❖For those Users who are just starting to use the MKMS General Ledger System, before installing the STARK 35 upgrade, you should:

1.Ensure - it is assumed - that the Accounts Receivable and Accounts Payable modules - and the Inventory Tracking & Job Costing module, if registered - have already been fully implemented.

2.Read the New General Ledger Features in STARK 35 chapter to get a sense of how information is presented in the General Ledger's Help Files chapters, and get to know some of the Features and Transactional Improvements which have been implemented in STARK 35 (New GL).

3.Read (review) the Understanding a General Ledger System chapter (and its subordinate Accounting Terminology, Understanding Debits & Credits, and the Double Entry Bookkeeping chapters to better understand how this integrated General Ledger System will function.

4.Read this General Ledger Start-up Overview for New Users chapter carefully to determine when you will start the conversion from your Company's existing (software or manual) General Ledger bookkeeping methods, and know what the implementation requirements will be for this fully integrated MKMS General Ledger System in STARK 35 (referred to in this, and all future chapters as the New GL)

❑As with all the modules within the Micro Key Millennium Series, the General Ledger System has a step-by-step "start-up" process that must be followed to ensure your Company gets accurate Financial Reporting in the future.

•Deciding when you will start the conversion to the MKMS General Ledger System.

✓It is always easier to start this module at the end of a financial reporting period (end of monthly Accounting Period, or the end of a Fiscal Year), or soon thereafter.

✓However, this is not mandatory - it's just easier, because you may actually start the General Ledger Setup Process at any time.

Start up Preparations for implementing the MKMS General Ledger System

❑An Overview:

•The outline below will describe each set of required tasks that, when performed properly, should have your Company running this new General Ledger System with a minimum number of issues.

a)This is an Overview

b)These steps are not to be performed now.

c)Just read the outline in the context of planning what needs to be done when you actually do start the implementation process.

d)You may install the MKMS STARK 35 upgrade but do not run the General Ledger Setup Wizard.

I.The first set of tasks required to implement the General Ledger System - these must be done before running the General Ledger Setup Wizard process - is to complete all of the Maintenance Entries (see the "Complete the initial Maintenance Entries before running the General Ledger Setup Wizard" discussion toward the end of this chapter for more information on this step):

A.If you do not have an existing in-house General Ledger Software System, arrange for your Company's Accountant to prepare a list of your Company's General Ledger Accounts (see the Designing Your Company's Financial Statements chapter for more information on creating your Company's a Chart of Accounts for this MKMS General Ledger System)

B.General Ledger Groups must be defined because this determines where each Group's associated General Ledger Accounts will appear in the Financial Statements & Reports.

C.Your Company's General Ledger Accounts must be defined and must include a General Ledger Group assignment (see # B. above).

D.If your Company will be implementing Multi-Departmental Accounting (the goal of which is to have the General Ledger System produce Departmentally based Income Statements), those Departments must also be defined.

E.Update the Sale-Purchase Item records to include the required General Ledger Account Numbers (e.g., a Sale GL#, and/or a Purchase GL#, and/or an Unearned Revenue GL#), and if appropriate, a Department Number.

F.If you are using the Inventory Tracking & Job Costing module and have not yet done so, be sure your Company's Inventory Valuation Method is set to the Average Inventory Item Costing method (see "Inventory Valuation Methods" for more information).

▪Inventory Valuation Methods: There are three (3) Inventory Valuation Methods available when using the Inventory Tracking & Job Costing System.

1.Original Price (Cost) - By default (except for STARK 35 General Ledger System Users who should use the Average Cost of Inventory method), the Value of each Inventory Item is the original Price (Cost) assigned to that Inventory Item as it was entered (or subsequently manually updated) in the Sale-Purchase Category Form.

2.The LIFO (Last In - First Out) - The original Price and COGS Value (Cost) Value is automatically re-set, based on the most recent Cost paid for an Inventory Item - as charged on a Bill from a Vendor for the Re-Purchase of each Inventory Item.

a)When creating a Purchase Order and/or a Bill: be sure to enter the actual Price (Cost) being charged by the Vendor for each Inventory Item.

b)Once the actual Price being charged by the Vendor is entered on a Bill, this will automatically become the new LIFO cost ("Price") on the Sale-Purchase Category Form.

3.Average Inventory Cost - The Average Cost of Inventory is the Value that is used for the Cost when posting Inventory related Financial Transactions into the General Ledger System, and for Inventory Related Reports and General Ledger System's Financial Statements and Reports.

