❑The new Credit Card Maintenance & Tracking feature provides the ability:

1.To pay a Bill using a Credit Card - by using the Credit Card Pay option that is now available within the Bills Form

2.To create an internal Bill from the Credit Card Company for a specified Amount to pay for some (or all) of those Credit Card charges, using the Create Bill option on the Credit Card Register Form

3.To maintain a running Balance of what is due to any Credit Card (company) which are being used by your Company to Pay those Bills

4.To be able to reconcile your Credit Card Statement using the Credit Card Reconciliation Form.

•Credit Card Payments for Bills are tracked within a Credit Card Maintenance & Tracking System, and require the following steps be completed to properly implement this feature:

1.For General Ledger System Users:

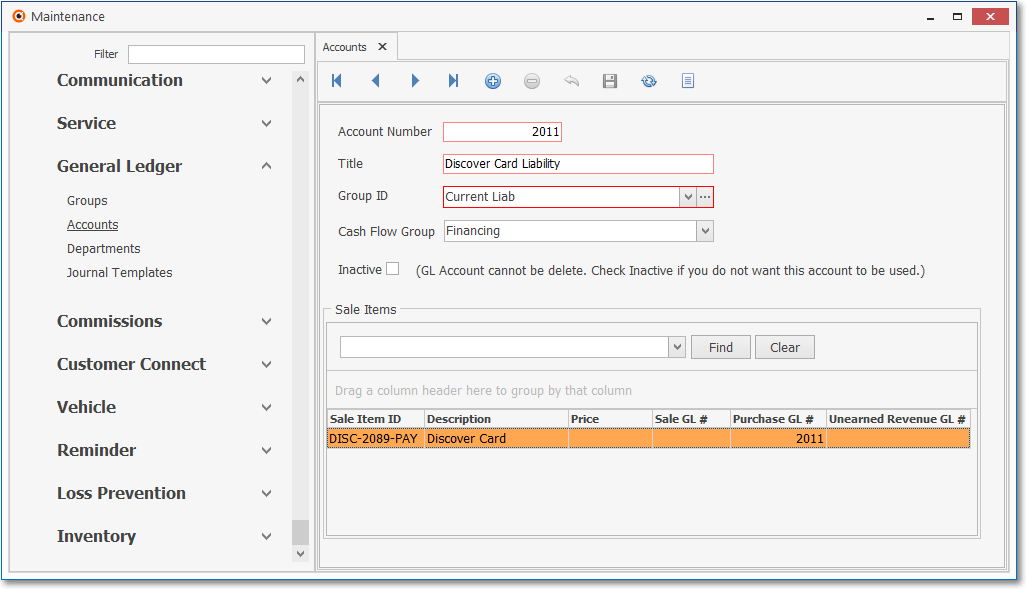

a.Create a General Ledger Account (this will be a Liability Account) for each Credit Card so that Debt - when it exists - may be tracked as a Current Credit Card Liability.

i.You may create an individual Current Credit Card Liability Account for each Credit Card (recommended), or simply have one Credit Card Liability Account to which all Credit Card Debt is posted.

b.Create a General Ledger Account (this will be an Expense Account) for each Credit Card so Credit Card "Purchases" may be properly recorded.

i.You will only need one Credit Card Expense Account to which all Credit Card Purchases is posted.

2.Create a Purchase Category for each Credit Card that will be used for this purpose (i.e., pay a Bill using a Credit Card) and assign a Code (e.g., an abbreviation of the Credit Card and the last four digits of your account number) representing that Credit Card, followed by a dash, and then the letters "PAY" (e.g., AMEX 7515-PAY)

a.For General Ledger System Users: assign the Purchase GL# Account Number assigned (see step 1., b. above) to the General Ledger Credit Card Purchase Account for tracking Credit Card Purchases.

