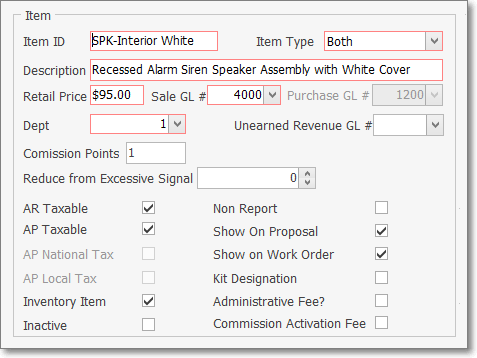

An Overview of the Sales Tax fields in the Sale-Purchase Items Form

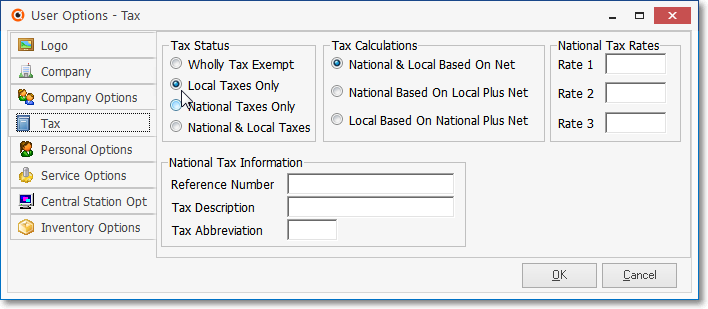

❑User Option - Tax tab - Understanding the Tax tab on the User Options Form.

•Local Tax - If your subject to and/or must charge Local Sales Taxes only, that condition is established in the Tax tab on the User Options Form

User Options Form - Tax tab - Local Only

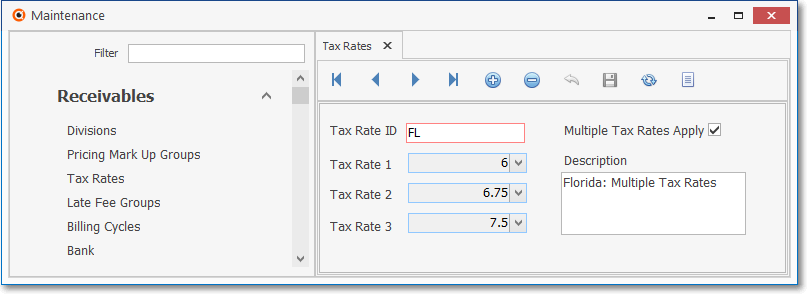

✓Then, any number of Sales Tax Percentage Rates for specific Sales Taxing Authorities may be identified in the Tax Rates Form.

Tax Rates Form - Florida Tax Rates (example)

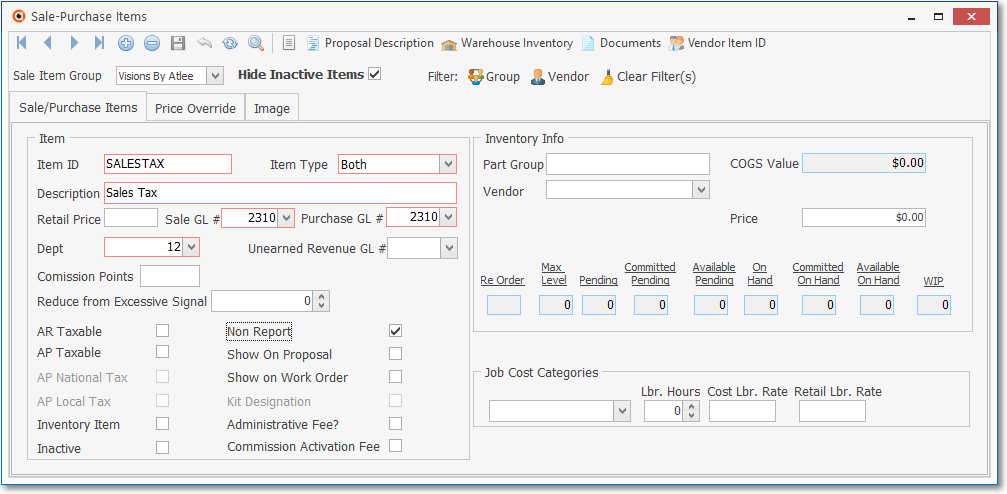

✓Finally, a special "SALESTAX" Sale-Purchase Item record must be created and specifically identified with an Item Type of "Both"