G.For those Companies using the STARK 35 version of the General Ledger System, the required Inventory Valuation Method is the Average Cost of Inventory

▪The Average Inventory Cost method provides an automatic Inventory Revaluation when using the General Ledger System in conjunction with the Inventory Tracking System.

▪See the "An Analysis of the various Inventory Tracking System Processes" section in the Understanding how Inventory Values & Counts are Calculated, and also the Inventory Valuation Method chapters for more detailed information.

II.The second set of tasks required to implement the General Ledger System will be to create the set of Financial Statements described below:

A.A Balance Sheet [This is a report which provides, on a month by month or an annualized basis, the Value of the Company's Assets, Liabilities and its net Equity].

B.An Income Statement [This is a report which provides a comparison between the posted Sales (with a summary total for each sales category) and the posted Expenses (summary totals for each expense category) reporting the net difference as the Profit (or Loss, if the Expenses are greater than those Sales)].

C.A Trial Balance [This is a report which provides a comparison of the sum of all Debit and Credit Financial Transactions, posted to all of the Debit and Credit Accounts (see the Understanding Debits & Credits chapter for more information on these Terms), and so determines whether your Company's General Ledger is, or is not "in balance" currently].

❖ Most importantly, all of these reports should represent the Balances that existed in your Company's existing General Ledger bookkeeping system on a known date; and so will provides the necessary Account Balance information that will be required when running the General Ledger Setup Wizard.

1.It is in your best interest to have these Financial Statements created for the most recent month that is practical (but not including the current month - which isn't finished yet).

2.By doing so, you will reduce the number of General Journal entries that may be required later to bring your new MKMS General Ledger System up to date (up to Today).

3.These Financial Statements will be used for two purposes:

a.To have the information required to complete the General Ledger Setup Wizard process.

b.To have those Financial Statements available for comparison with the corresponding reports that may (should) be produced by the MKMS General Ledger System - once the General Ledger Setup Wizard process has been completed.

III.The third set of tasks required to implement the General Ledger System will be to prepare for, and ultimately run the General Ledger Setup Wizard procedure:

A.It is assumed that the Financial Statements - created in Step II. above - represent a Month or Fiscal Year Ending Date that was somewhat before the current month; and that all of the Financial Transactions of any Months reported in those Financial Statements have been Closed in the Accounts Receivable and Accounts Payable modules within MKMS.

1.If not, following the information in the appropriate chapters (see the Closing the Month for Accounts Receivable, and Closing the Month for Accounts Payable chapters), do so now.

2.Also, a "clean up" process should be undertaken as follows:

a.All Monies received should be posted

b.All new Sales should be recorded as Invoices

c.All Checks to Vendors should be allocated and printed

d.All Advance Deposits from Subscribers should be applied to Invoices (even if they are applied to temporary dummy invoices - more on this later)

e.All Deposits on Account to Vendors should be applied to Bills (even if they are applied to temporary dummy bills - more on this later)

B.Then, Month by Month, Close the Month of any Accounts Receivable and/or Accounts Payable module's month(s) that are still open after the Ending Date of those Financial Statements from the existing General Ledger bookkeeping system, but do not close the current month (see the Print the Transaction Summary Reports chapter for detailed information relating to this Month Closing exercise).

1.For each Month that is being Closed, before doing so:

a.Post any outstanding Deposits, create any required Payments.

b.Allocate Receipts to Invoices and Payments to Bills,

c.Print Checks, Print unprinted Invoices.

d.Apply Credit Memos (to Sales and/or Purchases, as needed),

e.Print the recommended reports per the instructions in the Closing the Month for Accounts Receivable, and Close Month for Accounts Payable chapters.

f.Bundle the reports separately: month by month, and module by module.

g.The information in these reports will be used to create a Summary of the Financial Transactions that occurred in those months whose Financial Transactions were not included in the Financial Statements created in Step II. above.

▪Later, these Summarized Transactions will be entered (using the General Journal Form) into the new General Ledger System to bring it's General Ledger Account Balances up to the current month.

2.Then, when Steps III. B., 1. a. to g. are completed, close that month in the Accounts Receivable and Accounts Payable modules

a.Repeat this process until you get to the current month.

b.Each bundled set of the reports will be used to create a set of Summarized Financial Transactions (see the General Ledger Start-up Transactions chapter for more information) which will then be posted in the new MKMS General Ledger System.

