❑In Canada, three types of sales taxes are levied. These are:

1.Provincial Sales Taxes (PST), levied by the Provinces

2.Goods and Services Tax (GST), a value-added tax levied by the federal government

3.The combined Harmonized Sales Tax (HST), also a value-added tax, but in this case is a single blended combination of the PST and GST which is used in Ontario, (formerly) British Columbia, and the Atlantic provinces; New Brunswick, Newfoundland and Labrador, Nova Scotia and Prince Edward Island.

a.The HST is collected by the Canada Revenue Agency, which then remits the appropriate amounts to the participating provinces.

•Your Company is required to collect sales tax from your customers on many of the items they purchase.

•Depending on the Province or Territory in which you operate your business, and the Province or Territory in which you sell your products and services, you need to collect:

a)A combination of GST and PST

b)GST only

c)HST only

d)HST in some areas and PST + GST in others

❖ See http://www.cra-arc.gc.ca/gsthst/ for more information.

❑The goods and services tax (GST) is a tax that applies to most supplies and services in Canada.

•These goods and services also include real property and intangible personal property.

•For more information, see this link: What supplies does the GST/HST apply to?

❑Certain Provinces, referred to as the Participating Provinces, have harmonized their Provincial Sales Tax with the GST to create their HST Rate.

•Generally, the harmonized sales tax (HST) applies to the same base of goods and services as the GST.

✓These Provinces are referred to as the “Participating Provinces”.

✓Those HST participating Provinces are New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, and Prince Edward Island.

•In the remaining Provinces and Territories, GST is imposed on taxable goods and services.

✓In these Provinces, there may also be a Provincial Sales Tax, or a retail sales tax in place (PST).

Province |

Type |

PST (%) |

GST (%) |

HST (%) |

Total Tax Rate (%) |

Notes: |

|---|---|---|---|---|---|---|

Alberta |

GST |

|

5 |

|

5 |

|

British Columbia |

GST + PST |

7 |

5 |

|

12 |

As of April 1, 2013, the HST rate no longer applies in British Columbia. |

Manitoba |

GST + PST |

8 |

5 |

|

13 |

|

New Brunswick |

HST |

|

|

15 |

15 |

|

Newfoundland and Labrador |

HST |

|

|

15 |

15 |

|

Northwest Territories |

GST |

|

5 |

|

5 |

|

Nova Scotia |

HST |

|

|

15 |

15 |

|

Nunavut |

GST |

|

5 |

|

5 |

|

Ontario |

HST |

|

|

13 |

13 |

|

Prince Edward Island |

HST |

|

|

15 |

15 |

|

Quebec |

GST + *QST |

*9.975 |

5 |

|

14.975 |

|

Saskatchewan |

GST + PST |

5 |

6 |

|

11 |

3/2017 |

Yukon |

GST |

|

5 |

|

5 |

|

Canada Tax Rates Chart as of 12/31/2019

❑Almost everyone has to pay the GST/HST on purchases of taxable supplies of property and services (other than zero-rated supplies).

•However, certain persons may not always pay the GST/HST on taxable supplies.

•These exceptions include Indians and certain Provincial and Territorial governments.

❑Generally, if your Company sells taxable (including zero-rated) goods or services in Canada and it is a registered for a GST/HST account, your Company must charge your customers GST/HST.

•GST/HST registrants, or businesses required to have a GST/HST registration number, must charge and account for the GST on taxable supplies (other than zero-rated supplies) of property (for example, goods) and services made in Canada.

•Where GST/HST registrants make taxable supplies (other than zero-rated supplies) in a participating Province, they must charge and account for the HST instead of the GST.

❑GST/HST registrants must meet certain responsibilities.

•Generally, they must file returns on a regular basis, collect the tax on taxable supplies they make in Canada, and remit any resulting net tax owing.

•Most property (for example, goods) and services is taxed.

❑Is anything Tax Free?

•Certain supplies of goods and services are taxable at the rate of 0% (zero-rated GST/HST is charged at a rate of 0% on these supplies).

•These zero-rated goods and services include goods and services designated as essential items (e.g., groceries, agricultural products, prescription costs, medial devices, education related services, most governmental and charity related goods and services) which are supplied in or imported into Canada are designated as taxable supplies and are subject to the GST/HST, but at the zero-rated GST/HST (charged at a rate of 0%).

❑Specific rules apply to determine whether a supply is made in Canada and whether it's made in or outside of a Participating Province.

a)A taxable supply, other than a zero-rated supply, made in a non-participating Province is subject to the GST.

b)When such a supply is made in a Participating Province, it is subject to the HST.

