❑The Decision - How should your Company Calculate & Remit Sales Taxes?

1.Determine whether your Company must Remit Sales Taxes based on a Sale being Invoiced or on the actual Receipt of the Sale Tax for that Sale.

2.This decision must be based on the rules of the governing State, Local, and/or Federal Taxing Authority to whom this Sales Tax must be remitted.

❑Accounts Receivable module steps to Charge the required Sales Tax:

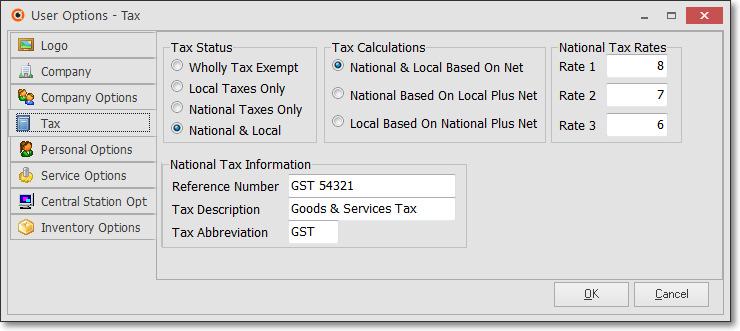

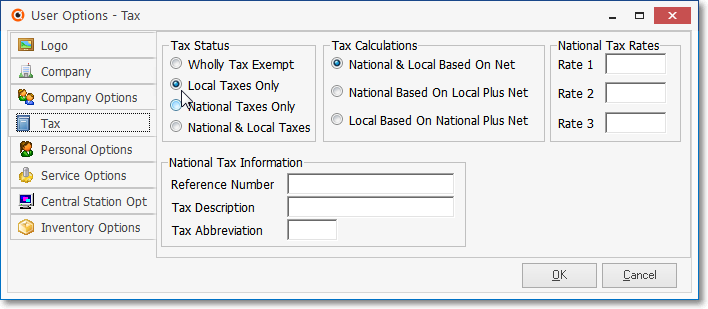

1.Identify the way applicable Local and/or National Sales Taxes are to be handled in User Options Form on its Tax tab.

User Options Form - Tax tab - National & Local

User Options Form - Tax tab - Local Only

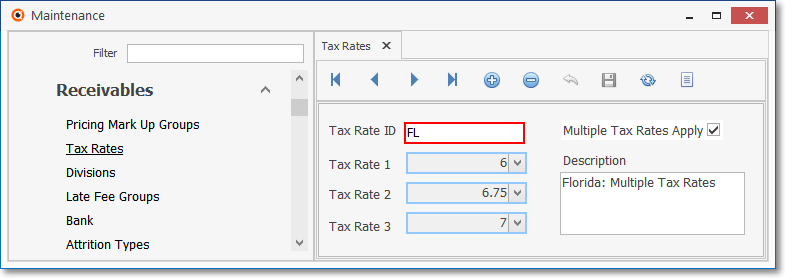

2.For calculating and assessing Local Sales Taxes - when their is no National Sales Tax (e.g., the US has no National Sales Tax, but Canada does) - create the required Tax Rates records.