▪Later, the General Journal will be used to Post those Summarized Transactions that occurred after the Ending Date identified in the Setup Wizard - but only after you complete the General Ledger Setup Wizard procedure.

3.The current month's Financial Transactions will be addressed in Step IV. below.

C.Stop - Before proceeding any further: You would now Stop entering Financial Transactions into any and all modules!

▪If you need a break, this would be a good time to take it.

➢Note 1: However, Monitoring related Data Entry and Signal Processing may continue in the normal manner.

D.You will not execute the General Ledger Setup Wizard procedure until you have completed Step IV. below (where you will use the Financial Statements created in Step II. above):

➢Note 2: Although not recommended, if you do not want to enter Financial Statements data in the General Ledger Setup Wizard (because you entered zero balances in all Accounts), you could use the General Journal later to initialize those General Ledger Account Balances.

IV.This is the final - mandatory - step which is required to record the current month's Financial Transactions:

A.Post any outstanding Deposits, create any required Payments.

B.Allocate Receipts to Invoices and Payments to Bills,

C.Print Checks, Print unprinted Invoices.

D.Apply Credit Memos (to Sales and/or Purchases, as needed),

E.Print the recommended reports per the instructions in the the Closing the Month for Accounts Receivable, and Close Month for Accounts Payable chapters.

F.These will be used to create a Summary of the Financial Transactions for current month which occurred prior to running the General Ledger Setup Wizard procedure.

V.Run the General Ledger Setup Wizard procedure.

A.Once the General Ledger Setup Wizard procedure has been completed, the Summarized Financial Transactions created for the current month - as explained immediately above and in the Post the Summarized Transactions chapter - may now be posted.

B.Once the General Ledger Setup Wizard procedure is finished, Resume entering accounting related Financial Transactions for all modules, as needed

C.The MKMS General Ledger System will now post all new Financial Transactions, automatically!

D.The Summarized Financial Transactions created in Step III. B. above may be posted at anytime - as explained in the Post the Summarized Transactions chapter - but keep in mind, newer Financial Statements can not be created until this posting task is completed.

❖This completes the Overview of the General Ledger Start-Up process.

Completing the Preparations for running the General Ledger Setup Wizard

❑Complete the initial Maintenance Entries before running the General Ledger Setup Wizard

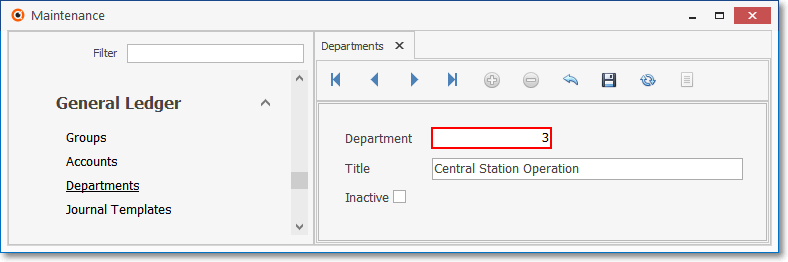

•Departments - These may be used to identify a Work Group or Profit-Center within your Company (i.e., have the responsibility for installing, servicing and/or monitoring systems for Subscribers) and so provide another General Ledger itemization tool for Financial Reporting, specifically in the Income Statement.

Maintenance Menu - General Ledger - Departments Form

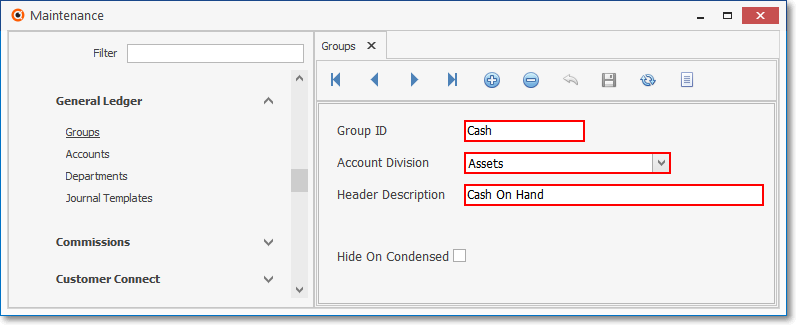

•General Ledger Groups - These are used to sub-divide the five basic Financial Transaction Account Types (i.e., Assets, Liabilities, Equity, Sales and Expenses) into more finely defined sub-groups (or segments).