•The rate of tax to charge for a supply is determined by the Province or Territory in which the supply is made, which is referred to as the place of supply.

•Usually, if your Company is supplying goods or services in your place of business, you will charge the GST or HST rate for your Province or Territory (see the Canada Tax Rate Chart information above).

❑When your Company sells and ships, or delivers taxable goods and services to out-of-province/territory customers, the sales tax that applies in your customer's Province or Territory is generally applicable.

•In provinces where you have to charge the GST and the provincial sales tax (PST), calculate the GST on the price excluding the PST.

•For more information on the PST in your Province, contact your provincial sales tax office.

❑You can recover GST/HST that your Company pays or owes on purchases and expenses related to your business activities in the form of input tax credits.

•Input tax credits are then counted against the GST/HST that your Company collected during each reporting period.

•When claiming input tax credits, it is important to know exactly what qualifies.

•Generally speaking, if your Company does not use the item you are purchasing directly for business purposes, you cannot claim an input tax credit for it.

❑For most businesses, this calculation ITC is straightforward.

•Generally, under the regular method, the GST/HST is calculated on every purchases and expenses.

•However, to help reduce paperwork and bookkeeping costs, most small businesses can use the quick method of accounting to calculate their GST/HST remittance.

•Under the quick method, the GST/HST paid or payable is calculated based on a percentage.

❑As a GST/HST registrant, your Company may recover the GST/HST paid or owed on purchases and expenses related to your Company's commercial activities by claiming input tax credits (ITCs) on line 106 of your Company's GST/HST return, or by claiming an ITC in the line 108 calculation if your Company is filing electronically.

•You must calculate your Company's net tax for each GST/HST reporting period and report this on the GST/HST return. To do so, calculate:

a)the GST/HST collected or that became collectible by you on your taxable supplies made during the reporting period; and

b)the GST/HST paid and payable on your business purchases and expenses for which you can claim an ITC.

c)The difference between these two amounts, including any adjustments, is called your Company's net tax due.

❖To assist you in calculating the net tax and completing the GST/HST return using the regular method, on the Web consult GST/HST return working copy and the line-by-line instructions.

❑Follow these steps to properly instruct MKMS on how to charge the correct Canada Tax rates:

1.Set the CanadaTax option in Company Settings to True ("T").

▪Canada Tax - By default, the CanadaTax option is set to False ("F") in the Company Settings Form

▪Setting the CanadaTax option to True ("T") enables the specialized Goods & Services Tax tracking system (e.g., PST/GST/HST) for Companies who are required to pay that type of sale tax in Canada

User Options Form - Company tab - Company Settings - Canada Tax option

2.In the Tax tab of the User Options Form update these fields in the following sections, as required:

➢Note: Sales Taxing assessments for other Nations may be addressed using these same Tax Status options.

If the the CanadaTax option is not set to True ("T"), the system will still asses Sale Tax based on these rules if a National Sales Tax is all that is charged, and/or use the Tax Class assignment set for each Subscriber.

User Options Form - Tax tab - Canada Tax sections

a)Tax Status - Based on your Company's situation (e.g., subject to HST=National Taxes Only, or subject to GST and/or PST=National & Local Taxes), Click the appropriate button.

➢Note: If your Company may ever have to assess a PST (Provisional Sales Tax), be sure to Click the National & Local Taxes button.

b)Tax Calculations - Based on your Company's situation (see the Canada Tax Rates Chart information above), Click the appropriate button.

c)National Tax Rates - Based on your Company's situation (see the Canada Tax Rates Chart information above), enter the appropriate Tax Rates.

d)National Tax Information - Enter your Company's Registered Agent information.

❖See the detailed "Filling in the Tax tab as required when implementing the Canada Sales Tax system" discussion at the end of this chapter.

3.Exit and then Restart MKMS

4.Define one or more Tax Rate records as needed,

a)Each Tax Rate record may have one or two (2) Tax Rates (the Tax Rates as required

b)This is determined by the PST Tax Rate your Company must assess (if any) plus the GST Tax Rate, or

c)Just an HST Tax Rate -

▪Refer to the Canada Tax Rates Chart information above), one of these Tax Rate IDs must be assigned in the Receivables section of the Edit View on the Subscribers who are subject to a Provincial Sales Tax (PST) and Goods & Services Tax (GST); or the Harmonized Sales Tax (HST) which corresponds to your Company's Tax Status referred to in step 2. above.

