*******************************************************

* INSTRUCTIONS FOR NACHA PAY IMPORT *

*******************************************************

This Chapter is still being revised!

❑NACHA

File Type: Drafts Bank Accounts and Credit Cards

- Requires EFTID, Destination, OrigDFI, and DestinationABA fields in Bank Table

- Produces 94 Character Fixed Width File

- Output Fields

- File Header Record

1. Hard Coded Value = '101' (3 Characters)

2. Bank.DestinationABA - Company's Bank Routing Number (10 Characters)

3. Bank.EFTID - Company's ID number with the Bank (10 Characters)

4. Current Date - Format=yymmdd (6 Characters)

5. CurrentTime - Format=hhmm (4 Characters)

6. Hard Coded Value = 'A0941101' (7 Characters)

7. Bank.Destination - Company's Bank Name (23 Characters)

8. UserOptions.CompanyName - Company's Name (23 Characters)

9. BLANK - (8 Characters)

- Batch Header Record

1. Hard Coded Value = '5200' (4 Characters)

2. UserOptions.CompanyName - (16 Characters)

3. BLANK - (20 SPACES)

4. Bank.EFTID - (10 Characters)

5. Hard Coded Value = 'PPD'

6. Entry Description = Entered on Post Auto Draft Form (10 Characters)

7. BLANK - (6 SPACES)

8. Draft Date - Entered on Post Auto Draft Form (6 Characters)

9. Hard Coded Value = '1' (4 Characters 3 SPACES and the number 1)

10. Bank.OrigDFI - (8 Characters)

11. Hard Coded Value - (7 Characters, 6 Zeros and the number 1)

- Transaction Records

1. Hard Coded Value = '6' (1 Characters)

2. Subscriber.BankNumber - "27" Checking Deduction or "37" Savings Deduction (2 Characters)

3. TransitNumber -

if Bank Account - Subscriber's bank routing number

if Credit Card - 4 Zeros + Subscriber.CardEpiryDate 'mmyy'

4. TransitCheckDigit -

if Bank Account - '1'

if Credit Card - 1 Space

5. AccountNumber -

if Bank Account - Subscriber's bank account number

if Credit Card - Subscriber's Credit Card number

6. Transaction Amount - InvoiceHeader.BalanceDue

7. CustomerID - Subscriber.BillPayer

8. Customer - Subscriber.SubscriberName

9. Hard Coded Value = '0'

10. Bank.OrigDFI + Currnet Transaction Count (Pad Left with Zeros)

- If this is a Credit Card Transaction add an address line for verification

- Address Verification Record

1. Hard Coded Value = '7'

2. CustomerID = Subscriber.BillPayer

3. Address = Subscriber.AddressStreet

4. City = Subscriber.AddressCity

5. State = Subscriber.AddressState

6. Zip = Subscriber.AddressZip

7. BLANK - 19 Spaces

- Batch Control Footer Record

1. Hard Coded Value = '8200' (4 Characters)

2. TransactionCount - (6 Characters)

3. Hard Coded Value = '0' (10 SPACES)

4. Debit Total - Total Amount to Deposit to Company Bank (12 Characters)

5. Credit Total - always 0.00 left padded with zeros (12 Characters)

6. Bank.EFTClientID (10 Characters)

7. BLANK - (25 SPACES)

8. Bank.OrigDFI

9. Hard Coded Value = '1' (7 Characters 6 SPACES and the number 1)

- File Footer Record

1. Hard Coded Value = '9'

2. Hard Coded Value = '1' (6 characters 5 zeros and the number 1)

3. Bank.EFTID - Company's ID number with the Bank (10 Characters)

4. BlockCount = Total number of records divided by 10

5. TransactionCount = Number of transactions

6. Hard Coded Value = '0' for 10 characters (10 Characters)

7. DebitTotal - Total Amount to Deposit (12 Characters)

8. CreditTotal - Always 0.00 (12 Characters)

9. BLANK - (39 Characters)

❑When your Company selects NACHA as the File Type to be used for Auto Draft Processing, the options available to be selected are:

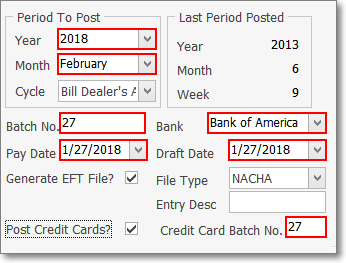

Post Auto Drafts - NACHA selected

•Period To Post - Define what Recurring Billing Period is being processed for Pre-Authorized Auto Drafts.

✓Year - Use the Drop-Down Selection List to Choose the Year that is being processed for Pre-Authorized Auto Drafts.

✓Month - Use the Drop-Down Selection List to Choose the Month that is being processed for Pre-Authorized Auto Drafts.

✓Cycle - If the Multiple Billing Cycles feature has been implemented, use the Drop-Down Selection List to Choose the Recurring Billing Cycle that is being processed for Pre-Authorized Auto Drafts.

Post Auto Drafts - NACHA options

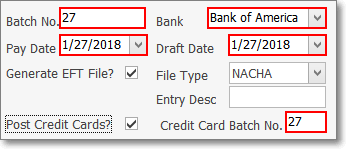

•Batch No. - By default, it will be the calendar number of Today. Change this Batch Number, as needed.

•Bank - The correct Bank Name will be automatically inserted based on the Bank assigned to the selected Recurring Billing Cycle.

•Pay Date - By default, it will be Today

✓Use the Drop-Down Calendar/Date Entry field to Choose the Date these Invoices will be marked as Paid within the Accounts Receivable System.

✓This Pay Date should be on or after the Draft Date entered next.

•Draft Date - By default, it will be Today

✓Use the Drop-Down Calendar/Date Entry field to Choose the Date that these Amounts will be Withdrawn (Drafted) from the Subscriber's Bank account, and/or Charged to their Credit Card.

✓This Draft Date should be on or before the Draft Date entered prevously.

•Generate EFT File - You will need an EFT file generated, so Click this Generate EFT File? box.

•File Type - Use the Drop-Down Selection List to Choose the NACHA EFT system.

•Entry Desc - For the NACHA (and Wells Fargo) File Types, enter a brief Description of the purpose for these Charges (e.g., 'Monitoring', 'Service Contract').

•Post Credit Cards? - If this Auto Draft process should post both EFT Cash Deductions and Credit Card Charges, Check this box.

•Credit Card Batch No. - If Post Credit Cards? was Checked, this field will be activated and will become a mandatory entry.

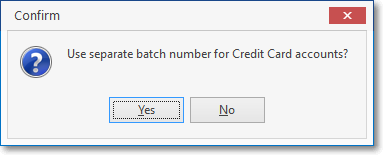

✓Use separate batch number for Credit Cards? - Click Yes and enter the desired Batch Number below.

✓Credit Card Batch No. - By default it will also be the calendar number of Today. Enter the desired Batch Number, as appropriate, which may (usually will) be different than Today.

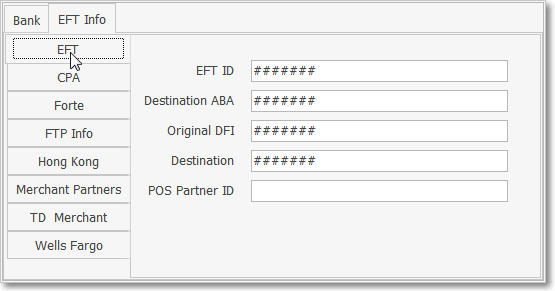

❑Understanding the NACHA File Format

•File Type: NACHA - For EFT Drafts Bank Accounts and Credit Cards

✓Requires these fields in EFT sub-tab of the Bank Table

▪EFT ID - Enter the EFT ID specified by the EFT Processor.

