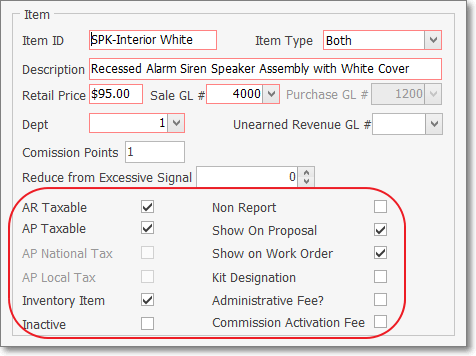

❖Sale-Purchase Items Form - The Sale-Purchase Items Form has been revised and now has several new fields including Sales Tax status fields, and a WIP (Work in Progress) field containing the Quantity of items identified as Inventory Items which in the process of being used on a Job and/or Work Order.

•New Check boxes - There are several new Check Boxes:

✓AR Taxable - Check this box if this Item is normally Taxable.

▪When entering a Sales Invoice:

a)If AR Taxable is Checked, whenever this Inventory Item is entered on a Sales Invoice, the appropriate Tax Code & Tax Percentage Rate will be inserted automatically, based on the Sales Tax information entered in the Receivables section within the Edit View for that Subscriber.

b)If Not Checked, whenever this Inventory Item is entered on a Sales Invoice, the Tax Code will be entered as N (Non) and the Tax Percentage Rate set set at 0%, regardless of the Sales Tax information entered in the Receivables section within the Edit View for that Subscriber.

✓AP Taxable - Check this box if your Company is normally charged Sales Tax when purchasing this Inventory Item.

▪When entering a Bill (Vendor's Invoice):

a)If AP Taxable is Checked, whenever this Inventory Item is entered on a Bill (Vendor's Invoice), the appropriate Tax Code & Tax Percentage Rate will be inserted automatically, based on the Sales Tax information entered in the Tax Information section within the Edit View for that Vendor.

b)If Not Checked, whenever this Inventory Item is entered on a on a Bill, the Tax Code will be entered as N (Non) and the Tax Percentage Rate set set at 0%, regardless of the Sales Tax information entered in the Tax Information section within the Edit View for that Vendor.

✓Inventory Item - If this is an Inventory Item that will be tracked as such, Check the Inventory Item box.

▪When you Check Inventory Item, the Form will require additional information needed to properly track Parts as actual Inventory.

▪If an Inventory Item is entered, and saved, and subsequently a User attempts to Remove this Check mark, a Warning will be displayed.

▪Never Check the Inactive box unless this part will no longer be used.

▪Do not Delete an Inventory Item record once it has been used in an Invoice or a Bill (i.e., Sales or Purchases).

▪If you will no longer order or sell the part, just mark it as Inactive.

✓Show on Work Order - Check the Show on Work Order box if this Sale-Purchase Item has been assigned an Item Type of Sale or Both and might be needed when recording the use of Inventory and/or Materials on a Service Request.

▪The Drop-Down Selection List used to Choose the appropriate Inventory Item used on a Work Order, accessed within the Web Tech Service, will list only those Sale-Purchase Items which have a Check in the Show on Work Order box.

▪The Drop-Down Selection List used to Choose the appropriate Inventory and/or Materials usage in the Inventory/Materials tab of the Service Request Form will list only those Sale-Purchase Items which have a Check in the Show on Work Order box.

▪By Not Checking this box, this Sale-Purchase Item will not be included in the Drop-Down Selection Lists that are provided to a Technician working in the field using the Web Tech Service and/or to any User recording information within the Inventory and/or Materials tab on a Service Request Form.

▪Therefore any Sale-Purchase Items that are defined to identify Purchases or Sales which are unrelated to providing Service to Subscribers will be eliminated from the list - making that Selection process easier and faster, thus reducing the length of the Drop-Down Selection List to a manageable size, and more importantly, with a definable content.

✓Administrative Fee? - If shown, Do not Check this box unless you are defining an Administrative Fee for the Dealer Billing application.

•A new Work In Progress field (WIP) on the Sale-Purchase Items Form tracks that WIP Quantity of Inventory Items as follows:

✓Basically, the WIP Quantity is increased when an Inventory Item is Used on a Job; and/or recorded in the Inventory/Materials tab on a Work Order Form.

✓Then the WIP Quantity is reduced when those Inventory Items recorded on the Inventory/Materials tab on a Work Order are actually Invoiced to the Subscriber after the Work Order is completed; or when a Work Order associated Job Task is Invoiced, and/or the Job itself is marked as Completed.

✓See the New Inventory Tracking & Job Costing Features chapter for more information.