General Maintenance Menu - Receivables sub-menu - Tax Rates Form - Canada Tax Rates (PST)

5.Modify the records in the Sale-Purchase Items Form that have been assigned an Item Type of either Both or Purchase to include a Check in one or more of the fields listed below:

Sale-Purchase Item Form - Canada Tax - Check boxes

a)AP Taxable, - If this item is ever Taxable when Purchased, Check this box.

b)AP National Tax - Regardless of whether it is a GST or an HST Tax that will be charged on this Purchase, Check this box.

c)AP Local Tax - Only Check this box when the National Tax is GST and the Province also assesses a PST Sales Tax (not required if your Company's Purchases are only assessed an HST).

6.When Subscribers are subject to Canada Sales Taxes (PST and GST; or HST), in the Receivables section so be sure to Update each Subscriber record as described below.

a.Charge Tax - Check the Charge Tax field to indicate that this Subscriber could be assessed Sales Tax on their Invoices.

b.Tax Rate ID - The Tax Rate ID must identify the Tax Rate record containing the appropriate PST Tax Rate for each Subscriber's location.

c.Tax Code - If multiple Tax Rates were defined for the selected Tax Rate ID, Choose the appropriate Tax Code using the Drop-Down Selection List provided.

d.Tax Rate - This field will be populated automatically based on the Tax Rate ID (and Tax Code, if required) that was selected.

Subscribers Form - Edit View - Receivables section - Charge Tax options

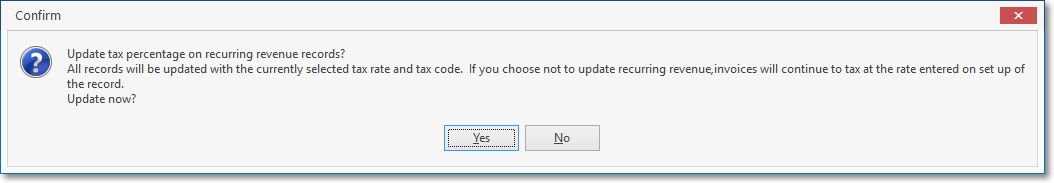

✓Update Recurring Revenue records - If the assignment of a Tax Rate ID represents a change from the previous Tax Rate ID selection, a confirmation message will be displayed offering the option to update all of the Recurring Revenue records previously defined for this Subscriber.

Update tax percentage on recurring revenue records?

▪By answering Yes, the Tax Information section for this Subscriber's Recurring Revenue record(s) will be updated based on the Tax Rate ID and the associated Tax Rate assigned to that Subscriber; and the first National Tax Rate identified in the Tax tab of the User Options Form (see #2. above). If this Subscriber has a different National Tax Rate, reset the Natl Tax Code field using the Drop-Down Selection List provided.

Recurring Revenue Form - Tax Information section

✓Post Sales - When Sales are posted (Recurring Revenue Sales are illustrated in this example), each Invoice has the appropriate Taxes added automatically (based on - as shown in the illustration immediately above - the defined status and rate identified in the Recurring Revenue Form) and based on the Canada Tax Status, Tax Calculation, and Tax Rate information in the Tax tab of the User Options Form.

Auto Billing of Recurring Revenue

✓Invoices - The Invoices that are created - whether using the Invoices or the Auto Billing option - will contain the Local and National Sales Tax Status and Rate for each Detail Line Item.

Recurring Revenue Invoice with Local and National Tax Status and Tax % Rate

✓In the General Ledger System the Local and National Taxes are posted as follows (see #10 above).

a)When Invoicing for Recurring Revenue:

i.The Gross Amount of the Invoice is posted to the Accounts Receivable Asset Account

ii.The Net Amount of the Invoice is posted to the Deferred Revenue Liability Account (assuming that your Company is tracking Deferred Revenue and your Company is billing a month in advance).

iii.The Local Sales Tax (PST) is posted to the PST Liability Account (these funds are also obligated to the designated Taxing Authority).

iv.The National Sales Tax (GST or HST) is posted to the designated HST/GST Liability Account (these funds are obligated to the designated Taxing Authority).

b)When Invoicing for Services:

i.The Gross Amount of the Invoice is posted to the Accounts Receivable Asset Account

ii.The Net Amount of the Invoice is posted to the Designated Sales Account.

iii.The Net Amount of the Invoice is posted to the Earnings Posting Account.

iv.The Net Amount of the Invoice is posted to the Earnings Equity Account.

v.The Local Sales Tax (PST) is posted to the PST Liability Account (these funds are also obligated to the designated Taxing Authority).

vi.The National Sales Tax (GST or HST) is posted to the designated HST/GST Liability Account (these funds are obligated to the designated Taxing Authority).

