❑This General Ledger Procedures chapter (and its associated sub-chapters) is provided as guidance for the Employees who are authorized to Manually use the MKMS General Ledger System module.

•It contains information relating to entering, altering, closing and reporting the Financial Transactions using the General Ledger System.

•This MKMS General Ledger System is quite flexible, allows multiple months to be open at the same time, and even permits re-opening and re-closing previously closed month - just in case additional (adjustment) Financial Transactions were required for that month.

❑There are two types of Financial Transactions that occur within the MKMS General Ledger System - each of which is outlined below, then explained in detail later in this chapter.

1.Automatically Posted Financial Transactions where the User is not required to enter any of the General Ledger Account Numbers for these Financial Transactions as they are posted such as:

a.Sales, Receipts and Allocations from the Accounts Receivable module

b.Purchases, Payments and Allocations from the Accounts Payable module

c.Inventory Usage, Expenses and Adjustments from the Inventory Tracking & Job Costing modules

2.Manually entered or initiated Financial Transactions where the User is required to enter the General Ledger Account Numbers such as:

a.Using the General Journal Form (where the user manually enters a combination of Debit and Credit transactions to record an adjustment), post a Financial Transaction that is not accommodated in the automatic part of the system, accountant directed end-of-month Financial Transactions (for recording Depreciation and other types of periodic entries), or to make start-up entries that establish initial balances within the General Ledger.

b.Using the Payroll Import, or using either the Regulus Import, ItsPayd (The ItsPayd service must be Purchased and Registered to be accessible), or Custom Import options, to insert a series of Financial Transactions (imported in a specifically designated format), and/or to post a batch of Financial Transactions from an outside service (these are also imported in a specifically designated format).

❑Automatically Posted Financial Transactions create at least two, but sometimes more, Debit and Credit entries.

•Examples of the General Ledger's automatic Financial Transaction postings from within the Accounts Receivable module are:

✓Entering a Sales Invoice - The Invoice is started, a Sale Date (which becomes the Transaction Date), and a system generated Invoice Number (among other information) are inserted in the Invoice's header record.

❖As Detail Line Items are added to identify what is being sold:

a)The Amount (the result of the per unit Price times the Quantity that is Invoiced for each item) is posted as a Credit (added) to the Sales Category Code's assigned General Ledger Account Number, along with the Invoice's Transaction Date and Invoice Number for reference.

b)Because there must always be at least two entries recorded for each Financial Transaction, the other part of this transaction posts the same Amount as a Debit (addition to) the Accounts Receivable Account (identified as a Mandatory Account when the General Ledger Setup Wizard procedure was executed).

c)The Gross Value of this line item is posted to Current Earnings as a Credit entry, and to Earnings Posting as a Debit entry - both of these are also Mandatory Accounts.

d)Inventory Sales are posted somewhat differently (see the "Transaction Example" discussion in the Double Entry Bookkeeping chapter and the "When any Inventory Item is directly Sold" discussion in the Tracking Inventory Values & Quantities as Assets, Liabilities, Sales & Expenses chapter for that information).

❖But, if this Invoice is actually being created as a Credit Memo (the Quantity will be a minus value), the Amount posted will be a minus value as well, and so - technically speaking - the Sales Account, which is by definition a Credit Account, will be Debited instead (because when you are subtracting from a Credit Account, the phrase used for reducing a Credit Account is "Debiting a Credit Account"); and therefore the Accounts Receivable Account will be Credited (reduced). The other entries as outlined above will also be reversed.

✓Receipts related Financial Transactions: When a Receipt is initially posted, it is recorded as Undeposited Funds in an Asset Account.

▪Undeposited Funds - This is the Asset Account that stores the Amount of your Company's Undeposited Receipts.

oReceipts - Unless the Receipt has been designated as a Customer Deposit (see the "Customer Deposit (Liab)" discussion below), when a Receipt from a Subscriber is entered, the Amount is initially Debited (added) to the Undeposited Funds Account; and then Credited (subtracted) from the Accounts Receivable Account which represents the other half of that Financial Transaction .

oA Receipt record may be Edited and/or Deleted until it is actually Deposited into a Bank (see the "Bank Deposit" discussion below).

oWhen the Receipt is Deposited into a Bank, the "Deposit" Amount is Credited (subtracted) from the Undeposited Funds Account, and Debited (added) to the selected Bank Account which has a General Ledger Account assigned to it (a Debit Account).

▪Customer Deposit (Liab) - This is the Liability Account that stores your Company's Advance Deposits balance.

oCustomer Deposit - When you accept a Receipt from a Subscriber that is meant to be a Deposit paid in Advance for an expected - but not yet started - future Sale, an Invoice does not yet exist.

oSo, when a Subscriber pays a Salesperson a Deposit for future work, that Deposit is a Liability (you owe them something for that deposit - typically an installation - but you have not yet completed it, nor have you actually invoiced them for it).

1)When the Amount of the Receipt from a Subscriber is an Advance Deposit provided in anticipation of a future Sale to that Subscriber: it is not actually affecting your Company's Accounts Receivable Account balance.

2)Therefore, when the Customer Deposit box is Checked on the Receipt Form, that Receipt Amount will be Credited (added) to the Customer Deposit (Liab) Account, and Debited (added) to the Undeposited Funds Account.

oThis Deposit Amount is not available to apply to any Invoice (Sale) until it is converted to an actual Receipt (i.e., Money to be applied to - as a payment for - a specific Invoice (Sale).

oIdentifying a Receipt as a Customer Deposit will also activate the Make Receipt button (see "Make Receipt" below) on the Receipts Form.

oWhen this Receipt (Customer Deposit) is Deposited into a Bank, that Amount is Credited (subtracted) from the Undeposited Funds Account, and Debited (added) to the selected Bank Account which has a General Ledger Account assigned to it (a Debit Account).

