❑If you are reading this chapter, You should already have:

a)Read Understanding a General Ledger and the General Ledger Setup Overview.

b)Completed your General Ledger related Maintenance Entries

c)Summarized the Start-up Transactions.

d)Successfully run the General Ledger Setup Wizard

e)Decided which method (Month by Month or Lump Sum) you will use to enter the Financial Transaction history (see the "How do I proceed from here?" discussion immediately below).

•Therefore, now is the time to enter your Company's General Ledger Start-up Transaction Entries.

STOP

•We strongly suggest that, before beginning with you Start Up Entries, you read this entire chapter - completely from start to finish.

❑How do I proceed from here?

•Chose one of the two available methods for entering your Company's General Ledger Start-up Transaction Entries:

1.Month by Month Posting - Individually post each month's data for each module, then close that month for that module, and repeat that process until you have posted all of your Summarized Start Up Transactions in the General Ledger System.

✓General Journal Entries would be created, and months/years closed for the following periods:

i.Previous Year End Financial Transactions Summary, only required if you didn't enter those Account Balances when you executed the General Ledger Setup Wizard.

ii.Summary of each of the Closed Months for the Financial Transactions that were entered after the the Ending Date of the Closed Month identified earlier in the Fiscal Year Start up Form of the General Ledger Setup Wizard.

iii.Summary of the Financial Transactions entered after the most recently Closed Month but before the Setup Wizard was run (no closing is required for this month until it is actually completed).

✓This is the method (detailed in the "Summarizing the Start-up Transactions" chapter) that will provide the standard set of Financial Statements (i.e., Income Statement, Balance Sheet, Trial Balance) for each month which you've taken the time to summarize individually, and then enter those Account Balances using the General Journal Form.

▪This will provides the most detailed General Ledger history for future reference within MKMS.

✓The current month's Summary of the Financial Transactions must still be posted as recommended regardless of which option is chosen.

2.Lump Sum Posting - Use the various reports outlined in the Summarizing the Start-up Transactions chapter, but summarize All Transactions for all of the Closed Months (by entering the appropriate Date Range when printing each report) and only post those combined summary values.

✓Three sets of Journal Entries would be entered:

i.Previous Year End Financial Transactions Summary, if required.

ii.Summary of all Closed Months Financial Transactions for the Current Year.

iii.Summary of the Financial Transactions entered after the most recently closed month.

✓This is the method will only provide Financial Statements as a summary of the all the transactions for those Closed Months.

▪This will provide, for future reference within MKMS, only one summarized set of Financial Statements (i.e., Income Statement, Balance Sheet, Trial Balance) covering all the Accounting Periods which have passed since the Ending Date used in the General Ledger Setup Wizard.

✓The current month's Summary of the Financial Transactions must still be posted as recommended regardless of which option is chosen.

•When must these General Journal Financial Transaction entries of your Summarized Start Up Transactions be completed?

✓The timetable for completing these entries - whichever method you choose - is not as "immediate" as you might think.

✓Once the Setup Wizard is successfully completed, all future Financial Transaction will immediately be posted to the General Ledger System.

▪This means that whether you make all of these "start up entries" before you continue using the Accounts Receivable and Accounts Payable modules, or make them on an "as time allows" process, makes no difference.

▪As long as you have your Transaction Summary spreadsheet documents which contain all of the needed itemized Month End Summarized Financial Transactions (as detailed in the "Summarizing the Start-up Transactions" chapter), the actual posting of these Financial Transactions may be done at any time in the future.

▪But, the sooner the better - because you cannot permanently Close any of the affected Accounting Periods in the General Ledger until these entries is completed!

✓Keep in mind that, until each of these Month's Financial Transactions are entered in the General Ledger System, those month's Financial Statements will be unavailable (or worse, they will be inaccurate because of the missing Financial Transaction entries).

❑The following is an outline of the required set of step-by-step procedures - which should be performed after the successful completion of the Setup Wizard procedure - to accomplish the goal of being able to create the Financial Statements in MKMS for all of the subsequent Closed Months that followed the Ending Date Account Balances that you entered during the Setup Wizard procedure.

•General Ledger Start-up Transactions - This is the step-by-step process that you will perform to input the set of Financial Transactions created in the Summarized Start Up Transactions - thereby documenting the Financial Transactions that occurred since the ending of the Period and Year identified during the Setup Wizard procedure.

1.If you did not enter your Company's Financial Statements data as part of the Setup Wizard process, using the General Journal, make those starting entries dated for the last day (i.e., the Ending Date) of that closed Month, or completed Fiscal Year using the Trial Balance from your old General Ledger created in the instructions.