▪This "SALESTAX" Sale-Purchase Item record is used for two purposes:

Sale-Purchase Item - 'SALESTAX'

1.Invoicing of any Sales Tax that was mistakenly not assessed on an Invoice to a Subscriber, and

2.Billing for Sales Tax that was mistakenly not charged on a Bill from a Vendor.

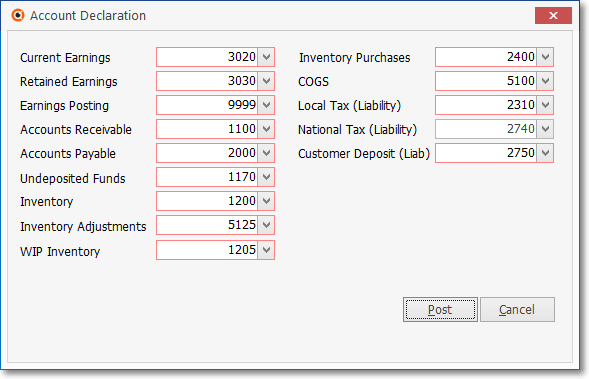

▪For General Ledger System Users:

Sample Account Declaration entries - Local Tax (Liability) Account is 2720 in this example

oThis Sale-Purchase Item record must be assigned the same Local Sales Tax Liability Account - Local Tax (Liability) - previously identified in the Account Declaration Form

oThis Local Tax (Liability) General Ledger Account must be assigned to both the Sale GL# and the Purchase GL# fields.

•However, you can individually control whether Sale-Purchase Items are ever taxable when Sold, and now whether they are ever taxable when Purchased.

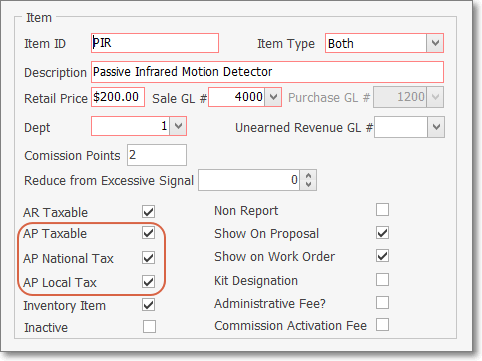

Sale-Purchase Items Form - AR Taxable & AP Taxable fields

a)The AR Taxable field - Check this box if this Item may be subject to a Local Sales Tax when sold.

b)The AP Taxable field - Check this box if this Item may be subject to a Local Sales Tax when purchased.

➢Note: The AP National Tax and AP Local Tax Check Boxes are inactive unless the Canada Sales Tax system is activated (see the "Canada (Local and/or National) Tax" discussion immediately below).

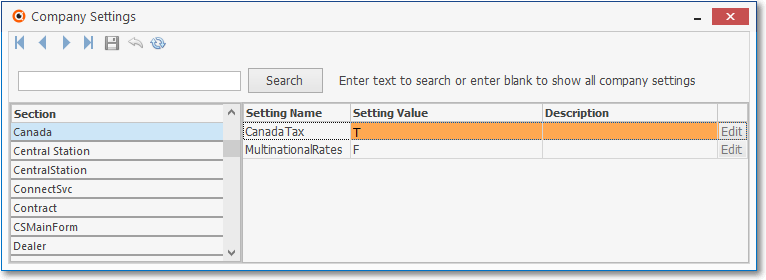

❑Canada (Local and/or National) Tax - There is a CanadaTax option in the Company Settings dialog available from within the Company tab of the Users Options Form

❖We strongly recommend that you read the Canada Sales Tax chapter for more detailed information!