✓Make Receipt - At some point - unless Refunded - a Customer Deposit will be converted to an actual Receipt.

▪To do so, Click the Make Receipt button on the Receipts Form and the Amount of the Customer Deposit will be Debited (subtracted) from the Customer Deposit (Liab) Account, and Credited (subtracted) from the Accounts Receivable Account which represents the other half of that Financial Transaction.

▪This step allows the Amount of the Receipt to be Allocated to a designated Invoice (see "Allocating a Receipt" below).

✓Allocating a Receipt - Any Receipt - which is not identified as a Customer Deposit - may be allocated to any Open Invoice(s), all of which will be displayed in the Open Invoices section at the bottom of the Receipts Form and also accessible from the Receipt Allocations Form.

▪No Financial Transaction entries are required in the General Ledger System when a Receipt is allocated to a specified Invoice because the required Financial Transactions have already been, and/or will be posted as needed, when the Receipt is actually Deposited into a Bank).

▪However, to properly identify which Receipts "paid" for what Invoices (on certain reports and the Subscriber's Ledger Card), eventually all Receipts do need to be appropriately Allocated to the correct Invoices.

✓Deleting a Detail Line Item on a Sales Invoice - Many times you will need to remove an item from an existing Invoice.

▪Right-Click on a Detail Line Item and select Delete.

▪By doing so, the system will automatically:

oCredit (subtract the Sales Amount from) the Accounts Receivable Asset Account, and

oDebit (subtract the Sales Amount) from the Sales Account, for the Amount of that Detail Line Item.

✓Post Earned Revenue - The is used to periodically calculate, distribute, and post Deferred and Earned Revenues to the appropriate General Ledger Accounts, the Transaction File and Account Register.

❖Aren't you glad all of this General Ledger posting happens automatically!

•Other Examples of how the General Ledger's automatic Financial Transaction are posted in MKMS are available in these chapters:

a)Understanding Debits & Credits

c)Use of an Purpose for Mandatory Accounts

❑User Generated or Initiated Financial Transactions are those that a User enters manually, or initiates by the execution of a Procedure which creates a batch of Financial Transactions in the General Ledger System.

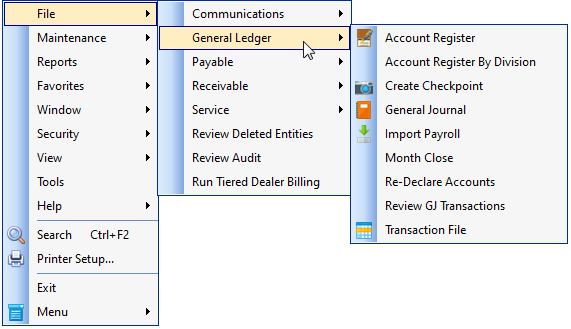

a)From the Backstage Menu System Select File and Choose the General Ledger Menu, then Click the required option, or

b)From the Quick Access Menu, Select File and Choose the General Ledger Menu, then Click the required option.

File Menu General Ledger Options

•File Menu, General Ledger options:

1.Account Register - Provides a very detailed listing of every Debit or Credit entry that was posted to the General Ledger System - based on a specified Date Range, Filter, and/or Search By criteria.

2.Account Register By Division - The Account Register By Division Form also provides a selectable List of every Debit and Credit Financial Transaction that was posted to one User Specified General Ledger Account Number - based on a selected Date Range, various User definable Filters for Source , Document Type, Department and/or Division criteria and is also accessible through the Trial Balance Report by Clicking on a specific General Ledger Account Number.

3.Create Checkpoints - This dialog is used to create and/or review system created General Ledger Checkpoints which are recorded when an Accounting Period is Closed in the General Ledger System, and the General Ledger Checkpoints that were initiated manually.

4.General Journal - Except for the start-up process, General Journal entries are used to make adjustment entries suggested by your Company's Accountant (such as entries for Depreciation and Inventory "shrink", or for posting end-of-period Earnings).

5.Import Payroll - A batch of Financial Transactions supplied by an outside Payroll service that includes all required Debit and Credit entries for a designated Payroll Period.

6.Month Close - Closing an Accounting Period - This selection is used to Close an Accounting Period within the General Ledger System.

7.Re-Declare Accounts - Allows the Mandatory Account Declarations, entered when the General Ledger Setup Wizard procedure was executed, to be altered.

8.Review GJ Transactions - Use the Review GJ Transactions Form to Review, Modify, or Reverse a set of previously entered General Journal transactions.

9.Transaction File - Provides a List of every Debit and Credit Financial Transaction that was posted to the General Ledger System - within on a User Specified Date Range.

•Other Procedures associated with the General Ledger System.

Post Earned Revenue - This dialog is used to periodically calculate, distribute, and post Earned Revenues to the appropriate General Ledger Accounts in the Transaction File and Account Register.

General Journal Templates - Templates for repetitively posted transactions - entered through the General Journal - may be predefined to ensure that these types of entries are always posted in the same manner.

Import Payments - A process whereby a batch of Receipts which were pre-processed by a drop box service may be imported and posted as individual Receipts to each Subscriber's account, automatically.

❑What's Next?

•Use the General Ledger System.

•Print Reports.

•Repeat...