❑For General Ledger System Users - When Earned and Deferred Revenues are being tracked (established by running the Deferred Revenue Setup Wizard)

•Thereafter, when the Auto Billing procedure is executed:

a.The Gross Amount (including Sales Tax, if charged) of each Recurring Revenue Sale is Debited (added) to the Accounts Receivable Asset Account (a Mandatory Account)

b.The Net Amount (not including any Sales Tax) is Credited (added) to the associated Deferred Revenue Liability Account

c.When Sales Tax is charged, the Amount of that Sales Tax is Credited (added) to the appropriate Sales Tax Payable Liability Account (i.e., Local, National, or both, as required).

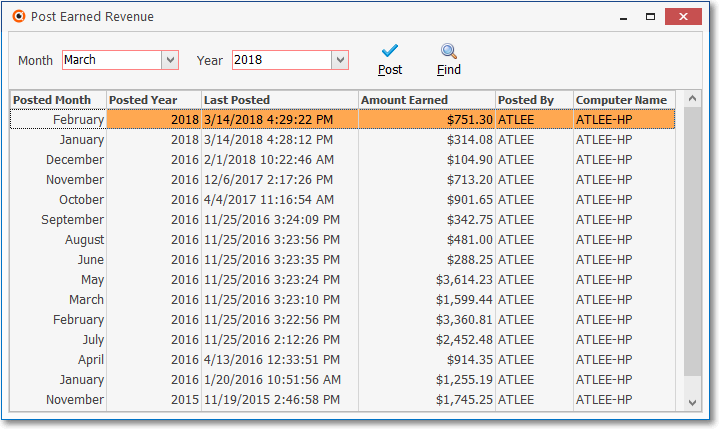

❑The Post Earned Revenue dialog is used to periodically calculate, distribute, and post Deferred and Earned Revenues to the appropriate General Ledger Accounts' balances, and record them in the Transaction File and Account Register.

•During this Post Earned Revenue procedure:

1.The proportioned Earned Revenue Amount for each Detail Line Item is Posted (added) to the Detail Line Item's EarnedAmount field (an internal system field that is not visible to the User)

2.The Invoice Header of any Invoice with a Recurring Revenue Sale (containing one or more Detail Line Item(s) that were assigned a Recurring Revenue Sale-Purchase Item) will also have the currently calculated Earned Revenue Amount Posted (added) to its EarnedAmount field (an internal system field that is not visible to the User)

✓Therefore, the Invoice Header will contain the most recently updated Total of all of the Earned Revenue for that Invoice.

Post Earned Revenue Form

❖See the Post Earned Revenue and the Understanding Earned & Deferred Revenue chapters in the General Ledger System section of these Help Files for complete information.