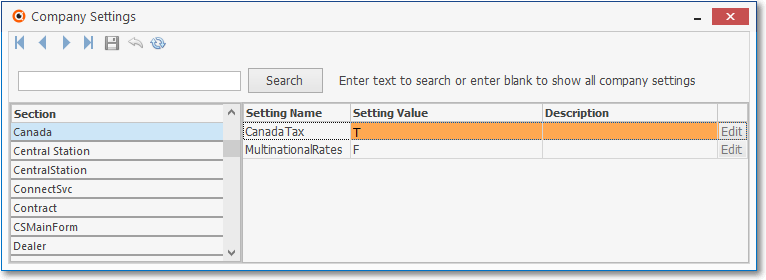

❑Canada (Local and/or National) Tax - There is a new "CanadaTax" option in the Company Settings dialog available from within the Company tab of the Users Options Form

➢Important Note: We strongly recommend that you read the Canada Sales Tax chapter, and the Sale-Purchase Item - Sales Tax Fields chapter, for more details about Sales Tax Charging Options in the latest Help Files for more specific information!

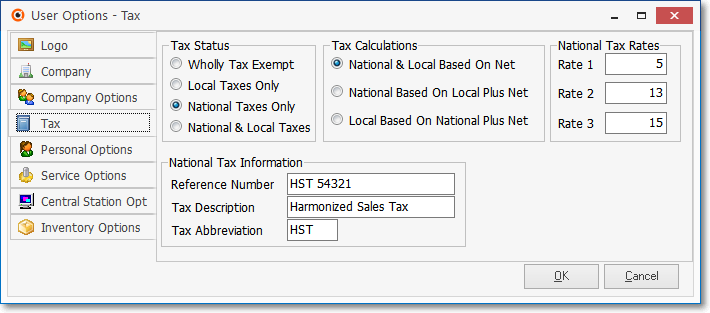

•National Taxes Only - The Tax tab on the User Options Form remains unchanged when only a National Sales Tax is charged, but the MKMS Sales Tax Tracking functionality has been improved.

*User Options Form - Tax tab - National Taxes Only

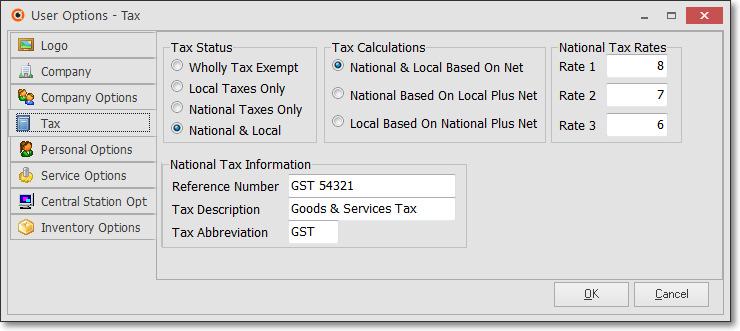

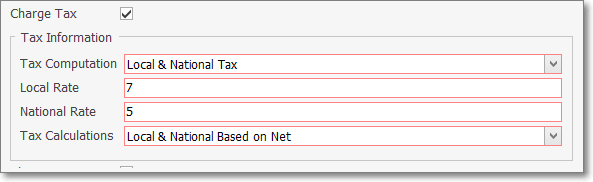

•National & Local Tax - The Tax tab on the User Options Form remains unchanged when a National and Local Sales Tax is charged, but the MKMS Sales Tax Tracking functionality has been improved.

User Options Form - Tax tab - National & Local

•Canada Tax - Setting the CanadaTax option to True ("T") will Turn On the newly revised Canadian Sales Tax tracking system

User Options Form - Company tab - Company Settings - Canada Tax option

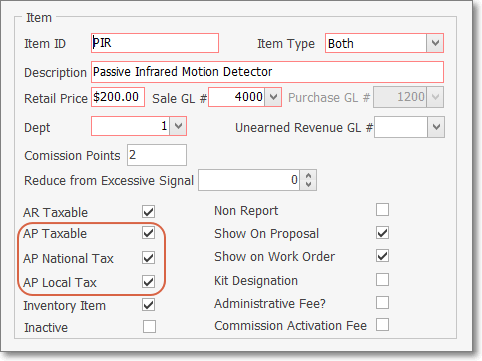

•When the revised Canadian Sales Tax tracking system is activated, there are two additional Check boxes available on the Sale-Purchase Item Form

Sale-Purchase Item Form - Canada Tax - Check boxes

✓AP Taxable - This is a new field in the Sale-Purchase Item Form and must be Checked when implementing this new Canadian Sales Tax tracking system.

