations that are made are based on the User adopted Numbering Scheme, as are the Financial Statements that may subsequently be produced.

✓Title - Enter the Account Title for this General Ledger Account.

▪Although it's best to keep these Titles a brief as possible, up to 50 characters, upper & lower case letters, numbers, basic punctuation, and spaces are permitted.

✓Group ID - All General Ledger Accounts must be grouped with others of a similar type on your Company's Financial Statements and Reports, use the Drop-Down Selection List provided to Choose the appropriate General Ledger Group ID.

✓Cash Flow Group - The Financial Transactions from any General Ledger Account which are to be included in this Cash Flow Statement must be assigned to a Cash Flow Group (i.e., Financing, Investing, Operating).

d)Specific General Ledger Accounts reported on the Balance Sheet (i.e., Asset, Liability, and Equity Accounts) may need to be assigned to a Cash Flow Group.

e)Consult the Cash Flow Group chapter for more information before assigning any Cash Flow Group.

▪Then, only when required, use the Drop-Down Selection List provided to Choose the appropriate Cash Flow Group.

✓Inactive - Check this box if this General Ledger Account is no longer being used.

▪An Account may be identified as Inactive even if it has an Account Balance.

▪An Account should not be identified as Inactive if there are Financial Transaction(s) which have been posted to it within an Open Accounting Period!

▪An Account cannot be identified as Inactive if it is one of the Mandatory Accounts

▪An Account cannot be identified as Inactive if it has been assigned to a Bank or Credit Card.

✓Click the ![]() Icon to record this General Ledger Account entry.

Icon to record this General Ledger Account entry.

![]() List Icon - The Navigation Menu also has a List option which provides a tabular view of these General Ledger Account records.

List Icon - The Navigation Menu also has a List option which provides a tabular view of these General Ledger Account records.

General Ledger Accounts Form - List View

✓Click the List Icon to display the associated Grid Data.

✓The columns of Grid Data may be rearranged, filtered, sorted, and exported as a PDF file and/or an Excel formatted file.

✓Find - Enter text to search for a specific record, then Click the Find option.

✓Clear - To remove the text to search for entry, Click the Clear option

![]()

Navigation Menu shown with the List Options for Export & Print

✓Click the List Icon again to Close the List View and return to the Record Editing View.

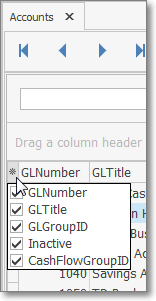

•Columns - You may also Select which columns of data are to be displayed:

Available Columns

✓Click the asterisk (¬) at the left of the data grid's Header row (see the mouse pointer in the illustration above) to display a list of all of the column names - and associated data - which may be displayed.

✓By default, all Column Names will be Checked.

✓Remove the Check mark (Click on the Check to remove it) to hide that column of data from the data grid.

❖See the Grid & Lists - Print Preview - Export Data chapter for complete information on using the List View, including its Export & Print options.

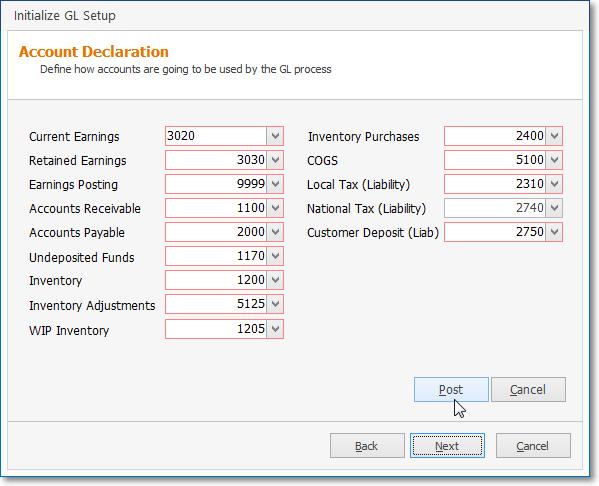

❑Purpose for the Mandatory Accounts - The Account Declaration Form presented while running the General Ledger Setup Wizard process provides the means to identify these required Mandatory General Ledger Accounts.

•Therefore, you must ensure that the General Ledger Account that are created for each of these Mandatory General Ledger Accounts (the numbers shown in the illustration below are representative only), and the associated Titles (titles shown are descriptive of the Mandatory Account's purpose, but your Company's Account Titles do not have be exactly the same), are entered as part of the process of defining all of your Company's General Ledger Accounts.

General Ledger Setup Wizard - Account Declaration

•Mandatory Accounts required for the General Ledger Wizard Setup - specifically in the Account Declaration Form are:

1.Current Earnings - This must be created as the Equity Account for Current Earnings.

2.Retained Earnings - This must be created as the Equity Account for Retained Earnings.

3.Earnings Posting - This must be created as the Special Expense Account for Posting Earnings.

4.Accounts Receivable - This must be created as the Asset Account for Accounts Receivable.

5.Accounts Payable - This must be created as the Liability Account for Accounts Payable.

6.Undeposited Funds - This must be created as the Asset Account for Undeposited Receipts

7.Inventory - This must be created as the Asset Account for Inventory.

8.Inventory Adjustments - This must be created as the Expense Account for Inventory Adjustments

9.WIP Inventory - This must be an Asset Account for the Inventory Items that have been identified as part of a Work In Progress.

10.Inventory Purchases - This must be created as the Liability Account for Inventory Purchases

11.COGS (Cost of Goods Sold) - This must be created as the Expense Account for Cost of Goods Sold.

12.Local Tax (Liability) - This must be created - regardless of whether or not you must charge that tax - as the Liability Account for Local Sales Tax Liability.

13.National Tax (Liability) - This must be created - regardless of whether or not you must charge that tax - as the Liability Account for National Sales Tax Liability.

14.Customer Deposit (Liab) - This must be created as the Liability Account for Advance Deposits.

Canadian Sales Tax:

15.(15.) HST/GST (Asset) - Only required when the CanadaTax option is set to True ("T") in the Company Settings list, this field must be the Asset Account designated for HST/GST tax collections.

16.(16.) PST (Expenses) - Only required when the CanadaTax option is set to True ("T") in the Company Settings list, this field must be the Expense Account designated for PST tax charges.

❖See the Mandatory Account Declarations, the Re-Declare Mandatory Accounts and the General Ledger Wizard Setup chapters for more information about this requirement.