❖This chapter is being reviewed/revised

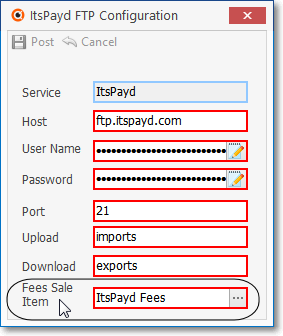

❑The ItsPayd FTP Configuration Form used by the optional ItsPayd service (e.g., it must be Purchased and then Registered) requires the User to identify a Fees Sale Item Code for the associated ItsPayd processing fees

ItsPayd FTP Configuration dialog - Fees Sale Item

•Sale Item - this field requires the Code that will used to track the associated ItsPayd processing Fees.

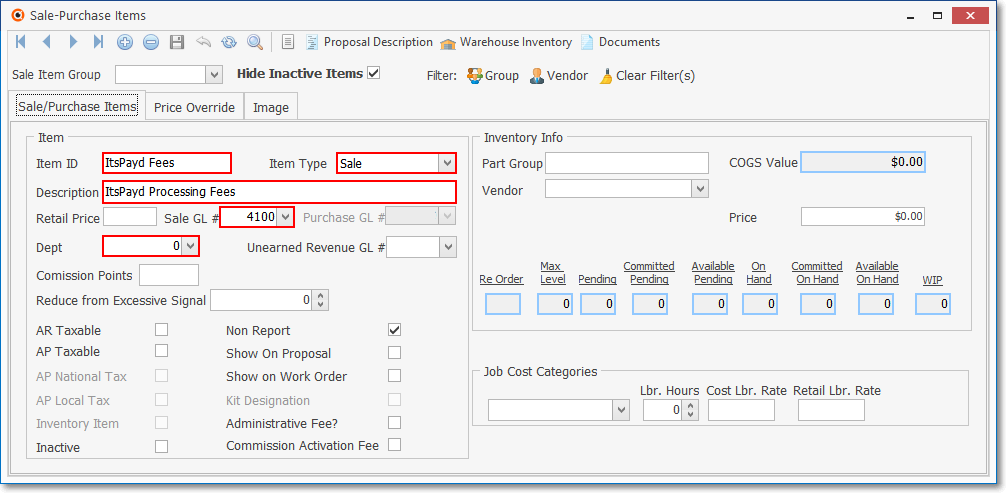

✓To facilitate the proper posting of the Receipts imported from ItsPayd, the Code for that processing Fee must be defined as a Sale-Purchase Item

Sale-Purchase Item Form - Itspayd Processing Fees definition

•Sale GL # - The proper Sale GL # General Ledger Account Number must be assigned to the ItsPayd processing Fee Sale-Purchase Item record to ensure that all ItsPayd processing Fees incurred, are tracked and posted to the appropriate General Ledger Accounts.

✓This processing Fee Code is entered in the Fees Sale Item field on the ItsPayd FTP Configuration Form.

✓This processing Fee Code is used later when offsetting the ItsPayd processing Fee that is internally charged (see the Why? and How? discussions below).

•Why? - Why is this ItsPayd processing Fee Sale-Purchase Item Code required?

✓When a Subscriber pays any portion of a Balance Due on an Invoice to ItsPayd, logically, the entire Amount collected needs to be applied to that open Invoice.

✓However, an ItsPayd processing Fee for collecting that payment Amount has been incurred.

▪This ItsPayd processing Fee is not paid by the Subscriber, it is assessed to your Company.

✓Therefore, instead of depositing the entire payment (Receipt) that was collected by ItsPayd: The Amount collected minus the ItsPayd processing Fee is posted to the Invoice as follows:

a)The processing Fee is deducted from the collected Amount and the resulting net Amount is posted to the Invoice;

b)That same net Amount is Allocated to the associated Invoice.

•How? - Understanding how this Financial Transaction is posted within MKMS when importing and recording the collected Amounts:

1.First, a Receipt record is created for the net Amount that was actually deposited (i.e., the Amount collected minus the ItsPayd processing Fee)

✓That same net Amount is Allocated to the associated open Invoice.

1.Next, a Credit Memo is created for the cost of that ItsPayd processing Fee.

✓That same Fee cost is also Allocated to the associated open Invoice.

•The result: the actual Amount that was collected by ItsPayd has now been properly applied to the Invoice.