c)When Invoicing for Inventory Items:

i.The Gross Amount of the Invoice is posted to the Accounts Receivable Asset Account

ii.The Actual Inventory Cost Amount of the Invoice is posted to the COGS Expense Account.

iii.The Retail Price Amount of the Invoice (excluding Taxes) is posted to the Designated Sales Account.

iv.The Net Amount (the difference between the Retail Price Amount and the Actual Inventory Cost Amount) of the Invoice is posted to the Earnings Posting Account.

v.The Net Amount (the difference between the Retail Price Amount and the Actual Inventory Cost Amount) of the Invoice is posted to the Earnings Equity Account.

vi.The Actual Inventory Cost Amount of the Invoice is posted to the Inventory Asset Account.

vii.The Local Sales Tax (PST) is posted to the PST Liability Account (these funds are also obligated to the designated Taxing Authority).

viii.The National Sales Tax (GST or HST) is posted to the designated HST/GST Liability Account (these funds are obligated to the designated Taxing Authority)

✓The Sales Taxes Invoiced report may then be printed one Division at a time to see

Sales Taxes Invoiced - One Division

7.Vendors -Update each Vendor record within the Tax Information section of the Edit View to include the appropriate Canada Tax Rates

Vendor Form - Edit View - Tax Information section

a.Charge Tax - Check this box if this Vendor ever charges Sales Tax.

b.Tax Information: If the box was Checked, this Tax Information section will be activated.

i.Tax Computation - Using the Drop-Down Selection List provided, Choose the appropriate option (usually, if paying an HST it would be National Tax Only, and if paying a GST it would be Local & National Tax).

ii.Local Tax - If paying GST and the Vendor is also subject to collecting a PST, enter that PST Rate here (see the Canada Tax Rates Chart information above).

iii.National Tax - Whether subject to GST or HST, enter the appropriate Rate here (see the Canada Tax Rates Chart information above).

iv.Tax Calculation - Choose the appropriate Tax Calculation method:

a)National & Local Based on Net - (The default selection) - National & Local Based on Net is selected when Sales Tax is calculated on the Net Amount of all Taxable Items within an Invoice. This is also the choice if there is no National Sales Tax required at all.

b)National Based on Local Plus Net - National Based on Local Plus Net is selected when there is a National and a Local Sales Tax and the National Sales Tax is charged on the Gross Amount of all Items within an Invoice PLUS the amount of the Local Sales Tax which has been calculated on the Net Amount of the Invoice's Taxable Items.

c)Local Based on National Plus Net - Local Based on National Plus Net is selected when a National Sales Tax is charged on the Gross Amount of an Invoice and then a Local Sales Tax is calculated based on the sum of the Net Amount of all Taxable Items within an Invoice PLUS the amount of the National Sales Tax being charged.

8.For General Ledger System Users only - These are the steps that must be completed to have the General Ledger properly track Canada Tax:

a. Create the required General Ledger Accounts to track the Canada Tax your Company is charged by Vendors, and the Canada Tax that your Company assesses to Subscribers.

i.An HST/GST Asset Account which will be used to store the value of the Harmonized Service Tax (HST) and/or Goods and Services Tax (GST) your Company has assessed on Invoiced to Subscribers.

ii.A PST Expense Account which will be used to store the expense related Provincial Sales Tax (PST) that was charged on the Bills for your Company's purchases and supplies.

b.Identify the appropriate HST/GST Asset Account number in the Re-Declare Accounts Form

Mandatory Account Declaration Form when CanadaTax is are set to True ("T")

c.If your Company is ever subject to a PST tax, enter that PST Expense Account number in the Re-Declare Accounts Form

d.The Taxes Billed Report provides a list of all Bills entered for a specified Date Range, and which and at what rate, each of the Bill's Detail Line Items were charged Sales Tax.

❑Thereafter, as Purchase Orders are issued, and Bills created, the Canada Tax obligations will be calculated by the system and inserted automatically.

•When a Purchase Order is created for Inventory Items, the appropriate Local (PST) and National (GST) tax is calculated and inserted automatically based on the information provided (see step 6. above) in the Tax Information section of the Edit View of the Vendors Form.

Purchase Order Form - Local & National Sales Tax

•When the ordered Inventory Items are Checked In on the Purchase Order, within the Transaction File in the General Ledger, the Value of the Inventory Items (excluding PST and GST, or HST) is Debited to the Inventory Asset Account; and Credited to the Inventory Purchases Liability Account.

Transaction File Form - Inventory Checked In

•When the Purchase Order is Billed, the appropriate Canada Tax(es) will be calculated and applied to that Bill.