Maintenance Menu - General Ledger - Groups Form

✓Understanding General Ledger (sub) Groups: Several sub-classifications of the five major Account Divisions are provided, but all General Ledger Accounts must be specifically assigned to a General Ledger Group and each of those Groups must be assigned to one of the system default Account Divisions.

▪These General Ledger Groups' Titles (Names) are printed as Sub-Headers when Financial Statements & Reports are created, and also identifies the Financial Transaction Account Division to which this Group belongs.

▪These General Ledger Groupings also provide Sub-Totals for each of the Sub-Headers that are define.

•Account Divisions are Major Transaction Types (i.e.,, Assets, Liabilities, Equity, Sales and Expenses) and are referred to as the Primary Account Divisions.

✓Most of these Primary Account Divisions also have several additional, predefined sub-classifications which are referred to as the Secondary Account Divisions.

✓The Primary and Secondary Account Divisions are predefined and included as part of the General Ledger System.

✓The General Ledger Account Numbering scheme (see the "Choosing your Account Numbering scheme" discussion immediately below) may contain up to 8 digits; plus 4 additional digits following a decimal point (e.g., 12345678.1234)

✓However, the list below presents a typical - and our recommended - Account Numbering scheme (i.e., the recommended Numbering Range) for each of the five Primary Account Divisions:

1.Asset Accounts 1000 - 1999 - Debit - An Asset Account identifies items that have an actual cash value or can reasonably be converted to cash.

2.Liability Accounts 2000 - 2999 - Credit - A Liability Account identifies a portion of what the Company owes, or in some other manner is obligated to pay to others.

3.Equity Accounts 3000 - 3999 - Credit - The Equity Accounts identify the net value of the business (Company).

4.Sales Accounts 4000 - 4999 - Credit - These Revenue Accounts identify the Revenue (Income) from Sales, Interest earned from savings, and any other miscellaneous Income.

5.Expense Accounts 5000 - 9999 - Debit - These Expense Accounts identify the Purchases made to sustain the business, produce product, complete an installation, and/or provide services.

•Choosing your Account Numbering scheme

✓Decide on the Account Numbering scheme and the Numbering Range for each Primary Account Division which will be used for designing your Company's Chart of Accounts (i.e., General Ledger Accounts).

✓Although a Numbering Range of 1000 to 9999 is recommended, a much more complex numbering scheme may be utilized, if necessary.

▪Up to 9,999,999 General Ledger Accounts, each with up to 9,999 subordinate Accounts, may be created (e.g., 12345678.1234).

▪This power and capacity must be used wisely, as the longer and more complex the number scheme used for defining General Ledger Accounts becomes, the more complicated the management and reporting becomes for this (or any) General Ledger System.

▪Remember: With Power comes Responsibility

✓So, unless you have a compelling reason to be more complicated and complex when designing your Numbering Range, stick with our recommendation (i.e., a Numbering Range of 1000 to 9999).

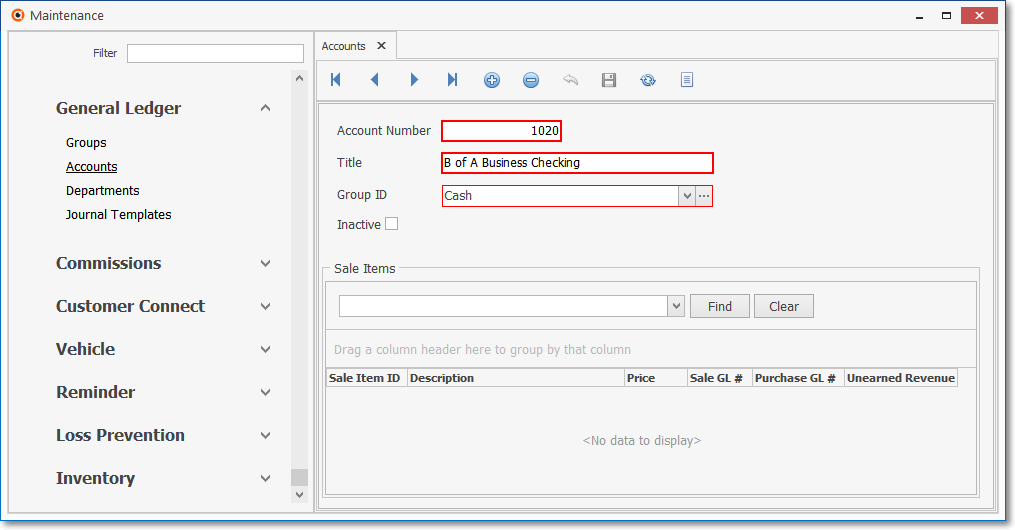

•General Ledger Accounts - The General Ledger Account Form is used to enter all of the General Ledger Account Numbers and their Descriptions.