▪Destination ABA - Enter the EFT Processor's Bank's Routing Number.

▪Original DFI - This is required by your EFT Processor and may be up to 10 characters in length.

▪Destination - Data required in the NACHA format specifications specified by the EFT Processor.

✓Produces a 94 Character Fixed Width File

•Auto Draft file's Output Fields

✓File Header Record (1)

1. Hard Coded Value = '101' (3 Characters)

2. Bank.DestinationABA - Company's Bank Routing Number (10 Characters)

3. Bank.EFTID - Company's ID number with the Bank (10 Characters)

4. Current Date - Format=yymmdd (6 Characters)

5. CurrentTime - Format=hhmm (4 Characters)

6. Hard Coded Value = 'A0941101' (7 Characters)

7. Bank.Destination - Company's Bank Name (23 Characters)

8. UserOptions.CompanyName - Company's Name (23 Characters)

9. BLANK - (8 Characters)

✓Batch Header Record (1)

1. Hard Coded Value = '5200' (4 Characters)

2. UserOptions.CompanyName - (16 Characters)

3. BLANK - (20 SPACES)

4. Bank.EFTID - (10 Characters)

5. Hard Coded Value = 'PPD'

6. Entry Description = Entered on Post Auto Draft Form (10 Characters)

7. BLANK - (6 SPACES)

8. Draft Date - Entered on Post Auto Draft Form (6 Characters)

9. Hard Coded Value = '1' (4 Characters 3 SPACES and the number 1)

10. Bank.OrigDFI - (8 Characters)

11. Hard Coded Value - (7 Characters, 6 Zeros and the number 1)

✓Transaction Records (as required)

1. Hard Coded Value = '6' (1 Characters)

2. Subscriber.BankNumber - "27" Checking Deduction or "37" Savings Deduction (2 Characters)

3. TransitNumber -

if Bank Account - Subscriber's bank routing number

if Credit Card - 4 Zeros + Subscriber.CardEpiryDate 'mmyy'

4. TransitCheckDigit -

if Bank Account - '1'

if Credit Card - 1 Space

5. AccountNumber -

if Bank Account - Subscriber's bank account number

if Credit Card - Subscriber's Credit Card number

6. Transaction Amount - InvoiceHeader.BalanceDue

7. CustomerID - Subscriber.BillPayer

8. Customer - Subscriber.SubscriberName

9. Hard Coded Value = '0'

10. Bank.OrigDFI + Currnet Transaction Count (Pad Left with Zeros)

➢If this is a Credit Card Transaction, add an address line for verification

Address Verification Record (1)

1. Hard Coded Value = '7'

2. CustomerID = Subscriber.BillPayer

3. Address = Subscriber.AddressStreet

4. City = Subscriber.AddressCity

5. State = Subscriber.AddressState

6. Zip = Subscriber.AddressZip

7. BLANK - 19 Spaces

✓Batch Control Footer Record (1)

1. Hard Coded Value = '8200' (4 Characters)

2. TransactionCount - (6 Characters)

3. Hard Coded Value = '0' (10 SPACES)

4. Debit Total - Total Amount to Deposit to Company Bank (12 Characters)

5. Credit Total - always 0.00 left padded with zeros (12 Characters)

6. Bank.EFTClientID (10 Characters)

7. BLANK - (25 SPACES)

8. Bank.OrigDFI

9. Hard Coded Value = '1' (7 Characters 6 SPACES and the number 1)

✓File Footer Record (1)

1. Hard Coded Value = '9'

2. Hard Coded Value = '1' (6 characters 5 zeros and the number 1)

3. Bank.EFTID - Company's ID number with the Bank (10 Characters)

4. BlockCount = Total number of records divided by 10

5. TransactionCount = Number of transactions

6. Hard Coded Value = '0' for 10 characters (10 Characters)

7. DebitTotal - Total Amount to Deposit (12 Characters)

8. CreditTotal - Always 0.00 (12 Characters)

9. BLANK - (39 Characters)