❑Processing Receipts for a Bank Deposit - An Overview:

•Regardless of whether a Receipt was allocated to an Invoice, or was identified as a Customer Deposit, each Receipt must still be Deposited into one of your Company's Bank Account(s).

•The Bank Deposits Form is used to:

✓Identify which Receipts are to be deposited, and so

✓Document the actual Deposit of those Receipts using the Cash Receipts Report.

❖See the Making a Bank Deposit chapter for other information.

❑Understanding the Bank Deposit Form (and process) for depositing Receipts:

•To open the Bank Deposits Form:

a)From the Backstage Menu System Select File and Choose Receivable and Select the Bank Deposits option, or

b)From the Quick Access Menu, Select File and Choose Receivable and Select the Bank Deposits option

1.Deposit Date - Choose the Date - Using the Drop-Down Calendar/Date Entry field provided, Select the Deposit Date on which this Deposit will be (has been) made (Today is the default).

a)Click on the Date field and type the desired Date using a MM/DD/YYYY format; or

b)Use the Drop-Down Calendar/Date Entry field provided to Choose the desired Date

2.Refresh - Click the Refresh Icon to import these Receipts.

3.Deposit - Once the Receipts to be Deposited have been identified (see above), Click the Deposit Icon.

Bank Deposits Form - Receipts selected - Deposit button

4.Batch # - Examine the Batch Number of the Receipt(s) that are to be deposited, based on the Batch Number that was assigned on the Receipts Form.

a)Batch Numbers are assigned whenever a Receipt is recorded by using the Receipts, the Receipts Posting, Post Auto Drafts, and/or the E-Payments Form(s).

➢Note: See the "Batch Number Assignment" discussion in the Receipts chapter for more information about the Batch Numbering process.

b)More than one Batch of Receipts may be chosen to be Deposited at the same time.

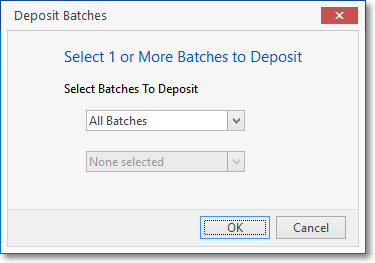

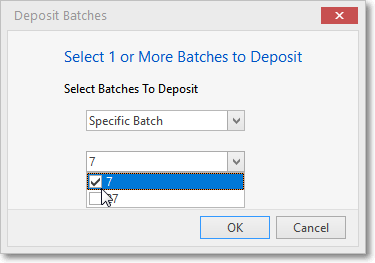

c)Choose which Receipts' Batch(es) are to be deposited using the Deposit Batches dialog displayed when the Deposit Icon is selected:

i.All Batches - By default (as shown below), if selected: All Batches of Receipts will be recorded as Deposited.

All Batches option

ii.Specific Batch - Alternatively, using the Drop-Down Selection List provided, identify (Check the appropriate boxes) a set of one or more Batch Numbers to be recorded as Deposited.

oReview the "Batch Number Assignment" discussion in the Receipts chapter for more information about the Batch Numbering process.

Specific Batch option

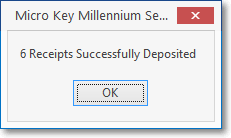

iii.OK - Click OK when you are ready to execute the Bank Deposit process.

oA confirmation message will be displayed.

## Receipts Successfully Deposited

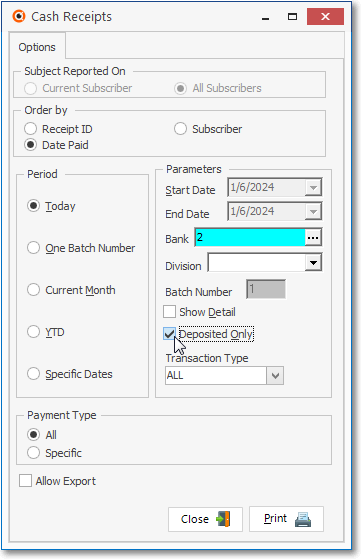

5.Cash Receipts Report - To Document the actual Deposit of these Receipts, use the Cash Receipts Report (i.e., to print a Cash Receipts Report for a specific Bank Deposit)

Cash Receipts - Today, specified Bank, Deposited Only

a)As appropriate:

i.Choose either the Today option, or Choose the Specific Dates option and enter the Date Range to be reported, or

ii.Choose the One Batch Number option (and enter the appropriate Batch Number), or

▪To print the list of Receipts that were (recorded as) Deposited Today, into a specific Bank, follow the example in the illustration above.

b)Choose the Bank into which those Receipts have been Deposited if multiple Banks could have received Deposits in the Date Range specified.

c)Check the Deposited Only box.

d)Print this Cash Receipts Report to list only those items that have been deposited into the selected Bank within the Date Range (and/or Batch Number) specified.

Cash Receipts Report for Today listing the Deposited Only Receipts

6.Attach the validated Deposit Slip to the Cash Receipts Report (produced as explained immediately above).

7.Save these documents, together in one place, until you have Reconciled that Bank Statement.

❑For General Ledger System Users (see the Mandatory Accounts and the Use of, and Purpose for Mandatory Accounts chapters for additional information):

•When a Bank Deposit is recorded:

a.The Asset Account assigned to the Bank into which these Receipts are being Deposited is Debited (added to) for the Gross Amount of all of the Receipts included in that Bank Deposit - regardless of whether they represented Customer Deposits or were Receipts which had been designated for paying Invoices -

b.That same Amount will be Credited (subtracted) from the Undeposited Funds Asset Account.