✓AP National Tax - This is a new field in the Sale-Purchase Item Form and allows new control of managing Taxable Purchases made within Canada.

▪If either a GST or an HST Tax will ever be charged for this item, Check this box.

✓AP Local Tax - This is a new field in the Sale-Purchase Item Form and allows new control of managing Taxable Purchases made within Canada.

▪If a PST will ever be charged for this item, Check this box.

• Then, update each Vendor record within the Tax Information section of the Edit View to include the appropriate Canada Tax Rates

Vendor Form - Edit View - Tax Information section

a)Charge Tax - Check this box when this Vendor is charges any Tax.

b)Tax Computation - Using the Drop-Down Selection List provided, Choose the appropriate option (usually if paying an HST it would be National Tax Only, and if paying a GST it would be Local & National Tax).

c)Local Tax - If paying GST and the Vendor is also subject to a PST, enter that PST Rate here (see the Canada Tax Rate Chart information in the Canada Sales Tax chapter).

d)National Tax - Whether subject to GST or HST, enter the appropriate Rate here (see the Canada Tax Rate Chart in the Canada Sales Tax chapter).

e)Tax Calculation - Choose the appropriate Tax Calculation method:

▪National & Local Based on Net - (The default selection) - National & Local Based on Net is selected when Sales Tax is calculated on the Net Amount of all Taxable Items within an Invoice. This is also the choice if there is no National Sales Tax at all.

▪National Based on Local Plus Net - National Based on Local Plus Net is selected when there is a National and a Local Sales Tax and the National Sales Tax is charged on the Gross Amount of all Items within an Invoice PLUS the amount of the Local Sales Tax which has been calculated on the Net Amount of the Invoice's Taxable Items.

▪Local Based on National Plus Net - Local Based on National Plus Net is selected when a National Sales Tax is charged on the Gross Amount of an Invoice and then a Local Sales Tax is calculated based on the sum of the Net Amount of all Taxable Items within an Invoice PLUS the amount of the National Sales Tax being charged.

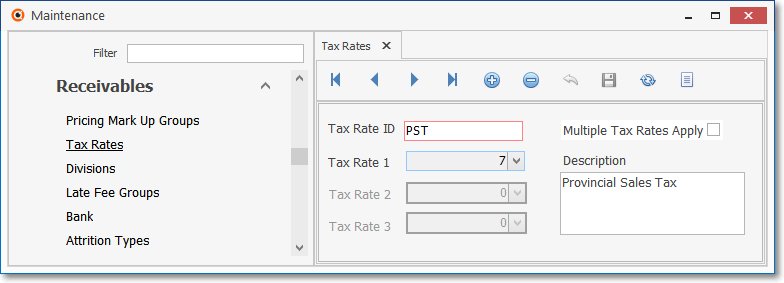

•You must also define as many PST Tax Rate records as needed, which will then be assigned (in the Receivables section of the Edit View on the Subscribers Form) to those Subscribers who are subject to a Provisional Sales Tax (PST) which corresponds to the Local Tax referred to above.

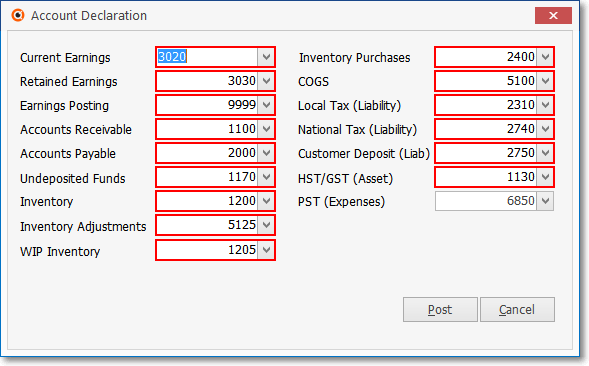

➢Note: For General Ledger System users, it adds two new fields to the Mandatory Accounts (and in the Re-Declare Accounts) Form (read the Canada Sales Tax chapter in the Help Files for that specific information).

Mandatory Account Declaration Form when CanadaTax is are set to True ("T")

a)Enter the HST/GST Asset Account number in the Re-Declare Accounts Form

b)If your Company is subject to a PST tax, enter that PST Expense Account number in the Re-Declare Accounts Form

c)The Taxes Billed Report provides a list of all Bills entered for a specified Date Range, and which and at what rate, each of the Bill's Detail Line Items were charged Sales Tax.

➢Important Note: We strongly recommend that you read the Canada Sales Tax chapter and the Sale-Purchase Item - Sales Tax Fields chapter for more details about Sales Tax Charging Options for the latest Help Files for more specific information!