✓The Number assigned to an Account (see the "Choosing the Account Numbering scheme" discussion above) identifies which of the five Primary Financial Transaction Account Divisions (i.e., Assets, Liabilities, Equity, Sales or Expense) they will represent (see 1. to 5. above).

Maintenance Menu - General Ledger - Accounts Form

✓A Group ID must be assigned to each Account (see the Understanding General Ledger (sub) Groups discussion above) thereby further sub-dividing an Account Type into smaller, more finely defined sub-groups.

✓There are several Mandatory Accounts that must also be defined prior to running the General Ledger Setup Wizard, which actually "starts" the General Ledger System.

✓These Mandatory Accounts must also be predefined before running the General Ledger Setup Wizard procedure.

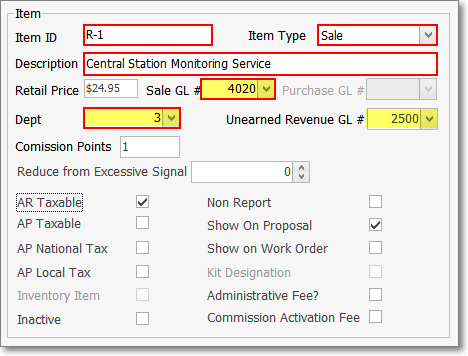

•Sale Purchase Items - Once you have defined your Company's General Ledger Accounts, you must assigned each Sale Purchase Item the appropriate Sale Purchase Item the appropriate General Ledger Accounts Number(s).

✓Later, as you run the General Ledger Setup Wizard, if any Sale Purchase Items have not been assigned the required General Ledger Accounts Number(s), you will be prompted to do so at that time.

✓Before running the General Ledger Setup Wizard,

▪Department - If Multi-Departmental Accounting is to be implemented, using the Drop-Down Selection List provided, Choose the preferred Department Number.

oThe Department Number assigned to each Sale-Purchase Item becomes the default (but User changeable) Department when recording a Sale and/or Purchase line item.

▪General Ledger Accounts - Complete the required GL# fields for each Sale Purchase Item (based on need: a Sale GL#, and/or a Purchase GL#, and/or an Unearned Revenue GL#).

Sale-Purchase Item Form - Record editing view

Sale GL # , Dept, Unearned Revenue GL # fields highlighted

▪Item Type = Sale - Sale GL # - Enter the General Ledger Account Number for this type of Sale.

oUnearned Revenue GL# - Optionally - for Recurring Revenue definitions only - if tracking Earned and Deferred Revenues, enter the appropriate General Ledger Account Number - the Liability Account which is defined for Deferred Revenues.

▪Item Type = Purchase - Purchase GL # - Enter the General Ledger Account Number for this type of Purchase.

▪Item Type = Both - Enter both the Sale GL # and the Purchase GL # General Ledger Account Numbers

▪Dept - As noted above, if you plan to initiate Multi-Departmental Accounting, enter the appropriate Department number using the Drop-Down Selection List provided.

➢Note: The mandatory General Ledger related fields will NOT be boxed in Red until After the General Ledger Setup Wizard is run successfully.

Thereafter, those mandatory fields will be boxed in Red.

•Bank Maintenance - Once the General Ledger Accounts have been defined,as you run the General Ledger Setup Wizard, the appropriate General Ledger Account Number must be assigned to each of the Company's Bank Account(s), so you will be prompted to do so at that time if you have not already done so previously.

❑What's Next?

A.Complete the initial Maintenance Entries as described above

B.Determine if you are ready to Start the General Ledger System

C.If so, Stop entering Financial Transaction in the MKMS Accounts Receivable and Accounts Payable modules at this time.

D.Execute the Five Steps of the General Ledger Setup Process outlined below, and explained in much more detail within their associated chapters:

1.Print the Transaction Summaries Reports

2.Summarize the Start-up Transactions

3.Run the General Ledger Setup Wizard to validate that you have created the appropriate Maintenance Entries in the appropriate places, and to enter your Company's Starting Balances.

4.Post the Summarized Transactions for the Financial Transactions that occurred after the Accounting Period identified in the General Ledger Setup Wizard, but before the current month.

5.Post the Summarized Transactions for the Financial Transactions that occurred in the current month.