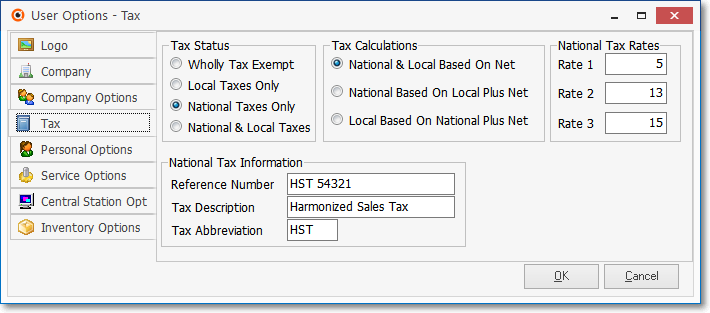

•National Taxes Only - This button is selected on the Tax tab on the User Options Form when only a National Sales Tax is charged.

User Options Form - Tax tab - National Taxes Only

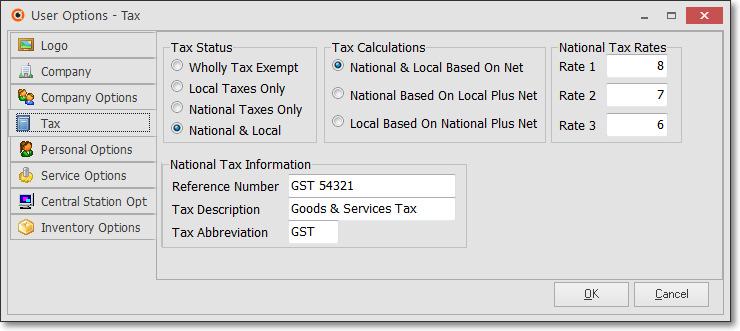

•National & Local Tax - This button is selected on the Tax tab on the User Options Form when a National and Local Sales Tax is charged..

User Options Form - Tax tab - National & Local

•Canada Tax - Setting the CanadaTax option to True ("T") in the Company Settings Form will Turn On the Canadian Sales Tax tracking system capabilities.

User Options Form - Company tab - Company Settings - Canada Tax option

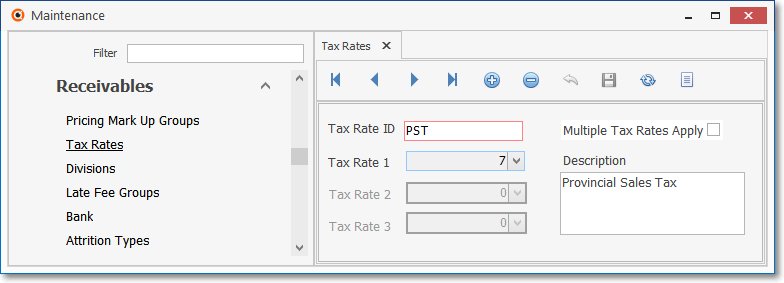

✓Define the Canada PST Tax Rate records as needed, which will then be assigned (in the Receivables section of the Edit View on the Subscribers Form) to those Subscribers who are subject to a Provisional Sales Tax (PST).

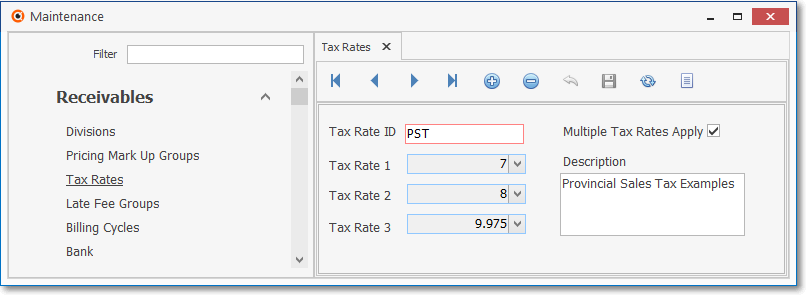

General Maintenance Menu - Receivables sub-menu - Tax Rates Form - Canada example