Tax Rates Form

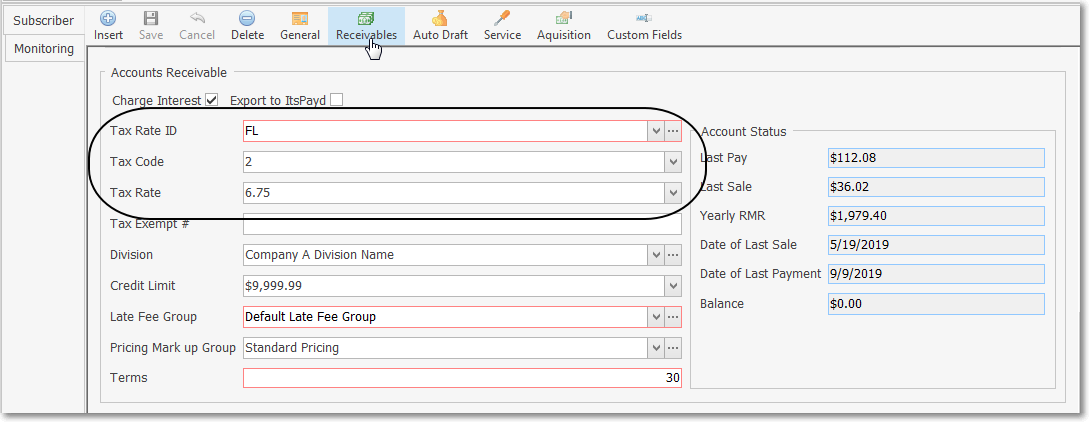

3.In the Accounting Receivable Section within the Edit View of the Subscribers Form enter the required Sales Tax assessment information.

Subscriber Form - Edit View - Accounts Receivable section - Tax Rate information

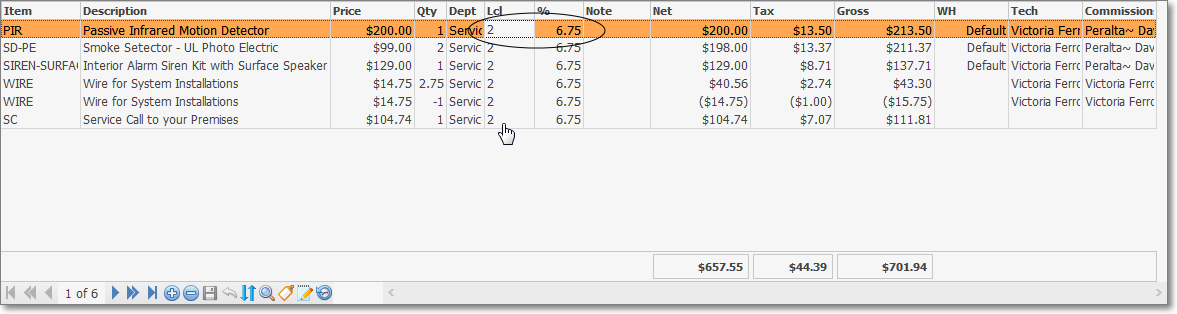

4.Invoices are entered indicating which Detail Line Items will be assessed Sales Tax.

Invoice Form - Detail Line Items - Sales Tax information

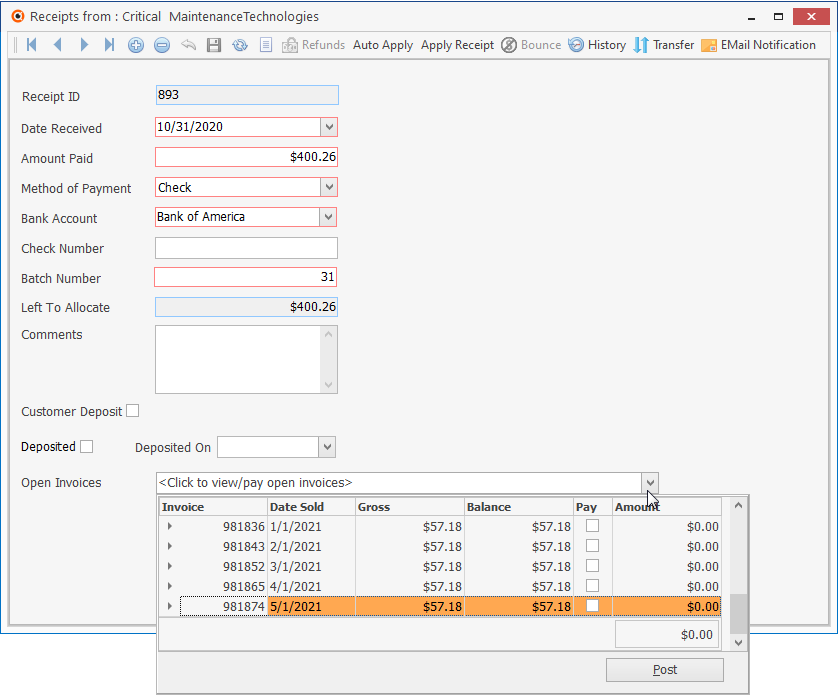

5.Post the Receipts for these Invoices.