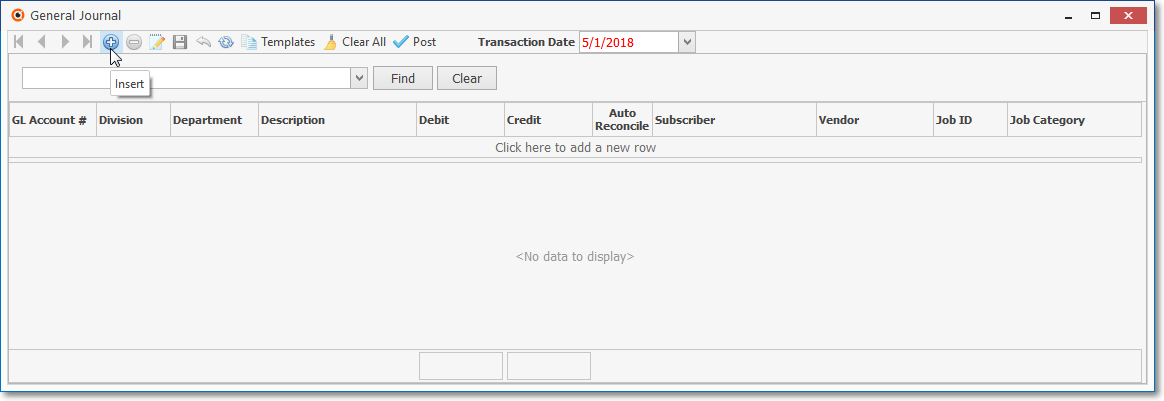

▪Open the General Journal Form using one of these methods:

a)From the Backstage Menu System Select File and Choose the General Ledger Menu, then Click the General Journal option, or

b)From the Quick Access Menu, Select File and Choose the General Ledger Menu, then Click the General Journal option.

General Journal Form

▪Assuming that your did not enter your Company's Financial Statements data as part of the Setup Wizard procedure, you will now use the Account Balances from the Trial Balance - that was created from your Company's old General Ledger's most recently closed month (as explained in the "General Ledger New User's Start-up Procedures" chapter) - which contains the Assets, Liabilities, Equity, Sales and Expense Account Balances of the old General Ledger's last closed Month or last closed Fiscal Year.

▪Using the General Journal Form illustrated above, post the appropriate Financial Transactions - the Debit and Credit entries shown on that Trial Balance - until you have entered all of the General Ledger Account Debit and Credit entries listed on that Trial Balance.

oWhen completed (or at anytime while making these entries when the Value of all Debit entries equal the Value of all Credit entries), the Save Icon will become active.

oClick the Save Icon to save these General Journal entries at any time.

oYou may still continue to make additional entries.

![]()

▪Click the Post button to save the completed set of (now "in-balance") General Journal entries

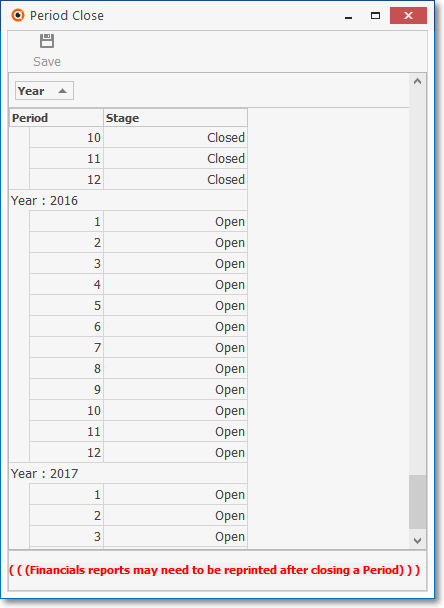

2.Next, Close that Accounting Period in the MKMS General Ledger System

▪To open the Period Close Form to close a month in the General Ledger System:

a)From the Backstage Menu System Select File and Choose General Ledger then Click the Month Close option, or

b)From the Quick Access Menu, Select File and Choose General Ledger then Click the Month Close option.

▪The Period Close Form will be displayed.

General Ledger System - Period Close Form

▪See the Closing an Accounting Period chapter for complete information on how to use the Period Close Form.

▪If the set of Financial Transactions entered above represent those for the last month of your Company's Fiscal Year, once you've completed the steps above, Close the Accounting Period representing the end of the Fiscal Year:

oFinalize Profit (Loss) - To Finalized this "end of fiscal year" month, in the General Journal, dating the transactions the first day of the new Fiscal Year, Post your Company's Profit (i.e., the balance of the Current Earnings Equity Account) to Retained Earnings Equity Account:

1.To Distribute a net Profit for the Fiscal Year, Debit (reduce) your Current Earnings Equity Account for the Year's Profit and Credit (increase) the Retained Earnings Equity Account for that amount.

2.To Distribute a net Loss for the Fiscal Year, Credit (Increase) your Current Earnings Equity Account for the Year's Loss and Debit (decrease) Retained Earnings Equity Account for that amount.

•You are now ready, when the appropriate time comes, to Close Months in the new (current) Fiscal Year.

❑What's Next?

•Complete the Final General Ledger Start-up Procedure by posting information for the (current) Fiscal Year derived from the MKMS Accounts Payable and/or Accounts Receivable module's Reports.

•Read and complete the steps in Post the Summarized Transactions.