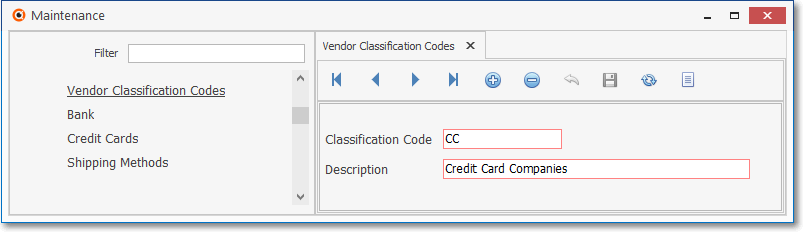

3.Create a Vendor Classification Code to be assigned to each Vendor record that represents a Credit Card company.

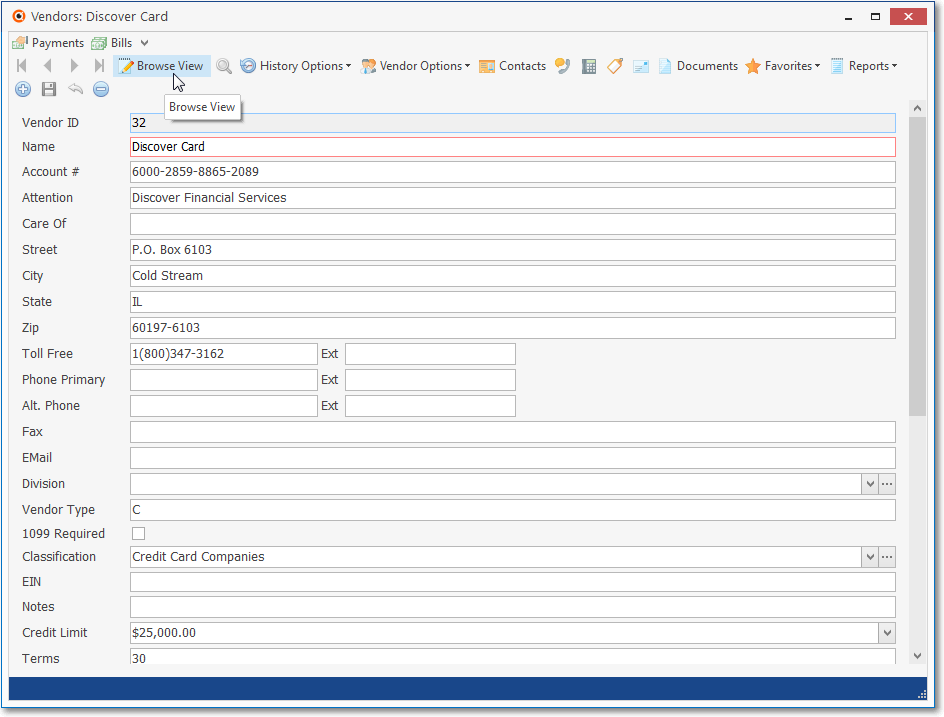

4.Create a Vendor record for each Credit Card your Company will be using to make Credit Card Payments for Bills

5.Create a Credit Card maintenance record with a unique Credit Card Name (perhaps the standard abbreviation for that type of Credit Card plus the last four digits of its Account Number)

a.Identify the associated Vendor record created for this purpose (see step 3. above)

b.Enter the actual full Account Number of that Credit Card

c. For General Ledger System Users: assign it the General Ledger Credit Card Liability Account Number defined for its Credit Card Debt (see step 1. above)

d.Assign the Purchase Category Code that was created for this specific Credit Card (see step 2. above) .

6.When entering a Credit Card maintenance record you may also create an entry that will be inserted into the associated Credit Card Register (which is automatically maintained for each Credit Card) that represents the current balance on this Credit Card; or at start-up, you may set the current balance on the associated Credit Card Register to $0.00.

7.The Bills Form - for a Vendor who is not classified as a Credit Card Company - will have a Credit Card Pay option with a Drop-Down Selection List containing all of the established Credit Cards.