Receipts Form

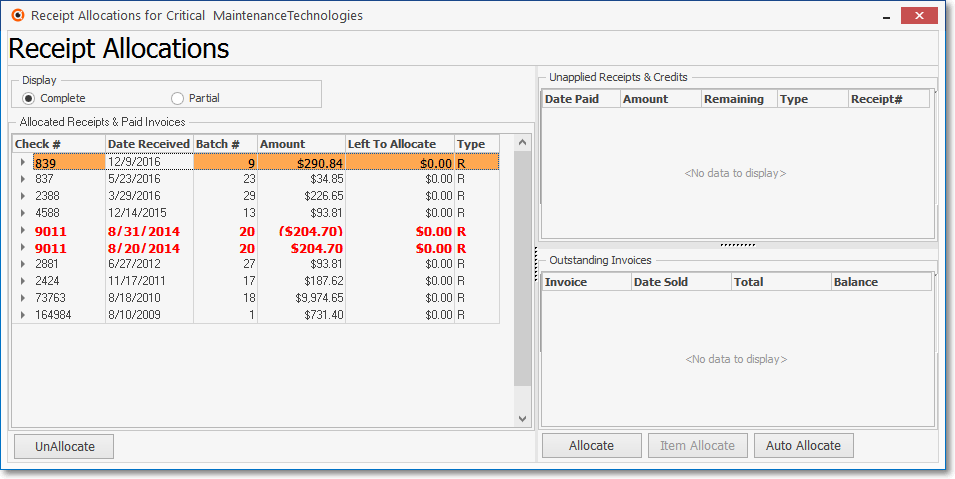

6.Allocate those Receipts (which will also identify the Amount of the Sales Tax that was Paid) to the appropriate Invoice(s).

Receipts Allocation Form

❖For General Ledger System Users: As the Invoices are entered for a Subscriber, for those Detail Line Items which have been charged a Sales Tax Amount

a)That Sales Tax Amount will be Debited (added) to the Accounts Receivable Asset Account (a Mandatory Account)

b)The same Sales Tax Amount will be Credited (added) to the Sales Tax Liability Account (which is also a Mandatory Account).

❑Reports for calculating Sales Taxes that are Owed to the the governing State, Local, and/or Federal Taxing Authority:

•Sales Taxes Collected Report - Used when your Company must Remit the charged and collected Sales Tax on an "As Collected" basis (i.e., based on the actual Receipt for that Sale).

•Sales Taxes Invoiced Report - Used when your Company must Remit the charged Sales Tax on an "As Billed" basis (i.e., based on a Sale being Invoiced - regardless of whether or not is was ever Paid).

•Sales Tax Breakdown Report - Provides the detailed information required for those Sales Taxing Authorities that have multiple Local Option Sales Tax Rates (see the "Assessing Multiple Sales Tax Rates" discussion in the Sales Tax Rates chapter for more information).

❑Accounts Payable module - Steps to Remit the Sales Tax to each Sales Taxing Authorities:

1.Create a Vendor for each Department of Revenue (each Taxing Authority) to whom your Company must remit Sales Tax.

2.Create a Purchase Category code representing the Sales Tax Remittance Expense

3.Determine whether your Company will Remit Sales Taxes based on Invoices or Receipts.

4.Print the Sales Taxes Collected, Sales Taxes Invoiced, and/or the Sales Tax Breakdown report(s), as appropriate, to Calculate the Sales Tax that your Company is required to remit to each Taxing Authority.

5.Create a Bill (using the Purchase Category code for the Detail Line Item representing that Sales Tax Remittance Expense) for the Amount of Sales Tax that is due to be Paid to each Taxing Authority

6.Create a Payment for each of those Sales Tax Bills.