Bills Form - Local & National Sales Tax posted from PO

•In the General Ledger System the Local and National Taxes are posted as follows (see #10 above):

a)The National Sales Tax (GST or HST) is posted to the designated HST/GST Asset Account, and

b)The Local Sales Tax (PST) is posted to the PST Expense Account, other Financial Transactions are also posted in the normal manner.

Transaction File Form - Bill Local Tax Debit & Bill National Tax Debit and other transactions

❑Filling in the Tax tab as required when implementing the Canada Sales Tax system:

a.Tax Status - Click on the button that represents your Company's Sales Tax obligation(s).

i.Wholly Tax Exempt - If there is no Sales Tax charged in the State(s) and Country in which you do business, Click here.

ii.Local Taxes Only - If there are only a Local Sales Taxes (City, County, School District, State or Provincial), but no National (Federal) Sales Tax - the typical case in the U.S. - Click the Local Taxes Only button and define the Tax Rate(s) in the Tax Rates Form.

iii.National Taxes Only - If there is only a National Sales Tax, Click this button.

iv.National & Local Taxes - If there are Local Sales Taxes (e.g., City, County, School District, State or Provincial), and a National Sales Tax - a typical case in Canada - Click this button (see b. immediately below for more information)

b.Tax Calculations - When there is a National as well as a Local Sales Tax (see National & Local Taxes option above), various Governments may assess these Sales Taxes in different ways. To accommodate this, several choices are offered here. Click the appropriate button for how your Local (Province) and National Governments calculate their Sales Tax.

i.National & Local Based on Net - (The default selection) - National & Local Based on Net is selected when Sales Tax is calculated on the Net Amount of all Taxable Items within an Invoice. This is also the choice if there is no National Sales Tax at all.

ii.National Based on Local Plus Net - National Based on Local Plus Net is selected when there is a National and a Local Sales Tax and the National Sales Tax is charged on the Gross Amount of all Items within an Invoice PLUS the amount of the Local Sales Tax which has been calculated on the Net Amount of the Invoice's Taxable Items.

iii.Local Based on National Plus Net - Local Based on National Plus Net is selected when a National Sales Tax is charged on the Gross Amount of an Invoice and then a Local Sales Tax is calculated based on the sum of the Net Amount of all Taxable Items within an Invoice PLUS the amount of the National Sales Tax being charged.

c.National Tax Rates - If different sections of the country are charging different rates, or different products and services are charged at different sales tax percentage rates, you may still select this as your Sales Taxing Method - as long as there are never more than three different percentage rates charged.

✓If you are subject to these multiple National Sales Tax Rates which may vary from Subscriber to Subscriber, enter up to three Tax Rates here.

i.Rate 1 - Enter Rate 1 as the regular GST Sales Tax Percentage Rate normally charged. Enter as a whole number if the Rate is a simple whole number percentage (e.g. 7%, 8%) or followed by a decimal point and the appropriate value if the rate is not an even amount (e.g. 7.25%, 8.375%).

ii.Rate 2 - If your have multiple Sales Tax Rates based on the type of Part or Service provided, enter those additional rates. Enter as a whole number if the Rate is a simple whole number percentage (e.g. 7%, 8%) or followed by a decimal point and the appropriate value if the rate is not an even amount (e.g. 7.25%, 8.375%).

iii.Rate 3 - If your have multiple Sales Tax Rates based on the type of Part or Service provided, enter those additional rates. Enter as a whole number if the Rate is a simple whole number percentage (e.g. 7%, 8%) or followed by a decimal point and the appropriate value if the rate is not an even amount (e.g. 7.25%, 8.375%).

✓Then, enter the complete set of PST taxing authority tax rates as individual records in the Tax Rates Form.

d.National Tax Information - Companies that must charge a National Sales Tax, are normally required to have a Tax Account reference number printed on their Invoices along with the "Name" of that tax and it's normal abbreviation.

✓For the typical reporting requirements of a National Sales Tax, enter the information below as noted.

✓If you are subject to these multiple National and Local (Provincial) Sales Tax Rates which may vary from Subscriber to Subscriber, enter the primary taxing authority information.

i.Reference Number - An alpha-numeric field for your National Sales Tax reference number.

ii.Tax Description - Enter the National Sales Tax's Description as you would want it printed on Invoices and reports (such as "Harmonized Sales Tax" or "Goods & Services Tax").

iii.Tax Abbreviation - Enter an abbreviation for this tax (e.g., VAT, PST, GST).

✓Be sure to enter the complete set of PST taxing authority information as individual records in the Tax Rates Form.