8.Thereafter, the Credit Card Form, and the associated Vendor record created for each Credit Card your Company uses (see step 4. above), will have a Credit Card Register Form that displays a Grid with:

a.A list of all the previously posted Payments made on Bills using to the currently selected Credit Card (or Credit Card Company);

b.A list of all Statements (entered as Bills to that Credit Card Company Vendor) for the currently selected Credit Card Company.

c.A Create Bill option which may be used to create a Bill for a specified Amount (or all) of the outstanding charges listed on a Statement received from that Credit Card Company.

d.This Bill created for that Credit Card Company may then be Paid in the normal manner to the Vendor (which was identified for that Credit Card).

e.A Check may then be printed (or an EPay payment executed) for those Credit Card Statement charges.

9.You may also Process Credit Card Refunds using a Credit Memo

a.When a previous Payment for a Bill was made using a Credit Card and your Company is now eligible for (and getting) a Refund this process may now be recorded within MKMS as follows:

i.Create a Credit Note for the Bill that was Paid using a Credit Card

ii.Use the Credit Card Pay option on that Credit Note Form to post a credit to that Credit Card Account's Register.

iii.The appropriate General Ledger System Financial Transactions will be posted automatically.

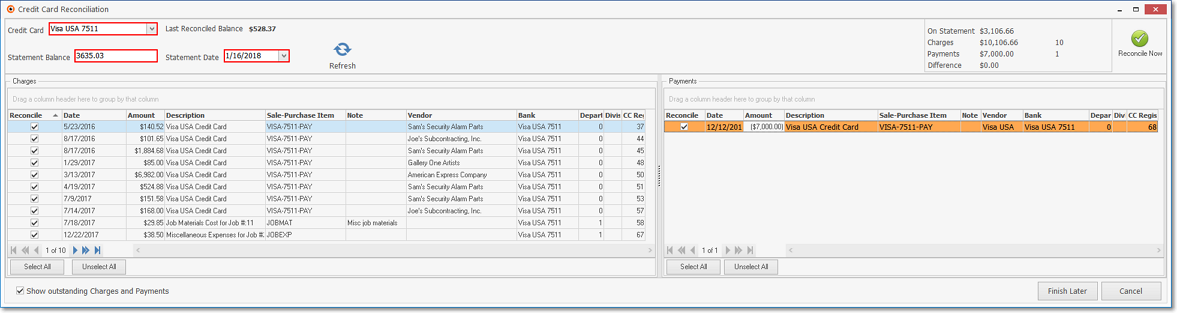

10.Once each month when the Credit Card Statement is received, you will use the the Credit Card Reconciliation Form to validate all of the Charges and Payments activity to conform the Balance Due.

❑Overview of the Credit Card Maintenance & Tracking Instructions:

•The Credit Cards which are being used by your Company to make Payments on Bills, and the associated Charges that will appear on those Credit Card Statements, may be tracked using this Credit Card Maintenance & Tracking System.

✓To implement this capability, you must complete these required steps:

a.For General Ledger System Users: Create the necessary General Ledger Accounts:

b.Create a Vendor Classification Code and Description for designating a Vendor as Credit Card Company.

i.This Vendor Classification Code may then be assigned to each of those Vendors (created in step c. below) who are Credit Card Processors.

c.Create a Vendor record (representing a Credit Card Company) for each Credit Card your Company uses for making Credit Card (see f. below) Payments on Bills.

i.Assign each of these Vendor records with the Vendor Classification Code created in step b. above.

ii.Thereafter, a Bill may be created for that Vendor representing the outstanding balance on a Credit Card, which may then be Paid by Check or Electronic Transfer.

iii.This process will reimburse (make a payment to) that Credit Card Company (Vendor) for the Amount your Company had previously charged as Payments on various Bills.

d.Create a Purchase Category for each specific Credit Card that will be used for making Payments on Bills:

i.You may assign an Item ID Code representing that Credit Card, followed by a dash, the last four digits of its Account Number, followed by a dash, and then the letters "PAY" (e.g., VISA-7511-PAY) or use whatever other method deemed appropriate.

ii.Assign it the Purchase GL# General Ledger Expense Account Number ("Credit Card Purchases") created (in step a, ii. above) for the Credit Card Liability Account to be used for tracking the current Credit Card Debt.

