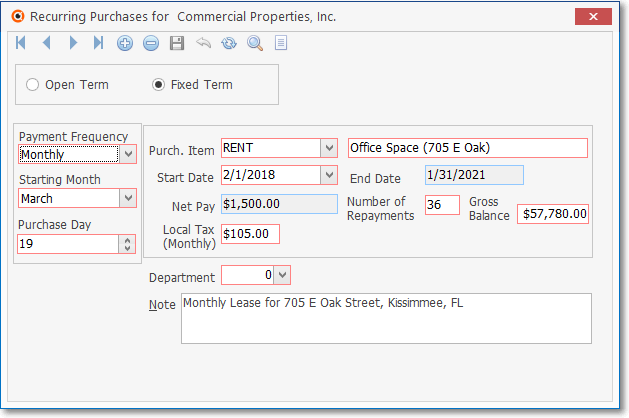

❑The new Fix Term Recurring Purchases process (used to define Payments that have a fixed term (Number of Repayments) with an agreed upon expiration date (End Date), and having a gross amount (Balance) to be Paid) has been redesigned for improved stability and operation.

Recurring Purchases Fixed Term record with Local and National Sales Tax

![]() Click the Insert Icon to start the Recurring Purchase entry in the Record Editing section.

Click the Insert Icon to start the Recurring Purchase entry in the Record Editing section.

•Click the Fixed Term button.

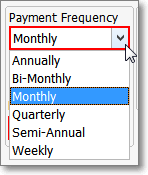

•Payment Frequency - Using the Drop-Down Selection List provided, Choose how often an Invoice (Vendor Bill) is to be created for this item:

Payment Frequencies

✓Annually - This Recurring Purchase is billed to your Company once each year:

▪The Recurring Purchase Invoice that is created will be Dated on the Purchase Day specified (see below), with the Due Date for the Invoice calculated based on that Vendor's Terms.

▪The final Invoice for this Fixed Term obligation will be created within the Month of the End Date.

✓Bi-Monthly - This Recurring Purchase is billed to your Company once every two months:

▪The Recurring Purchase Invoice that is created will be Dated on the Purchase Day specified (see below), with the Due Date for the Invoice calculated based on that Vendor's Terms.

▪The final Invoice for this Fixed Term obligation will be created within the Month of the End Date.

✓Monthly - This Recurring Purchase is billed to your Company once every month:

▪The Recurring Purchase Invoice that is created will be Dated on the Purchase Day specified (see below), with the Due Date for the Invoice calculated based on that Vendor's Terms.

▪The final Invoice for this Fixed Term obligation will be created within the Month of the End Date.

✓Quarterly - This Recurring Purchase is billed to your Company once every three months:

▪The Recurring Purchase Invoice that is created will be Dated on the Purchase Day specified (see below), with the Due Date for the Invoice calculated based on that Vendor's Terms.

▪The final Invoice for this Fixed Term obligation will be created within the Month of the End Date.

✓Semi-Annually - This Recurring Purchase is billed to your Company once every six months:

▪The Recurring Purchase Invoice that is created will be Dated on the Purchase Day specified (see below), with the Due Date for the Invoice calculated based on that Vendor's Terms.

▪The final Invoice for this Fixed Term obligation will be created within the Month of the End Date.

✓Weekly - This Recurring Purchase is billed to your Company once each week:

✓When the Auto Pay procedure is executed, the required set of Recurring Purchase Invoices are created for the entire Month.

✓The first Invoice will be Dated with the Purchase Day specified (see below), and each subsequent 7 Day Period's Invoice will be Dated as appropriate, until all of the required Invoices are created for that Month.

✓All Invoices in the set will have the same Invoice Number, but each Number will have a hyphenated numeric suffix (e.g., 1234-1, 1234-2, 1234-3).

✓The Due Date for each Invoice in the set will be calculated based the Purchase Date assigned and the Vendor's Terms.

✓The final set of Invoices for this Fixed Term obligation will be created within the Month of the End Date.

•Starting Month - Using the Drop-Down Selection List, Choose the Month this Recurring Purchase will start.

•Purchase Day - Enter the Day number for the date - within each month - that this Recurring Purchase Invoice should be Dated.

✓The Due Date that is created for this Fixed Term Recurring Purchase will be calculated by taking this Purchase Day and adding to it the number of Days defined for the Vendor's Terms (previously entered in the Vendors Form).

