❑The Late Fee Invoice Generation method uses a combination of factors (rate, grace period, minimum charge, etc.) to assess Late Fees based on two entries:

1.A specific Sale-Purchase Item that is used to create the Invoice for the Late Fees (see ØNote #1)

2.Any number of User defined Late Fee Groups (see ØNote #2)

➢Note #1: Be sure there is a generic Sale-Purchase Item named Finance/Late Charges assigning it the Item ID of F/C.

Sale-Purchase Item Form - Finance/Late Fees (F/C)

➢Note #2: Late Fee Groups must be defined to identify the Grace Period, Sales Tax status, Interest Rate to Charge, Minimum Late Fee, and the Minimum Past Due Balance needed to be assessed a Late Fee.

Late Fee Groups Form - Interest Rate To Charge field

❑To open the Late Fee Invoice Generation Form:

a)From the Backstage Menu System Select File and Choose Receivable and Select the Run Late Fee Invoice Generation option, or

b)From the Quick Access Menu, Select File and Choose Receivable and Select the Run Late Fee Invoice Generation option

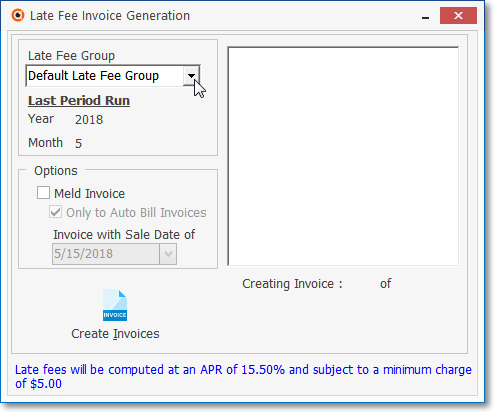

•The Late Fee Invoice Generation dialog will be displayed.

•Late Fee Group - Choose the Late Fee Group that is to be assess Late Fees using the Drop-Down Selection List provided.

•Options - Optionally, certain Late Fees may be added to existing, unpaid Recurring Revenue Invoices, or any Invoice dated on a specific day:

✓Meld Invoice -

✓Only to Auto Bill Invoice with Sale Date

✓Sale date -

•Click the Create Invoices button.

•The process runs automatically and when finished, displays to whom, and how much, each Subscriber was charged a Late Fee.

Late Fee Invoice Generation completed

✓Click the Close ![]() box on the top right corner to exit the Late Fee Invoice Generation Form.

box on the top right corner to exit the Late Fee Invoice Generation Form.

•Repeat this procedure at the appropriate time in the month for each of your Late Fee Groups.

❑Late Fee Invoice assessments are based on the Total Past Due Amount owed by the Subscriber, and calculated using the information entered for the selected Late Fee Groups.

Invoice Form - Body of Late Fee Invoice showing the Item, Description, Total and automatically created Comments

•Each Invoice is created with the Sale-Purchase Item "F/C", its Description, a Quantity of 1, the Finance Charge Price, and the Net and Gross Values.

✓The Note field Drop-Down Info Box itemizes all of the Late Charges that were assessed.

Invoice Form - Comments field - Late Fee Assessment

✓The Comments section is automatically inserted based on the Late Fee assessment rules set for the selected Late Fee Group.