e.Create a Credit Card maintenance record with its Name (and last four digits of its Account Number)

i.Assign it to the Vendor record created for this purpose (see step c. above), and enter the actual full Account Number for the Credit Card

ii.Assign it the General Ledger Liability Account (e.g., AMEX Liability, MasterCard Liability, Visa USA Liability) representing the Credit Card's current (created in step a. above) Debt

iii.Assign it the Purchase Category Code ("Purchase Item") created for this specific Credit Card (created in step d. above).

iv.You may also set the current balance for this Credit Card maintenance record when prompted to do so (or set it to $0.00).

f.The Bills Form for those Vendors who are not classified as a Credit Card Company, will have a Credit Card Pay Icon (see the "Credit Card Pay" discussion in the Bills - Understanding the Bills Form chapter for more information)

![]()

i.Use its Drop-Down Selection List of all established Credit Cards to Choose the Credit Card that should be used to Pay for the currently selected Bill.

ii.The Amount Due on the Bill will be the default Payment for the Credit Card Pay Icon transaction and will be Debited (added to) the General Ledger Expense Account (e.g., "Credit Card Purchases"); and that Amount will be Credited (added to) the General Ledger Liability Account (e.g., AMEX Liability, MasterCard Liability, Visa USA Liability)

iii.This Payment to that Vendor will be recorded in the Credit Card Register Form.

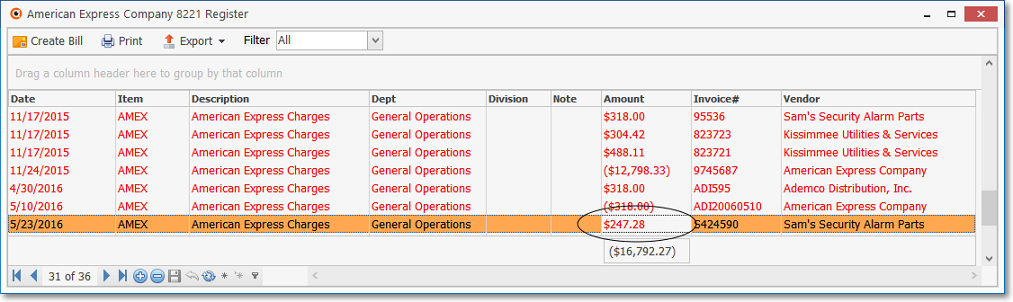

g.Thereafter, the Credit Card Form, and the designated Vendor record created for each Credit Card that your Company uses to Pay Bills, will each provide access to the Credit Card Register Form

▪This Credit Card Register will display a Grid with:

Credit Card Register

a)A list of all the previously posted Payments made on Bills using the currently selected Credit Card (or Credit Card Company);

b)A list of all Statements (entered as Bills to the designated Credit Card Company Vendor) received from the currently selected Credit Card Company.

c)A Create Bill option (see below) to created a Bill for charges that are to be paid to the designated Credit Card Company Vendor.

▪Filter - Using the Drop-Down Selection List provided to Choose the Date Range on or after which Credit Card data is to be listed

▪Create Bill - This option on the Credit Card Register Form is used to create a Bill for the Vendor identified as a Credit Card Company - for a designated Amount.

![]()

oWhen this Bill is generated, that Amount will be Debited (subtracted from) the General Ledger Liability Account (e.g., AMEX Liability, MasterCard Liability, Visa USA Liability); and Credited (added to) the normal Accounts Payable Liability Account

oThis Bill can then be Paid in the normal manner using for making Payments (i.e., Auto Pay, E-Pay, or a Hand Check, but not with a Credit Card)

oWhen the Payment is created, that Amount will be Debited (subtracted from) the the normal Accounts Payable Liability Account; and Credited (subtracted from) the designated Bank''s General Ledger Asset Account

oA Check may then be printed (an Epay executed or hand check written) for that designated Amount.

▪Print - This Print Icon on the Credit Card Register Form will open a Print Preview dialog which can Print the Register data, or Export this information to a PDF file.

h.Use the Credit Card Reconciliation Form to validate the monthly Credit Card Statement(s).

Credit Card Reconciliation Form