7.Print the Checks and mail them in a timely manner, and with the required reporting documentation, to each Taxing Authority.

❖For General Ledger System Users: When an Invoice is created, if Sales Tax was charged on that Invoice, the Sales Tax Amount of each Detail Line Item that was taxed will be Credited (added) to the Sales Tax Liability Account and Debited (added) to the Accounts Receivable Asset Account.

▪In the "Accounts Payable module - The Steps to Remit the Sales Tax to each Taxing Authority" were presented immediately above:

i.These Sales Tax Bills that were created cause a "Sales Tax Expense" to be posted [e.g., the Bills that are created will post a Debit (addition) to the Expense Account and a Credit (addition) to the Accounts Payable Account].

ii.Plus, that same Billed Amount as posted as a Debit (subtraction) from the Current Earnings and a Credit (subtraction) from the Earnings Posting Account.

oThe problem that arises here is: No Earnings (profit or loss) have occurred here, and no real Expense was incurred either.

oIt was simply a transaction executed to pay the previously collected Sales Tax to the Taxing Authority to which it was owed.

▪So, because these Bills are not truly recording an Expense, but rather are paying for a required reimbursement of an existing Sales Tax Liability:

oOnce that Sales Tax is reimbursed to the appropriate Taxing Authority following those steps outlined above, a set of General Journal Entries must be made to redistribute these "Sales Tax Expense" and "Earnings" Amounts to the proper General Ledger Accounts.

oThis will be required every time the Sales Tax Liability is reimbursed to a Taxing Authority,

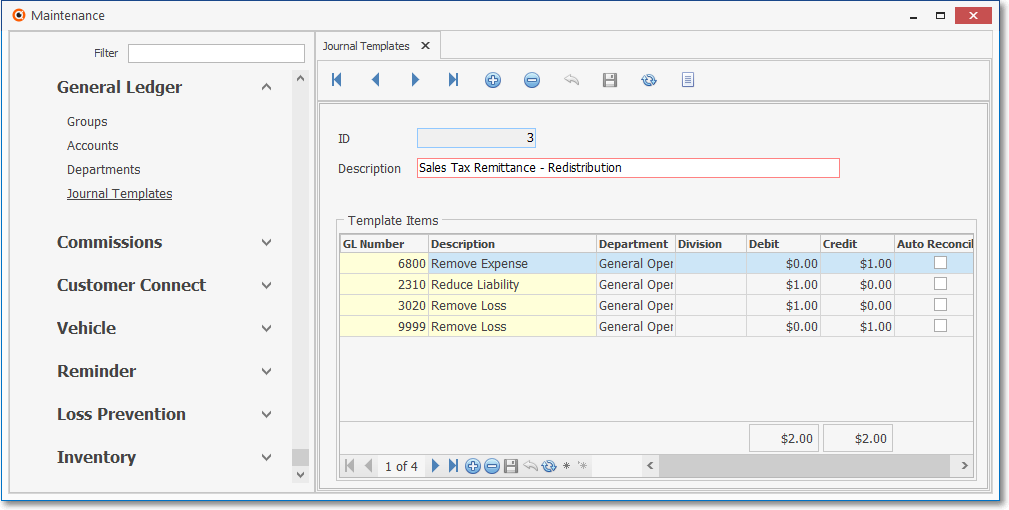

oIt is recommended that a General Journal Template be created (using a temporary $1.00 value for each entry) to accommodate these required Financial Transactions.

General Journal Template - Sales Tax Redistribution

▪The General Journal Entries that are required to redistribute the Expense posting and the Earnings reversal are:

i.A Credit (subtraction) from the Expense Account (eliminating the erroneous Expense posting), and a Debit (subtraction) from the Sales Tax Liability Account (which was what actually happened).

ii.A Credit (addition) to the Current Earnings and a Debit (addition) to the Earnings Posting Account (Completing the reversal of those Earning entries).