❑There are several types of Financial Transactions which are not actually "Billed" to, or "Invoiced" by your Company in the normal manner, but instead are identified on a Bank Statement, or by executing an internal - non commercial - Billing and/or Invoicing action. Each of these Special Types of there Financial Transactions will require the creation of an associated, special purpose Sale-Purchase Item Code.

•Currently within MKMS, there are four Special Types of there Financial Transactions which may be directly entered (recorded) using the Bank Transaction Register:

1.Bank Fees Paid - Those charges and fees - technically a Purchase from a Vendor (Bank) - are periodically assessed by those Banks, generally reported on their Bank Statements [not actually Billed on a separate document (i.e., Bill, Invoice,single purpose Statement)], and may include charges checking account services, and other management and maintenance fees (e.g., stop payment orders, bounce checks, letters of credit, etc.).

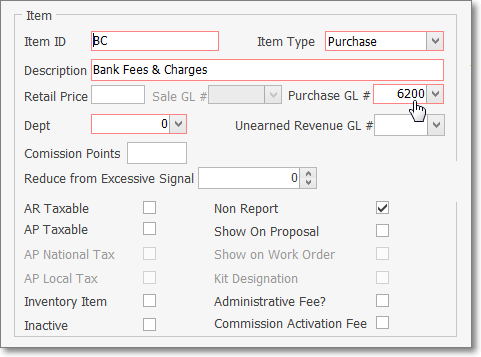

Purchase Category - Bank Fees Paid

a.This "Purchase" of Bank Fees & Charges is recorded in the Bank Transaction Register using a Sale-Purchase Item assigned a Type of Purchase - which, when using the General Ledger System must also be assigned to a General Ledger Expense Account Number (see the Account Divisions chapter for an explanation of the 5 primary Account Types - Assets, Liabilities, Equity, Sales and Expenses).

b.This is a non-taxable charge ("Purchase") and so is generally classified as a Non Report item.

2.Employee Payments - These are direct - typically no, or minimal interest - pay day loans made to an Employee. and are directly entered (recorded) through the Bank Transaction Register.

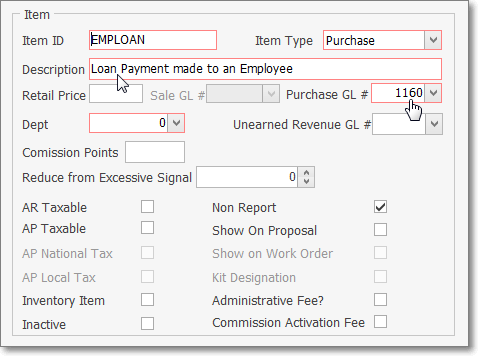

Purchase Category - Employee Loan provided

a.The "Purchase" of this type of Employee Payments is recorded in the Bank Transaction Register using a Sale-Purchase Item assigned a Type of Purchase - which, when using the General Ledger System must also be assigned to a General Ledger Asset Account Number (see the Account Divisions chapter for an explanation of the 5 primary Account Types - Assets, Liabilities, Equity, Sales and Expenses).

b.This is a non-taxable charge ("Purchase") and so is generally classified as a Non Report item.

3.Employee Receipts - These are the repayment(s) from an Employee of a previously funded direct pay day loan.

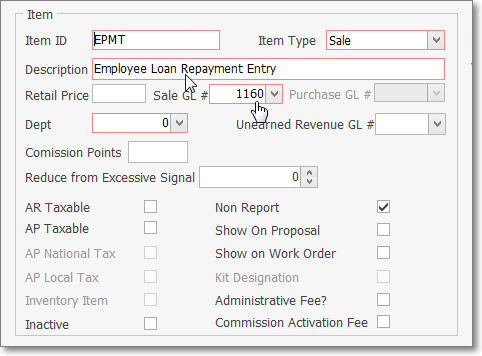

Purchase Category - Employee Loan Repayment

a.This "Sale" of Employee Receipts is recorded in the Bank Transaction Register using a Sale-Purchase Item assigned a Type of Sale - which, when using the General Ledger System must also be assigned to a General Ledger Asset Account Number (see the Account Divisions chapter for an explanation of the 5 primary Account Types - Assets, Liabilities, Equity, Sales and Expenses).

b.This is a non-taxable charge ("Sale") and so is generally classified as a Non Report item.

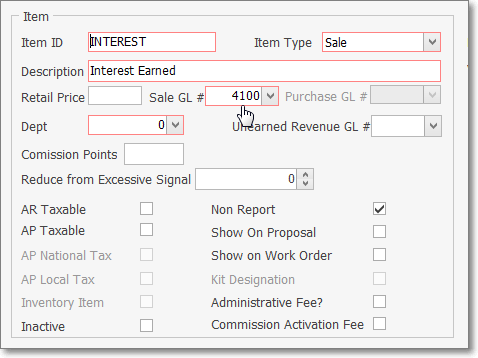

4.Interest Earned - Those Monies which are earned from your Company's Average Daily Balance of Bank Deposits, Money Market Accounts, and./or other interest bearing Financial Instruments (savings certificates, savings bonds, etc.) which are reported on their Bank Statements.

a.This "Sale" of Interest Earned is recorded in the Bank Transaction Register using a Sale-Purchase Item assigned a Type of Sale - which, when using the General Ledger System must also be assigned to a General Ledger Sales Account Number (see the Account Divisions chapter for an explanation of the 5 primary Account Types - Assets, Liabilities, Equity, Sales and Expenses).

b.This is a non-taxable charge ("Sale") and so is generally classified as a Non Report item.