•When the Canadian Sales Tax tracking system is activated, there are two additional Check boxes available on the Sale-Purchase Item Form

✓Canadian Taxation - Special Check box rules for those Companies who must charge Canada Sales Tax on Bills:

Sale-Purchase Item Form - Canada Sales Tax - Check boxes

a)AP Taxable, - If this item is ever Taxable when Purchased, Check this box.

b)AP National Tax - Regardless of whether it is a GST or an HST Tax that will be charged on this Purchase, Check this box.

c)AP Local Tax - Only Check this box when the National Tax is GST and the Province also assesses a PST Sales Tax (not required if your Company's Purchases are only assessed an HST).

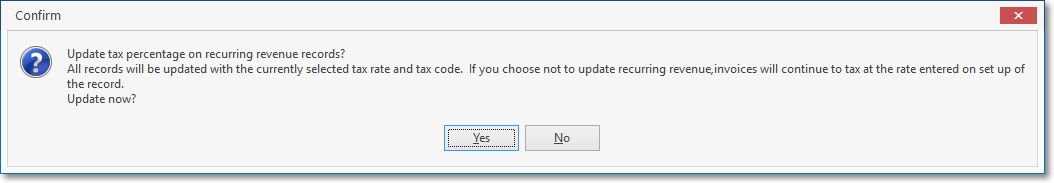

•Update the Receivable section of the Edit View of each affected Subscriber record, as needed.

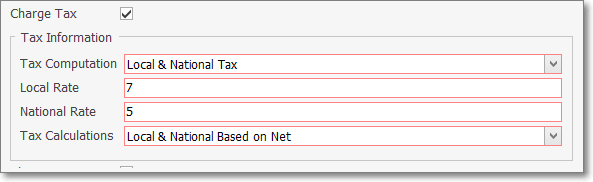

• Then, update each Vendor record within the Tax Information section of the Edit View to include the appropriate Canada Tax Rates

Vendor Form - Edit View - Tax Information section

a)Charge Tax - Check this box when this Vendor is charges any Tax.

b)Tax Computation - Using the Drop-Down Selection List provided, Choose the appropriate option (usually if paying an HST it would be National Tax Only, and if paying a GST it would be Local & National Tax).

c)Local Tax - If paying GST and the Vendor is also subject to a PST, enter that PST Rate here (see the Canada Tax Rate Chart information Canada Sales Tax chapter).

d)National Tax - Whether subject to GST or HST, enter the appropriate Rate here.

e)Tax Calculation - Choose the appropriate Tax Calculation method:

▪National & Local Based on Net - (The default selection) - National & Local Based on Net is selected when Sales Tax is calculated on the Net Amount of all Taxable Items within an Invoice. This is also the choice if there is no National Sales Tax at all.

▪National Based on Local Plus Net - National Based on Local Plus Net is selected when there is a National and a Local Sales Tax and the National Sales Tax is charged on the Gross Amount of all Items within an Invoice PLUS the amount of the Local Sales Tax which has been calculated on the Net Amount of the Invoice's Taxable Items.

▪Local Based on National Plus Net - Local Based on National Plus Net is selected when a National Sales Tax is charged on the Gross Amount of an Invoice and then a Local Sales Tax is calculated based on the sum of the Net Amount of all Taxable Items within an Invoice PLUS the amount of the National Sales Tax being charged.

•You must also define as many PST Tax Rate records as needed, which will then be assigned (in the Receivables section of the Edit View on the Subscribers Form) to those Subscribers who are subject to a Provisional Sales Tax (PST) which corresponds to the Local Tax referred to at the beginning of this chapter.

Tax Rates Form - PST tax entry