▪If this Recurring Purchase is billed using the Weekly Payment Frequency option, the Due Date for each individually calculated Purchase Date assigned to each Invoice in the monthly sequence is entered as follows: Initially the Purchase Date is the Purchase Day, then the Purchase Date is set at 7 days thereafter for the next Invoice, then the next Purchase Date is set as 7 days after the previous Invoice, etc., and in each case the Due Date is calculated by taking each Purchase Date and adding to it the number of Days defined for the Vendor's Terms (previously entered in the Vendors Form).

•Payment Information - Enter the transactional information for this Recurring Purchase expense.

✓Purc. Item - Using the Drop-Down Selection List provided, Choose the appropriate Purchase Category for this Expense.

✓Description - By default, this will be the Description enter for the selected Purchase Category code.

▪Edit this default Description to document the purpose/type of this fixed term recurring expenditure.

✓Start Date - By default, this will be the first Day and current Year of the selected Starting Month.

▪Using the Drop-Down Calendar/Date Entry field provided, Choose a Date on or after the default Date on which this Recurring Purchase should begin.

✓Number of Repayments - Enter the total number of Installment Payments which will be billed.

✓Gross Balance - Enter the Total Gross Balance Due including all Sales Taxes for the entire Fixed Term, if applicable.

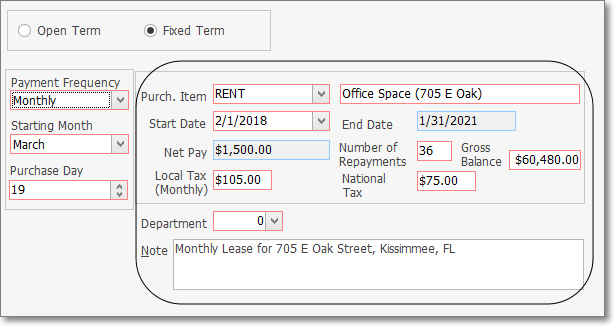

✓Local Tax - Enter the Monthly Amount of the Local Sales Tax, if applicable (see Important Note below).

Recurring Purchase Form - Fixed Term entry - Local Tax only

National Tax - Enter the Monthly Amount of the National Sales Tax, if applicable.

Recurring Purchase Form - Fixed Term entry - Local & National Tax

➢Important Note: If a Local and/or a National Sales Tax is not required (based on the previously entered Vendor Tax Information), these Sales tax field(s) will not be displayed.

✓Department - This field does not need to be completed unless you are using the General Ledger System.

▪Using the Drop-Down Selection List provided, Choose the Department number for this Recurring Purchase, if required.

✓Note - Enter any additional information related to this Fixed Term Recurring Purchase.

![]() Click the Save Icon to record this Fixed Term Recurring Purchase entry.

Click the Save Icon to record this Fixed Term Recurring Purchase entry.

•System Calculated Fields:

✓End Date - Calculated by the system based on the number of Repayments and the Start Date that was entered.

✓Net Pay - The Amount of the Recurring Purchase Payment excluding any Sales Taxes is calculated automatically as follows:

a)The Gross Amount of the Sales Taxes (entered previously and included in the Gross Balance) is calculated by multiplying the Monthly Sales Taxes by the Term of this Fixed Term Recurring Purchase

b)That Gross Amount of the Sales Taxes is subtracted from the Gross Balance to arrive at the actual Net Balance of the contracted amount - not including any Sales Taxes.

c)That Net Balance result is divided by the Term of this Fixed Term Recurring Purchase to determine what the net Monthly Payment Amount (Net Pay) will be (excluding any Sales Taxes)

d)When Billed: the (Net Pay, plus the Local Monthly Sales Tax plus the National Monthly Sales Tax) multiplied the number (Qty) of Months being billed (usually one) will be what is recorded on the Bill.

•Why does the system go though this complex calculation process?

✓It is easier and faster to make this calculation once, at the time of original entry, rather than each time the monthly Post & Pay Recurring Purchases process is run.

✓Each time this record is Billed, the Number of Repayments and Gross Balance Values are recalculated based on the Full Amount (i.e., Net Pay and Sales Taxes) that was Billed.

✓However, while billing your Company's Recurring Purchases, the system needs to know the Net Payment Amount (Net Pay), plus any separate Sales Tax Amounts being charged to properly record this information in the Bill and in the Taxes Billed report

✓Finally, if using the General Ledger System, these separate Net Pay and Sales Tax Amounts must also be posted to the Transaction File.